Introduction

All registered taxpayers under the GST regime must file their GST returns at the appropriate time. Failing to submit GSTR1 filing for sales can result in late fees, charges, and penalties. The returns contain all your income details and include the tax amount you must pay the government. GSTR 1 is a return form for an outward supply of goods, and it is crucial for sales reporting under GST.

It is a monthly/quarterly return statement that you must file for your company. When you run a supply business and complete sales transactions, all the transaction details must be uploaded to the GST portal for returns submission. The inward supply will be auto populated by the GST network using details in GSTR 1. So, you must fill out the crucial GST form with utmost care.

Through this blog, you will understand the importance of the GSTR 1 form, its components, and its relevance for GST compliance.

Understanding Sales Reporting

Depending on your business, you must submit GSTR 1 returns monthly or quarterly. It contains all sales transactions. The due dates and GSTR 1 filing requirements depend on the aggregate turnover of your business. If your company has an annual turnover of up to Rs. 5 crore, you can file GSTR 1 quarterly under the QRMP scheme. The due date is the 13th of the month in the relevant quarter. If you have not registered for the QRMP scheme or your business’s annual turnover is more than Rs. 5 crore, you must submit the GSTR 1 form monthly for every month before the 11th of the next month.

You must understand the significance of due dates because late filing of GSTR 1 will result in late fees and penalties. Not filing GSTR 1 is an offence, and you might face fines and legal charges. Every registered taxpayer must submit GSTR 1 on or before the due date for all sales transactions. Even if your business didn’t complete any sales for the current month, you must file GSTR 1 for the next month, indicating that no outward supply has been made. This is called nil GSTR 1 filing and can be done through SMS now. However, the following persons need not file GSTR 1:

- Composition dealers

- Input service distributors

- Online Information and Database Access or Retrieval (OIDAR) suppliers who must pay tax themselves

- Taxpayer liable to collect TCS

- Non-resident taxable person

- Taxpayer liable to deduct TDS

Key Components of GSTR 1

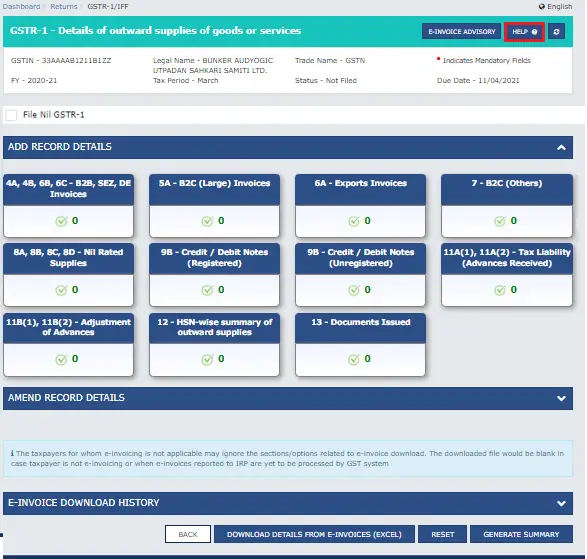

The GSTR 1 form has a total of 13 tables. You must fill in the sections appropriately, mentioning the sales transactions.

Source – https://tutorial.gst.gov.in/userguide/returns/Creation_of_Outward_Supplies_Return_in_GSTR-1.htm

- Tables 1, 2, and 3: GSTIN, legal names, and aggregate turnover in the past year

- Table 4: Taxable outward supplies to GST-registered customers, including UIN holders (not including zero-rated supplies and deemed exports

- Sub table 4A: Invoice details of all supplies except reverse charge or made through e-commerce operator

- Sub table 4B: Invoice details of registered supplies incurring a reverse charge

- Sub table 4C – Invoice details of supplies through e-commerce operator

- Table 5: Taxable outward interstate supplies to unregistered customers when the invoice exceeds Rs. 2.5 lakh

