GST registration is essential for business operations in India. It guarantees legal conformity and simplifies tax procedures. The approval process for GST registration varies due to some factors.

Variance in these factors influences the timeline for GST Registration clearance. So, business owners need to know the duration for GST registration approval. It helps for an easy transition into the GST regime.

This article focuses on the GST registration time frame for the approval process. It also looks into factors that affect approval time and strategies to speed up GST registration approval.

Introduction to GST Registration

Businesses that generate more income than Rs. 40 lakh, Rs. 20 lakh, or Rs. 10 lakh, depending on the situation, must submit an application under the Goods and Services Tax (GST) to register as ordinary taxable people.

- Eligibility Criteria: Businesses and individuals registered under previous tax services, non-resident and casual taxable persons, reverse charge mechanism taxpayers, e-commerce aggregators, businesses with turnover exceeding Rs. 40 lahks or Rs. 10 lakh in Uttarakhand, Himachal Pradesh, Jammu & Kashmir, and North-Eastern states, input service distributors, supplier agents, and individuals supplying goods through an e-commerce aggregator or providing online information from outside India are among the groups of individuals and companies eligible for GST registration.

- Types of GST Registration: There are four types of GST registration available. Business owners must know these types before GST registration. The characteristics and requirements for each type of registration are as follows:

| 1. Normal Taxpayer: Struggling with Billing and Inventory?

Join thousands of Indian MSMEs who use CaptainBiz for a hassle-free billing solution.

Register Now

|

2. Casual Taxable Person:

|

3. Composition Taxpayer:

|

4. Non-Resident Taxable Person:

|

- Penalties for failing to register with the GST: If a tax offender makes a genuine error and fails to pay, they will be penalized 10% of the total amount outstanding up to a minimum of 10% of Rs. 10,000. The penalty will be 100% of the taxes due if an individual doesn’t pay the tax intentionally.

Understanding the GST Registration Process

The GST registration process involves the following steps:

- Visit the GST Portal.

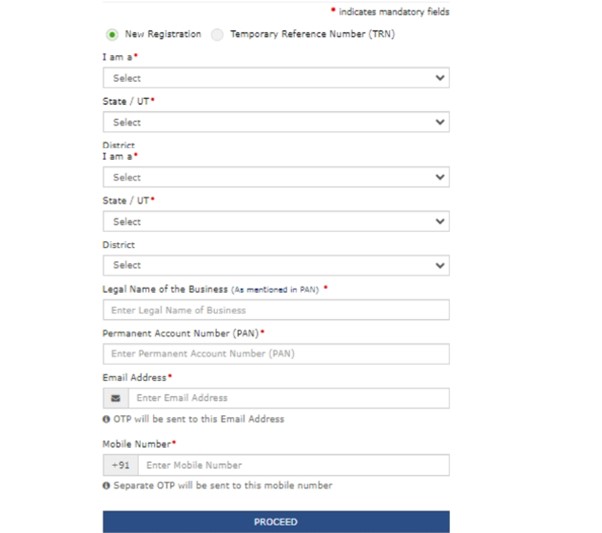

- Initiate Registration by clicking on ‘Register Now’ under the ‘Taxpayers’ tab.

- Choose Registration Type and select ‘New Registration’.

- Fill in the business details, PAN, email, and mobile number. Verify your identity through OTP.

- The screen will display a Temporary Reference Number (TRN). Write it down.

- Click ‘Register’ under ‘Taxpayers’ after login to the GST portal again. Choose ‘Temporary Reference Number (TRN)’.

- Enter TRN and Captcha details, then click ‘Proceed’.

- Complete the verification process by entering the OTP sent to email and mobile. Verify application status and edit if necessary.

- Input relevant details in 10 sections and upload necessary documents for GST registration such as

|

|

|

|

|

|

|

|

- Visit the ‘Verification’ page and submit the application using the Electronic Verification Code (EVC), e-Sign, or Digital Signature Certificate (DSC).

- After completion, a success message will be displayed. Application Reference Number (ARN) will send a registered mobile number and email.

- Check the ARN status on the GST Portal.

GST Registration Via Authentication of Aadhaar

Using Aadhaar, new businesses can obtain their GST registration. The process is simple and quick. The updated process came into operation on August 21, 2020.

The following describes how to pick Aadhaar authentication:

- You can select Aadhaar authentication when applying for GST registration.

