Nowadays, canceling an E-invoice is a crucial part of running a contemporary business; therefore, it’s critical to ensure everything goes according to plan. Organizations must implement best practices that adhere to legal and regulatory standards while streamlining the cancellation process in light of the growing popularity of electronic invoicing.

This article discusses the significance of following recommended procedures for canceling electronic invoices, highlighting the necessity of striking a compromise between productivity and legal requirements. Businesses looking to preserve financial correctness and regulatory integrity must comprehend and put these E-invoice cancellation best practices into practice in the digital age, where financial transactions are changing quickly.

What is E-invoice?

The government and the GST rule introduced the concept of E-invoice to simplify communication between businesses. In this process, the taxpayers must upload the invoice details on the IRP or invoice registration process.

After registration, there will be an invoice reference number, IRN, from the portal. This IRN number is a unique number linked to E-invoices and needs to follow E-invoice compliance.

This process was introduced in 2020 under the GST law, and people with an annual turnover of Rs. 10 crores are mandated to do E-invoicing. There is a standardized form that is supposed to be filled by all.

What is E-invoice Cancellation?

Cancellation of E-invoice is often done when the seller has entered incorrect information in the invoices. The reason cancellation is done is because once the E-invoices are created, nobody is allowed to modify the same. Additionally, it is also important to remember that one can only cancel their E-invoices within 24 hours of making their invoices.

Here are the reasons why a taxpayer can cancel any E-invoice:

- If the buyer cancels the order.

- If there is any incorrect entry.

- In case of any duplicate entry.

What is the Importance of Accuracy in E-invoice Cancellation?

Maintaining the integrity of financial transactions depends on the accuracy of E-invoice cancellation. Inaccurate cancellations may result in economic disparities, erroneous documentation, and legal issues. Accurate cancellation guarantees that incorrect bills don’t interfere with tax compliance, financial reporting, or vendor relationships.

In addition, it protects against fraud and accounting errors by fostering openness and confidence in electronic invoicing systems. Thus, regulatory compliance, seamless and effective financial operations, and the general dependability of digital financial processes all depend on the accuracy of E-invoice cancellation.

Challenges and Solutions in E-invoice Cancellation Process

How to Cancel E-invoice on GST Portal?

To ensure E-invoice accuracy, taxpayers should follow the proper process of canceling their E-invoice as stated by the government. Here are two ways mentioned on the GST portal:

Single Invoice Cancellation

Follow the below steps on the GST portal to cancel your single E-invoice:

- You need to log in to the E-invoice portal.

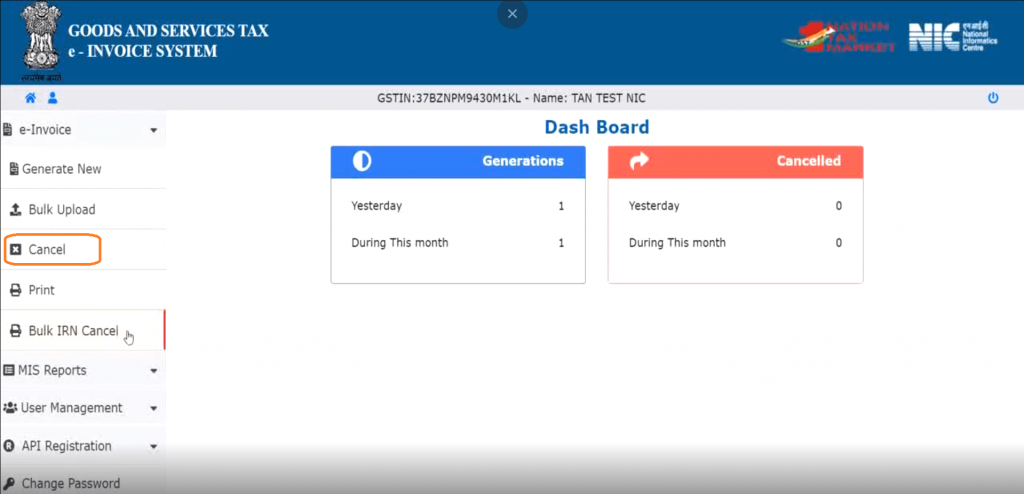

- On the sidebar, there will be a cancel option; click on the same.

