GST registration is a crucial step for businesses in complying with the Goods and Services Tax (GST) regulations. It requires the submission of specific documents to the tax authorities. Understanding the necessary documents is essential to ensure a smooth registration process. This article provides an overview of the documents required for GST registration, with a focus on industry-specific requirements. Whether you are in manufacturing, service, e-commerce, or export-oriented industries, having the right documentation in place is vital. By following the guidelines outlined in this article, businesses can navigate the GST registration process with greater ease and avoid potential issues.

Introduction to GST registration

What is GST registration?

GST registration is like getting a VIP pass to the world of taxation. It is the process by which a business gets registered under the Goods and Services Tax (GST) system of India. Basically, it’s the government’s way of keeping tabs on who’s selling what, where, and for how much.

Importance of GST registration

Now you might be wondering, “Why do I need to go through this registration hassle?” Well, my friend, it’s not just about avoiding hefty fines and legal troubles. GST registration actually comes with a bunch of benefits. For starters, you can legally collect taxes from your customers. It also gives you access to tax credits on your input costs. Plus, it’s a sign that you’re a serious player in the business world. So, don’t be a tax-evading rebel – get yourself registered!

While GST registration may seem like an administrative formality, it holds the key to unlocking various benefits and opportunities for businesses in India. To fully grasp its significance, let’s explore the key advantages and their implications:

| Benefit | Description | Impact on Business |

| Compliance with Law: | GST registration ensures compliance with the law, preventing penalties and legal implications. | Averts legal troubles and safeguards business reputation. |

| Ability to Collect GST: | Registered businesses can legally collect GST from customers, acting as agents of the government. | Generates revenue for the government and contributes to a transparent tax system. |

| Input Tax Credit (ITC): | Registered businesses can claim ITC on taxes paid on purchases, reducing overall tax liability. | Lowers costs, improves cash flow, and enhances competitiveness. |

| Supply to Other Businesses: | Registration is often mandatory to supply goods or services to other GST-registered businesses. | Expands market reach and enables participation in supply chains. |

| Business Credibility: | GST registration signals legitimacy and compliance, enhancing trust and credibility among customers and suppliers. | Strengthens business relationships and facilitates access to credit. |

| Access to Government Tenders: | Only GST-registered businesses can participate in government tenders and contracts. | Unlocks opportunities for growth and expansion in the public sector. |

Additional Advantages:

- Simplified Inter-state Trade: GST registration simplifies inter-state trade by eliminating multiple state-level taxes and barriers.

- E-Way Bill Generation: Enables seamless movement of goods across states through e-way bill generation.

- Online Compliance Portal: Access to the GST portal for filing returns, paying taxes, tracking status, and managing compliance activities.

- Formalization of Business: Encourages businesses to operate within a formal framework, leading to better financial management and access to formal credit.

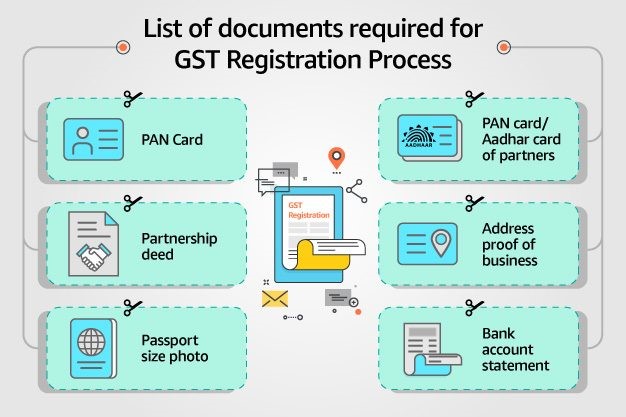

Common documents required for GST registration

Proof of identity

This one’s a no-brainer. You’ll need to prove who you are, so grab your PAN card or passport. No disguises please!

Proof of address

Where do you hang your hat? You’ll need to show some proof of your business address, like utility bills or rental agreements. Sorry, your favorite coffee shop’s address doesn’t count!

Bank account details

Get ready to spill the beans on your bank account. The government wants to know where the money flows, so have your account details handy.

Business registration documents

Time to show off your business’s registrations and licenses. Whether you’re a sole proprietor, a partnership, or a private limited company, make sure you have the right documents to prove it.

Also Read: GST registration documents checklist for small businesses

Industry-specific documents for GST registration

Understanding industry-specific requirements

Different industries have different needs – it’s like ordering your coffee with extra foam or a double shot of espresso. Industry-specific documents are like that extra foam or espresso shot, but for GST registration. So, hold on tight as we dive into the specific requirements for different industries!

Documents required for manufacturing industries

Licenses and permits for manufacturing

Manufacturing ain’t child’s play, my friend. You’ll need to gather all the necessary licenses and permits that prove you’re authorized to churn out those goods. It’s like collecting superhero badges, but for manufacturing!

Clearances from pollution control board

Don’t forget to take care of Mother Earth while you’re busy manufacturing. Clearances from the pollution control board are like certifications for being green and clean. Time to show off your eco-friendly side!

List of manufacturing machinery and equipment

Do you have an impressive lineup of machinery and equipment to get the job done? Well, it’s time to share the details. Remember, size doesn’t matter – unless we’re talking about machinery, of course!

There you have it! Now you know what documents you’ll need to impress the GST registration gods. Just gather them up, put on your best “I mean business” face, and get ready to join the ranks of the registered taxpayers. Good luck, my soon-to-be-registered friend!5. Documents required for service industries.

If you’re in the service industry, get ready to gather some paperwork. Here are the documents you’ll need:

Proof of specialized skills or qualifications

To show that you’re a pro at what you do, it’s crucial to provide proof of your specialized skills or qualifications. This could include copies of your educational certificates, training course completion certificates, or any other relevant documents that demonstrate your expertise.