- Click “YES.” The registered email address and mobile number will receive the login link.

- Select the link for authentication.

- After entering the Aadhaar number, choose “Validate.”

- Upon data verification, an OTP will be transmitted to the registered email address and mobile number.

- Enter the OTP to finish the process. In three working days, you will receive a new GST registration.

Factors Affecting GST Registration Approval Time

Several factors impact the duration of GST registration approval. Business owners can improve their chances of a quicker approval process for GST registration by being aware of and taking action against these factors.

The factors that impact the GST registration approval time are as follows:

- Accurate Information: It is essential to give precise and comprehensive information for registration. Errors or inconsistencies could cause delays.

- Document Validation: The authorities check uploaded documents, such as proof of business address, Aadhaar card, and PAN card. It is necessary to ensure these documents are clear and valid to prevent delays.

- Business Type: The type of business can influence approval time. A composition taxpayer‘s registration process may take longer than that of a standard Taxpayer.

- Government Workload: Government offices may face a rise in workload during periods of high demand. This impacts the processing time for registrations.

- Digital Signature: Organisations using a Digital Signature Certificate may find that the approval procedure takes more time. It is because of the additional verification stages.

- Lack of technical expertise: Certain businesses may require greater technological knowledge. It helps to handle the technical aspects of the GST registration process without any issues.

- Technical Glitches: Delays may result from technical problems with the government portal or with the taxpayer. Streamline the online application process to reduce these kinds of interruptions.

Typical Timeline for GST Registration Approval

The Central Board of Indirect Taxes and Customs (CBIC) has declared that an Aadhaar identity is necessary for GST registration. The GST registration time frame to approve applications increased from three to seven working days.

Businesses would receive GST approval in seven working days after registering for the Goods and Services Tax using an Aadhaar number. As mentioned in the notification, a company would only be permitted to register for GST online https://www.india.gov.in/ following a physical examination of the business premises if it does not have an Aadhaar number.

A person who selects Aadhaar authentication for new goods and services would obtain it within seven working days and won’t have to wait for verification unless the GST administration issues a notification requesting clarification.

However, the clearance for registration for applicants who choose not to use Aadhaar identification for GST will only be granted following documentary or physical verification of the company’s location. The timeline for the GST registration clearance process may take up to 21 to 30 working days, or longer if a notification is sent.

It is also important to remember that the application for a grant of registration will be accepted if the appropriate officer does nothing within seven working days of receiving the clarification, information, or documents provided by the applicant.

In short, GST registration approval time was 3 to 7 working days depending on accurate completion of the enrollment process.

Strategies to Expedite GST Registration Approval Time

Businesses can implement various tactics to accelerate the approval of their GST registration. Consider the following strategies to expedite GST registration approval:

- Provide Accurate Information: Ensure all information you enter throughout the registration process is correct. Also, guarantee that these details correspond with the accompanying documentation. It will prevent unnecessary issues from arising in the future.

- Submit Clear Documents: Upload clear and legitimate papers like your PAN card, Aadhar card, and confirmation of your company address to expedite the verification process.

- Choose Aadhaar Authentication: During the registration procedure, choose Aadhaar authentication to expedite approval. Usually, it takes three business days.

- Timely Response to Queries: React quickly to prevent delays if authorities ask for more details or clarification.

- Make Use of Digital Signature Effectively: You can use a Digital Signature Certificate (DSC). It speeds up the approval process.

- Check the Status of Your Application Frequently: You may use the Application Reference Number (ARN) to check the progress of your application on the GST portal. It aids in making sure everything happens smoothly and on schedule.

- Follow-up with Authorities: If the clearance process takes longer than anticipated, you need to get in touch with the authorities via the proper channels once again.

- Keep Up to Date on advancements: Stay aware of any modifications to government legislation or developments in the GST registration process.

- Avoid Clear of Peak Times: Submit your application during periods of low demand to avoid delays due to heavy workload.

- Seek Professional Assistance: Look for professional assistance to ensure a smooth and error-free registration procedure.

Conclusion

In general, the approval procedure for a GST registration can take three to seven business days. The timely submission of the necessary documentation and the accuracy with which the application is filled will determine the outcome.

Several elements can prolong the approval period like Aadhaar authentication and physical verification. Businesses can speed up the process by ensuring they follow the most recent regulations.