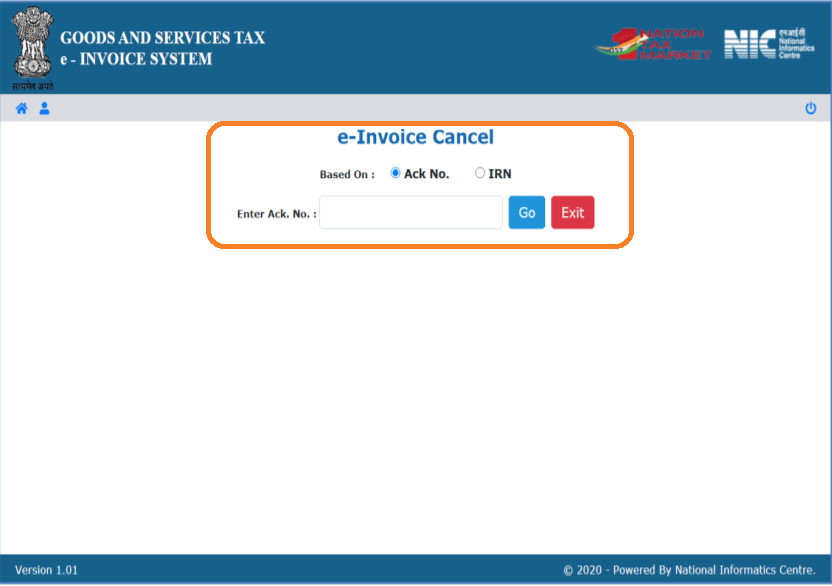

- Over there, you will need to mention either the IRN or the acknowledgment number and press go.

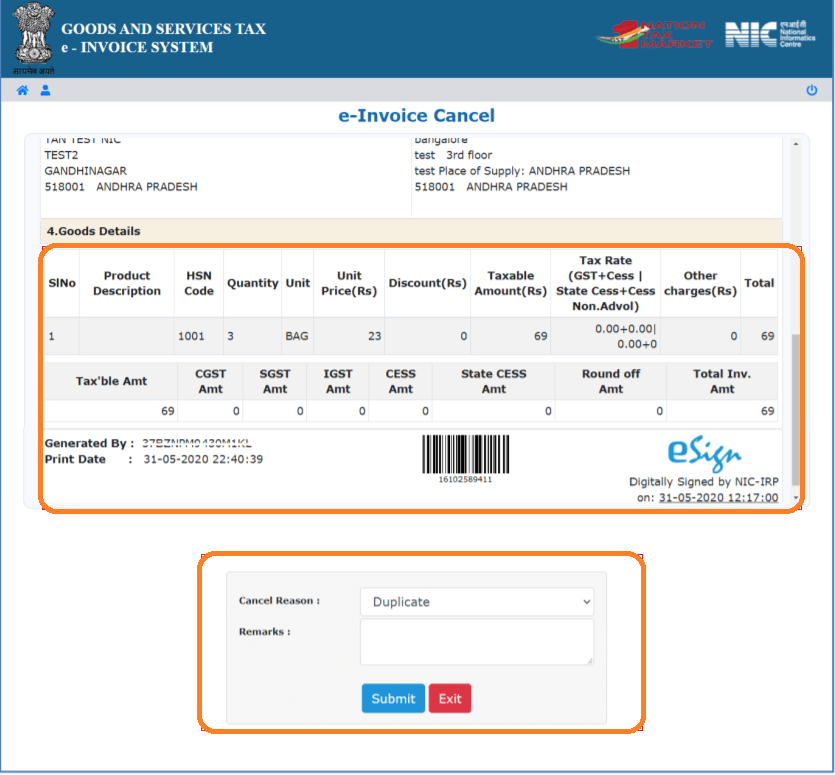

- You need to select the E-invoice you plan to cancel, mention the cancellation reason, and submit it.

Bulk Invoice Cancellation

You need to follow the below process to cancel bulk E-invoices:

- You need to log in to the E-invoice portal.

- From the help section, choose tools and click on bulk generation tools.

- You will see an option to download E-invoice cancel by IRN – JSON preparation offline utility.

- Mention IRN, cancellation reason, and remarks, and click on validate.

- Choose the Prepare JSON option after the file gets validated.

- Re-login to the E-invoice portal.

- Click the E-invoice option, select bulk IRN cancel, and upload your JSON file.

Why Can’t E-invoices Be Canceled After 24 Hours?

If you are wondering why an E-invoice cannot be canceled after 24 hours, here is the reason. The invoice registration portal, or the IRP, only stores E-invoices for up to 24 hours.

Tips for Ensuring the Accuracy and Compliance of E-invoice Cancellations

Here are some tips or E-invoice cancellation best practices that every taxpayer should remember:

- The taxpayers should reflect the time limit, which is 24 hours for cancellation.

- After 24 hours, the cancellation would not be allowed by the government portal.

- Taxpayers must amend the GSTR-1 in case the cancellation time frame is over.

- Taxpayers cannot cancel partial E-invoices. They can only cancel it as a single or bulk in case of any error.

- The same E-invoice number cannot be used again if the IRN is withdrawn. In case it is used, the E-invoice will be rejected.

- If the IRN is canceled, GSTR-1 gets automatically updated with canceled status.

- You can also issue a debit or credit note to nullify the E-invoice after the 24-hour window has lapsed.

- Businesses should also keep a close watch on the various changes in the E-invoice cancellation process.

