The enactment of the LPG bill in 1991 opened doors to various opportunities in India, ranging from a variety of products to upscaled quality of goods. Undoubtedly, it was a revolutionary move for the Indian financial system. However, it also had its repercussions on the small enterprises in the country. To date, they face difficulties in competing and sustaining with MNCs.

Therefore, to avoid such hindrances in the Indian market and ensure a healthy trade environment, the government offers various MSME registration benefits. However, it has its registration process.

If you own a small-scale business and wonder how to register MSME in India, read this article till the end. It will also discuss the documents required for this process in detail.

MSME & its Meaning

MSME is also known as Micro, Small, and Medium Enterprises. These are businesses that vary in size and scale. Here is a detailed breakdown of its classification:

1. Micro Enterprises

Micro enterprises are the smallest businesses in terms of size and scale. These businesses operate on a very modest level. The investment in plant and machinery or equipment for manufacturing does not exceed one crore rupees.

In the case of service enterprises, the investment limit is capped at ₹10 lakhs. Micro enterprises, by definition, are characterised by their very small scale of operations.

2. Small Enterprises

Small enterprises are larger than micro-enterprises but still fall within the category of smaller businesses. These businesses have a greater investment capacity compared to micro-enterprises.

The investment in plant and machinery or equipment for manufacturing ranges from one crore to ten crore. For service enterprises, the investment limit extends from ₹10 lakhs to ₹2 crores. Small enterprises occupy a middle ground between micro and medium-sized businesses.

3. Medium Enterprises

Medium-sized enterprises represent a more substantial scale of business operations. These businesses are larger and more developed compared to micro and small enterprises.

The investment in plant and machinery or equipment for manufacturing falls within the range of ten crores to fifty crores. In service enterprises, the investment limit is set between ₹2 crores and ₹5 crores. Medium enterprises play a crucial role in bridging the gap between small businesses and larger industrial players.

What is MSME Registration?

In the Indian context, MSME registration signifies the formal enrollment of Micro, Small, and Medium Enterprises with the government. This process involves providing crucial details like the business’s name, type, location, and capital investment in equipment.

MSMEs gain access to many government incentives through this official recognition. This acts as a catalyst for their growth and development. Such advantages encompass financial assistance, prioritization in state-run programs, and facilitated loan acquisition.

Eligibility Criteria for MSME Registration

For eligibility for MSME registration under the Udyam initiative, an enterprise must meet specific criteria based on its type (proprietorship, partnership, company, etc.) and investment/turnover limits. Here’s a detailed breakdown:

| Enterprise Type | Investment Limit | Turnover Limit |

| Micro | Up to ₹1 crore | Up to ₹5 crore |

| Small | Up to ₹10 crore | Up to ₹50 crore |

| Medium | Up to ₹50 crore | Up to ₹250 crore (₹500 crore for export units) |

Additional Eligibility Points

- The enterprise must be engaged in a manufacturing or service activity.

- Certain activities like agriculture, retail trade, and financial services are not covered under MSME registration.

- The paid-up capital and turnover limits apply for companies and limited liability partnerships (LLPs).

The determination of investment and turnover limits for MSME classification is contingent on the financial data from the previous fiscal year. In cases where an enterprise engages in both manufacturing and service activities, the combined turnover from both sectors is considered to ascertain its MSME category. Notably, for export-oriented units, there is an extension of the turnover limit for medium enterprises, allowing them to qualify with turnovers up to ₹500 crore.

Documents Required for MSME Registration

No documents are required in the MSME registration process. It is completely paperless and relies on self-declaration for accuracy. The Udyam registration portal operates on a trust-based system, eliminating the need for uploading any documents.

This simplifies the process and makes it accessible to all potential MSMEs without worrying about paperwork hassles. However, during registration, you will be required to provide some essential details about your enterprise, including:

1. PAN Card

It serves as your unique identification for tax purposes.

2. Aadhaar Card

It is useful for verification and authentication.

3. Investment in Plant & Machinery/Equipment

It is self-declared based on the past financial year.

4. Turnover

It is self-declared based on the past financial year.

5. GSTIN (if applicable)

It is required for businesses registered under the Goods and Services Tax (GST) Act.

You can register your MSME quickly and seamlessly by understanding this document-free approach. It will further unlock the doors to government assistance and propel your business towards success.

What is the MSME Registration Process or Udyam Registration?

