Calculating Goods and Services Tax (GST) on services is complex and varies according to the kind of service and the applicable GST rate. In contrast to products, where the computation is usually straightforward, services might be categorized into several GST slabs, including 5%, 12%, 18%, or 28%. Accurate GST computation requires understanding these rates’ nuances and their application to the particular service in issue.

Understanding the GST calculation process is essential for consumers and service providers as it guarantees financial transparency and adherence to tax laws. People and enterprises must thoroughly understand how to compute GST on services in this ever-changing tax environment.

Calculating GST on Service Transactions

One of the easiest ways to calculate GST is by using a GST calculator, which is readily available online. Using this calculator, anybody can determine the amount they must pay monthly or quarterly towards GST on service transactions. It is excellent for people who offer different types of services to consumers. These calculators are built to divide the amount within CGST – Central Goods and Services Tax and SGST – States Goods and Service Tax to give the accurate amount.

Procedure for GST Computation for Services

Let’s look at how GST is calculated for services step by step:

-

Find the SAC Code

The first step is determining the SAC code for the services you must pay taxes for. SAC codes are international systems for determining the type of services. Once the code is selected, it is easy to check the correspondent rate. The rate could be either NIL, 5%, 12%, 18%, or 28%.

-

Check for IGST, CGST, and SGST

Next is to check whether the tax falls under IGST, CGST, or SGST criteria. IGST is for services supplied from one state to another. Meanwhile, CGST and SGST are for services provided within the same state. None of these three change the tax rate; these are just the modes of tax classification of where the revenue will be transferred.

-

Check for Reverse Charge Services

For services, it is essential to check whether or not it is a reverse charge service. Although the GST liability falls on the supplier of the services, in a reverse charges situation, it falls on the service recipient. The list of these services is very long. Some of these are online information and database access and retrieval services, insurance agent services, goods transport agency services, and advocate services, for example.

-

Determine the Transaction Type

In the case of a B2B transaction, the companies are eligible for GST input tax credit. However, it can only be possible if the supplier and recipient have GSTIN. However, B2C transactions do not qualify for input tax credits.

-

Check the GST Composition Scheme

Businesses with an annual turnover of over INR 75 lakhs are eligible for the GST composition scheme that allows them to pay GST at a fixed rate. However, if they opt for GST composition, they will not get the input tax credit and cannot supply services out of state. In addition, the reverse charge rates will also be applied to standard rates. Specific dealers are exempt and cannot opt for this scheme. These services include manufacturing paan masala, ice cream, and tobacco.

GST Calculation Method for Services

It has become quite simple to calculate because of the simplification of the indirect taxation system. The calculator on services can be done based on the transaction – inter or intra-state. Let’s have a look at both:

-

Intra-State GST Calculation

In the case of intra-state CGST = GST rate/2 and SGST = GST rate/2 and hence CGST + SGST = applicable GST rate

-

Inter-State GST Calculation

In the case of inter-state, it will be IGST = applicable GST rate

It is important to remember that for accurate tax computations, the GST rate should be increased by the GST Compensation Cess, if applicable. So, the formula will be:

GST amount = (original cost x GST rate percentage)/100

Net price = original cost + GST amount

Formulas for Determining GST on Services

The formula for GST calculations on services will be as follows:

GST amount = GST inclusive price x GST rate/(100 + GST rate percentage)

Original cost = GST inclusive price x 100/(100 + GST rate percentage)

Service-Specific GST Calculation Guidelines

The time and location of the supply—where the services were used—is where the GST statute requires the taxpayer to pay the tax. GST is a destination-based tax applied when services are utilized and paid for in a particular state. It is sometimes referred to as a consumption tax. The three tax levels under GST are IGST, CGST, and SGST. The applicable tax will be assessed based on the supplier’s location and the so-determined place of supply.

