What is GSTR 1

Every taxpayer has to file returns once the GST Registration is obtained have to file returns periodically. Regular Taxpayers or casual taxpayers have to file GSTR–1 on a monthly or quarterly basis based on the option selected in the common portal. It has to be filed online only, and taxpayers have to be very careful while filing GSTR-1 as they cannot revise the returns once filed; if any corrections have to be done, it has to be carried out through adjustments or amendments only that too before filing of the Annual Return.

- It is the return that requires the Taxpayer to furnish all the details of sales and outward supplies of Goods and Services for a tax per

- Advances received from the customers have to be furnished

- It is filled on a monthly, quarterly or annual basis.

Due Date of GSTR-1

The due date for filling GSTR 1 depends upon the Taxpayer aggregate Turnover.

- Taxpayers with turnover up to Rs.5 crore in the preceding financial year have the option to file quarterly returns under the Quarterly Returns with Monthly Payment, QRMP scheme and are due by the 13th of the month following the relevant quarter.

- Taxpayers with a Turnover above Rs.5 crore have to fill returns monthly or every month on or before the 11th of next month.

Read more: GSTR 1 Due Date and Filling Frequency: Everything You Need to Know

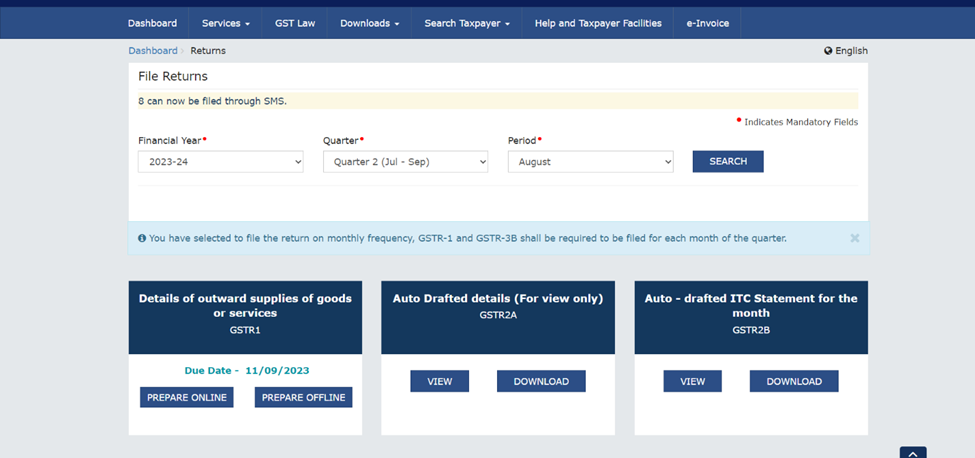

GSTR – 1 Form in GST Portal

Details required for GSTR-1 Filling

- B2B Sales – Supplies to taxpayers with GST Registration, SEZ Supplies with payment of taxes, SEZ Supplies without payment of taxes, Deemed Exports, Reverse Charge Supplies

- B2C Sales (Large Invoices)

- Exports Invoices – With payment of taxes or without payment of taxes

- B2C Sales (Small Invoices)

- Nil Rated Supplies

- Credit /Debit Notes (Registered)

- Credit /Debit Notes (Unregistered)

- Tax Liability (Advances Received)

- Adjustment of Advance

- HSN Wise Summary of Outward Supply

- Document Issued/Numbers Series (Tax Invoices, Debit Notes, Credit Notes, Receipt Vouchers, Refund Vouchers, Payment Vouchers, Delivery Challans)

- Details of amendments in Invoices wrongly filed in earlier months.

Check sample copy of GSTR 1 for detailed table wise information

Generate GSTR -1 Summary

After uploading all the details of Sales, click on the Generating GSTR-1 Summary to include the auto-populated details for file submission of GST sales details. Further, after about one minute, a summary will be generated by the GST Portal automatically. Once the GSTR summary is generated, Click on the ‘Preview’ Button.

It is always recommended to review the summary of invoices/ entries made in various sections before submitting the GSTR 1.

Related Read: GSTR-3B Reconciliation with GSTR-1 and GSTR-2A: Avoiding Tax Mismatches and Penalties

GSTR -1 Filing with DSC or EVC

GSTR -1 can be filled by both methods, i.e., Through a Digital Signature Certificate (DSC) or Electronic Verification Code (EVC). Select the Digital Signature if filling through DSC mode, or enter the OTP sent on the mobile number or email address of the Authorised Signatory to file with EVC mode.

Once the GSTR–1 Is filed, CaptainBiz recommends that all taxpayers to download the PDF of the GSTR-1 and preserve it for future reference. The taxpayers can use CaptainBiz, one of the mobile and cloud-based GST billing software recommended by GSTN for issuing invoices and filing of GST Returns.