Introduction to GST number

The Goods and Services Tax (GST) number has emerged as a fundamental requirement for businesses in many countries. It plays a crucial role in simplifying tax compliance, establishing legitimacy, and unlocking various benefits for businesses operating within a GST framework. Understanding the concept and significance of GST numbers is essential for entrepreneurs and organizations to navigate the complex tax landscape efficiently. This article explores the multiple advantages that businesses can gain by obtaining a GST number, ranging from streamlined tax compliance to increased market opportunities and improved cash flow management. By leveraging the benefits of a GST number, businesses can enhance their competitiveness, credibility, and profitability in today’s dynamic business environment.

Understanding the concept of GST

GST – three letters that have been the subject of countless discussions and the source of endless confusion for businesses. But fear not, my friend, for I am here to shed some light on this enigmatic acronym.

GST stands for Goods and Services Tax, a unified taxation system that has replaced the complex web of indirect taxes in India. It is a comprehensive and destination-based tax that is levied on the supply of goods and services.

Role and significance of GST numbers

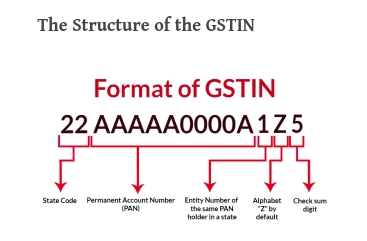

Now, let’s talk about the star of the show – the GST number. Every business that falls under the purview of GST needs to register for a unique GST identification number, also known as the GSTIN.

Think of the GSTIN as the superhero cape that gives your business the power to sail smoothly through the treacherous waters of taxation. It is your golden ticket to the GST realm, and it offers a plethora of benefits that can make your life as a business owner much easier.

Also Read: Why is a GST number important?

Simplified Tax Compliance

Tax compliance can be a complex and time-consuming process for businesses. However, several initiatives have been introduced to simplify compliance and reduce the administrative burden, particularly for small and medium-sized enterprises (SMEs).

Here’s an overview of common simplification measures and their benefits, presented in a table format for clarity:

| Initiative | Description | Benefits |

| Composition Scheme: | A simplified tax payment scheme for eligible businesses with lower turnover thresholds. | – Lower tax rates – Quarterly tax payments – Exemption from certain compliance requirements (e.g., detailed invoice filing) |

| Quarterly Returns: | Filing of GST returns quarterly instead of monthly. | – Reduced frequency of filings – Lower administrative costs |

| Simplified Returns: | Streamlined return forms with fewer fields to fill in. | – Easier to prepare and file – Lower risk of errors |

| E-Invoicing: | Mandatory electronic invoicing for businesses with turnover above a certain threshold. | – Standardized invoice format – Improved data quality – Easier reconciliation and compliance |

| GST Suvidha Providers (GSPs): | Third-party service providers offering assistance with GST compliance. | – Help with registration, filing returns, and other compliance tasks – Reduced workload for businesses |

| Government Portals and Resources: | Online platforms providing information, tutorials, and tools for GST compliance. | – Easy access to information and guidance – Self-service options for filing returns and making payments |

Additional Benefits of Simplified Compliance:

- Reduced costs: Lower administrative costs associated with compliance.

- Improved cash flow: Faster refunds and reduced penalties can positively impact cash flow.

- Increased efficiency: Streamlined processes save time and resources.

- Reduced risk of errors: Simplified procedures minimize the likelihood of mistakes.

- Enhanced compliance: Easier compliance encourages businesses to meet tax obligations.

- Better decision-making: Clearer tax information supports informed business decisions.

- Improved competitiveness: Reduced compliance burden allows businesses to focus on core operations and growth.

Single tax registration process

Picture this: You’re standing in a long line, paperwork in hand, waiting to register for multiple taxes like excise duty, service tax, and VAT. Sounds like a nightmare, right? Well, GST comes to the rescue with its single tax registration process.

With a GSTIN, you can bid farewell to the days of juggling multiple registrations and say hello to a streamlined, hassle-free experience. A single registration for GST covers all your indirect tax obligations, saving you time and energy.

Reduced compliance burden

Say goodbye to the days of drowning in a sea of tax paperwork. GST significantly reduces the compliance burden for businesses. Earlier, businesses had to file multiple tax returns for different taxes, which was a never-ending nightmare.

But with GST, there’s light at the end of the tunnel. Businesses only need to file a single monthly or quarterly return online. This simplification of the tax compliance process allows you to focus on what really matters – running your business.

Automated tax calculation and return filing

Remember those days when you had to manually calculate your tax liability and file your returns? Well, say goodbye to those days because GST brings automation to the party.

GST provides a seamless and automated tax calculation system, which means less room for human error and more accurate tax computations. Additionally, return filing is also done online, making the process faster and more convenient.

Legitimacy and Credibility

Establishing legal presence in the market

Having a GSTIN gives your business a stamp of legitimacy in the eyes of the law. It shows that you are a law-abiding citizen who follows the rules and regulations laid down by the government.

Not only does this boost your credibility, but it also helps establish your legal presence in the market. Customers and suppliers are more likely to trust and engage with businesses that have a valid GSTIN.

Enhanced trust among customers and suppliers

In the world of business, trust is key. Having a GSTIN adds an extra layer of trustworthiness to your business. It shows that you are accountable and transparent in your financial transactions.

Customers and suppliers feel more confident dealing with businesses that are registered under GST, as it ensures that proper tax compliance is being followed. So, flaunt that GSTIN like a badge of honor and watch trust grow like a flourishing plant.

Streamlined Input Tax Credit

Understanding input tax credit mechanism

The wonderful world of input tax credit (ITC). ITC is a beautiful concept that allows businesses to claim credit for the taxes paid on their purchases. It’s like getting a refund for the taxes you’ve already paid.

