Becoming a registered regular taxpayer is crucial for businesses to operate legally and comply with tax regulations. In this guide, we’ll explore the essential steps you need to take to become a registered regular taxpayer. By following these steps, you can ensure that your business is properly registered and meets its tax obligations. Let’s dive in!

NRT GST registration process for regular taxpayers

The Goods and Services Tax (GST) registration process for regular taxpayers in India involves several steps. Here’s a general overview:

- Eligibility Check: Determine eligibility based on turnover exceeding the prescribed threshold for GST registration.

- Online Application: Complete Form GST REG-01 on the GST portal with accurate business details.

- Verification: GST authorities verify submitted application details.

- Documents Submission: Upload necessary documents including PAN, Aadhaar, business registration, and bank details.

- Additional Information: Provide further details if requested by the GST department.

- Field Verification: Some cases may require physical verification by a GST officer.

- Application Processing: Upon successful verification, receive the GST registration certificate (Form GST REG-06) electronically.

- ARN Generation: Obtain an Application Reference Number (ARN) for tracking application status.

- Issuance of GSTIN: Upon approval, receive a unique Goods and Services Tax Identification Number (GSTIN).

- Start of Business Operations: Commence operations legally under the GST regime, adhering to regulations.

Step-by-step guide to obtaining NRT regular taxpayer registration

Here’s a step-by-step guide to obtaining NRT (Non-Resident Taxpayer) regular taxpayer registration in India under the Goods and Services Tax (GST) regime:

- Determine Eligibility: Ensure eligibility criteria are met for NRT registration based on taxable supplies and turnover exceeding the threshold limit.

- Access the GST Portal: Visit the GST portal and navigate to the ‘Services’ tab.

- Click on ‘Registration’: Select ‘Registration’ and then ‘New Registration’.

- Select Taxpayer Type: Choose ‘Non-Resident Taxpayer’ from the dropdown menu.

- Fill Form GST REG-10: Provide accurate details including PAN, email, business type, and address.

- Verification of Details: Review and verify information for accuracy.

- Upload Required Documents: Submit passport copy, proof of address, business registration, and authorization letter if needed.

- Payment of Fees: Pay applicable fees online if required.

- Submit Application: Electronically submit the application through the GST portal.

- ARN Generation: Receive an Application Reference Number (ARN) for tracking.

- Verification and Approval: GST authorities verify provided information and documents.

- Issuance of GSTIN: Upon approval, receive a unique GST Identification Number (GSTIN).

- Download Registration Certificate: Obtain Form GST REG-06 as proof of registration.

- Commence Business Operations: Start operations legally with GSTIN, ensuring compliance with regulations.

Documents required for NRT regular taxpayer registration

When applying for NRT (Non-Resident Taxpayer) regular taxpayer registration under the Goods and Services Tax (GST) regime in India, you will need to provide certain documents to support your application. Here’s a list of typical documents required for NRT registration:

- Passport Copy: A copy of your valid passport showing personal details, photograph, passport number, date of issue, and date of expiry.

- Proof of Address: Documentation proving your residential address in your home country. This could include a copy of a utility bill (such as electricity, water, or gas bill), bank statement, or any other government-issued document containing your address.

- Proof of Business Incorporation/Registration: Documents proving the legal existence of your business entity in your home country. This could include a certificate of incorporation, registration certificate, business license, or any other relevant document issued by the government authority in your country.

- Authorization Letter: If the application is being submitted by an authorized representative on behalf of the non-resident taxpayer, an authorization letter authorizing the representative to act on behalf of the taxpayer should be provided.

- Bank Account Details: Details of the non-resident taxpayer’s bank account, including the bank name, branch, account number, and IFSC code.

- Digital Signature Certificate (DSC): If applicable, a digital signature certificate is required for signing the GST registration application electronically.

- Other Supporting Documents: Depending on the specific requirements of the GST authorities or the nature of your business activities, additional documents may be requested. These could include business contracts, agreements, financial statements, or any other relevant documents.

