GST make-in-India, impact on manufacturing sector, its role in economic growth. The Goods and Services Tax (GST) has transformed India’s tax structure and given “Make in India.” fresh life. The eight-month-old GST is a paradigm change to modernize taxation and boost economic growth. It’s becoming clear that the GST helps the “Make in India” effort achieve its goals.

In September 2014, Prime Minister Narendra Modi launched “Make in India” to promote India as a global manufacturing powerhouse, attracting multinational and indigenous companies to design and manufacture things there.

For the most part, the new tax structure is helping already-existing economic programs like “Make in India.” The GST, or Goods and Services Tax, has been in operation in India for over eight months to modernize the tax structure and boost economic growth. The new tax scheme mostly supports “Make in India.”

As we examine GST’s role in economic growth and the impact on “Make in India,” we see how this tax reform has helped India boost economic growth, production capacity, and global competitiveness.

What is the “Made in India” Program Exactly?

Narendra Modi announced “Make in India,” a program to encourage domestic and international enterprises to design and produce items in India, making it a worldwide manufacturing hub, on September 25, 2014. The project seeks FDI, employment creation, and manufacturing capability.

The GST raised FDI by almost 40%, notwithstanding the program’s effectiveness in attracting foreign investment to India. The beneficial and bad effects of “Make in India” and GST are now becoming clearer.

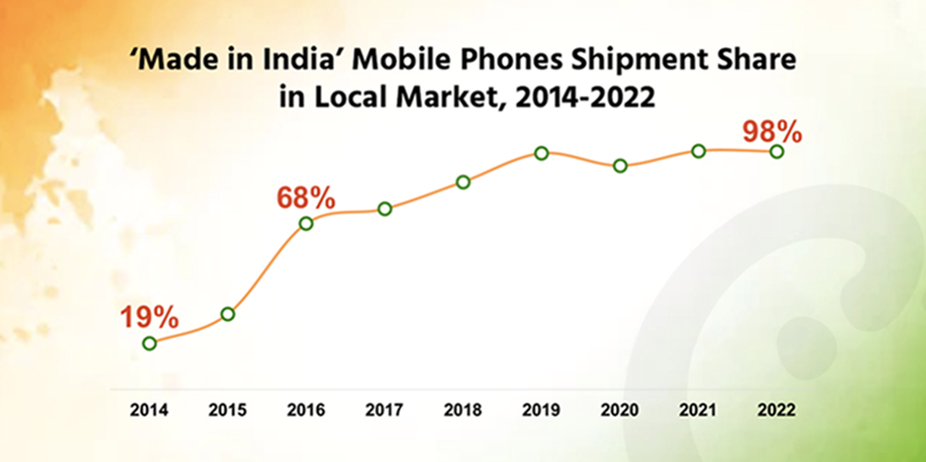

Image Source: Counterpoint Research

Positions for Balanced Payments

The transition to destination-based taxes is one of the most noticeable changes brought forth by the GST make-in-India. The “Make in India” campaign is impacted by this modification in three ways.

-

Imports

Since imported goods and services essentially enter an Indian state, they are subject to an integrated tax (IGST), which is equal to the sum of the central GST and state GST. Due to the equal taxation of domestic and imported items, Indian-made goods can now more successfully compete with imports.

-

Intrastate transactions

State-to-state commerce is further made easier by the fact that the cross-state integrated tax (IGST) is equivalent to both the federal and state GST in these situations. The tax ramifications of producing in one state and selling it in another were just as intimidating before the introduction of the Goods and Services Tax (GST).

The new tax structure increases the likelihood of Indian enterprises purchasing from each other by leveling taxes both inside and between states, irrespective of the supplier’s state of residence.

-

Exports

Destination-based taxation zero-rates exports under the GST because they are not consumed in India. This has boosted Indian exports abroad. Additionally, the method is designed to provide exporters with a spotless tax record with an instant return equal to ninety percent of their claims. In this aspect, there have been some challenges; however, more on that later.

