Introduction:

GST, or Goods and Services Tax, is a single tax that makes paying taxes easier for businesses in India. Understanding and using GST is not just a rule; it’s a smart move for businesses to work better and save money. It’s a big deal for businesses because it simplifies taxes, reduces the tax burden, and helps them stay organized. Many types of businesses, like those making things, offering services, selling goods, or doing online business, can use GST. Even small businesses need to use GST if they earn a certain amount, making taxes fair for everyone. If someone runs more than one business, they can add them all under the same GST registration. This is good because it makes things simpler. To do this, businesses just need to show that they are all part of the same legal group and fill out the right paperwork. It’s like putting all the businesses in one basket for tax purposes. In this blog, we will deep dive into the details of how to add multiple businesses under the same GST, consolidate businesses under one GST, and manage several businesses under a single GST registration. We’ll also explore the benefits of having one GST for multiple companies, making the process clear and easy to follow.Benefits of Having Multiple Businesses Under One GST Registration:

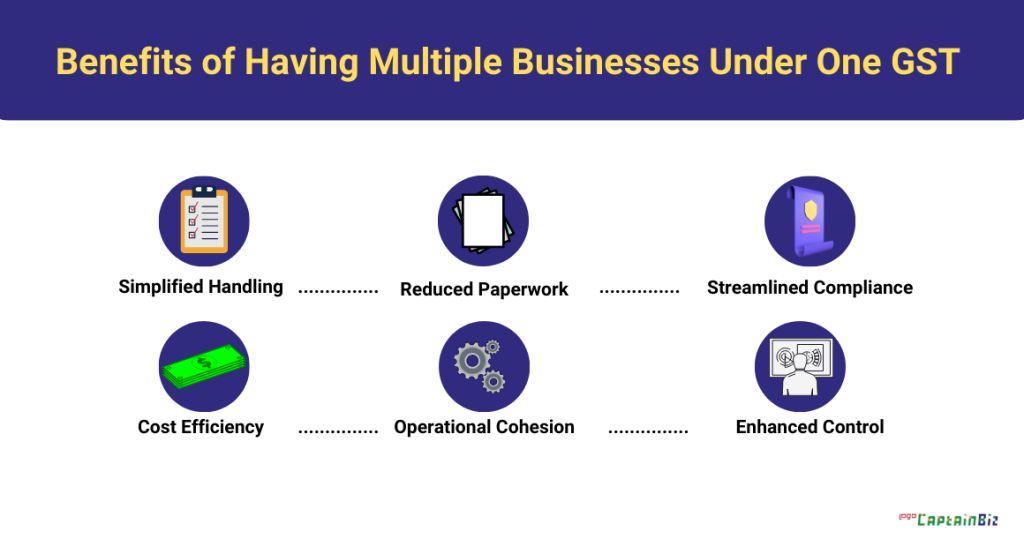

Here are the different benefits for Multiple Businesses Under One GST Registration:

Here are the different benefits for Multiple Businesses Under One GST Registration:

-

Simplified Handling:

-

Reduced Paperwork:

-

Streamlined Compliance:

-

Cost Efficiency:

-

Operational Cohesion:

-

Unified Reporting:

-

Optimized Tax Responsibilities:

-

Enhanced Control:

-

Ease of Expansion:

-

Comprehensive Business View:

Legalities and Criteria for Adding Multiple Businesses Under One GST

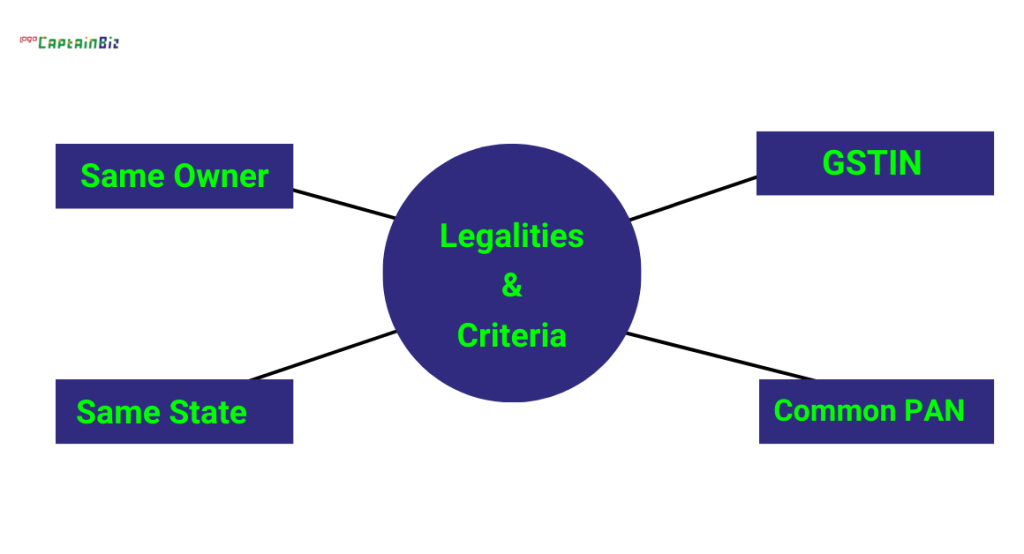

When you want to add multiple businesses under one GST, there are some important legalities and criteria to consider. Here’s a simplified overview:

When you want to add multiple businesses under one GST, there are some important legalities and criteria to consider. Here’s a simplified overview:

-

Same Owner:

-

Same State:

-

Similar Type of Business:

-

Common PAN Number:

-

Individual GSTIN:

-

Unified Business Operations:

-

Proper Documentation:

-

Informing Authorities:

-

Tax Advisor Consultation:

-

Adherence to GST Rules:

Step-by-Step Guide to Adding Multiple Businesses Under a Single GST Registration

Here’s a more specific step-by-step guide for adding multiple businesses under a single GST registration:-

Access the GST Portal:

-

Login or Register:

-

Navigate to ‘Add Business’ Section:

-

Provide Business Details:

-

Upload Required Documents:

- Business registration certificate

- PAN card of the business

- Address proof

- Identity proof of the business owner(s)

- Verify Additional Details:

- Verify additional details such as the business constitution, bank account details, and authorized signatory information.