Also, reacting quickly to notices and getting expert advice when necessary can expedite the approval process. Furthermore, accurate and timely participation in the GST registration procedure is essential. It helps to get approval in the allotted period.

Also Read: Step-By-Step Guide to GST Registration for Goods

FAQs

Q1. What is the duration of GST registration approval?

The application will be considered granted after seven working days if the tax official does not act within that time frame. Your registration application will not be considered authorized within 7 working days if you chose “No” for Aadhaar authentication while enrolling on the GST Portal.

Q2. What variables may affect the GST registration approval timeframe?

Aadhaar identification, physical verification, and the accuracy of the documents are a few factors that might affect the clearance schedule.

Q3. Is it possible to speed up the GST registration approval process?

Yes, companies may speed up approval by making sure that all paperwork is submitted correctly, choosing to use Aadhaar verification, and answering questions quickly.

Q4. What takes place if GST registration is started without completing Aadhaar authentication?

If Aadhaar authentication is not chosen or completed during the application procedure, the approval period can be extended to 30 days.

Q5. Is physical verification of business premises a common requirement for GST registration?

Physical verification may be conducted if deemed necessary by the proper officer, potentially extending the approval time.

Q6. What documents are crucial for a smooth GST registration approval?

Essential documents include a PAN card, an Aadhaar card, business address proof, bank statements, and relevant authorization forms.

Q7. Can seeking professional assistance expedite GST registration approval?

Yes, seeking professional guidance can provide insights, ensuring compliance and potentially expediting the approval process.

Q8. How often are notices issued during the GST registration approval process?

Notices requesting further information or clarification, such as Form GST REG-03, may be issued within 7 working days after the application date.

Q9. How important is Aadhaar authentication for the approval procedure?

Aadhaar authentication conforms to the updated regulations. It expedites the approval procedure and results in less processing time.

Q10. Does non-compliance or delay in GST registration procedures result in penalties?

Penalties for non-compliance or delayed registration may include a minimum penalty of Rs. 10,000 (for willful tax evasion) or a 10% charge on the required amount (for legitimate mistakes).

Q11. Why is the GST Site Not Working?

The reason why the GST site is not working could be a result of various factors such as the site experiencing some technical problems of its own that may include server problems or server maintenance, jams commonly experienced especially during rush hour that is during filing of the GST returns, the outdated browser that one is using to access the site, network disturbances or incorrect usage by the user where for instance he or she has entered the wrong URL or the login session has expired. Knowledge of these potential causes can go a long way in eradicating the problem as indicated below.

Reasons why the GST portal/website does not work

-

Server Issues:

Among them, the most recurrent one is a server problem at the back end of the application. The GST portal deals with a humongous amount of data; therefore, problems with services result in the GST portal being unavailable.

-

Maintenance Activities:

The last two possibilities could be GST Portal Under Maintenance, and so on. The site may be offline briefly for updates purposes usually deemed crucial for improving the utility of the site including the removal of various glitches.

-

Internet Connection:

Internet connectivity also poses a problem whereby your Internet connection may be fluctuating hence resulting in challenges while connecting to the GST portal.

-

Browser Compatibility:

Other times it is just a Browser Issue. It means that the GST portal not working today was only on a particular browser, and it is working correctly on the other one.

-

Cache and Cookies:

Cache or cookie Problems can sometimes interfere with how a site is displayed on the browser and lead to errors.

Top Solutions for When the GST Website is Not Working

There can be several reasons why users face some problems concerning the GST portal, some of which include. However, the majority of them are easy and straightforward to solve.

1.Check Server Status:

When the GST portal is not available today, the first thing that would need to be done is to look at the server status. Occasionally, there is information about the availability of the servers at Down Detector.

2.Wait for Maintenance to End:

If the computer information portal is down, that is undergoing maintenance, one has to wait until the process is complete. As a usual practice, the maintenance schedule is given before the occurrence of the event within the website or the forum.

3.Clear Browser Cache and Cookies:

Why clear cache and cookies Most of the website related problems can be solved by clearing cache and cookies.

4.Check Your Internet Connection:

Here are simple solutions to apply when the GST portal is not functioning properly; when for instance the internet connection is poor.

-

Restart Your Device:

Firstly, turning your device off and then on again can solve a high number of issues in a blink of an eye.

-

Use A Different Browser:

Sometimes the reason could be your browser, in which case you should know the following. This may be the case; hence, get a different browser and open the site to check if the problem is fixed.