Introduction

Modern technology, software, and automation that were out of reach a few years ago are now driving the e-payments ecosystem in India. Participants such as banks, non-banking companies, payment processors, financial institutions, and remittance firms work together to improve financial efficiency. The banking and financial services (BES) ecosystem, collectively called Fintech, plays a crucial role in digital wallets, payment gateways, payment banks, Point of Sale (PoS) systems, microfinance, assessment management, and microfinance. The fintech market in India is expected to grow at a CAGR of 31% until 2025, which is higher than the global rate. The GST taxation system, which attempts to revolutionise taxation, has to accommodate the fintech way of business operations.

This blog will explore the multiple GST implications for fintech in India.

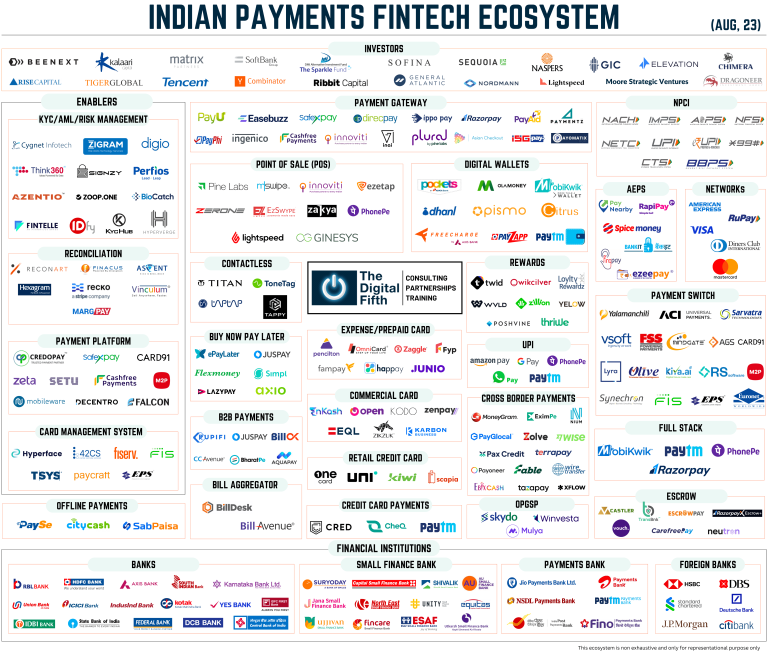

Understanding e-Payments Ecosystem

Source – https://i0.wp.com/thedigitalfifth.com/wp-content/uploads/Indian-Payment-Ecosystem-Aug-2023-1-1.png?resize=768%2C654&ssl=1

Conducting businesses across borders is facilitated by the ePayment ecosystem. Consumers now have multiple payment options when purchasing a product or service. The NBFCs offer different modes of real-time and instant payment systems at a lower cost for domestic and foreign markets. B2B retail payments are also made using the ePayment ecosystem. The different types of common ePayment systems are explained below:

1. Mobile Point of Sale (MPoS) Payment

Until a few years ago, customers predominantly paid cash because even credit card PoS were scarce. Retailers didn’t want to process plastic payments because they were expensive. Smartphones and tablets have now become MPoS systems that accept debit and credit card payments. Merchants can use these devices as card readers with an MPoS app.

When open architecture is used for MPoS, customers can make payments at the branch, in-store, unmanned kiosks, digital marketplaces, etc. Such applications support different payment modes, hardware, and platforms and are compatible with many banking partners. Closed solutions are also helpful in specific e-marketplaces, and merchants can get more incentives.

2. Unified Payment Interface (UPI)

UPI has revolutionised B2C payments in India, where customers can instantly transfer funds from their bank accounts to the merchant. The QR codes allow anyone to send and receive payments instantly to UPIs linked to bank accounts. Multiple apps support UPI payments. Merchants can benefit from the BHIM cash-back scheme for mobile payments.

3. Payment Gateways (PGs)

Payment gateways allow merchants to get paid easily using the website. Again, buyers can use any payment mode to complete payment through PG. They can also use mobile devices to facilitate these transactions. The fintech companies bundle these services into convenient payment apps for merchants to accept payments. They also enable plug-and-play international payments and Pay Later options to enable customers to pay using EMI without cards.