- Table 6: Deemed exports and zero-rated supplies

- Sub table 6A – Exports out of India

- Sub table 6B – Supplies to SEZ developer/unit

- Sub table 6C – Deemed exports

- Table 7: Taxable outward supplies to unregistered persons other than supplies mentioned in Table 5 (net of debit notes and credit notes)

- Table 8: Nil-rated outward supplies, non-GST supplies, and tax-exempted supplies

- Sub table 8A – Interstate supplies to registered persons

- Sub table 8B – Intrastate supplies to registered persons

- Sub table 8C – Interstate supplies to unregistered persons

- Sub table 8D – Intrastate supplies to unregistered persons

- Table 9: Amendments to taxable outward supplies reported in tables 4,5 and 6 of the earlier GSTR 1 returns

- Table 10: Amendments to taxable outward supplies to unregistered persons furnished in Table 7 of earlier tax periods

- Table 11: Information about advances received or adjusted in the current tax period. It also includes amendments of details wrongly reported in the earlier tax period.

- Table 12: Summary of outward supplies based on HSN codes

- Table 13: Documents issued during the tax period – includes details of documents such as invoices, credit notes, debit notes, receipt vouchers, refund vouchers, payment vouchers, and delivery challans issued and/or cancelled during the tax period. The total number of invoices reported in Tables 4,5, and 6 must match the information given in Table 13.

Also Read: Overview And Purpose Of GSTR-1

Importance of GSTR 1 in Sales Management

GSTR 1 form filing is mandatory for GST compliance. After filing, you cannot make changes to the returns form. However, you can make amendments to the subsequent GSTR 1 forms for the next tax period. Filing details and documents of outward sales is also helpful in sales management in the following ways:

- Accurate recording of all sales data

- Audit trail for tax compliance

- Input Tax Credit (ITC) reconciliation

- Effective cash flow management

- Valuable insights about business performance

Step-by-Step Guide to GSTR 1 Filing for Sales

The GSTR 1 form can be filed directly on the GSTN portal. If you use automated billing software such as CaptainBiz integrated with the GST network, you can file GSTR 1 returns directly from the software. Following are the steps to submit GSTR 1 returns using the GSTN portal:

Step 1: Log in to the GSTN portal https://services.gst.gov.in/services/login

Step 2: Click on Services -> Returns

Step 3: Select month and year to file returns for the corresponding tax period

Step 4: Click on GSTR 1

Step 5: Fill in the details in the appropriate tables

Step 6: Prepare and upload the returns

Step 7: Upload invoices and other documents

Step 8: Ensure that all information is uploaded correctly

Step 9: Click on Submit

Step 10: Click on file GSTR 1

Step 11: Sign the form digitally and confirm your decision to file GSTR 1

Step 12: Note down the Acknowledgement Reference Number (ARN) generated.

Also Read: GSTR 1 Due Date And Filling Frequency Everything You Need To Know

GSTR 1 and Its Influence on Taxation

The purpose of the GST regime is to streamline the country’s taxation system. With the mandatory requirement to record all outward supply transactions, businesses must pay their taxes promptly. Monthly and quarterly return filing is more manageable than annual return filing. The impact of GSTR 1 on taxation is as follows:

- Increased tax revenue with prompt tax payments

- Reduced tax evasion due to mandatory GSTR 1 filing requirement

- Simplified tax administration with reduced paperwork

- Improved business environment with a transparent taxation policy

Compliance and Legal Aspects Related to GSTR 1 and Sales Reporting

GSTR 1 filing is crucial for GST compliance and sales reporting. Accurate reporting of all outward supply transactions is mandatory for all registered taxpayers. The timely filing requirement ensures that businesses don’t commit tax fraud. GSTR 1 data is used to auto-populate other GST forms. It is also used in calculating taxable liability in GSTR 3B. Discrepancies between GSTR 1 and GSTR 3B can result in scrutiny and audits.

