Remaining compliance with e-invoice cancellation laws is a significant problem for organizations worldwide in an era of continuously changing tax and regulatory landscapes. In addition to completely changing how transactions are recorded and reported, electronic invoicing has forced tax authorities to update and modify existing regulations to protect the integrity of the digital economy.

An essential part of this ecosystem is e-invoice cancellation, which enables error rectification and appropriate handling of invoice disputes. Businesses must keep up with these changes to prevent expensive fines and operational disruptions, as authorities update and modify these requirements regularly. This article explores the constantly changing rules around e-invoice cancellation, emphasizing how crucial it is to comprehend and abide by the most recent updates and revisions to retain compliance and reduce risks in the contemporary tax climate.

Latest E-Invoice Cancellation Updates

Here are some of the significant e-invoice cancellation updates that came into existence from the last year:

- August 1, 2022: Starting October 1, 2022, as per notification # 17/2022, the B2B e-Invoicing system was made available to companies with annual total revenue of up to Rs. 20 crores instead of Rs. 10 crores.

- April 13, 2023: The GSTN published an advisory informing taxpayers that, starting on May 1, 2023, tax invoices and credit-debit notes with an annual turnover of Rs. 100 crore or more must be reported to the IRP within seven days of the invoice or CDN’s issuance.

- May 6, 2023: The 7-day deadline for reporting outdated electronic invoices on e-invoice IRP portals was extended by three months by the GST department. Additionally, the department disclosed the revised implementation date.

- May 10, 2023: The 6th phase of e-invoicing was announced by the CBIC. Starting from August 1, 2023, taxpayers with a turnover of Rs. 5 Crore and more in any fiscal year, effective 2017–18, will be required to issue e-invoices.

Step-By-Step Guide- E-Invoice Cancellation Changes

It is essential to understand that only taxpayers can cancel their e-invoices if the 24-hour window has lapsed after the issuance of the invoice. Even the portal will not allow for any amendments, and taxpayers will have to cancel or modify the GST portal or issue a debit note.

To make the e-invoice cancellation amendments in the GSTR-1 return, follow these steps:

Step 1: To make any changes, such as cancellation or modification, you must log in to the GST portal with your credentials.

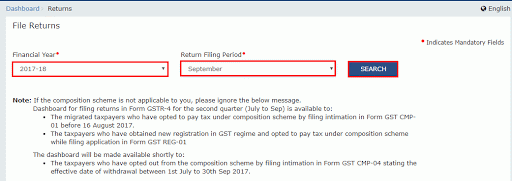

Step 2: Click on Services – Returns – Returns Dashboard

Step 3: You will see the File Returns option under Returns Dashboard. Click on the financial year and select the relevant return period from the drop-down. Enter search right next to it.

