Introduction

Plants and trees play a crucial role in our ecosystem and daily lives. They’re traded commercially for various purposes such as landscaping, decoration, and producing fruits and flowers. The sale of these live plants and trees falls under the Goods and Services Tax (GST) in India, a comprehensive tax system that replaced multiple indirect taxes. This article will delve into the GST details for sales of Live Plants and Trees.

Understanding GST Basics:

GST is a tax on the supply of goods and services. It’s a single tax that subsumes various other taxes like central excise duty, service tax, state VAT, etc. GST is collected by businesses and traders at every stage of the supply chain. They collect the tax from customers and then pass it on to the government.

For example: Let’s say you buy a shirt. The shopkeeper charges you GST on the price of the shirt. When they sell the shirt, they have to pay that GST to the government. If the shopkeeper bought the shirt from a manufacturer, they also paid GST on it, and that GST is deducted from what they collected, and the remaining amount is paid to the government. This process continues until the product reaches the consumer.

Three types of GST such as SGST (State GST): Collected by the state government on intra-state sales, CGST (Central GST): Collected by the central government on intra-state sales, IGST (Integrated GST): Collected by the central government on inter-state sales.

GST can benefit in many ways such as It simplifies the tax structure by replacing multiple taxes with a single one, second, It promotes uniformity in taxation across states. And third, with better tracking and transparency, it helps in reducing tax evasion.

Not all goods and services are taxed at the same rate. Some are exempt from GST, while others have different rates like 5%, 12%, 18%, or 28%.

III. GST and Agricultural Products

GST (Goods and Services Tax) has brought significant changes to the taxation system, including its impact on agricultural products. Here’s a simplified overview:

Exemption for Unprocessed Agricultural Products:

- In India, most unprocessed agricultural products are exempt from GST. This exemption includes items like fresh fruits, vegetables, grains, unprocessed milk, unbranded flour, etc. Farmers and primary producers typically do not have to pay GST on the sale of these raw agricultural products.

Taxation on Processed Agricultural Products:

- Processed agricultural products, such as packaged food items, processed fruits and vegetables, dairy products, etc., are generally subject to GST. The rate of GST on these products can vary depending on their classification under the GST system. For example, some essential food items may attract a lower rate of GST, while others may be taxed at the standard rates.

Input Tax Credit (ITC) for Farmers:

- Farmers and primary producers usually do not charge GST on their sales of raw agricultural produce. However, they may incur GST on their purchases of inputs such as fertilizers, machinery, pesticides, etc. While they cannot directly claim input tax credit (ITC) on these purchases, the absence of GST on their sales can indirectly reduce the tax burden on their inputs.

Impact on Supply Chain:

- The implementation of GST has brought about changes in the supply chain for agricultural products in India as well. It has led to better integration of markets across states, reduced transportation time and costs, and streamlined processes for traders and suppliers, which has positively impacted the agricultural sector.

Also Read: How GST Has Helped To Increase Agricultural Productivity?

