Income Tax Return (ITR) filing is a process where we tell the government how much money we earned. It’s important because it helps the government know who earned what and how much tax they need to pay. Anyone who earns money, whether from a job or business, should fill out an ITR. You should fill out your ITR every year before the deadline by the government, usually around the end of the financial year. This helps ensure that everyone pays their fair share of taxes and helps the government provide essential services like schools, hospitals, and infrastructure.

Preparing for ITR Filing

To prepare for filing income tax returns, individuals or businesses should follow these steps:

- Gather necessary documents: Collect all relevant financial documents such as income statements (like salary slips, profit and loss statements), investment proofs, receipts for deductible expenses, and any other relevant paperwork.

- Organize financial records: Arrange the gathered documents systematically to ensure easy access and accurate reporting of income, expenses, and investments.

- Review tax laws and regulations: Stay updated with the latest tax laws and regulations to ensure compliance and maximize available deductions or exemptions.

- Determine applicable ITR form: Identify the appropriate Income Tax Return (ITR) form based on the nature of income, sources of income, and taxpayer category. Different forms cater to various types of taxpayers, such as individuals, businesses, or other entities.

- Calculate taxable income: Calculate total taxable income by adding up all sources of income and deducting allowable expenses, exemptions, and deductions as per the tax laws.

- Claim deductions and exemptions: Make use of available deductions and exemptions to minimize taxable income, such as those related to investments, expenses, or specific allowances.

- Double-check calculations: Ensure accurate calculations of taxable income, deductions, and tax liability to avoid errors or discrepancies.

- File electronically or through a tax professional: Choose the preferred method of filing tax returns, either electronically through online platforms provided by tax authorities or through a qualified tax professional.

- Keep records for future reference: Maintain copies of filed tax returns, supporting documents, and receipts for at least a few years for future reference or in case of audits or inquiries by tax authorities.

Different ITR Forms and their Applicability

Different ITR (Income Tax Return) forms cater to various types of taxpayers and their sources of income. Here’s a simplified breakdown of the commonly used ITR forms and their applicability:

-

ITR-1 (Sahaj):

- Applicability: Individuals with income from salary/pension, one house property, and income from other sources (excluding lottery winnings and income from horse races). Total income should not exceed ₹50 lakhs.

- Not applicable for: Individuals with income from business or profession, capital gains, agricultural income exceeding ₹5,000, or income from foreign assets.

-

ITR-2:

- Applicability: Individuals and Hindu Undivided Families (HUFs) not having income from profits and gains of business or profession.

- Includes all sources of income as mentioned in ITR-1 along with income from capital gains, foreign assets/foreign income, agricultural income exceeding ₹5,000, and more than one house property.

-

ITR-3:

- Applicability: Individuals and HUFs having income from profits and gains of business or profession.

- Applicable for taxpayers with income from business or profession under presumptive taxation scheme (Section 44AD, 44ADA, 44AE).

-

ITR-4 (Sugam):

- Applicability: Individuals, HUFs, and firms (other than LLPs) opting for presumptive income scheme under Section 44AD, 44ADA, or 44AE.

- Includes income from business or profession computed under presumptive taxation, salary/pension, one house property, and income from other sources.

-

ITR-5:

- Applicability: Firms, LLPs (Limited Liability Partnerships), Association of Persons (AOPs), Body of Individuals (BOIs), Artificial Juridical Persons (AJPs), and Cooperative Societies.

- Applicable for all types of income including income from business or profession.

-

ITR-6:

- Applicability: Companies other than companies claiming exemption under Section 11 (Income from property held for charitable or religious purposes).

- Companies opting for presumptive taxation under Section 115BA cannot file ITR-6.

-

ITR-7:

- Applicability: Persons including companies required to furnish return under Section 139(4A) or Section 139(4B) or Section 139(4C) or Section 139(4D) (charitable/religious trusts, political parties, institutions, colleges, etc.).

- Also applicable for entities claiming exemption under Section 10 (income not included in total income).

These are the main ITR forms and their applicability, each catering to specific categories of taxpayers and their sources of income.

