The Goods and Services Tax (GST) registration process is an essential requirement for businesses operating in India. It not only enables businesses to legally conduct their operations but also allows them to avail various benefits and comply with tax regulations. However, different industries may have specific document requirements for GST registration, depending on the nature of their business activities. Understanding these industry-specific document requirements is crucial to ensure a smooth and hassle-free registration process. In this article, we will explore the general documents required for GST registration, as well as delve into the specific documents necessary for manufacturing industries, service industries, e-commerce businesses, and export-oriented industries. Additionally, we will discuss common challenges faced in obtaining these documents and provide valuable insights and solutions to help businesses successfully navigate the GST registration process in specific industries.

Introduction to GST registration process

GST registration is essential for businesses operating in India to comply with tax regulations and conduct business activities smoothly. Here’s an overview of the process, with key information presented in a table for clarity:

What is GST Registration?

- A process of obtaining a unique 15-digit GST Identification Number (GSTIN) from the tax authorities.

- Enables businesses to collect and remit GST on sales and claim input tax credit on purchases.

- Mandatory for businesses with an annual turnover exceeding specific thresholds (currently INR 40 lakh for most states).

- Can be undertaken voluntarily, even if the turnover threshold isn’t met.

Benefits of GST Registration:

| Benefit | Description |

| Compliance with tax laws | Ensures adherence to GST regulations and avoids potential penalties. |

| Avoidance of penalties | Prevents financial penalties for non-compliance with GST laws. |

| Ability to claim input tax credit | Allows businesses to offset GST paid on purchases against GST collected on sales, reducing overall tax liability. |

| Enhanced business credibility | Projects a professional image and demonstrates compliance with tax laws, fostering trust with clients and suppliers. |

| Access to online GST services | Enables businesses to file returns, make payments, and manage GST compliance online, streamlining processes and saving time. |

Also Read: Benefits of GST Registration

Understanding the importance of GST registration

Are you a business owner wondering what this whole GST registration fuss is about? Well, buckle up, because we’re about to take you on a wild ride through the world of taxes and registrations. GST, or Goods and Services Tax, is a comprehensive indirect tax that has revolutionized the way businesses operate in India. And guess what? If your turnover exceeds a certain threshold, you need to get registered under GST. Trust us, it’s not as scary as it sounds!

Overview of the GST registration process

Now that you understand the importance of GST registration, let’s dive into the nitty-gritty of how to get yourself registered. The GST registration process involves a few steps that require some specific documents. Don’t worry, we’ll guide you through each one of them. It’s like solving a puzzle, but instead of earning a million dollars, you get to stay on the right side of the law. Sounds thrilling, right? So, let’s get started!

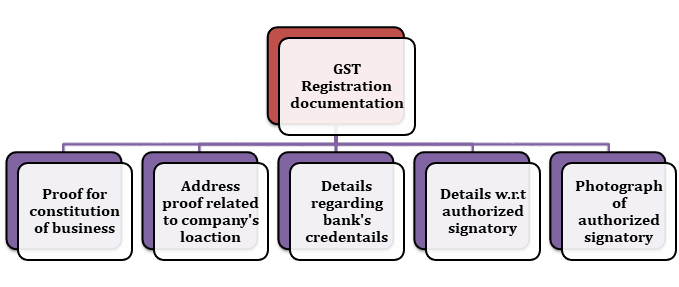

General documents required for GST registration

Identity and address proof

First things first, the government needs to know who you are and where they can send all the love letters (read: important documents). So, grab your Aadhaar card, passport, or any other valid identity proof that shows your beautiful face and don’t forget to bring along a proof of address, like a utility bill or rental agreement.

PAN card

You know that little card that makes your heart skip a beat every time you enter its number for some official work? That’s right, your PAN card. Make sure you have it handy, as it’s a crucial document for GST registration. No PAN card, no entry! It’s like trying to enter a fancy party without an invitation. Not happening, my friend.

Proof of business registration

You’ve got yourself a business, congratulations! Now, prove it to the government. Show them that your business is legally recognized by submitting your registration certificate or partnership deed. You’ve got nothing to hide, right? Good, then you’re all set!