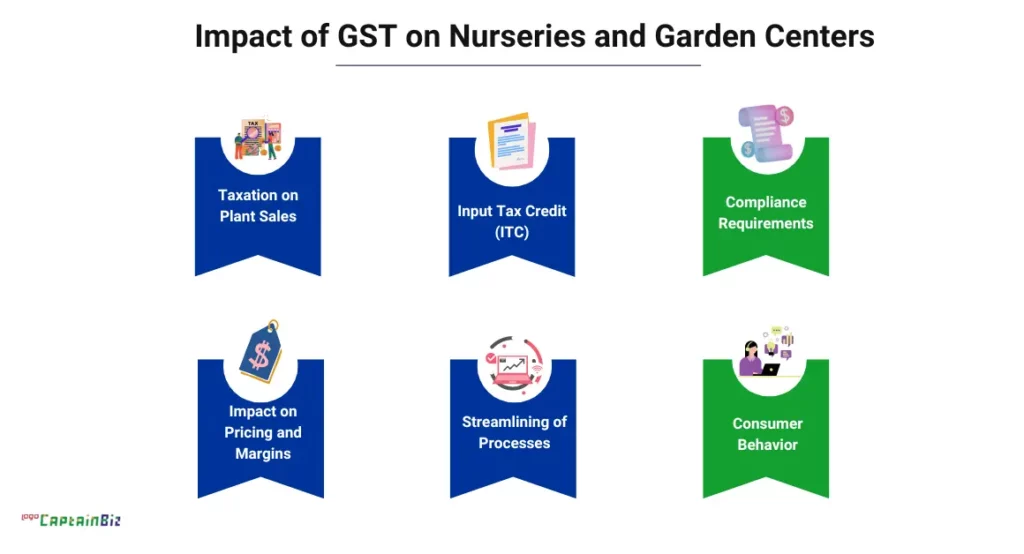

IV. Impact of GST on Nurseries and Garden Centers

The implementation of GST in India has affected various sectors, including nurseries and garden centers. Here’s how GST has impacted them:

Taxation on Plant Sales:

- Nurseries and garden centers sell plants, trees, shrubs, flowers, and other gardening products. Under GST, these sales are subject to taxation. The rates of GST on different plants and gardening products vary based on their classification under the GST system. Certain items may attract a lower rate of GST, while others may be taxed at standard rates.

Input Tax Credit (ITC):

- Nurseries and garden centers may incur GST on their purchases of inputs such as seeds, fertilizers, pesticides, pots, gardening tools, etc. The availability of input tax credit allows them to offset the GST paid on these inputs against the GST collected on their sales. This helps in reducing the overall tax liability and can positively impact the profitability of nurseries and garden centers.

Compliance Requirements:

- Nurseries and garden centers are required to comply with GST regulations, including registration, filing of returns, and maintaining proper records of transactions. Compliance with GST requirements ensures that businesses operate within the legal framework and contribute to the tax system effectively.

Impact on Pricing and Margins:

- The introduction of GST has led to changes in pricing strategies and margins for nurseries and garden centers. Businesses may need to adjust their pricing to reflect the impact of GST on their input costs and tax liabilities. Proper planning and understanding of GST implications are essential for maintaining competitive pricing and sustainable margins.

Streamlining of Processes:

- GST has streamlined various processes related to taxation, invoicing, and supply chain management for nurseries and garden centers. It has facilitated better integration of markets across states, simplified interstate transactions, and reduced compliance burdens associated with multiple tax regimes.

Consumer Behavior:

- The impact of GST on consumer behavior in nurseries and garden centers may vary. Changes in prices due to GST can influence purchasing decisions, and businesses need to adapt their marketing and sales strategies accordingly.

V. Sale of Live Plants and Trees: Tax Classification

the sale of live plants and trees is subject to the Goods and Services Tax (GST). The tax classification for live plants and trees under GST falls under HSN (Harmonized System of Nomenclature) code 0601, which pertains to live plants, bulbs, roots, and the like; cut flowers and ornamental foliage.

The applicable GST rate for the sale of live plants and trees depends on various factors such as whether they are meant for ornamental purposes, agriculture, or other uses. Here’s a general overview:

Ornamental Plants and Trees:

- Live plants and trees sold for ornamental purposes, landscaping, gardening, or decorative use are typically classified under HSN code 0602. These may include flowering plants, ornamental shrubs, indoor plants, bonsai trees, etc.

- The GST rate for ornamental plants and trees is usually 12%.

Plants for Agricultural Use:

- Live plants and trees intended for agricultural use, such as fruit-bearing trees, vegetable plants, medicinal plants, etc., are classified under various HSN codes depending on the specific plant type.

- The GST rate for plants and trees used for agriculture may vary. Certain essential plants for food production or horticulture purposes may be exempt from GST or attract a lower rate, while others may be taxed at standard rates.

Nurseries and Garden Centers:

- Businesses engaged in the sale of live plants and trees, including nurseries and garden centers, need to charge GST on their sales based on the applicable tax rates for the specific plant types. They are also eligible to claim input tax credit (ITC) on their purchases of inputs such as seeds, fertilizers, etc., subject to compliance with GST regulations.