Service-related licenses or certifications

Many service industries require specific licenses or certifications to operate legally. Make sure to include copies of these licenses or certifications along with your GST registration documents.

List of services offered

Don’t forget to provide a comprehensive list of all the services you offer. Make it clear and concise, so both the tax authorities and your clients understand what you bring to the table.

Also Read: GST Registration for Services: Documents Required

Documents required for e-commerce businesses

If you’re running an e-commerce business, get ready to tackle some digital documents. Here’s what you’ll need:

Company’s website and domain registration proof

First things first, you need to prove that your e-commerce business is legit. Provide proof of your website and domain registration to establish your online presence.

Details of payment gateway used

Since online transactions are the bread and butter of e-commerce, include details of the payment gateway you’re using. This could be information about the service provider, payment integration documents, or any other relevant information.

Sample copies of invoices generated

To show how you’re conducting transactions, include sample copies of the invoices generated from your e-commerce platform. It’s a good idea to organize these invoices neatly and keep them handy for tax audits or other purposes.

Documents required for export-oriented industries

If you’re in the export business, it’s time to put your shipping documents in order. Here’s what you’ll need:

Export license and registration details

To prove that you’re involved in exporting goods, provide your export license and registration details. These documents are crucial for government authorities to ensure compliance with international trade regulations.

Export-related bank account statements

A good practice is to include bank account statements that reflect your export-related transactions. This helps establish the flow of funds and confirms your involvement in export activities.

Shipping and logistics documents

Shipping and logistics play a crucial role in export-oriented industries. Include relevant documents, such as bills of lading, shipping invoices, customs declarations, and any other supporting paperwork.

Additional considerations for GST registration documents

Now that you know what specific industries require, let’s cover some general tips:

Importance of maintaining accurate and updated documents

Remember, accurate and updated documentation is key. Keeping your records in order not only helps with GST registration but also benefits your overall business operations. It’s worth investing time and effort into maintaining organized and up-to-date records.

General Documents for All Applicants:

- PAN card of the applicant

- Business registration proof (e.g., Certificate of Incorporation for companies, Registration Certificate for proprietorships)

- Address proof of business premises (e.g., rent agreement, electricity bill)

- Bank account details with a cancelled cheque

- Aadhaar card of the authorized signatory

Industry-Specific Documents:

-

Manufacturers:

- Manufacturing License or Permission (if applicable)

- List of raw materials used for production

- List of finished goods manufactured

- Technical specifications of manufacturing processes

-

E-commerce Operators:

- Website URL and details of online platforms used

- Delivery and logistics partners’ details

- Payment gateway integration details

- Information on marketplace or inventory-based model

-

Restaurants:

- Food Safety and Standards Authority of India (FSSAI) license

- Health and trade licenses from local authorities

- Lease agreement or ownership documents for premises

- Menu and price list

-

Transporters:

- Goods carriage permit

- Vehicle registration certificates

- Insurance policies for vehicles

- Goods and services contracts with clients

-

Construction Companies:

- Work contracts or agreements with clients

- List of machinery and equipment owned or leased

- Site location details and relevant permits

-

Exporters:

- IEC (Import Export Code)

- Letter of credit or export invoices

- Custom clearance documents for previous exports (if applicable)

Additional Documents for Specific Cases:

- Partnership firms: Partnership Deed

- Limited Liability Partnerships (LLPs): LLP agreement

- Professionals (lawyers, doctors, etc.): Professional registration certificates

- Government entities: Authorization letter from competent authority

Important Considerations:

- The exact document requirements may vary slightly across states. It’s advisable to check with the relevant state GST authorities for specific guidelines.

- Documents must be valid and up-to-date.

- Foreign entities need additional documents like passport copies and address proof in their home country.

- Professional guidance from a GST expert can streamline the process and ensure compliance with industry-specific requirements.

Tips for organizing and storing GST registration documents

To make your life easier, consider organizing your GST registration documents in a systematic manner. Use digital storage solutions or physical folders to keep everything in one place. Label and categorize documents for easy retrieval when needed.

Now that you’re armed with the knowledge of what documents are required for specific industries and some extra tips, go conquer that GST registration process with confidence!In conclusion, GST registration is a fundamental requirement for businesses across various industries. By being aware of the specific documents needed for registration, businesses can streamline the process and avoid delays or complications. It is crucial to stay updated with any changes in the GST regulations and ensure that all documentation is accurate and up-to-date. By maintaining proper records and organizing GST registration documents efficiently, businesses can operate in compliance with the GST laws and contribute to a seamless tax system.

Also Read: What are the documents required along with the GST registration application form?

FAQ

1. What are the common documents required for GST registration?

The common documents required for GST registration include proof of identity, proof of address, bank account details, and business registration documents. These documents help establish the identity and legitimacy of the business.

2. Are the documents required for GST registration the same for all industries?

No, the documents required for GST registration can vary depending on the industry. Different industries may have specific requirements based on their nature of operations, such as manufacturing, service, e-commerce, or export-oriented businesses.

3. How important is it to maintain accurate and updated GST registration documents?

Maintaining accurate and updated GST registration documents is crucial for businesses. It helps ensure compliance with tax regulations, simplifies the auditing process, and minimizes the risk of penalties or legal issues. It is advisable to regularly review and update the documents as necessary to reflect any changes in the business.

4. What are some tips for organizing and storing GST registration documents?

Organizing and storing GST registration documents in a systematic manner can help businesses retrieve them easily when needed. Some tips include maintaining digital copies as backups, using cloud storage services, labeling documents appropriately, and keeping them in secure and easily accessible folders or files.