Unrestricted Movement of Goods

As previously indicated, GST has been effective in lowering economic barriers and clearing the path for a national integrated economy, both of which have benefited the logistics industry. In the past, vehicles traveling across the nation would often stop at border checkpoints for extended periods while their paperwork was examined and processed.

This time, logistics efficiencies have decreased dramatically, which is good for the manufacturing industry and the “Make in India” campaign. Over time, more advantages are anticipated to come from infrastructural improvements.

| Distance Range (km) | Validity Period (Days) |

| Less than 100 | 1 |

| 100 – 300 | 3 |

| 300 – 500 | 5 |

Table: Bill validity based on kilometers traveled

The GST has increased demand in several areas, including tire production, by moving enterprises from wait-and-watch to execution. In the future years, rising demand will boost production.

Challenges That Remain

- While they wait for their unpaid GST make-in-India returns, many exporters are suffering from cash flow problems. Due to different problems with necessary documentation and the lack of checklists, these exporters have been among the worst hit, which has hurt the “Make in India” campaign.

- The country’s leading luxury automobile manufacturer, Mercedes-Benz, even canceled its plan to expand under the “Make in India” campaign after the industry harshly criticized the move.

- In some domains, the combination of GST with “Make in India” and “Skill India” is producing the opposite outcome. Specifically, the country’s startup scene is entering a new era thanks to economic measures and tax reform. India made the biggest rise of any nation last year, rising from position 130 to position 100 to rank among the top 100 nations for ease of doing business.

All things considered, GST is still being developed. Over time, the GST controversy is probably going to blow over and turn out to be a minor detail compared to the success of “Make in India” and other economic stimulus programs.

Effects of GST

The manufacturing industry and the Made in India program will be significantly impacted by GST. A clear, unambiguous tax structure is necessary for a manufacturing sector to thrive, and GST is one of those. The following effects of GST on the Made in India initiative are anticipated:

-

The Cost of Making

Cost is a component that has persisted in importance in both traditional and modern marketplaces. If you are a Chinese manufacturer, service provider, or exporter, a low-cost product will always enable you to enter the market successfully.

Reliance Jio, a cheap phone service, and the emergence of e-commerce sites like Flipkart and Amazon, which are giving steep discounts to gain market dominance, are two real-world examples. Since there would no longer be a cascading impact of taxes, production costs may be reduced under the new GST regime. Reducing the cost of the issue will increase earnings for the businesses, hence bolstering the Made in India initiative.

-

Rise in Investments

The relationship between cost and investment is inverse. More investment will always be drawn to a lower cost. Businesses from all over the world select their operating regions based on easy operations and low production costs. This lets them offer high-quality items at low prices and enter worldwide markets.

The proposed GST impact on the manufacturing sector regime aims to cut manufacturing costs and allow firms to transfer goods across the nation freely. Consequently, it’s feasible that businesses will begin producing in India and exporting their goods worldwide.

-

Transformation of Supply Chain Economics

The field of supply chain economics is set to undergo a paradigm shift due to its existing design, which follows the current indirect tax system. The warehouse’s current location is determined by the various state-specific VAT rates that apply to the commodity.

However, the GST regime will standardize tax rates nationwide. Businesses will rebuild their supply chains to consider economic factors like delivery time and cost. For this reason, another name for the GST is “business reform.”

Also Read: How Does GST Impact Manufacturers?

Consequences for the Manufacturing Sector

Here are some of the opposing viewpoints that will harm Made in India in the manufacturing sector:

-

Working Capital Requirement

Since stock transactions are not regarded as sales under the current laws, they are not subject to taxation. The GST regime levies taxes on supplies, including stock transfers. Businesses must pay taxes on stock transfers.

They may be entitled to receive a tax credit for their payment. Nevertheless, the working capital requirement would increase due to the early cash outflow.

-

Tax on Free Supply

Under the existing system, excise duty is the basis for the taxation of free supplies. Excise duty is unchallengeable once it is imposed under excise law. Similarly, under GST, whether or not there is consideration involved in the supply of goods or services is subject to GST.

