The GST rate list is critical for every Indian business and consumer. When the GST Council revises GST rates, it affects specific industries, trade bodies, and end consumers, affecting the economy. Everyone evaluates their position as a result of this development. Our HSN cum GST rates finder assists you in determining the most accurate and current GST rate applicable to the product/service.

In this post, you will learn what a GST rate is and get all the newest details on GST rates in India 2024.

What are the GST rates in India?

Various GST rates have been established to improve transparency and confidence between customers and sellers during the tax procedure. Each of these slabs has several types of goods based on specific parameters.

These rates are set by the GST Council. This Council periodically revises the rate slab for products and services. The GST rates are often high for luxury items and low for necessities. In India, the GST rate for various goods and services is divided into four slabs: 5%, 12%, 18%, and 28%.

Meaning of GST Rates

GST rates are the percentage rates of tax levied on the sale of goods and services under the CGST, SGST, and IGST Acts. A GST-registered business must issue invoices that include GST amounts charged on the value of supplies.

The GST rates for CGST and SGST (for intrastate transactions) are roughly the same. The GST rate in the event of IGST (for inter-state transactions) is approximately the sum of the CGST and SGST rates.

Types of GST Rates and GST Rate Structure in India

The primary GST slabs for each regular taxpayer are now set at 0% (nil-rated), 5%, 12%, 18%, and 28%. There are a few lesser-used GST rates, including 3% and 0.25%.

Furthermore, the composition taxable people must pay GST at lower or nominal rates, such as 1.5%, 5%, or 6% of their sales. TDS and TCS are also part of the GST system, with rates of 2% and 1%, respectively.

These are the total GST rate of IGST for interstate supply or the sum of CGST and SGST for intrastate supply. To calculate the GST amount on a tax invoice, multiply the GST rates by the assessable value of the supply.

Furthermore, the GST law imposes a cess in addition to the above GST rates on the sale of certain commodities such as cigarettes, tobacco, aerated water, gasoline, and motor vehicles, with rates ranging from 1% to 204%.

The following table shows the GST rate structure for some of the most widely used consumable products.

| Tax Rates | ||

| 0% | Milk | Kajal |

| 0% | Eggs | Educational Services |

| 0% | Curd | Health Services |

| 0% | Lassi | Children’s Drawing & Colouring Books |

| 0% | Unpacked Foodgrains | Unbranded Atta |

| 0% | Unpacked Paneer | Unbranded Maida |

| 0% | Gur | Besan |

| 0% | Unbranded Natural Honey | Prasad |

| 0% | Fresh Vegetables | Palmyra Jaggery |

| 0% | Salt | Phool Bhari Jhadoo |

| 5% | Sugar | Packed Paneer |

| 5% | Tea | Coal |

| 5% | Edible Oils | Raisin |

| 5% | Domestic LPG | Roasted Coffee Beans |

| 5% | PDS Kerosene | Skimmed Milk Powder |

| 5% | Cashew Nuts | Footwear (< Rs.500) |

| 5% | Milk Food for Babies | Apparels (< Rs.1000) |

| 5% | Fabric | Coir Mats, Matting & Floor Covering |

| 5% | Spices | Agarbatti |

| 5% | Coal | Mishti/Mithai (Indian Sweets) |

| 5% | Life-saving drugs | Coffee (except instant) |

| 12% | Butter | Computers |

| 12% | Ghee | Processed food |

| 12% | Almonds | Mobiles |

| 12% | Fruit Juice | Preparations of Vegetables, Fruits, Nuts or other parts of Plants including Pickle Murabba, Chutney, Jam, Jelly |

| 12% | Packed Coconut Water | Umbrella |

| 18% | Hair Oil | Capital goods |

| 18% | Toothpaste | Industrial Intermediaries |

| 18% | Soap | Ice-cream |

| 18% | Pasta | Toiletries |

| 18% | Corn Flakes | Computers |

| 18% | Soups | Printers |

| 28% | Small cars (+1% or 3% cess) | High-end motorcycles (+15% cess) |

| 28% | Consumer durables such as AC and fridge | Beedis are NOT included here |

| 28% | Luxury & sin items like BMWs, cigarettes and aerated drinks (+15% cess) |

|

Note: Beginning July 18, 2022, labeled and pre-packaged paneer, buttermilk, and curd will be subject to a 5% GST.

Also Read: Different GST Tax Rates

What are the GST rates in India in 2024?

The year 2024 began with significant increases to GST rates passed during the final week of December 2022. During its meetings, the GST Council also amended the GST rates on some essential commodities for 2022. Some were done to fix the current inverted tax structure, while others were updated for revenue purposes. The sections below provide a summary of changes to GST rates in India, including the new GST rates in 2024.

