GST brought uniformity and efficiency to the indirect tax system and was instrumental in improving the economy of India to a great extent. As part of the compliance process, taxpayers registered under GST have to file various returns as specified under the law. Taxpayers whose registration has been canceled voluntarily or by a government order also have to follow certain rules and procedures. Filing GSTR-10 is important for people whose registrations have been canceled. It is a last return that is filed by the taxpayer, and so it is also called the final return.

What is GSTR-10?

GSTR-10 is a final return that taxpayers whose registration has been canceled have to file. It is a statement containing details of the closing stock of the business and the input tax credit pertaining to this stock, both on inputs and capital goods that are required to be reversed or paid back to the government. A NIL GSTR-10 can be filed when there are inputs held in stock, inputs contained in semi-finished or finished goods, and capital goods on which input tax credit is required to be reversed or fulfilled before or the amount that is required to be paid back to the government. Filing this return is mandatory for taxpayers whose registration has been canceled or a cancellation order received to file GSTR-10 under Section 39 (1). It is also mandatory for taxpayers to first file GSTR-1 and GSTR-3B before filing the final return in GSTR-10.

Due date for filing GSTR-10

GSTR-10 is required to be filed within 3 months from the effective date of cancellation or the date of the order of cancellation, whichever is later. Hence, if the cancellation was done on January 1, 2022, and the order was received on January 13, 2022, then the due date for filing GSTR-10 would be March 13, 2022.

Penalty for late-filing or non-filing of GSTR-10

If the taxpayer does not file the GSTR-10 by the due date, a notice will be sent to the registered person. If he does not respond to it within 15 days, a final order of cancellation with a computation of liabilities along with interest and late fees is sent to the taxpayer to discharge the liabilities.

Also read:

Understanding GSTR-10: The Final Return after GST Registration Cancellation

Filing GSTR-10 online

To create and file details in GSTR-10, the following steps need to be followed by the taxpayer:

Step 1: Login with valid credentials in the GST portal www.gst.gov.in

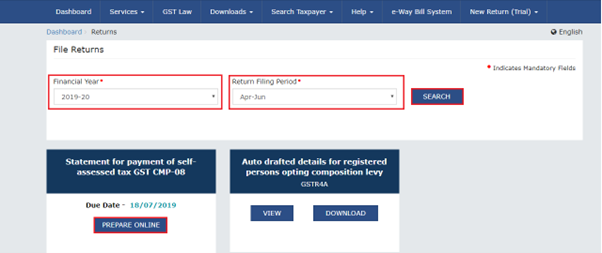

Step 2: Go to services>Returns>Final Return; the final return page is displayed

Step 3: Next, click on prepare online option

- Update address for future correspondence and CA certificate if required

- Fill invoice-wise details in tables 8A, 8B, and 8C, and without invoice in table 8D

Step 4: Click on ‘proceed to file’ and file GSTR-10

Step 5: Once the ‘proceed to file button’ is clicked, the tax, interest and late fee are computed

Step 6: Click on table 9 and 10 to pay the liabilities and file the return

Additional details can be added even after clicking on the ‘proceed to file button’. Then steps 1 to 3 have to be followed again.

Step 7: Click on the ‘download filed GSTR-10’ button to view the summary of filed details in pdf format.

Step 8: The cash and credit ledger balances as available on the date are shown in table

When you click on ‘late fee payable hyperlink, you can see the details of the late fee if applicable.

There are two scenarios. The first scenario is when the available balance in the cash or credit ledger is less than the amount needed to offset the liabilities, and then a part payment can be made from the available balance in the electronic cash or credit ledger. A challan can be created for the balance amount by clicking on the ‘create challan’ button, and payment can be made.

In the second scenario, when the available balance in the cash or credit ledger is more than or equal to the amount needed to offset the tax liabilities, no additional amount needs to be paid. The amount in the credit ledger can also be used to pay the tax liabilities. The credit utilization values are auto-populated and editable.

Step 9: Click the ‘preview draft GSTR-10 button to view the summary of GSTR-10. The summary can be downloaded and checked thoroughly before making payment

Step 10: After selecting the declaration and authorized signatory checkboxes, click on the ‘file GSTR-10’ button. After clicking ‘yes’ on the warning message, ‘the submit’ application’ file is displayed. Click the ‘file with DSC’ or ‘file with EVC’ button, and then the submit application page is displayed. Click the submit button. The success message, along with the ARN, is displayed. The status of the form GSTR-10 turns to filed. Click on ‘download GSTR-10’ button to download the return filed.