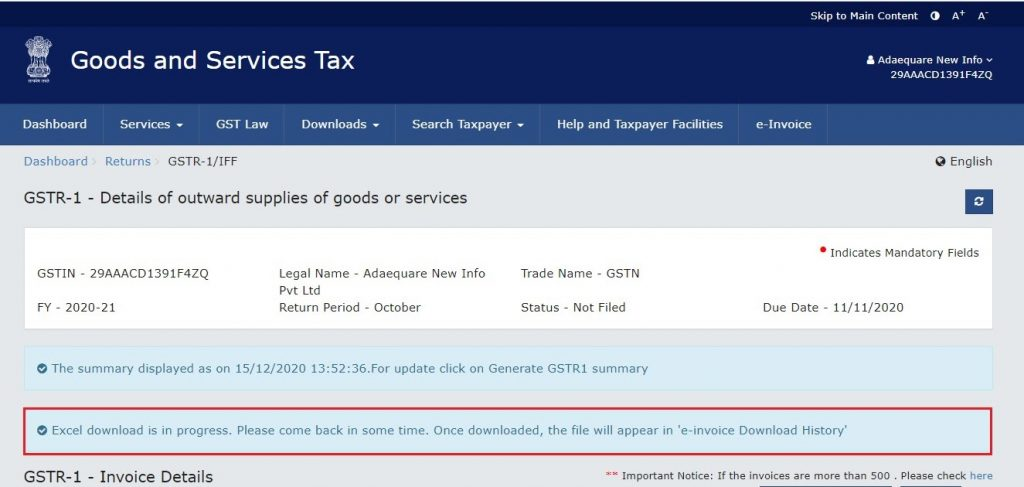

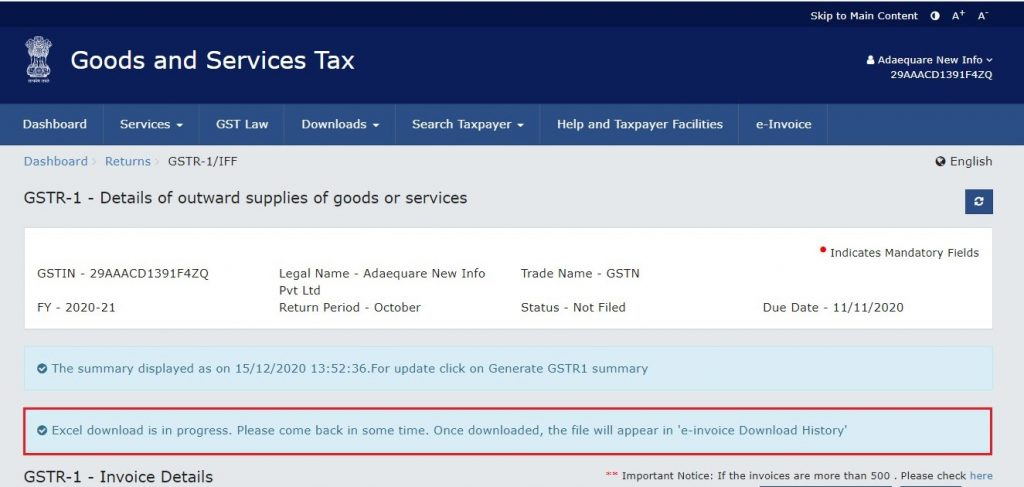

Step 4: The information must be downloaded from e-invoices. For that, you must click on Download Details from the e-invoices button. It will be in the excel format with the below message:

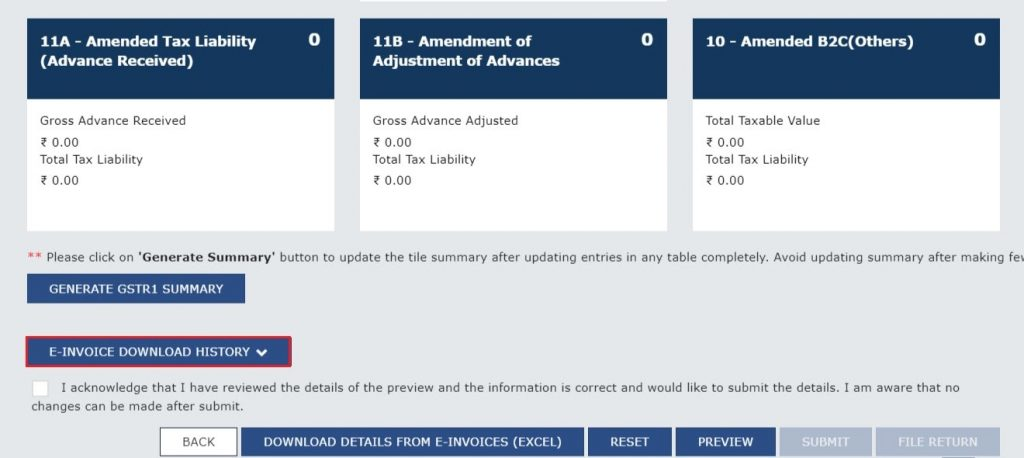

E-invoice download history: you need to click on that button to access the downloaded files.