Bank account details

The smell of money! Now, the government wants to know where you keep all that hard-earned cash. So, don’t forget to provide your bank account details, such as the account number and IFSC code. It’s like telling the government, “Hey, this is where the magic happens!” They just need to make sure everything is running smoothly.

Also Read: What are the documents required along with the GST registration application form?

Specific documents required for manufacturing industries

Copy of MOA and AOA

Attention, manufacturers! If you’re part of the manufacturing industry, the government wants to see your Memorandum of Association (MOA) and Articles of Association (AOA). These documents provide a sneak peek into the inner workings of your company. It’s like showing the government your secret recipe. Okay, maybe not that exciting, but you get the point.

List of directors and shareholders

Who’s running the show? The government wants to know! Prepare a list of all the directors and shareholders of your company. It’s like introducing your team to the government, except this time you don’t have to worry about handshakes or awkward small talk.

Proof of ownership or lease of premises

Where are the magic hands of your manufacturing industry working their wonders? If you own the premises, flaunt that ownership by providing the necessary documents. But if you’re leasing the place, no worries! Just make sure you have a lease agreement handy. It’s like letting the government know, “We’ve got the space, let’s get to work!”

Other industry-specific documents

Manufacturing is a complex world, and different industries may require additional documents to prove their authenticity. So, keep an eye out for any industry-specific documents that may be needed. It’s like playing a game of “find the missing puzzle piece,” but instead of puzzle pieces, you’re collecting a bunch of crucial documents.

Specific documents required for service industries

Service tax registration certificate

Attention, service providers! If you’re in the service industry, the government wants to know if you’ve been paying your service taxes on time. So, dig out that service tax registration certificate and show them you’re a responsible citizen. It’s like saying, “Hey, we may not be saving lives, but we’re contributing to the economy!”

Description of services provided

What exactly do you do in the service industry? The government wants a detailed description of your services. It’s like explaining your job to a skeptical relative at a family gathering, but this time, you’re doing it on paper. So, be specific and make it interesting!

Proof of past service transactions

You’ve been serving clients left, right, and center! Now it’s time to prove it. Gather some documents that show your past service transactions. It’s like building a case to prove your credibility, but instead of a courtroom, you’re presenting it to the government. Drama optional.

Also Read: GST Registration for Services: Documents Required

Other industry-specific documents

Like manufacturing, the service industry may have some unique requirements too. Make sure to keep an eye out for any industry-specific documents that may be needed for your GST registration. It’s like searching for hidden treasures, but instead of gold, you’re finding documents. So, put on your explorer hat and get ready for an adventure!

Now that you know the specific documents required for GST registration in different industries, go forth and conquer! Remember, it’s just a process, and soon you’ll be registered and ready to take on the world of taxes like a pro. Good luck! Specific documents required for e-commerce businesses.

Details of e-commerce platform

When registering for GST as an e-commerce business, you will need to provide details of the platform you are using to sell your products or services. This includes the name of the platform, its URL or website address, and any relevant registration numbers associated with the platform.

Proof of turnover and sales data

To validate your turnover and sales data, you will need to submit documents such as your financial statements, sales invoices, purchase orders, and any other relevant documents that can verify the revenue generated through your e-commerce platform.

Delivery and warehousing arrangements

As an e-commerce business, you will also need to provide details of your delivery and warehousing arrangements. This includes documents such as lease agreements or ownership proof of your warehouse or storage facility, delivery partner agreements, and other relevant paperwork confirming your logistical setup.

Other industry-specific documents

In some cases, there might be additional documents specific to your e-commerce industry that are required for GST registration. This can include licenses or permits related to the products or services you offer, any certifications required for operating in certain sectors, or any other industry-specific documents deemed necessary by the authorities.

Specific documents required for export-oriented industries

Export-import code

For export-oriented industries, obtaining an Export-Import (EXIM) code is essential. This code is issued by the Directorate General of Foreign Trade (DGFT) and serves as an identification number for businesses engaged in foreign trade. You must provide this code when applying for GST registration.

