Exhibitions, trade shows, and demos are essential venues for businesses to present their goods and services. It is imperative to adhere to all legal regulations, including creating an E-waybill, while shipping items to these events.

An Electronic Waybill, or E-waybill, is an electronic document for the transportation of goods that contains information on the shipment, its origin, destination, and the vehicle carrying it.

The purpose of the E-Way bill system is to enable GST-registered individuals or enrolled transporters to digitally generate waybills when the movement of goods over Rs. 50,000, either for supply-related reasons or because the items are being supplied inward by an unregistered individual.

This article is a comprehensive guide that explains how to send items to exhibitions and other similar events using an E-waybill. Let’s begin!

Exhibition Goods E-waybill Procedure

The process of creating an electronic waybill for the transportation of goods to a demonstration is known as the exhibition goods E-waybill procedure. The following is a brief synopsis:

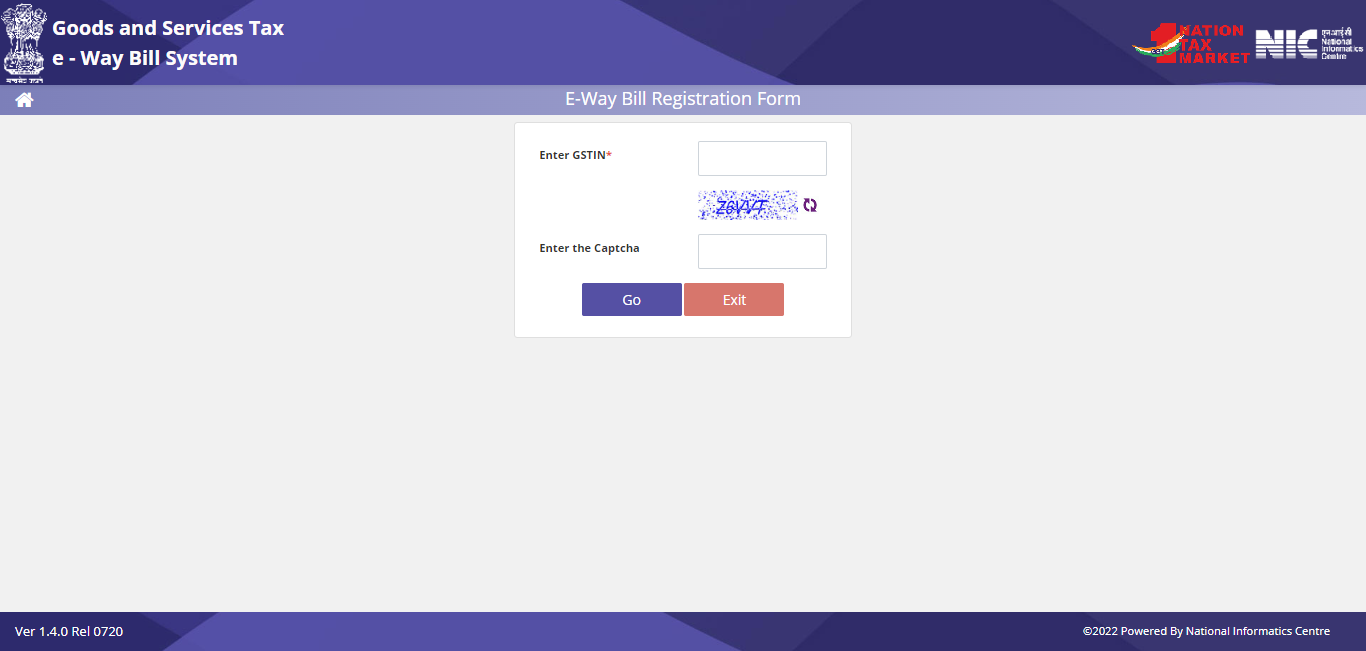

- Register via the E-waybill Portal: Go to the official E-waybill portal that the tax authorities have set up.

- Give the Required Information:

A)Enter the necessary information, including the supplier, receiver, and transporter’s GSTIN (Goods and Services Tax Identification Number).