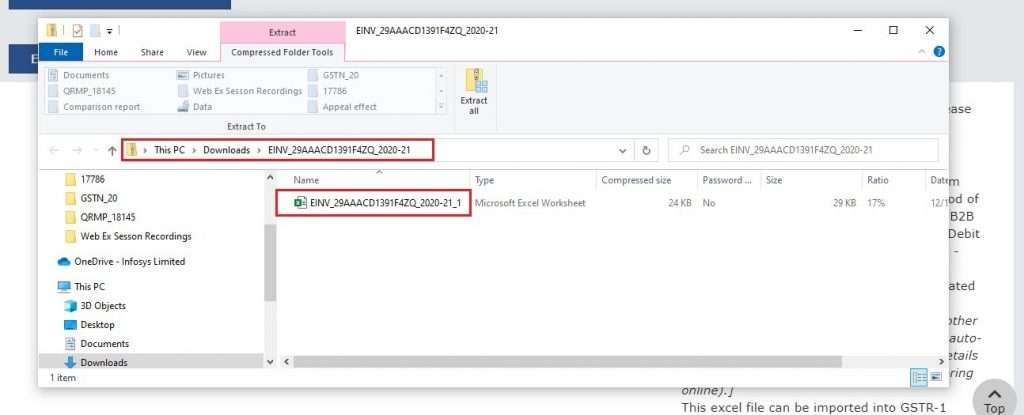

Step 5: Here, you can see the last five e-invoices downloaded by you. You can click on the Click here to download – File one link for the downloaded Excel file. Once clicked, the downloaded file will be saved to your system’s local drive. You can also see the link at the bottom of the same page.

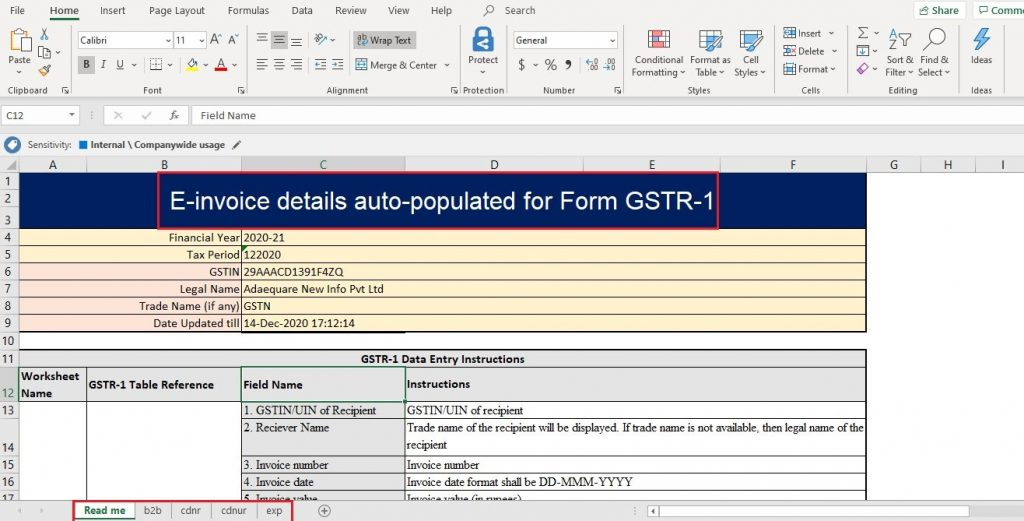

Step 6: There will be a file icon that will open the folder on your system. You can see the Excel file there, and all the auto-populated e-invoice details of the GSTR-1 form will be visible in that Excel file. The several sheets will show the information of the different tables. Clicking on the tabs at the bottom of the sheet will allow you to access them.

Step 7: The data will be auto-populated in the below tables of the GSTR-1 form:

- 4A,4B,4C,6B,6C – B2B invoices.

- 6A – Export invoices

- 9B – CDNR (registered credit or debit notes)

- 9B – CDNUR (unregistered credit or debit notes)

Step 8: To edit any of the above, click on that specific tile, such as B2B invoices.