As per the CGST Rules, GSTR 1 forms and all GST forms must be submitted in a timely manner. Failure to meet the deadlines for GST return filing can incur late fees and penalties for non-compliance. Errors and omissions can also result in unnecessary charges and penalties. Irregularities in GSTR 1 return filing will trigger audits and invite legal scrutiny. Cooperation is mandatory for registered taxpayers, the failure of which will lead to additional penalties.

Advantages of Efficient GSTR 1 Reporting for Sales

Efficient GSTR 1 reporting is more than just ticking a compliance box. It is a powerful tool that unlocks multiple benefits for your sales department. The following are some key advantages:

- Companies can get better insight into their performance through accurate sales data.

- Streamlined return submission reduces the risk of legal complications and tax audits.

- Accurate GSTR 1 data will help with annual return submission

- Commitment to return filing improves business reputation

Conclusion

Accurate sales reporting is essential, not just for compliance with GSTR 1 for businesses. Monthly or quarterly return file submission will reduce administrative overhead for your staff. Also, it will help you stay on top of your tax obligations and avoid late fees, charges, and penalties. To simplify the process, you can upload GSTR 1 details frequently and avoid bulky uploads during return filing time. You must remember to file GSTR 1 as a nil return if there are no outward supply transactions during the tax period. Automating GST return submission will eliminate manual processing and automate return filing.

CaptainBiz is an all-in-one GST billing software that helps you streamline all financial transactions. Ensure GST compliance with ease using the automation system. Manage your sales effectively by accurately monitoring and recording all business transactions, including bank reconciliation.

Also Read: GSTR 1 Details: Everything You Need To Know

FAQs

-

Is GSTR 1 applicable for sales reporting?

Yes, GSTR 1 is the monthly/quarterly return registered supplies that must be submitted to report all the details of outward supply transactions. This includes the supply of goods and services during the tax period.

-

What is the crucial information in GSTR 1?

GSTR 1 form must include all details about sales, including description of goods and services, invoice number, date, taxable value of supplied goods or services, applicable GST rates, and total payable tax amount.

-

How often must I file GSTR 1?

Businesses with an annual turnover of less than 5 crore and registered under the QRMP scheme can file GSTR 1 quarterly. If the annual turnover is more than Rs. 5 crore, you must file GSTR 1 monthly.

-

What is the due date for filing GSTR 1?

The due date for monthly GSTR 1 filers is the 11th of the succeeding month, and for quarterly GSTR 1 filers, the due date is the 13th of the following month.

-

Do I need to pay GST after filing GSTR 1?

No, you only need to pay taxes after filing GSTR 3B. The GSTR 1 has the primary purpose of reporting all outward supply transactions in the tax period.

-

Is there a cutoff date for amending GSTR 1 form details?

After filing the GSTR 1 form, you cannot change the details. However, you can include amendments in the subsequent GSTR 1 filing. The cutoff date for amending GSTR 1 form details is 30th November of the following financial year. No rectification of errors is allowed after the cutoff date.

-

Can I claim ITC using GSTR 1?

No, GSTR 1 is for reporting sales. It is not for reporting purchases. You can claim ITC only after filing GSTR 2, which is necessary for reporting purchases of goods and services.

-

What happens after filing GSTR 1?

Data submitted in the GSTR 1 form is used to calculate your tax liability. The GSTR 3B form is auto-populated using details from GSTR 1. You need to file GSTR 3B and pay your taxes.

-

Is there a penalty for including incorrect information in GSTR 1?

If you have entered erroneous details, you can make amendments in the subsequent GSTR 1 return filing. Incorrect information in the GSTR 1 form after the cutoff date for amendments is considered a GST offense. You must pay penalties and face legal action in that case.

-

Is manual filing of GSTR 1 possible?

No, after the launch of the GSTN portal, all return filing must be done online. An automation billing software such as CaptainBiz will help you efficiently maintain accurate records and file the GSTR 1 form.