Also Read: GST Registration for Regular Taxpayer: Process and Document Checklist

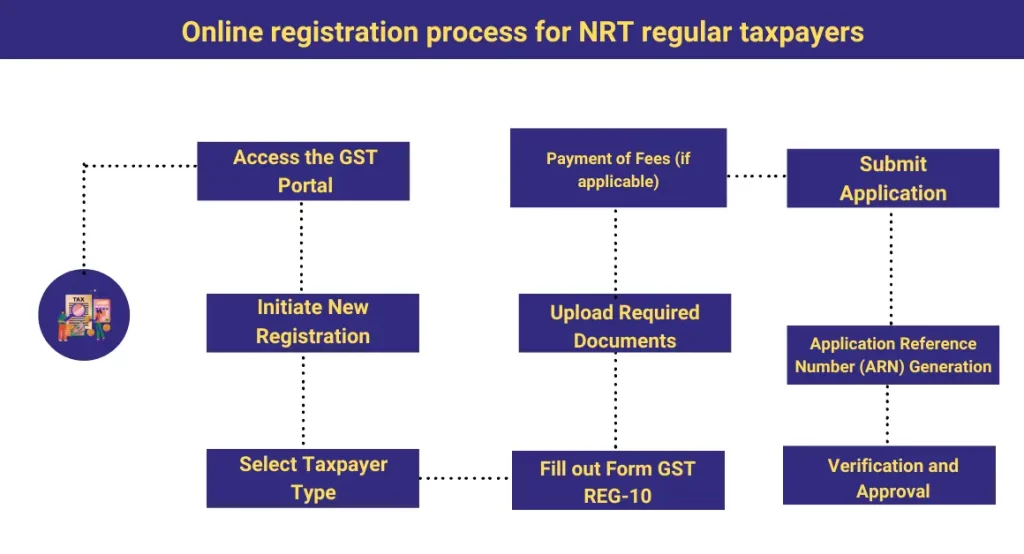

Online registration process for NRT regular taxpayers

The online registration process for NRT (Non-Resident Taxpayer) regular taxpayers under the Goods and Services Tax (GST) regime in India typically involves several steps. Here’s a general guide to the online registration process:

- Access the GST Portal: Visit https://www.gst.gov.in/ for official GST services.

- Navigate to Registration Section: Click “Services” then choose “Registration.”

- Initiate New Registration: Select “New Registration” from the registration section.

- Select Taxpayer Type: Opt for “Non-Resident Taxpayer (NRT)” from the dropdown.

- Fill out Form GST REG-10: Provide accurate business details in Form GST REG-10.

- Upload Required Documents: Submit necessary documents including passport copy and proof of address.

- Payment of Fees: If applicable, pay fees online via the GST portal.

- Submit Application: Electronically submit the completed application.

- Application Reference Number (ARN) Generation: Receive an ARN for tracking application status.

- Verification and Approval: GST authorities verify application details for approval.

- Issuance of GSTIN: Approved applicants receive a unique GSTIN.

- Download Registration Certificate: Obtain Form GST REG-06 as proof of registration.

- Commence Business Operations: Begin operations legally with the obtained GSTIN, ensuring compliance with regulations.

Also Read: How To Do GST Registration Online

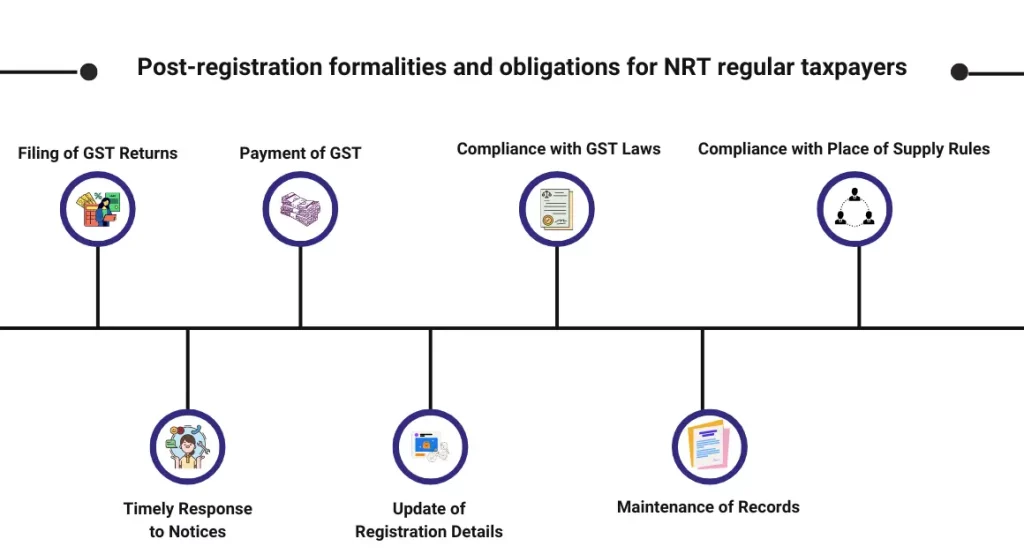

Post-registration formalities and obligations for NRT regular taxpayers

After successfully registering as a Non-Resident Taxpayer (NRT) under the Goods and Services Tax (GST) regime in India, there are several post-registration formalities and obligations that NRT regular taxpayers need to fulfill to remain compliant with GST regulations. Here are some of the key post-registration obligations:

- Filing of GST Returns: NRT regular taxpayers are required to file various GST returns depending on their business activities. The primary returns include GSTR-1 (for outward supplies), GSTR-3B (summary return of monthly transactions), and GSTR-9 (annual return). Additionally, NRTs may need to file GSTR-5A (non-resident OIDAR service provider) or other specific returns as applicable.

- Payment of GST: NRTs must ensure timely payment of GST liabilities as per the prescribed due dates. Payments can be made online through the GST portal using available payment options.

- Compliance with GST Laws: NRT regular taxpayers must comply with all provisions of the GST Act and rules, including invoicing requirements, maintaining proper records, and adhering to tax rates and classifications.