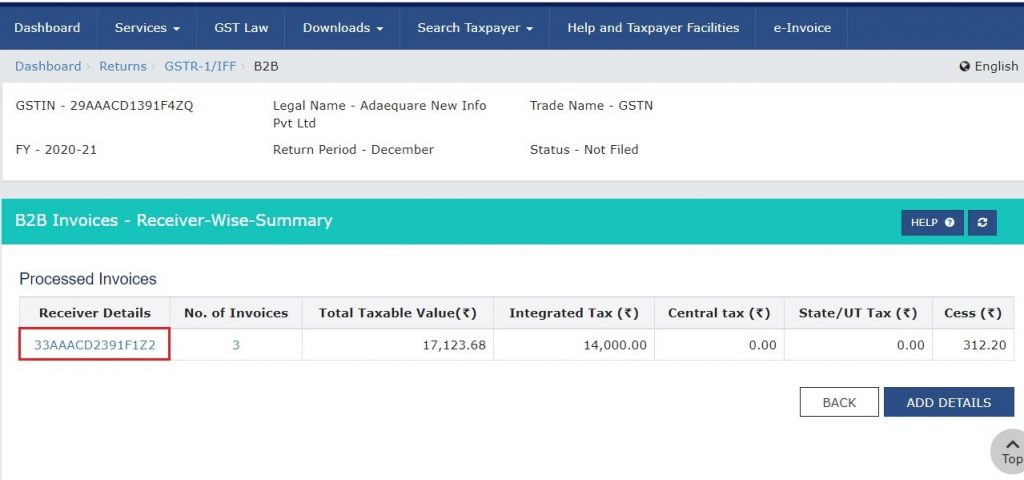

Step 9: Click Receiver’s Details – GSTIN to open all the related e-invoices. You will see all invoices received by the GSTIN selected.

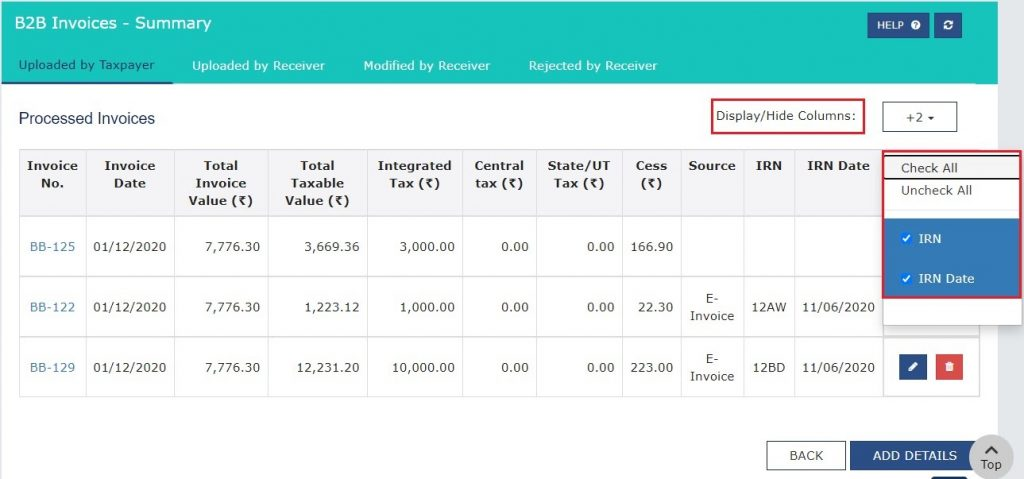

Step 10: Select Display/Hide Columns from the drop-down to view all the columns. Then click Check All, and columns will be displayed with data auto-populated.

Step 11: Viewing the following information on the “Processed Documents” tab is possible if the e-invoice details are automatically filled in on Form GSTR-1:

- Source: This shows the source from which the GSTR-1 details were uploaded. “E-invoice” means the data is automatically pulled from the electronic invoice system.