4. Digital Wallets

Digital wallets allow customers to purchase without worrying about sharing their bank details. The Reserve Bank of India has updated its guidelines to enable interoperability between mobile wallets.

5. Digital Banking

NBFCs now provide digital banking services, offering full-fledged business accounts with multiple financial products at a much lower cost. There is no need for NBFCs to invest in physical branches and operations. This allows these corporations to transfer cost savings to the users. The Bharat Bill Pay System (BBPS) was launched to convert utility bill payments into electronic mode.

Taxation for Fintech Companies

Any fintech entity must register as a company under the Companies Act 2013. In that case, the institution is subject to Corporate Income Tax. Based on the company’s origin, they can register as Domestic companies under section 2(22A) of ITA or as foreign companies under section 2(23A) of ITA.

This distinction is again vital for taxation because domestic companies must pay tax on every type of income. In contrast, foreign companies must only pay tax on income earned within Indian jurisdiction. Domestic companies that don’t claim any allowances must pay 22% as tax, while others must pay 30% tax. A 7% or 12% surcharge also applies when the total income is less than Rs. 10 crores or more than Rs. 10 crores. For some companies, when the tax is less than 15% of the total book income, they must pay only the Minimum Alternate Tax (MAT). Foreign fintech companies are taxed at 40%. A surcharge of 2% or 5% is also applicable.

Fintech companies must also pay an equalisation levy for payments received by non-resident service providers. It is set at 2% of the amount receivable. Fintech companies with gross receipts of less than Rs. 2 crore in the previous year need not pay this levy.

GST in the ePayments Context

GST-registered businesses must pay the GST taxes they collect from their customers at the time and place of supply. They also need to submit invoices and documents to claim input tax credits. Maintaining accurate records of all financial transactions is mandatory for GST compliance.

Source – https://www.shutterstock.com/image-vector/government-tax-gst-filing-compliance-illustration-1258768642

However, the ePayment ecosystem consists of multiple players with diversified payment systems. In this case, the ePayment platform is not owned by anyone. According to GST law, the supplier must collect GST and pay the collected tax to the government. In the ePayment ecosystem, the concept of supplier becomes ambiguous.

All participants in the ePayment ecosystem work together to deliver financial services to the customer. However, they have no agency or agreement and no definite supply transaction. So, how will the GST affect the players in the ePayment ecosystem?

While addressing the Service Tax regime, the Honourable Tribunal has declared that if any activity doesn’t involve IT software development, adoption, or adaptation service of IT software, it will not be categorised as Information Technology Services. So, fintech companies need not worry about GST implications as long as they only allow another participant to use their software or platform.

However, the services enabled by fintech companies can be considered supply transactions as these companies facilitate transactions. The tax authorities may have different opinions about sharing customer data, buying habits, and other data analytics. When fintech is involved, multiple fintech companies work together, and identifying the exact service provider is not clear.

The fintech companies can receive deposits from merchants for MPoS terminals at the premises. Another question that needs to be addressed is whether these transactions are eligible for GST. Fintech companies cannot claim Input Tax Credit for these transactions.

GST Issues for Fintech

The fintech companies and digital operations question many aspects of GST compliance. The GST laws are still nascent, and these issues must be addressed with care.

❖ Place of Supply

NFBCs offer pan-India operations to provide services nationwide and are often registered as a centralised entity. However, GST requires NBFCs to get a separate registration for each operational state with different compliance requirements. Also, NBFCs registered in one remote location will provide services in another location, creating the question of the place of supply.

❖ Payment Aggregator GST Exemption

The acquiring bank is exempt from GST when the settlement size is less than Rs. 2000 for in-card transactions. However, whether the payment aggregator qualifies as an acquiring bank remains unanswered. Usually, the fees for payment aggregators are deducted when they are settled in merchant accounts. Under GST, these could be considered as an advance collection of fees, and GST may need to be paid at the time of deduction. In some cases, the invoice date and settlement date may differ, and there could be gaps in GST payment.