Also Read: Revision Of GST Rate From 1 Jan 2024

GST Rate Changes at 49th GST Council Meeting

Key GST rate revisions

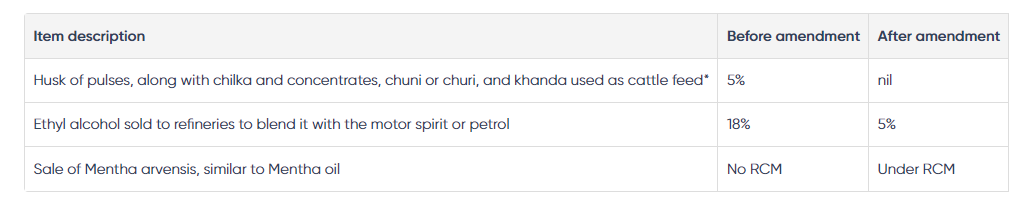

The 49th GST Council meeting took place on February 18, 2023, to consider specific GST rate modifications as follows:

Other important GST rate-related decisions

- Due to scheduling constraints, the issue of MUV classification in accordance with SUVs was not addressed.

- GST on cement was not brought up by the fitment committee for further review; it may be on the agenda for the next Council meeting.

- There has been no agreement achieved on lowering the GST rate for millet-based health goods, and further discussions are required.

- Services such as renting premises for commercial use to local bodies and others given by registrars of courts/tribunals would be subject to GST on reverse charge beginning March 1, 2023, as per CGST (Rate) Notification no. 2/2023 issued February 28, 2023.

Also Read: 49th GST Council Meeting Highlights, Updates, Outcome, and More

GST Rate Changes at 48th GST Council Meeting

At the 48th GST Council meeting held on December 17, 2022, the following amendments were suggested by the GST Council and notified by CBIC to take effect on January 1, 2023.

Clarifications on tax rates for the delivery of goods and services include the following:

- Rab, also known as rab-salawat, is classed under HSN code 1702 and has an 18% GST rate.

- GST at 18% is levied on “fryums” created through extrusion, which are mainly covered under HSN number 19059030.

- The SUV cess of 22% applies if four criteria are met: 5% GST on imported equipment or items in the concessional, 5% GST rate category for petroleum operations, and 12% GST if the general GST rate exceeds 12%.

- No GST is paid if the residential dwelling is rented to a GST-registered person for personal use/account as a residence rather than for business.

- The Central Government provides incentives to banks as a subsidy for the development of RuPay Debit Cards and low-value BHIM-UPI transaction systems, which are not subject to GST.

Also Read: 48th GST Council Meeting Highlights, Updates, Outcome and More

Wrapping It Up

The trading community and the GST council have recently debated GST tax rates extensively. The GST council of members has held multiple rounds of meetings to adjust the GST rates. The most recent GST rates show a drop of 6% to 18% in GST rates for numerous commodities across most categories.

FAQs

-

What is the GST gold rate?

Under HSN Chapter 71, the GST rate for gold jewelry and gold biscuits, as well as any semi-manufactured form, is 3% (IGST or 1.5% each of CGST and SGST).

-

What is the GST rate applicable to mobile?

Currently, the GST rate on mobile phones is 18% under HSN Chapter 3 and HSN code 85171219.

-

What are the GST rates for goods and services?

GST rates for goods and services can range from 0% to 28%. Certain commodities, such as gold, diamonds, and valuable stones, may incur a 3% or 0.25% tax.

-

What are the correct GST slabs for goods and services?

The GST law specifies and classifies products and services as 5%, 12%, 18%, and 28%. However, a few commodities have a GST charge between 0.25% and 3%. These include gold, diamonds, and valuable stones.

-

What are the three types of GST?

Currently, there are three forms of GST: central goods and services tax (CGST), state goods and services tax (SGST), and integrated goods and services tax (IGST). While a taxpayer must deposit CGST and SGST for all intrastate transactions, IGST is required for imports and interstate transactions.

-

Who has to pay the GST rate?

Suppliers of taxable products and services must charge and collect GST at the specified rate from their buyers or customers. The collected GST must be submitted to the government after claiming the appropriate input tax credit on their purchases. It’s referred to as the forward charge. In other circumstances, the buyer or consumer pays the GST directly to the government as a reverse charge.

-

Is GST charged at the GST rate on all goods and services?

No, certain things are free from GST and do not require payment. Exempted products include those that are not rated, are not subject to GST, or are exempted by notification. Furthermore, when zero-rated products are sold, any GST paid will be refunded.

-

What are the most recent changes in GST rates?

New GST rates have been decreased for certain items classified as domestic goods.

-

What are HSN and SAC?

The SAC code stands for Services Accounting Code. It applies to all services delivered in India. In India, the SAC code system is used to identify, classify, measure, and determine the application of GST to services. The Harmonized System Nomenclature (HSN) code applies to Indian commodities.

-

Who decides the GST rates?

The central government sets the country’s GST rates.