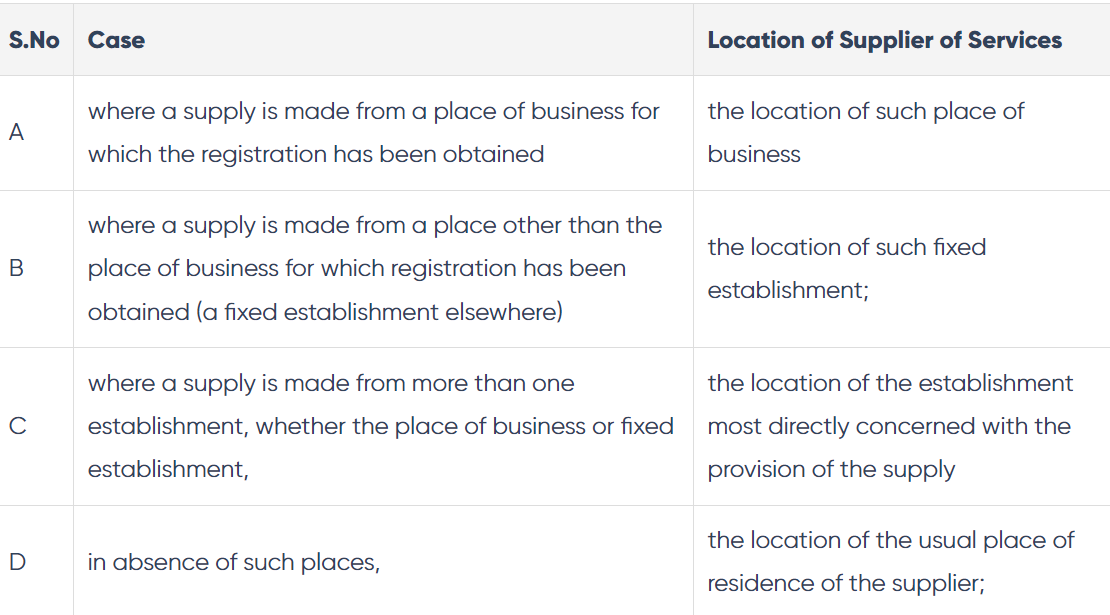

Location of Supplier of Services

Ensuring Accurate GST Calculations for Services

It is a good idea to use a calculator or consult a tax expert to ensure you are calculating accurately and avoiding errors and mistakes. However, remember the below if you plan to calculate independently.

- Use the net price of the services.

- Check for its GST rate, which can be NIL, 5%, 12%, 18%, or 28%.

- Calculate based on the formulas mentioned above or use a calculator.

Conclusion

In conclusion, financial correctness and compliance depend heavily on your ability to calculate GST on services. Due to varying GST rates and the nature of the service, the process necessitates a thorough comprehension of applicable slabs and their ramifications. This information guarantees accurate tax computations and enables you to make well-informed decisions as a consumer or business owner in the constantly changing tax environment.

Knowledge of GST computations is essential because, given the continued importance of services to the world economy, it helps create an efficient and transparent financial system that encourages responsible spending and adherence to legal requirements.

FAQs

-

How do you calculate 18% GST on services?

If a service is sold for INR. 1,000, and the applicable GST rate is 18%, the net price determined is equal to Rs. 1,180 plus (1,000X(18/100)) = 1,000+180.

-

How to calculate GST?

A straightforward formula is (Original Cost*GST Rate Percentage) / 100 = the GST Amount. Original Cost + GST Amount = Net Price.

-

How much is the GST rate for services?

There are different rates for GST on services. If the service is not exempted and no rate is provided, it will be charged at 18%.

-

Who is liable to pay GST on services?

The supplier of the services is responsible for paying for GST. However, there are certain situations where the recipient of the services is supposed to pay the GST.

-

Who all are needed to pay GST on services?

A person who conducts business wherever in India and is registered or obliged to get listed within the GST Act is referred to as a taxable person by the GST Act. A taxable person conducts economic activity, such as trade or commerce.

-

Is it mandated to pay GST on services?

If a service provider’s total revenue surpasses INR 10 lakh (for a particular state category) or INR 20 lakh (for normal category states), they must register and pay the GST.

-

Are there any services exempt from GST?

Certain services, such as healthcare, education, and agriculture, are exempt from GST.

-

Is GST applicable on all services?

GST rates are applicable on services except the ones that are exempted. The rates will vary based on whether it is necessary or luxury.

-

What does the term service mean in GST?

Services refers to anything unrelated to goods, money, or securities. This includes using money or converting it into another form, currency, or denomination. It can be either through cash or another method—a separate fee is required.

-

How are services taxable under GST?

There are three tax levels under GST: IGST, CGST, and SGST. The applicable tax will be assessed based on the supplier’s location and the determined place of supply. Where a transaction occurs inside a state, CGST and SGST are levied; where a transaction occurs between states, IGST is charged.

Also read how to calculate GST on food.