B)Input the type of document (bill of supplies, delivery challan, invoice, etc.) together with the relevant information (document number, date).

- Details of the goods: Give specifics about the items being carried, such as the unit, amount, and HSN (Harmonised System of Nomenclature) number.

- Select Mode of Transportation: Specify whether you will travel by car, plane, train, or ship.

- Submit the Exhibition Information: Indicate that the products are for an exhibition and include pertinent information such as the event’s location, time, and duration.

- Validity Period: Choose a validity period that accounts for both the time the goods will be at the show and the transit to the site, taking into consideration the length of the show.

The below table shows the common E-waybill validity period:

| Type of Vehicle | Distance | Validity |

| Normal Cargo | Up To 1oo Km | 1 Day |

| For every additional 100 Km | 1 Additional Day | |

| Over Dimensional Cargo | Up To 12o Km | 1 Day |

| For every additional 20 Km | 1 Additional Day |

- Generate E-waybill: Create the E-waybill once you’ve entered all the required data. After that, the system will produce a special E-waybill number.

- Print and Transport: Print a copy of the created E-waybill. Make sure that the transporter carries it while in transit.

Special Considerations for E-waybills in Exhibitions

On July 18, 2019, the Central Board of Indirect Taxes and Customs (CBIC) released a circular outlining the steps to ensure that items transported or taken away from India for the promotion of exports or demonstration function properly.

The Central Board of Indirect Taxes and Customs (CBEC) made it clear in the circular that a transaction or activity is considered a “supply” after meeting the following two requirements:

- Such an action or transaction has to be completed for consideration.

- Such a transaction or function must be completed to expand the business.

The products will not be considered a “supply” under the GST scheme if they have been sent for display at an exhibition (which may require interstate transit), since that would be a supply made in exchange for consideration. About these kinds of movements:

- The consignor must provide a delivery challan rather than an invoice while the goods are removed for transportation.

- Because there isn’t an invoice or payment and the movement is just covered by a delivery challan, there is no legal obligation.

Concerning the application of “zero-rated supply,” it was made clear that “supplies” would only be considered zero-rated if they are either exports or supplies directed towards a Special Economic Zone unit or developer. Since products supplied or removed from India do not meet the criteria for “supply,” they do not meet the criteria for “zero-rated supply.”

Additionally, the products may be relocated under the same delivery challan, even though the GST structure does not indicate any process for this. It is important to specify on the delivery challan that the goods included under it have the purpose of return after the show.

E-waybill Documentation for Trade Shows

When the goods are sent or taken out of India for trade shows or on a consignment basis regarding export promotion, an e-way bill is necessary.

It shall contain the following details:

| Date and number of Delivery challan |

| The consignor’s name, address, and GSTIN, if registered |

| The consignee’s name, address, and GSTIN, if registered |

| The goods’ description and HSN code |

| The taxable value |

| The tax rate and amount |

| Supply location for interstate transit |

Exhibition Goods Compliance Obligations

Businesses must adhere to several legal and regulatory requirements while shipping items for exhibits to maintain efficient and legal operations. The following are some typical requirements for show goods compliance:

- Compliance with E-Waybills: Create and convey an electronic waybill (E-waybill) with all the necessary information, including the goods description, the GSTIN, the transportation details, and the exhibition details.

- GST Compliance: Adhering to the Goods and Services Tax (GST) laws is crucial. This includes ensuring the GST on the displayed items have proper invoice and report.

- Customs Compliance: Observe all import/export processes, documentation requirements, and customs duties if the exhibition entails international transit.

- Compliance with Temporary Import/Export Legislation: If the exhibition calls for the temporary import or export of products, guarantee that the items are re-exported within the allotted time frame and adhere to the legislation about temporary importation.

- Environmental Compliance: Observe environmental laws on the movement and presentation of goods. This might entail limitations on particular items or substances.

- Compliance with Health and Safety Standards: Ensuring that the display items do not represent a risk to public health is a crucial aspect of compliance with health and safety standards. Adherence to product safety norms and guidelines may be necessary in this regard.