Filing GSTR-10 offline

Taxpayers who have more than 500 records per table must compulsorily make use of this facility. The GSTR-10 offline tool can be downloaded from the download section on the pre-login page of the portal and installed on the taxpayer’s computer.

Step 1: Go to the GST portal www.gst.gov.in

Step 2: Proceed to downloads>offline tools>GSTR-10 offline tool

Step 3: Click on download and download the file

Step 4: Extract the contents of the zip file and open the excel utility

Step 5: Click on enable editing button and enable content button to ensure macros are enabled

Step 6: Add table-wise details to the worksheet.

Step 7: Enter all the details as per the instructions and generate the JSON file

Step 8: Click on ‘prepare offline’ and select ‘upload’ to upload the JSON file, then file the return with the help of instructions available in the GSTR-10 dashboard

If an error file is generated, the file with error records can be downloaded from the link available with the message ‘processed with error’

The JSON file can be downloaded to view, update or add new details in offline tool

Step 9: a pop-up message is displayed to indicate that the file is saved and can be uploaded on the portal. Click ‘ok’

Steps to upload the generated JSON file of GSTR-10

Step 1: Login to the GST portal

Step2: Go to service>returns>final return

Step 3: On the GSTR-10 tile, click on prepare offline button

Step 4: In the upload option, select the ‘choose file’ button. Select your JSON file and click on open

Step 5: The file will get uploaded, and you will receive a message that your JSON file has been uploaded successfully. It may take 15 minutes to do validation.

Step 6: After validation, two things can occur. First, if there are no errors, the upload history table will show the status as ‘processed’, and the error report column will show ‘NA’. The data can be previewed by navigating to service>returns>final return and clicking on the ‘prepare online’ button on the GSTR-10 tile. Suppose there are errors; the upload history table will show the status as ‘error occurred’ and the error report column will show the entries that failed validation.

Steps to download the error JSON file

Step 1: click on ‘generate error report’ link to download the error report

Step 2: After the error report is ready, the error report column will display a link to download the error report. Click on this link. The error report will be downloaded.

The validation errors can be dealt in the following manner:

Steps to fix the errors using the offline tool in GSTR-10

After extracting the error file, the following steps are involved in fixing the errors in the file:

Step 1: Open the offline utility and go to the home tab

Step 2: Under the ‘error handling section’, click on the ‘open downloaded error JSON files’ button. Select the saved JSON file and click ok

Step 3: In every sheet, in the column ‘GST portal validation errors’, the nature of the error is mentioned. Make the required corrections and click on the ‘validate sheet’ button on every sheet.

Step 4: go to the home sheet and click on ‘generate JSON file to upload’ button

Step 5: In the ‘save as’ window, choose the location for the JSON file to be saved and click on save button.

A message is displayed asking the user to upload the file to the GST portal.

Conclusion

GSTR-10 is a crucial document as it provides the tax authorities with complete information on the taxpayer’s financial activities prior to filing the final return. The main purpose of filing GSTR-10 is to ensure that all the liabilities and input tax credits of the taxpayer are settled on the day prior to the date of cancellation. It also provides the taxpayer with a closure from the GST compliance requirements. Reading and understanding the instructions provided by the portal are very helpful, and taxpayers must utilize this facility. They need to understand the filing process and due dates of GSTR-10 thoroughly to avoid penalties and other legal consequences due to late filing or non-filing.

Frequently asked questions

-

What is the difference between an annual return and a final return?

Answer: The annual return has to be filed by all registered taxpayers every year, while the annual return is a one-time return that is filed by taxpayers whose registration has been canceled or surrendered.

-

What happens to the data already uploaded after re-uploading the file after corrections are made?

Answer: The data previously uploaded will be updated with the new data after the file with the corrections is uploaded.

-

Can the amount paid at the time of applying for cancellation in Form REG-16 be adjusted towards liabilities while filing GSTR-10?

Answer: Yes, the amount paid at the time of filing the application for cancellation of registration in Form REG-16 can be adjusted towards the liability at the time of filing the final return.