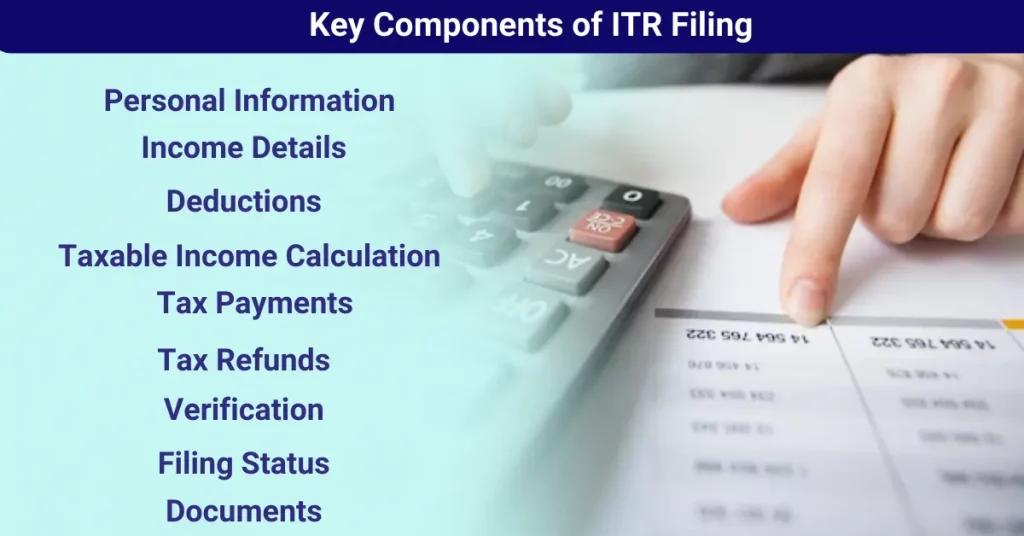

Key Components of ITR Filing

The key components of filing an Income Tax Return (ITR) include:

- Personal Information: This includes details such as name, PAN (Permanent Account Number), Aadhaar number (if applicable), address, contact information, and bank account details.

- Income Details: This section requires information on various sources of income such as salary, income from house property, capital gains, business or profession income, other sources of income like interest, dividends, etc.

- Deductions: Details of deductions claimed under various sections of the Income Tax Act, such as Section 80C (investment in specified instruments like PPF, EPF, life insurance premium, etc.), Section 80D (health insurance premiums), Section 80G (donations), and others.

- Taxable Income Calculation: After deducting eligible deductions from the total income, the taxable income is calculated.

- Tax Payments: Details of tax payments made during the financial year such as TDS (Tax Deducted at Source), advance tax, and self-assessment tax.

- Tax Refunds: If there is any excess tax paid, details of tax refunds claimed should be provided.

- Verification: The taxpayer needs to verify the accuracy of the information provided in the return.

- Filing Status: Choose the appropriate filing status, whether it’s original return, revised return, or return in response to notice.

- Documents: Supporting documents such as Form 16 (for salary income), Form 16A (for TDS on non-salary income), bank statements, investment proofs, etc., should be kept ready for reference.

- Form Selection: Choosing the correct ITR form based on the taxpayer’s income sources and other criteria.

- Submission: Once all the details are filled correctly, the taxpayer can submit the return electronically using the e-filing portal of the Income Tax Department.

- Acknowledgment: Upon successful submission, an acknowledgment is generated. This acknowledgment should be retained for future reference.

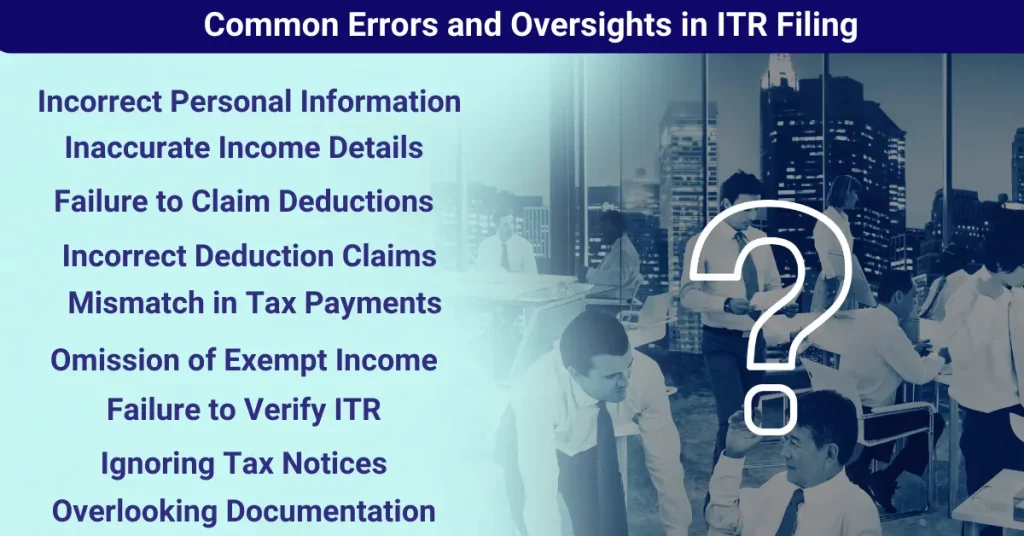

Common Errors and Oversights in ITR Filing

Common errors and oversights in ITR filing include:

- Incorrect Personal Information: Providing wrong details like name or PAN can complicate return processing.

- Inaccurate Income Details: Not reporting all income sources accurately may lead to underreporting.

- Misclassification of Income: Misclassifying income can cause errors in tax calculation.

- Failure to Claim Deductions: Forgetting eligible deductions can increase tax liability.

- Incorrect Deduction Claims: Providing wrong deduction figures may invite tax authority scrutiny.

- Mismatch in Tax Payments: Failing to reconcile TDS amounts can lead to discrepancies.

- Omission of Exempt Income: Neglecting to report exempt income can result in underreporting.

- Failure to Verify ITR: Not verifying the ITR on time can lead to penalties or non-processing.