Although getting your MSME registered is a simple process, many people still search for how to register MSME in India. So, follow the following step-by-step process to ensure an effortless registration:

1. For Individual Entrepreneurs (Proprietorship, HUF)

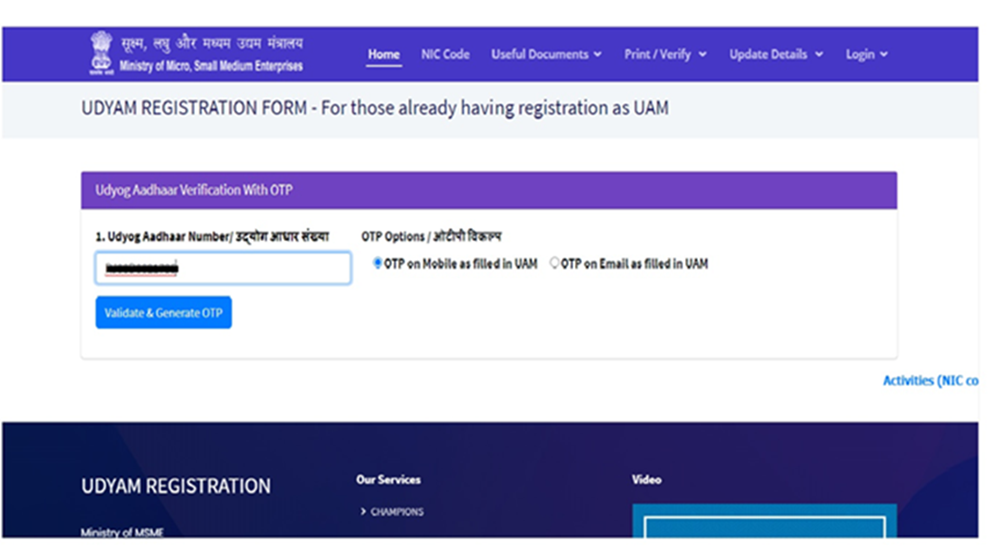

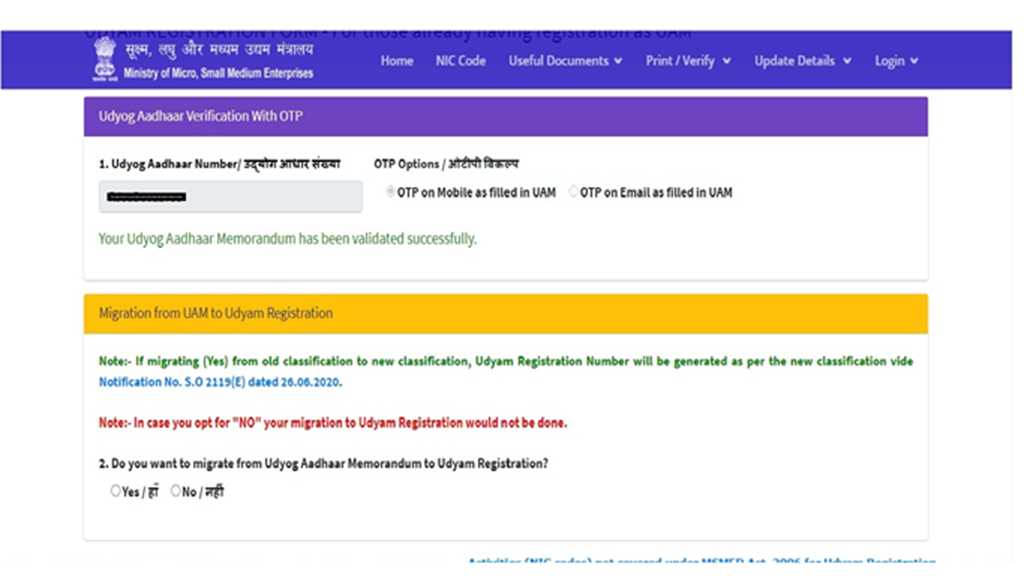

Step 1: Visit the Udyam Registration Portal

You must start by visiting Udyam and clicking “For New Entrepreneurs who are not registered yet as MSME or those with EM-II.”

Step 2: Enter Aadhaar & Validate

Input your Aadhaar number and the name of the entrepreneur, then click “Validate & Generate OTP.” You will get a one-time password on your registered mobile number.

Step 3: Fill in Enterprise Details

Provide information about your business, including its name, type (manufacturing or service), and location.

Step 4: Investment & Turnover

Declare your investment in plant & machinery and annual turnover based on the previous financial year.

Step 5: Review & Submit

Review all entered details for accuracy, then click “Submit” to complete the registration.

Step 6: Registration Confirmation

You will get a confirmation mail including your own Udyam Registration Number. Download and print the certificate for reference.

Also Read: Do I Need a GST Identification Number for Udyam Registration?

2. For Companies/LLPs

Step 1: Prepare Required Information

Start by gathering details like company name, PAN, GSTIN (if applicable), authorised signatory information, and investment/turnover figures.

Step 2: Access the Portal

Visit the Udyam portal and choose “For existing Entrepreneurs / Companies / LLPs already registered with any Government Department / Agency.”

Step 3: Authentication

Choose your preferred authentication method (PAN, GSTIN, or CIN) and enter the corresponding details to proceed.

Step 4: Complete the Form

Provide the requested information about your company/LLP, including investment, turnover, and authorised signatory details.

Step 5: Verification & Confirmation

The platform verifies the data you provide through official channels. Once successful, you will receive a Udyam Registration Number and a downloadable certificate.

What are the Benefits of MSME Registration?