- IRN: The invoice reference number of your e-invoice.

- IRN Date: E-invoice date

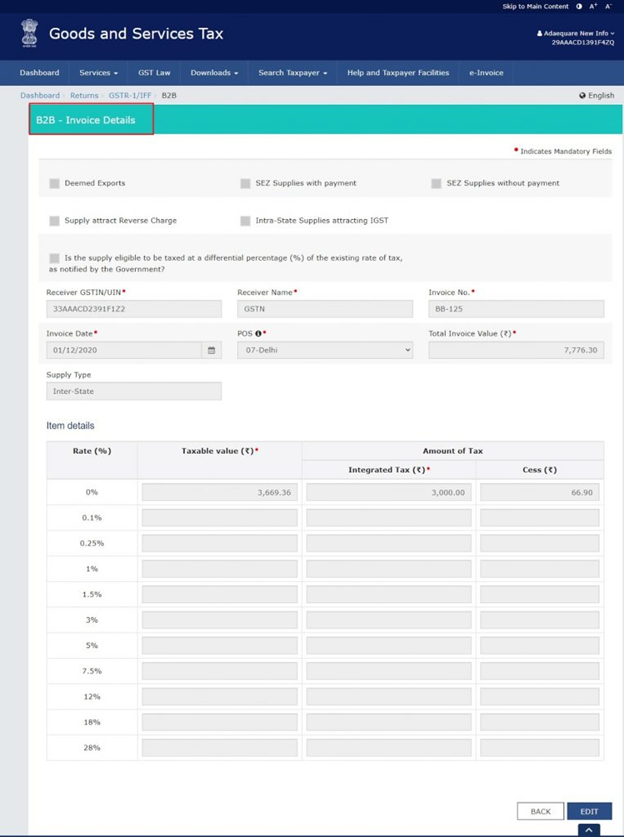

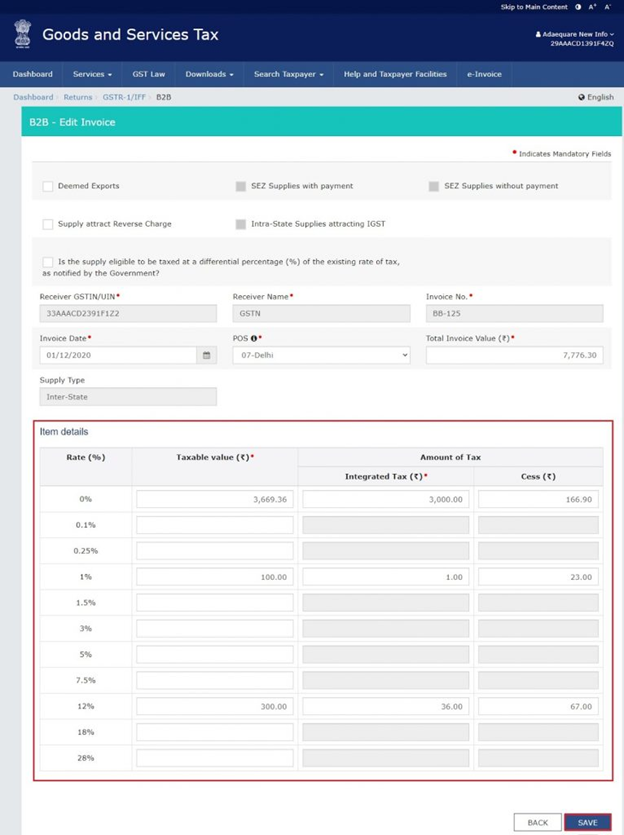

Step 12: Now, if you want to edit the invoice, go to Actions – click on the edit icon for the invoice data to display.

Step 13: There will be an edit button at the bottom of the page; click to make everything editable.

Step 14: Make the necessary changes and click on the save button.