- Input Tax Credit (ITC) Reconciliation: Ensure reconciliation of input tax credit (ITC) claimed with the details available in GSTR-2A (auto-generated statement of inward supplies). Any discrepancies should be addressed and rectified in a timely manner.

- Compliance with Place of Supply Rules: NRTs must understand and comply with the place of supply rules applicable to their specific transactions. This includes determining whether a supply is an intra-state or inter-state transaction for GST purposes.

- Timely Response to Notices: If the NRT receives any communication or notices from the GST authorities, it’s essential to respond promptly and provide the required information or clarification within the stipulated time frame.

- Attendance to GST Audit: If selected for a GST audit, NRT regular taxpayers must cooperate with the audit authorities and provide all necessary documents and information as requested.

- Update of Registration Details: Any changes in the registration details such as business address, authorized signatories, bank account details, etc., should be promptly updated on the GST portal using the appropriate form.

- Maintenance of Records: Maintain proper books of accounts and records as per the requirements of the GST law. Records should be kept for at least six years from the end of the financial year to which they relate.

- Timely Response to Amendments in Law: Stay updated with changes in GST laws and regulations and ensure timely compliance with any amendments or notifications issued by the government.

Ensuring compliance and avoiding penalties for NRT regular taxpayers

Ensuring compliance and avoiding penalties as a Non-Resident Taxpayer (NRT) under the Goods and Services Tax (GST) regime in India requires diligent adherence to GST laws and regulations. Here are some key steps NRT regular taxpayers can take to maintain compliance and mitigate the risk of penalties:

- Stay Informed: Stay updated on GST laws, rules, and circulars through official sources.

- Maintain Accurate Records: Keep detailed records of transactions for GST compliance.

- File Returns Timely and Accurately: Submit GST returns promptly and accurately.

- Pay Taxes Promptly: Ensure timely payment of GST liabilities to avoid penalties.

- Reconcile Input Tax Credit (ITC): Match ITC claimed with inward supplies to avoid discrepancies.

- Comply with Place of Supply Rules: Understand and follow place of supply rules for correct tax rates.

- Respond to Notices and Communications: Address GST authority queries promptly to avoid penalties.

- Cooperate with Audits: Fully cooperate with GST audits, providing necessary documents.

- Update Registration Details: Keep registration information up-to-date on the GST portal.

- Seek Professional Advice: Consult tax professionals for guidance on complex GST provisions.

Also Read: Non-Compliance and Penalties: Risks Faced by Regular Taxpayers

Conclusion:

In conclusion, becoming a registered regular taxpayer under the Goods and Services Tax (GST) regime involves essential steps to ensure compliance and avoid penalties. From understanding the NRT GST registration process and following a step-by-step guide for registration to providing the required documents and completing the online registration process, each step is crucial. Post-registration, fulfilling formalities such as filing returns, paying taxes promptly, and maintaining accurate records are vital obligations. By staying informed, responding to notices promptly, and seeking professional advice when needed, NRT regular taxpayers can ensure compliance and mitigate the risk of penalties, thus contributing to a smooth and efficient GST system.

FAQ’s

-

What is the NRT GST registration process for regular taxpayers?

It involves completing Form GST REG-10 with business details, uploading required documents, and submitting the application online.

-

Can you provide a step-by-step guide for obtaining NRT regular taxpayer registration?

Certainly! It includes accessing the GST portal, filling out Form GST REG-10, uploading documents, paying fees (if applicable), and submitting the application.

-

What documents are required for NRT regular taxpayer registration?

Typical documents include a passport copy, proof of address, proof of business incorporation, authorization letter (if applicable), bank account details, and digital signature certificate (if applicable).

-

How does the online registration process for NRT regular taxpayers work?

It involves accessing the GST portal, selecting “New Registration,” filling out Form GST REG-10, uploading documents, making payment (if applicable), and submitting the application electronically.

-

What are the post-registration formalities and obligations for NRT regular taxpayers?

They include filing GST returns, paying taxes on time, complying with GST laws, reconciling input tax credit, responding to notices, and maintaining accurate records.

-

How can NRT regular taxpayers ensure compliance and avoid penalties?

By staying informed about GST regulations, filing returns accurately and on time, paying taxes promptly, maintaining proper records, and responding promptly to notices or communications from GST authorities.

-

What happens if NRT regular taxpayers fail to comply with GST regulations?

Non-compliance may result in penalties, fines, or legal consequences, impacting the smooth operation of the business and reputation.

-

Is it necessary to update registration details after obtaining NRT regular taxpayer registration?

Yes, it’s essential to keep registration details updated, including changes in business address, authorized signatories, bank account details, etc., to ensure accurate information on record.

-

What role does professional advice play in ensuring compliance for NRT regular taxpayers?

Seeking professional advice helps navigate complex GST provisions effectively, ensuring understanding of compliance requirements and mitigating risks.

-

Can NRT regular taxpayers request assistance or clarification from GST authorities if needed?

Absolutely! GST authorities are available to provide assistance and clarification regarding registration, compliance, and other related matters to taxpayers.