Export order or agreement copies

To demonstrate that you are engaged in export activities, you will need to submit copies of export orders or agreements. These documents show the details of the export transactions, including the parties involved, the products or services being exported, pricing, and other relevant terms and conditions.

Bank realization certificate

A bank realization certificate (BRC) is required to prove that the payment for your exported goods or services has been received in India. This certificate is issued by an authorized bank and demonstrates that the foreign currency earned from exports has been converted into Indian rupees.

Other industry-specific documents

Just like e-commerce businesses, export-oriented industries may also have additional industry-specific documents that need to be submitted for GST registration. These can include licenses or permits related to export activities, certificates of origin, or any other documents required by the authorities for your specific industry.

Common challenges and solutions in obtaining GST registration documents

Lack of proper documentation

One common challenge faced by businesses is a lack of proper documentation. To overcome this, it is crucial to maintain accurate and organized records from the beginning of your business operations. Implementing an efficient record-keeping system and regularly reviewing and updating your documents will help in avoiding any hurdles during the GST registration process.

Difficulty in obtaining specific industry documents

Obtaining specific industry documents, especially those which require external certifications or clearances, can be challenging. In such cases, it is advisable to seek guidance from industry associations or consultants who are well-versed in the requirements of your industry. They can provide assistance in obtaining the necessary documents or advise alternative solutions.

Seeking professional assistance for document preparation

Preparing the required documents for GST registration can be a complex task. Engaging the services of a professional, such as a chartered accountant or a tax consultant, can help ensure that your documents are prepared correctly and that you meet all the necessary requirements. They can guide you through the process, saving you time and potential headaches.

Conclusion and key takeaways for industry-specific GST registration

Obtaining GST registration for specific industries, such as e-commerce and export-oriented businesses, requires providing industry-specific documents along with the standard registration requirements. These documents help the authorities assess your business operations and ensure compliance with GST regulations.

Remember to gather and maintain all necessary documents, keeping them organized and up to date. If you encounter challenges, seek professional guidance or assistance to navigate through the process smoothly. By being proactive and well-prepared, you can ensure a hassle-free GST registration experience and focus on growing your business. Conclusion and key takeaways for industry-specific GST registration.

Obtaining GST registration documents can be a complex and time-consuming process, especially when it comes to industry-specific requirements. However, by understanding the specific documents needed for different industries, businesses can streamline their registration process and ensure compliance with tax regulations. It is crucial to gather all the necessary documents beforehand and seek professional assistance whenever required. By doing so, businesses can successfully register under GST and enjoy the benefits it offers. Remember, staying updated with the latest guidelines and seeking expert advice will go a long way in making the GST registration journey smoother and more efficient for your industry-specific business needs.

Also Read: GST Registration Documents Required For Specific Industries

Frequently Asked Questions (FAQ)

1. Are the document requirements for GST registration the same for all industries?

No, the document requirements for GST registration vary depending on the industry and the nature of business activities. Manufacturing industries, service industries, e-commerce businesses, and export-oriented industries may have specific document requirements. It is important to understand the industry-specific documents needed to ensure a successful GST registration process.

2. Can I seek professional assistance for obtaining industry-specific GST registration documents?

Absolutely! Seeking professional assistance can greatly simplify the process of obtaining industry-specific GST registration documents. Tax consultants or experts familiar with the requirements of different industries can guide you through the process, help you gather the necessary documents, and ensure compliance with tax regulations.

3. What should I do if I face challenges in obtaining specific industry documents for GST registration?

If you encounter challenges in obtaining specific industry documents for GST registration, it is advisable to consult with professionals or experts who have experience in dealing with such situations. They can provide guidance, suggest alternative solutions, or help you understand any alternative documents that can be submitted in case the original documents are unavailable.

4. Can I proceed with GST registration if I do not have all the industry-specific documents?

While it is ideal to have all the required industry-specific documents for GST registration, it is worth noting that alternative documents may be permissible in certain cases. It is advisable to consult with professionals or reach out to the relevant tax authority for guidance on acceptable alternatives or any temporary provisions that may be in place.