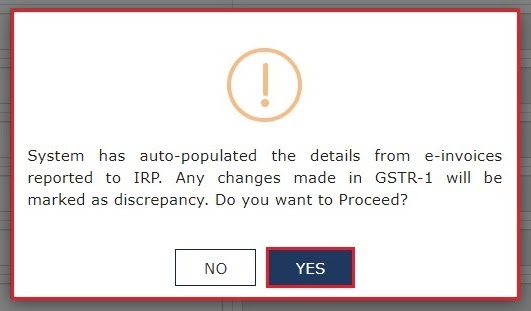

Step 15: There will be a pop asking – click yes to proceed.

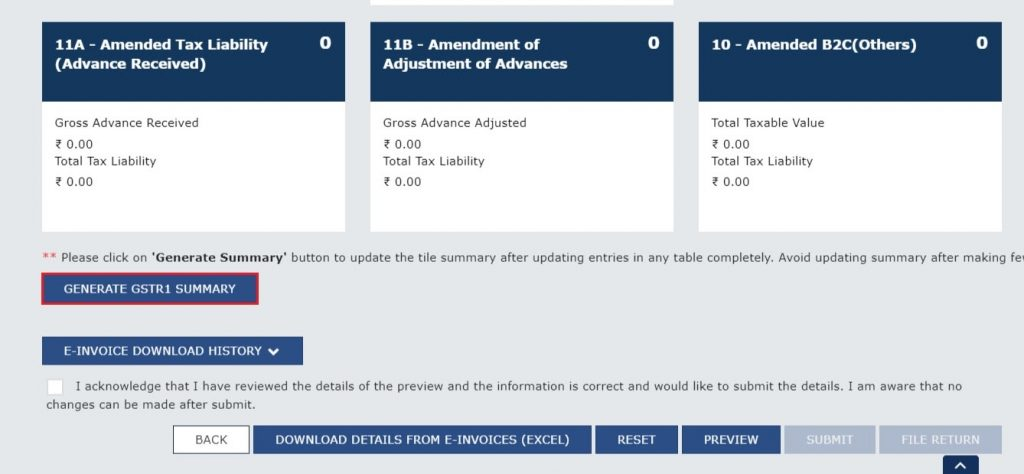

Step 16: Click on the generate summary option at the bottom of the page to update the invoice details.

If the 24-hour window has not lapsed, the taxpayer can choose to cancel e-invoices cancellation only under the below-mentioned conditions:

- Incorrect entry

- Duplicate entry

- If the buyer cancels the order

For cancellation purposes, you can follow the below-mentioned steps:

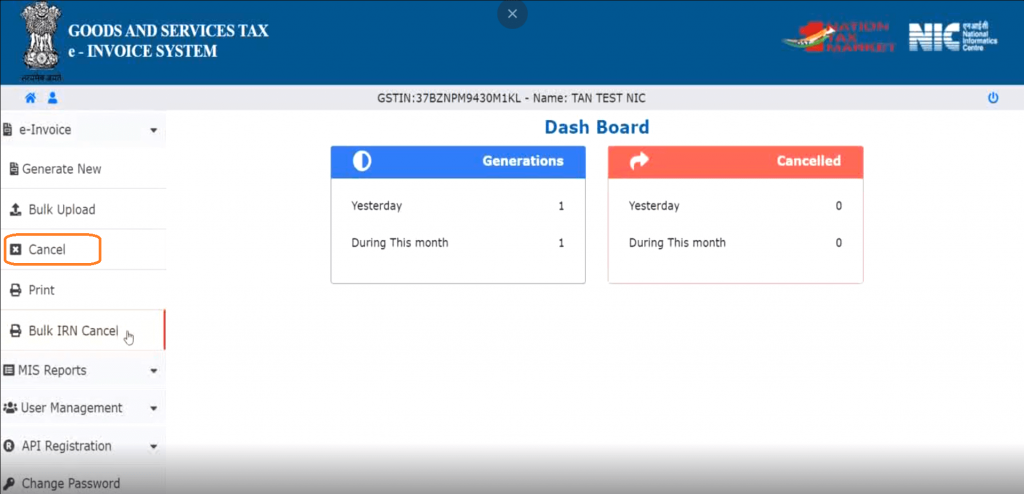

Step 1: Navigate to the e-invoice dashboard after logging into the e-invoice portal. Under the e-invoices menu – click on cancel.