❖ PoS Device GST

The fintech sector demands that the levy of GST at 18% on PoS devices be reduced. In fact, one of the key issues to address in the 2023-24 budget is the reduction of GST to 5% for PoS devices.

❖ Fintech Overseas Operations

Fintech operators in India may rely on companies overseas to function. Establishing GST on using software when foreign entities own the IP is complicated. It could be considered a supply even though it is not defined as a supply transaction per the CGST Act.

Conclusion

Many financial experts argue that GST regulations must be redefined for the fintech sector to address specific fintech issues. As the digitisation of banking and financial operations grows, the taxation sector faces numerous additional challenges. The only way forward for the RBI is to be open to making changes to the policies, and the government of India must follow with modifications for GST applicability for the fintech sector. For the latest updates and GST compliance regulations for fintech, visit CaptainBiz.

Also Read: What Are The Benefits Of Using An E-Payment In A Tally Invoice?

FAQs

1. Is fintech necessary for the business ecosystem in India?

Yes, the digital payment ecosystem is growing globally, and India needs to revolutionise payment processing to become a global export leader. Digital money transfer is quick, instant, and inexpensive compared to traditional methods. It enables Indian businesses to conduct cross-border transactions with ease. Regulating and monitoring the fintech sector in India is critical for the GDP growth of the country.

2. How does GST implementation affect fintech companies in India?

GST standardises taxation structure, and it affects every sector in India, including fintech. The fintech firms must adapt their processes and ensure GST compliance with all transactions. This includes pricing, GST tax collection, tax payment, and compliance with respect to all business operations.

3. Are there compliance requirements for fintech companies as per GST law?

Currently, there are no specific compliance requirements for fintech companies. They are also considered similar to other businesses. Fintech firms must obtain GST registration similar to any other business in India. They must update their systems, ensure accurate tax calculations, maintain proper records, and submit timely GST reports.

4. Do GST implications affect the pricing of ePayment products in the fintech sector?

Every company tries to make a profit by adjusting the pricing of their products based on the cost, including the taxes. As GST regulations become stringent for the fintech sector, the fintech companies will also change their pricing to reflect the changes in the GST regulations. It can impact the affordability and competitiveness of their services.

5. Are there drawbacks for consumers using ePayment systems?

The ePayment systems simplify payments and payment processing. Businesses need not rely on traditional payment methods to continue their operations. Mobile payment systems are almost instantaneous. However, to accommodate ePayment systems, businesses must invest in technology stack and API integration to achieve a seamless payment system.

6. How does GST impact cross-border ePayments?

The fintech companies enable cross-border ePayments through digital channels. When GST is enforced, it can affect taxation based on the nature of the service. The GST system attempts to bring all types of businesses under one taxation roof. So, the GST tax may vary based on the type of ePayment model. However, currently, there are no specific requirements for fintech companies to change GST rates.

7. How can fintech companies comply with GST regulations?

The core of GST regulations is maintaining accurate record keeping. The digital operations ensure that a valid audit trail is in place. The fintech companies can use software like CaptainBiz to keep track of all their accounts and finances. Submitting GST reports on time and calculating accurate GST is crucial to ensure compliance.

8. Are there GST exemptions or incentives for fintech startups?

Many government initiatives are now available to support startups in India. As the RBI regulates the fintech sector, it takes a cautious approach in approving fintech companies that can affect the national economy. The requirements for fintech companies are more stringent, but the startups can ease their burden using digital platforms. Currently, there are no exemptions for fintech companies.

9. Can fintech firms avail of the input tax credit?

When fintech companies charge GST for their services, they also pay GST to other companies. So, technically, fintech firms are eligible to avail of input tax credits to offset their GST taxes. However, the situation differs with specific fintech firms and the type of services they offer.

10. How can fintech companies stay updated on the latest GST regulations?

The GST regulations are updated based on the business ecosystem in India. Fintech companies must check government websites and notices to stay updated on the GST regulations. Digitising and recording all financial transactions is critical for GST compliance. The GST tool, like CaptainBiz, is helpful in recording, managing, and monitoring all types of business financial transactions.