- It is advised to prepare E-invoices using automated software to avoid errors and, thus, cancellation.

- Additionally, taxpayers should always be compliant with the GST rules and regulations.

Amendments and Updates to E-invoice Cancellation Provisions

How to Avoid Common E-invoice Cancellation Errors?

Here are some of the common E-invoice errors that often lead to cancellation and the ways by which they can be avoided:

- Duplicate Invoice Reference Number

It would be best to refrain from sending the same request multiple times on the IRP. You should only resend the E-invoice generation request if you have not received the IRN the first time.

- Invalid HSN Code

This error occurs when there is a mistake in the HSN code of the goods. Therefore, you should constantly re-check and validate the HSN code before entering the E-invoice.

- Taxable Value

Most times, the total taxable value differs from the sum of all the taxable values of the items in the invoice. To avoid this error, businesses should do a thorough reconciliation of their invoices.

- Incorrect Total Invoice Value

The discrepancies in the invoice values uploaded on the IRP lead to a mismatch in the overall invoice value. Companies need to double-check the overall taxable value by deducting the reduction from the values of each item with additional fees.

- GSTIN Missing

There will be an error in the E-invoice if the GSTIN needs to be included. To avoid this, the businesses should sync GSTIN from GST CP API and fetch the GSTIN data directly from the GST portal.

- Inactive GSTIN

If the status of the GSTIN is inactive, then the E-invoice will not be valid, and the businesses will have to cancel and upload a new one.

- Mandatory Information Missing

Every E-invoice must have specific critical and required fields, as specified by the E-invoicing model. There will be an error if those are not uploaded, and you might need to submit the same again.

- JSON Schema Invalid

An error could occur if there isn’t a comma. Therefore, investing in software would be preferable for businesses to do it manually.

- Field Type Errors

In case you have entered the data in any field incorrectly. For instance, if you have not used the correct date format, it can lead to incorrect entries.

- Not Used Specified Values

There are specific fields in the E-invoice where you must enter specified values. If there is any deviation in the same, it can lead to incorrect entry and cancellation of E-invoice.

- Incorrect PIN Code

Businesses should always use the pin codes mentioned by the NIC. Additionally, the pin code should also match with the state code. It is advisable to download these from the NIC portal and use them further.

- State Code, Tax Rate and UQC

Everyone must verify that the tax rate, UQC codes, and State code on the GSTN site are comparable to those on the Master’s list.

Software solutions and platforms designed for E-invoice cancellation

Businesses can effectively retract and correct invoices using software solutions and platforms for E-invoice cancellation. Software like CaptainBiz simplifies the cancellation procedure while guaranteeing adherence to legal specifications and minimizing mistakes. The entire invoice cancellation workflow is made simpler by their user-friendly interface for invoice administration, audit trails, and connectivity with accounting systems.

Conclusion

To sum up, E-invoice cancellation is an essential area of contemporary financial management that requires careful consideration. Maintaining best practices for cancellation is crucial, especially as businesses continue to use electronic invoicing because of its effectiveness and ease. By doing this, companies may show their dedication to legal and regulatory compliance and avoid expensive mistakes.

A clear set of best practices can help achieve the ideal balance between compliance and accuracy. Those who adopt these practices will not only prosper in the digital era but also guarantee the longevity and reliability of their financial operations in a constantly changing business environment as technology continues to change the face of financial transactions.

FAQs

-

How can a taxpayer change or modify their E-invoice?

No one can change or modify once the E-invoice is created. The GST rule does not permit changing any invoice, including E-invoice, after creation.

-

Can I cancel an E-invoice?

Yes, E-invoice can be canceled within 24 hours of creation.

-

Can someone delete their E-invoices?

No, taxpayers cannot delete their E-invoices once it is created and uploaded on the portal.

-

Can the same E-invoice number be used after it has been canceled?

The IRN is a unique number that is generated for an E-invoice. Once the E-invoice is canceled, use the same IRN and E-invoice number when creating a new one.

-

Can I revoke an E-invoice cancellation?

No, once the taxpayer has submitted a cancellation request, it cannot be revoked.

-

Can an E-invoice be canceled after 24 hours?

No, after the 24 hours is lapsed, E-invoices cannot be canceled. However, taxpayers can make amendments to the GSTR-1.

-

Can a taxpayer cancel their E-invoice partially?

No, E-invoices can only be canceled as a whole.

-

How to avoid cancellation of E-invoices?

The best way to ensure that businesses do not have to go through the process of E-invoice cancellation is by entering every information correctly. They should double-check before submitting and uploading the same in the system.

-

Can the same E-invoice be used again?

No, taxpayers cannot use the same E-invoice again. They must start over and enter the correct data in a new electronic invoice.

-

How can an E-invoice receiver know whether it has been canceled?

To find out the status of the E-invoice cancellation, taxpayers can visit the GST portal and check the status of their E-invoice. They can find the status under the My Profile – E-invoice status option.