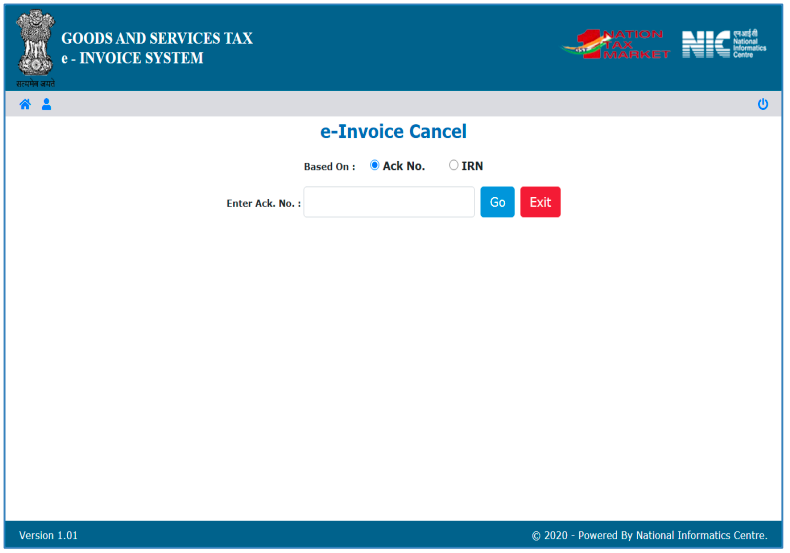

Step 2: You must enter the IRN or the acknowledgement number and click on Go.

Step 3:

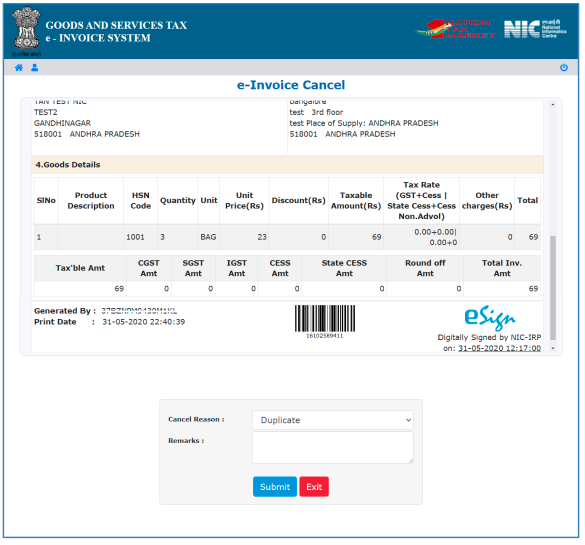

- Choose the reason for the cancellation of the e-invoice.

- Type in the remarks.

- Select the submit button.

The above steps are reasonable if you want to cancel a single e-invoice. However, if there are multiple e-invoices to cancel, follow the below steps:

Step 1: On the e-invoices portal, go to the help section. You will see bulk generation tools in that section.

Step 2: Download e-Invoice Cancel by IRN-JSON Preparation, an offline utility.

Step 3: Choose or enter the details, such as the IRN, cancellation reason, and cancellation remarks, and click validate to double-check for errors. If there are errors, rectify them before moving to the next step.

Step 4: Click – Prepare JSON after the file is thoroughly validated and error-free.

Step 5: Go back to the e-Invoice portal, re-login, and go to the e-Invoice section. Click bulk IRN cancel and upload the JSON file.

Best Practices for E-invoice Cancellation: Ensuring Accuracy and Compliance

How to Stay Compliant with the Latest E-Invoice Cancellation Amendments and Updates

Generating e-invoices is necessary for businesses and also a mandate from the government’s end. Therefore, it is essential that you follow the e-invoice compliance and not default on any parameter; otherwise, there will be penalties attached to it.