At the moment, GST impacts on manufacturing sector, and marketing and advice encompass numerous schemes where products are given away for free. For instance, products offered as free samples, etc. These procedures will now cost between 18 and 20 percent more (final tax amount notwithstanding).

-

Enhanced Adherence

GST is frequently referred to as a one-nation, one-tax system. It isn’t finished, though. A corporation operating from 15 separate nations, for instance, would need to register under 15 different names. Even worse, independent compliance will be required for every registration.

Conclusion

The GST make-in-India campaign has faced both favorable and unfavorable consequences since the Goods and Services Tax (GST) was enacted in India. GST has simplified taxation, decreased manufacturing costs, and promoted an interconnected economy, but it has also come with challenges, including higher working capital needs, taxes on free supplies, and intricate compliance requirements.

Destination-based taxes have improved competitiveness in the international market by balancing payment positions. GST impact on the manufacturing sector has ushered in a transformative era by promoting innovation, boosting production capacity, and positioning India favorably for global investments and manufacturing growth—all while enduring teething pains, such as delays in refunding export taxes.

FAQs

-

What Is The Initiative Called “Make In India”?

On September 25, 2014, Narendra Modi launched the “Make in India” campaign to make India a manufacturing powerhouse. It encourages domestic and multinational companies to design and produce products in the country, increasing production capacity, job creation, and FDI.

-

What Beneficial Effects Has GST Had On The “Make In India” Campaign?

The “Make in India” campaign has benefited from the GST’s streamlining of taxation, reduction of production costs, and facilitation of an integrated economy. Due to its zero-rated exports, normalized taxes for both domestic and imported goods, and balanced payment positions, Indian-made goods are now more competitive.

-

What Advantages Do Lower Production Costs Under The GST Offer?

Production expenses are reduced in comparison to the previous tax system because of the homogeneity of the tax structure and the smooth operation of the input tax credit. This cut has a good effect on the manufacturing industry, boosting revenue, encouraging creative creation, and creating new markets.

-

How Has GST Impacted India’s Free Movement Of Goods And Logistics?

Economic barriers have been successfully eliminated by GST, advancing an interconnected economy and helping the logistics industry. It has improved the productivity of the manufacturing sector by drastically lowering the wait times for trucks traveling between states at border checks.

-

What Difficulties Has The “Make In India” Campaign Encountered Since The GST Went Into Effect?

Payment delays for export tax refunds have posed a serious obstacle to the “Make in India” initiative. The program has been badly impacted by exporters who are compelled to pay GST at the border as customs duties and are experiencing financial shortages while waiting for outstanding GST refunds.

-

How Has The GST Affected Indian Production Costs And Investments?

By offering a platform with cheaper manufacturing costs and freely transferable commodities across the nation, the planned GST regime seeks to draw in more investment. A lower cost of production will probably encourage more funding and help the “Make in India” initiative.

-

How Does The GST Affect The Economics Of The Supply Chain?

Supply chain economics is predicted to undergo a paradigm change as a result of GST. Companies will rework their supply chains based on parameters like cost and delivery time if tax rates are uniform throughout the nation, changing the current supply chain structure.

-

What Are The Negative Effects Of GST On The Manufacturing Sector?

Among the difficulties are the need for separate registrations for every state, which raises the complexity of compliance procedures, and the need for more operating capital due to taxed stock transfers and taxation on free deliveries.

-

In What Ways Has GST Facilitated Company Operations In India?

Together with programs like “Make in India” and “Skill India,” GST has brought in a new age for Indian startups, helping the nation rank among the top 100 for ease of doing business.

-

Does GST Address All Issues, Or Are There Still Problems?

Even though GST has resulted in improvements, there is still room for improvement. Issues like policy changes and delays in export tax refunds are being resolved, and in the long run, the GST is anticipated to improve measures meant to boost the Indian economy, such as “Make in India.”