-

Pay Application Fee (if applicable):

-

Submit Application Form:

-

Receive Application Reference Number:

-

Wait for Processing:

-

Verification and Approval:

-

Consult with a Tax Advisor:

Challenges and Solutions in Managing Multiple Businesses Under One GST

| Challenges | Solutions |

| 1. Complex Record-Keeping: Managing records for multiple businesses can become complicated, leading to potential errors. | 1. Centralized Record-Keeping System: Implement a centralized system to streamline and organize data for all businesses. This ensures a more straightforward approach to record-keeping, minimizing the chances of errors. |

| 2. Varied Tax Rates: Different businesses may have varied tax rates, making it challenging to ensure accurate calculations. | 2. Use of Accounting Software: Utilize accounting software that accommodates different tax rates. This software allows for easy customization, ensuring accurate calculations for businesses with varied tax rates. |

| 3. Compliance Issues: Ensuring compliance with diverse GST rules for each business can be time-consuming and prone to oversight. | 3. Regular Compliance Checks: Conduct regular compliance checks to ensure adherence to GST rules for each business individually. This proactive approach helps in identifying and addressing compliance issues promptly. |

| 4. Unified Reporting: Creating unified reports for all businesses may pose a challenge due to differences in accounting practices. | 4. Standardized Reporting Formats: Develop standardized reporting formats that accommodate variations across businesses. This ensures consistency in reporting practices and facilitates a unified view of financial data. |

| 5. Administrative Burden: The administrative workload increases, requiring more time and effort to handle multiple businesses effectively. | 5. Delegated Responsibilities: Delegate specific responsibilities to individuals or teams for each business. This strategic delegation helps distribute the administrative burden effectively, ensuring tasks are managed more efficiently. |

Tips for Effectively Managing Multiple Businesses Under One GST

Here are the few ways to manage the multiple businesses under one GST:-

Stay Organized:

-

Use Technology:

-

Set Clear Roles:

-

Regular Check-ins:

-

Unified Banking:

-

Centralized Records:

-

Standardized Processes:

-

Delegate Wisely:

-

Stay Informed:

-

Seek Professional Advice:

Common Mistakes to Avoid When Adding Multiple Businesses Under GST

- Mixing Finances: Avoid mixing the money of different businesses; keep their finances separate.

- Incomplete Documentation: Ensure all required documents are complete and accurate for each business.

- Ignoring GST Rules: Stay updated on GST rules to avoid unintentional violations and penalties.

- Overlooking Differences: Acknowledge and address any unique features or differences among your businesses.

- Forgetting Regular Checks: Don’t forget to regularly check and update business information on the GST portal.

- Skipping Professional Advice: Seek advice from professionals to avoid misunderstandings or missteps.

- Not Delegating Effectively: Delegate responsibilities clearly to avoid confusion and errors.

- Ignoring Communication: Maintain open communication between businesses to prevent misunderstandings.

- Missing Renewals: Keep track of renewal dates for registrations and licenses to avoid lapses.

- Neglecting Record-Keeping: Consistently maintain accurate records to avoid complications during audits or reviews.

Conclusion:

Adding multiple businesses under the same GST is a positive step and it streamlining operations for all types of businesses. It simplifies compliance, particularly benefiting SMEs with the Composition Scheme. E-invoicing and digital return filing act as safeguards against fraud. Stringent compliance ensures efficient audits, and digital tools assist businesses seamlessly. Continuous upgrades in GST laws are essential to keep pace with the evolving digital landscape, especially for digital companies and operations. Overall, the move towards consolidation is a positive stride. Also Read: Know Everything About GST Billing Software Also Listen: GSTR Filing Process with CaptainBiz – TutorialsFAQ’s:

-

Why would I want to add multiple businesses under the same GST?

-

What benefits come with having multiple businesses under one GST registration?

-

What legal criteria should I be aware of when adding multiple businesses under one GST?

-

Can you guide me through the step-by-step process of adding multiple businesses under a single GST registration?

-

What challenges might I face when managing multiple businesses under one GST, and how can I overcome them?

-

What tips can you provide for effectively managing multiple businesses under one GST?

-

Are there common mistakes I should avoid when adding multiple businesses under GST?

-

How does having a unified GST benefit small businesses and startups?

-

Can I claim input tax credits for each of my businesses individually?

-

What is the importance of regularly checking and updating business information on the GST portal?

Easily manage multiple businesses under one GST registration with CaptainBiz tips.

Anjali Panda

Senior Content Writer

Anjali Panda, a skilled wordsmith and literature enthusiast, earned her bachelor's degree in English Language and Literature from KiiT University. Her Highest Qualification Holding an MBA in Finance, she effortlessly blends academic knowledge with practical insights in her finance-centric content. Presently, Anjali is leveraging her financial expertise at BitWale, a startup, where she plays a pivotal role in optimizing the company's overall financial operations