Here are a few tips for you to remain compliant:

- Always check the government websites, e-invoice, and GST portal to stay updated on the latest e-invoice cancellation amendments and updates.

- You can even approach your accountant’s department or the firm’s CA for any latest updates or changes.

- If, for any one reason listed in the above section, you need to cancel your e-invoice, try and do it within 24 hours of issuance. After 24 hours, you will not be able to cancel the e-invoice from the e-invoice portal.

- If you need to cancel after 24 hours, you must manually do it on the GST portal before filing the GST returns.

- If you want to amend and not cancel, you can only do it through the GST portal and as per the rules and regulations of the GST law.

- Remember, if your IRN is cancelled, you cannot use the same invoice number to generate a new IRN. If you do so, the e-invoice will be rejected by the IRP. Hence, be very careful while developing the new one.

- The IRP will not allow an IRN to be cancelled if the IRN has a current e-way bill.

- If an IRN is cancelled, GSTR-1 will be updated immediately with the status “cancelled”. Hence, it is imperative to remember this point to avoid any issues.

If you missed following any specific issues, rules, or regulations regarding e-invoice cancellation, you can be charged penalties as per Section 48 (5) of the CGST rule. Two kinds of penalties can be set:

- If you have not issued your e-invoice, 100% of the tax amount is due, or Rs. 10,000 (whichever will be higher).

- If you have given an incorrect e-invoice: Rs. 25,000

Conclusion

In the dynamic world of taxes and e-invoicing, it is impossible to overstate the significance of abiding by the ever-changing e-invoice cancellation policies. Businesses need to stay flexible and knowledgeable as governments modify laws to suit the needs of the digital era.

Organizations may confidently traverse the complex web of e-invoice compliance and protect themselves from potential liabilities and interruptions by staying abreast of these modifications and updates.

Compliance is essential to stable operations and sound financial management, not merely as a matter of law. Businesses that embrace the need for adaptability and attentiveness set themselves up for success in a world where regulations and electronic transactions are intertwined, and compliance is not only necessary but also a competitive advantage.

Suggested Read: Challenges and Solutions in E-invoice Cancellation Process

FAQs

-

How to cancel or amend an e-invoice?

You can cancel the e-invoice by going to the e-invoice portal within 24 hours of issuing the invoice. However, after 24 hours, the portal will not allow it, and you will have to cancel it manually on the GST portal.

-

What is the timeline for e-invoice cancellation?

The e-invoice can be cancelled within 24 hours of issuance.

-

What is the current update regarding e-invoice cancellation?

The latest update was released on May 10, 2023. In this update, the 6th phase of e-invoicing was announced by the CBIC. The update said that starting from August 1, 2023, taxpayers with a turnover of Rs. 5 Crore and more in any fiscal year, effective 2017–18, will be required to issue e-invoices.

-

Can amendments in an e-invoice only be allowed via the GST portal?

Yes, if there are any amendments that a taxpayer has to make, they can only get it done through the GST portal.

-

Can a taxpayer cancel an e-invoice?

Yes, an e-invoice can be cancelled only under three conditions – incorrect entry, duplicate entry, and when the buyer cancels the order.

-

Can an e-invoice be amended multiple times?

No, once the amendment is done, it cannot be amended again.

-

Can a taxpayer cancel the e-invoice partially?

No, the taxpayer cannot cancel the e-invoice partially. It can only be withdrawn as a whole.

-

What is the e-invoice turnover limit in 2023?

E-invoice is mandatory for all businesses with a turnover limit of over Rs. 5 crores.

-

What is the seven-day e-invoice limit?

Within seven days of the date shown on the invoice, debit note, or credit note, all tax invoices must be generated as e-invoices on the IRP.

-

What happens if someone misses to submit an e-invoice?

There are penalties for missing or submitting an incorrect e-invoice by the government.