Ensuring an MSME registration of your enterprise can give you numerous benefits. Some of the major MSME registration benefits are:

1. Easier Access to Loans

As an MSME, you enjoy a simplified loan application process, benefiting from preferential loan schemes that offer lower interest rates and collateral-free options. This streamlined approach makes it easier for your business to secure crucial financial resources.

2. Priority in Government Tenders

Being registered provides MSMEs with a strategic advantage in government procurement tenders. This preferential treatment opens doors to valuable opportunities for securing business contracts, contributing significantly to their expansion.

3. Subsidies & Grants

Government schemes provide substantial support, including subsidies on electricity bills, interest subventions, and assistance for technology upgrades. These financial boosts translate into significant cost savings and improved operational efficiency for your MSME.

4. Dispute Resolution

Dedicated tribunals handle commercial disputes involving MSMEs. This ensures a faster and more cost-effective resolution compared to traditional court proceedings.

5. Ease of Obtaining Licenses and Permits

MSME registration simplifies the often complex and time-consuming process of obtaining licenses and permits. This streamlined regulatory compliance facilitates smoother operations, enabling firms to concentrate more on their primary areas.

6. Training Programs

Government-supported skill development programs offer your employees access to specialised training and upskilling opportunities, enhancing their capabilities and contributing to overall business productivity.

7. Networking Opportunities

Vibrant networking platforms are created through government and private-sector initiatives. These initiatives allow you to connect with fellow entrepreneurs, share experiences, and collaborate for mutual growth.

8. Simplified Compliance

MSME registration brings relief from complex regulations and reporting requirements. The government eases various compliance processes, reducing the administrative burden on your business. This further allows you to concentrate on growth.

Also Read: How Has GST Helped MSMEs Grow Their Businesses?

Conclusion

MSMEs cherish a plethora of benefits in governmental and international trade situations. Therefore, ensuring your enterprise is registered as an MSME is essential to grow it to its full potential. Also, remember, no matter how difficult and complex MSMEs and their registration sound. It is a simple and easy process. So, take the help of the MSME registration process discussed above and take the first step to procure your MSME certificate. It would also be wise to keep all the necessary documents ready before the registration to ensure a fast and effortless registration.

Also Read: GST and the MSME Sector

Frequently Asked Questions

Q1. Is GST Compulsory for MSME?

For enterprises or entities that do not require GST registration, the GST number is not required for the MSME registration procedure. On the other hand, enterprises or firms with an annual revenue of more than 40 lakhs are taxable entities.

Q2. Is MSME Tax-Free?

MSMEs benefit from income tax exemption under Section 80J of the Income Tax Act, providing relief for seven years from the date of incorporation. This incentive supports the financial well-being of small and medium enterprises during their crucial initial years, fostering a conducive environment for sustained growth.

Q3. Which Business Comes Under MSME?

Enterprises that are involved in the business of leather goods, moulding items, xeroxing, etc., come under MSME.

Q4. What is the new MSME Scheme 2023?

The Pradhan Mantri Mudra Yojana (PMMY) aims to support non-corporate, non-farm small and micro enterprises by offering loans up to ₹10 lakh. On a broader scale, the PM Vishwakarma Scheme, a Central Sector Scheme, is allocated a budget of ₹13,000 crore for implementation from 2023-24 to 2027-28, emphasizing comprehensive support for various sectors and initiatives.

Q5. Who is Eligible for MSME 2023?

The MSME 2023 scheme applies when a business’s investment in plant and machinery or equipment does not surpass fifty crore rupees and the turnover remains within the limit of two hundred and fifty crore rupees. Meeting these criteria places the enterprise within a specific category, often associated with medium-sized businesses under the MSME framework.

Q6. Can a Startup be an MSME?

Startups have the opportunity to be recognised as MSMEs by submitting an application through the Udyog Aadhaar Memorandum (UAM) and providing the required declarations and documents. The detailed process for MSME registration is outlined to facilitate a straightforward and efficient application procedure for startups seeking MSME registration benefits.

Q7. Can a Person have 2 MSME Registrations?

Individuals with existing registrations such as EM-II or any other registration issued by authorities under the Ministry of MSME must undergo re-registration. It is important to note that no enterprise is permitted to file more than one Udyam Registration. This requirement ensures a streamlined and singular registration process, avoiding duplication in the MSME registration system.

Q8. What is an MSME Subsidy?

Under this MSME loan subsidy initiative, qualified businesses can get a 2% annual interest rate reduction on their outstanding fresh/incremental term loans or working capital loans while the scheme is in effect.

Q9. What is the Last Date of the MSME Certificate?

Each company is obligated to submit MSME Form I as a half-yearly return, with deadlines set for 31st October (covering April to September) and 30th April (covering October to March) annually. This form provides details regarding outstanding payments to MSMEs, ensuring transparency and timely reporting in compliance with regulations.

Q10. How Long is the Udyam Certificate Valid?

The Udyam certificate, obtained through Udyam registration with an Aadhaar, remains valid for a lifetime. Once the registration process is completed, the Udyam certificate serves as a permanent recognition for the enterprise, offering continuous access to the benefits and advantages associated with MSME status.