Also Read: GST For The Sale Of Live Plants And Trees

VI. Export and Import of Live Plants

| Activity | Tax Implication |

| Export of Live Plants | Exports of live plants are typically zero-rated under GST, meaning that no GST is charged on the export value of plants. However, export procedures and documentation requirements must be followed as per customs regulations. |

| Import of Live Plants | Import of live plants is subject to customs duties and taxes, including customs duty, Integrated Goods and Services Tax (IGST), and other applicable charges. Importers need to comply with customs clearance procedures and pay the required duties and taxes. |

When exporting live plants, businesses benefit from zero-rated GST, which means they don’t charge GST on exports, but they can claim input tax credit (ITC) on inputs used in the exported goods. Conversely, importers need to factor in customs duties and IGST while importing live plants into India. Compliance with customs regulations and documentation is crucial for both exporters and importers to ensure smooth transactions and legal compliance.

VII. GST Audit for Green Businesses

For green businesses, such as those involved in renewable energy, sustainable products, or environmental services, conducting a GST audit involves examining their tax compliance and ensuring adherence to GST regulations while also considering their eco-friendly practices. Here’s how the GST audit process for green businesses might look:

| Aspect of GST Audit | Description |

| Compliance with GST Regulations | Verify if the business has correctly registered for GST, filed periodic GST returns, and complied with GST provisions applicable to their industry. |

| Input Tax Credit (ITC) Verification | Check if the business has properly claimed ITC on eligible purchases related to their green activities, such as solar panels, energy-efficient equipment, etc. |

| Eco-friendly Product Classification | Ensure that products labeled as eco-friendly or sustainable are correctly classified for GST purposes and taxed accordingly. |

| Exemptions and Concessions | Assess if the business is availing applicable GST exemptions or concessions provided for green activities, such as renewable energy projects or eco-friendly products. |

| Environmental Levies and Taxes | Review compliance with any environmental levies or taxes imposed by state or central governments, ensuring accurate calculation and payment. |

| Documentation and Record-Keeping | Evaluate the maintenance of proper records, invoices, and documentation related to green activities for GST audit trail and transparency. |

Green businesses often have specific tax incentives, exemptions, or concessions aimed at promoting environmentally sustainable practices. Therefore, during a GST audit, it’s essential for auditors to understand the unique aspects of the green industry and ensure that the business is benefiting from applicable tax provisions while maintaining compliance with GST regulations. Additionally, promoting transparency and environmental accountability can be integral parts of the audit process for green businesses.

Also Read: Impact Of GST On Environmental Sustainability In India

Conclusion

In conclusion, navigating the tax implications of GST for the sale of live plants and trees in the green industry requires understanding GST basics, its impact on agricultural products, nurseries, and garden centers. Tax classification, export-import considerations, and GST audit for green businesses are crucial aspects to ensure compliance and sustainability.

FAQ’s

-

How does GST affect agricultural products?

Most unprocessed agricultural products are exempt from GST, but processed products are subject to varying GST rates.

-

What impact does GST have on nurseries and garden centers?

GST affects pricing, margins, and compliance requirements for nurseries and garden centers, influencing their operational strategies.

-

How are live plants and trees classified for GST purposes?

Live plants and trees are classified based on their use, such as ornamental or agricultural, and are taxed accordingly under specific GST rates.

-

What are the considerations for exporting live plants and trees?

Export of live plants is usually zero-rated for GST, but exporters must adhere to customs regulations and documentation requirements.

-

What taxes apply to the import of live plants and trees?

Import of live plants is subject to customs duties, IGST, and other charges, necessitating compliance with customs procedures.

-

How does GST audit benefit green businesses?

GST audit ensures compliance with GST regulations, proper ITC utilization, and classification of eco-friendly products, promoting transparency and sustainability.

-

Can nurseries claim Input Tax Credit (ITC) under GST?

Yes, nurseries can claim ITC on eligible purchases like seeds, fertilizers, and equipment, which helps reduce their overall tax liability.

-

Are there specific GST concessions for green businesses?

Yes, certain green activities may qualify for GST exemptions or concessions, encouraging environmentally sustainable practices in the green industry.

-

What records should green businesses maintain for GST audit?

Green businesses should maintain proper records, invoices, and documentation related to their eco-friendly activities for GST audit trail and compliance verification.