Having a valid GSTIN enables you to take full advantage of the ITC mechanism. You can claim credit for the GST paid on your inputs and use it to offset your tax liability. This helps in reducing your overall tax burden and improving your cash flow.

Also Read: Benefits And Rights Of Regular Taxpayer: Access To Input Tax Credit And Refunds

Simplified and transparent ITC claim process

Gone are the days of struggling to track and calculate the taxes paid on your purchases. GST simplifies the ITC claim process by providing a transparent and organized system.

With a GSTIN, you can easily reconcile your purchases and claim the appropriate ITC. The electronic matching of invoices makes the process more efficient and reduces the chances of errors or discrepancies.

So, my friend, having a GST number isn’t just a bureaucratic requirement. It’s a gateway to a world of simplified tax compliance, credibility, and streamlined financial operations. Embrace the power of the GSTIN and watch your business flourish.

Increased Market Opportunities

Seamless movement of goods and services

The introduction of GST has brought about a streamlined process for the movement of goods and services across the country. With the implementation of a common tax system, businesses no longer have to navigate through the complex web of multiple state taxes. This has resulted in a more efficient supply chain, reducing the time and cost involved in transporting goods from one state to another. So, whether you’re a manufacturer or a distributor, GST has made it easier for your products to reach customers in different parts of the country.

Expanded customer base across states

Gone are the days when businesses had to focus solely on their local markets. With the harmonization of taxes under GST, businesses now have the opportunity to tap into a much larger customer base across states. Whether you’re a small local vendor or a budding e-commerce startup, GST has leveled the playing field and opened up markets that were previously inaccessible due to tax barriers. So, if you’ve been dreaming of expanding your business beyond your state borders, obtaining a GST number can be a game-changer.

Access to GST Network Services

Exploring the features of GSTN

GSTN, or the GST Network, is the backbone of the GST system. It is a robust IT infrastructure that connects taxpayers, tax authorities, and other stakeholders. By registering for a GST number, businesses gain access to various services provided by GSTN. From filing tax returns online to electronic invoicing, GSTN offers a range of user-friendly tools and services that simplify tax compliance and reduce paperwork. So, say goodbye to those piles of physical documents and embrace the convenience of digital record-keeping with GSTN.

Leveraging technology for tax compliance

Technology is at the heart of GST implementation, and businesses can leverage this to their advantage. With the use of GST-compliant accounting software, businesses can automate their tax compliance processes, making it easier to generate GST invoices, reconcile financial data, and file returns accurately and on time. This not only saves businesses valuable time and effort but also minimizes the risk of errors and penalties. So, if you want to stay ahead of the game and make tax compliance a breeze, embracing technology is the way to go.

Improved Cash Flow Management

Timely input tax credit refunds

One of the significant advantages of holding a GST number is the ability to claim input tax credit. Under the GST regime, businesses can set off the taxes paid on inputs against their output tax liability. This means that the tax already paid at the earlier stage of the supply chain can be utilized to reduce the tax liability when selling the final product or service. By availing input tax credit and ensuring the timely refund of any excess credits, businesses can improve their cash flow and maintain a healthy working capital position.

Minimizing tax leakages and bottlenecks

GST has been instrumental in curbing tax leakages and bottlenecks that were prevalent under the previous tax system. The introduction of a transparent and comprehensive tax framework has reduced the scope for tax evasion and malpractices. With increased scrutiny and the use of technology-driven compliance measures, businesses can now focus on their operations without the fear of non-compliant competitors gaining an unfair advantage. This not only levels the playing field but also ensures a more efficient and fair tax ecosystem.

Conclusion: Leveraging the Benefits of GST Number for Businesses

In conclusion, obtaining a GST number can be a game-changer for businesses. It opens up new market opportunities, expands customer reach, and provides access to a host of technological tools and services. With improved cash flow management and a reduction in tax leakages, businesses can thrive and grow in the GST era. So, if you haven’t already jumped on the GST bandwagon, it’s time to get on board and leverage the benefits that come with a GST number. Happy GSTing! Conclusion: Leveraging the Benefits of GST Number for Businesses.

Obtaining a GST number offers numerous advantages for businesses. From simplified tax compliance and legitimacy to streamlined input tax credit and increased market opportunities, the benefits are undeniable. Access to GST network services and improved cash flow management further contribute to the overall growth and success of businesses. By embracing the GST framework and leveraging the benefits of a GST number, businesses can enhance their operational efficiency, gain a competitive edge, and establish a strong foundation for long-term success. It is crucial for businesses to recognize the value of a GST number and take proactive steps to incorporate it into their operations to maximize the benefits it offers.

Also Read: Advantages Of Having GST Number

FAQ

1. Do all businesses need to obtain a GST number?

Yes, in most countries with a GST system, businesses above a certain annual turnover threshold are required to register for a GST number. It is important to check the specific regulations and requirements in your country to determine if your business needs a GST number.

2. How can a GST number simplify tax compliance?

A GST number simplifies tax compliance by allowing businesses to file a single consolidated tax return, instead of dealing with multiple tax registrations and filings. It streamlines the tax calculation process and ensures businesses comply with the GST regulations in a more efficient and hassle-free manner.

3. Can a GST number help businesses expand their market opportunities?

Yes, a GST number can help businesses expand their market opportunities. With a GST number, businesses can engage in interstate trade without any additional tax implications. This opens up new avenues for selling products or services in different states, thereby increasing the customer base and market reach.

4. How does a GST number contribute to improved cash flow management?

A GST number allows businesses to claim input tax credit on purchases made for business purposes. This means businesses can offset the tax paid on inputs against the tax collected on sales, resulting in improved cash flow. Additionally, timely input tax credit refunds further enhance cash flow management and provide businesses with more financial stability.