- Ignoring Tax Notices: Neglecting to respond to tax notices can have legal consequences.

- Overlooking Documentation: Not maintaining proper documentation can pose challenges during audits.

Importance of Accuracy in ITR Filing

The importance of accuracy in ITR filing cannot be overstated due to several reasons:

- Compliance with Tax Laws: Accurate ITR filing ensures compliance with tax laws, regulations, and reporting requirements mandated by the government. Failure to comply may lead to penalties, fines, or legal consequences.

- Avoidance of Penalties: Filing an inaccurate return or providing incorrect information may attract penalties from the tax authorities. Accuracy helps in avoiding such penalties and unnecessary financial liabilities.

- Assessment of Tax Liability: Accurate reporting of income, deductions, and tax payments facilitates the correct calculation of tax liability. It ensures that taxpayers pay the correct amount of tax as per their income and eligibility for deductions.

- Prevention of Tax Evasion: Accurate reporting helps prevent tax evasion by ensuring that all sources of income are disclosed, and taxes are paid accordingly. It contributes to maintaining fairness and integrity in the tax system.

- Timely Processing of Returns: Accuracy expedites the processing of tax returns by the tax department. It reduces the chances of scrutiny or audit, as accurately filed returns are less likely to raise red flags.

- Claiming of Tax Refunds: Accurate reporting ensures that taxpayers claim eligible deductions and tax credits, leading to the rightful claiming of tax refunds. It maximizes tax benefits and financial returns for taxpayers.

- Financial Planning: Accurate reporting of income and tax liabilities enables taxpayers to make informed financial decisions and plan their finances effectively. It helps in budgeting, investment planning, and achieving long-term financial goals.

- Trust and Credibility: Accurate ITR filing enhances the trust and credibility of taxpayers in the eyes of tax authorities and financial institutions. It reflects honesty and transparency in financial matters, fostering goodwill and compliance.

- Avoidance of Future Issues: Accurate filing reduces the likelihood of receiving tax notices, undergoing audits, or facing legal disputes with the tax department in the future. It minimizes the risk of financial and reputational damage.

Tips to Avoid Costly Errors while Filing ITR

Gather all necessary documents. (Such as Form 16, Form 26AS, bank statements, investment proofs, and receipts for deductions before starting the filing process)

- Choose the correct ITR form (It should be based on your Income, residential status, and other relevant factors)

- Double-check personal information.

- Report all sources of income (Like salary, rental income, capital gains, interest income, and other earnings)

- Verify tax deductions and exemptions

- Reconcile TDS details (Verify TDS details mentioned in Form 26AS with the TDS certificates received from deductors

- Maintain accuracy in calculations.

- Review before submission.

- File on time.

- Seek professional assistance if needed.

Also Read: Income Tax Return (ITR) Filing Tips for Individual and Business for the New Financial Year

Conclusion

In conclusion, mastering the essentials of ITR filing and avoiding costly errors and oversights are paramount for every taxpayer. By understanding the process, gathering necessary documents, and ensuring accuracy in reporting, individuals can navigate the complexities of tax compliance with confidence. Vigilance in double-checking personal information, income details, deductions, and tax payments is crucial to prevent penalties and legal repercussions. Ultimately, adherence to ITR filing essentials not only safeguards financial interests but also fosters trust and compliance with tax laws. With diligence and attention to detail, taxpayers can effectively fulfill their obligations and optimize their tax outcomes.

Also Read: Know Everything About GST Billing Software

FAQ’s

-

What is ITR filing?

ITR filing refers to the process of submitting your income details, tax payments, and other financial information to the Income Tax Department.

-

Who needs to file an ITR?

Individuals, Hindu Undivided Families (HUFs), companies, firms, and other entities meeting specified criteria must file an ITR.

-

When is the deadline for filing ITR?

The deadline for filing ITR for individuals and HUFs is usually July 31st, but it may vary based on specific circumstances and extensions granted by the tax authorities.

-

What documents are required for ITR filing?

Documents such as Form 16, Form 26AS, bank statements, investment proofs, Aadhaar card, PAN card, and other relevant financial records are needed for ITR filing.

-

How can I file my ITR?

ITR can be filed online through the Income Tax Department’s e-filing portal or offline by submitting a physical copy of the ITR form.

-

What happens if I miss the deadline for filing ITR?

Late filing of ITR may attract penalties and interest on the outstanding tax liability. It’s advisable to file the return within the due date to avoid such consequences.

-

How do I calculate my tax liability for ITR filing?

Tax liability is calculated based on income earned during the financial year and eligible deductions claimed under various sections of the Income Tax Act.

-

What should I do if I make a mistake in my ITR?

If you notice any errors or discrepancies in your filed ITR, you can rectify them by filing a revised return within the specified time frame.

-

What are the consequences of incorrect ITR filing?

Incorrect ITR filing may lead to penalties, fines, scrutiny by tax authorities, and legal consequences. It’s crucial to ensure accuracy and compliance while filing ITR.

-

Can I seek professional help for ITR filing?

Yes, you can seek assistance from tax advisors, chartered accountants, or tax preparation services to ensure accurate and timely filing of your ITR.