Latest Update: GSTR-1 Filing Due Date to be Extended till Apr 12 – GSTN

A GST Return is a form a Taxpayer must file for every GSTIN registered under the Goods and Service Tax (GST). GST registered Taxpayer is required to file GST Return on a monthly, quarterly or annual basis. The GSTR fillings are done online on the GST portal.

The Frequency of filling out GST Returns differs in GSTR -1 and GSTR 3B if the Taxpayer opts for the QRMP (Quarterly Return filling and Monthly Payment of Taxes) scheme.

GSTR -1 Return

GSTR 1 is a primary and essential return and is to be filled by all the Normal taxpayers and the Casual Taxpayer registered under GST.

- It is the return that requires the Taxpayer to furnish all the details of outward supplies of Goods and Services for a tax period, along with the advance received from the customers.

- It is filled on a monthly or quarterly basis.

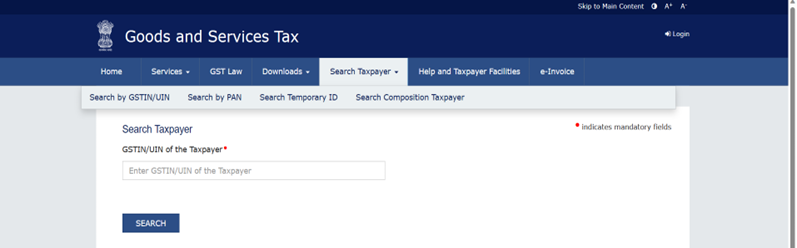

While filling a GST Return, a taxpayer must keep a check that a valid GSTIN is filled while entering the Sales Invoice Details and advances received along with the HSN Summary and documents issued during the return filing period. You can check through GST Search Tool. On search Taxpayer, choose the option Search by GSTIN/UIN.

GST Return-1 is important because the GST Input Tax Credit of Recipients depends on the timely filling of GST 1 by the supplier or supplier compliances.

While GSTR 3b is a monthly self-assessed return. Firstly, the Taxpayer must file GSTR 1 with all the details of outward supplies & advances received during the month. After that, only the Taxpayer is eligible to file GSTR 3B.

Read More: A Comprehensive Guide to GSTR-3B Amendments and Adjustments

Filling Frequency of GST Return

GSTR-1 can be filled on the following basis-

- Monthly- Taxpayerswho have opted for the Monthly return filling have to file returns every month.

- Quarterly– Registered persons whose aggregate turnover of up to Rs. 5 crores in the preceding financial year can opt for the QRMP scheme. But in case, Taxpayers’ aggregate turnover exceeds Rs.5 crore during any quarter in the current financial year; the Taxpayer is not eligible for the QRMP scheme from the next quarter. Taxpayer who has opted for the QRMP (Quarterly Return Filling and Monthly Payment of Taxes) scheme have to file two monthly return and one quarterly return.

What is a Due Date for GSTR 1?

The due date for filling GSTR 1 depends upon the Taxpayer aggregate Turnover.

- Taxpayers with turnover up to Rs.5 crores in the preceding financial year have the option to file quarterly returns under the QRMP scheme, and they are due by the 13th of the month following the relevant quarter.

- Taxpayers with a Turnover above Rs.5 crore have to fill returns every month on or before the 11th of next month.

|

Turnover

|

Frequency |

Due Date of GSTR 1 |

| For regular Taxpayer having Turnover less than or up to Rs. 5 Crore

(< 5 crore) |

Quarterly

|

13th of the month

|

| For regular Taxpayer having Turnover less than Rs. 5 Crore

(> 5 crore) |

Monthly

|

11th of the next month

|

Related Read: Understanding GSTR-1 IFF: A Comprehensive Guide

The regular and casual taxable person will file the above details of GSTR – 1 and GSTR – 3B. To ensure correct data for filing the GST Returns, the taxpayers can use the Logo’s CaptainBiz, a cloud based and mobile-based billing package. CaptianBiz maintains the master data and the transaction date, which is required to file GSTR – 1 & GSTR – 3B.