- Intellectual property compliance: Ensure that the exhibited goods do not violate any copyrights, trademarks, or other intellectual property rights. Get the approvals required to showcase branded goods.

Legal Requirements for E-waybill in Demonstrations

As per the prevailing GST regulations, an individual or a company that transports goods for demonstrations must meet the following legal criteria:

- A generated e-waybill is only necessary when the consignment value surpasses Rs. 50,000/-.

- E-waybill is also necessary if the provider is not GST-registered but the recipient is GST-registered. In certain situations, the GST-registered individual is obligated to guarantee compliance.

- If the supplier may not require the eWay bill, the transporter is required to generate the same irrespective of whether the goods transit through road, air, or water.

- A distinct E-way bill number (EBN) is sent to the supplier, receiver, and transporter when the E-way bill arrives on the shared site.

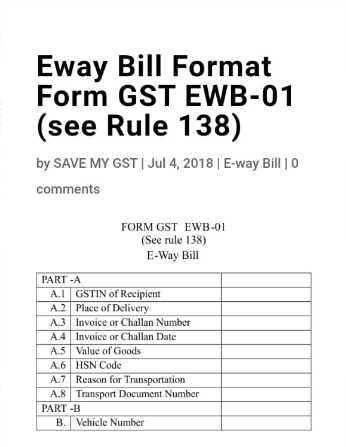

- Update the conveyance data in the E-way bill on the common portal using FORM GST EWB-01 if items shift between vehicles while in travel.

- When carrying more than one consignment at a time, the carrier can use the shared gateway to identify the unique E-way bill serial numbers and create a single E-way bill (FORM GST EWB-02) before transferring the packages.

- The registered supplier can get information in Part A of FORM GST EWB-01 via the common portal, which facilitates the filling details in FORM GSTR-1. The following screenshot shows the format of Form GST EWB-o1:

- The registered supplier can access information in Part A of FORM GST EWB-01 on the shared site, which will assist in filing details in FORM GSTR-1.

- Within 24 hours of generating, an e-way bill can be electronically canceled, except being confirmed while in transit.

- All states and union territories accept e-way bills produced under this rule.

- Users of the common site can see information about their E-way bills. The agreement is deemed accepted if they don’t reply within 72 hours.

- For some commodities, non-motorized conveyances, port-to-port operations, and inside notified zones, there is no requirement for an E-way bill.

Trade Show and E-waybill Best Practices

A few recommended practices can assist in guaranteeing seamless regulatory compliance and effective logistics while attending trade shows and working with E-waybill creation. The following are standard procedures for managing E-waybills at trade shows:

- Recognize the E-waybill Requirements: Know exactly what are the requirements for submitting in the jurisdiction for E-waybills where the trade show is being held. Learn the regulations governing the creation, validity, and cancellation of E-waybills.

- Make a plan in advance: Give careful thought to the logistics in advance, and consider the delivery of goods to and from the trade show location. This entails figuring out how much shipments are worth and if E-waybills are necessary.

- Work along with the transporters: Work in concert with transporters to ensure they have the information they need to generate E-waybills. Make sure they understand the needs unique to the show.

- Respect GST requirements: If relevant, make sure that the Goods and Services Tax (GST) requirements are followed. In the E-waybill, accurately include information on GST.

- Employee Education: Educate employees working in transportation and logistics on E-waybill processes. This promotes accurate and uniform compliance throughout the company.

- Keep Up With Any Changes: Keep an eye out for any revisions or modifications to the E-waybill regulations.

E-waybill Challenges for Exhibition Goods

The process of creating an E-waybill for work has several challenges. Here are a few of them:

- Creating and preparing E-waybills well in advance of the show is a problem for exhibitors, necessitating collaboration with carriers and guaranteeing adherence to deadlines set by regulations.

- Transporting products across states for exhibits might complicate the filing of E-waybills as it requires collaboration with various tax authorities and adherence to interstate restrictions.

- Coordinating with foreign carriers and adhering to customs procedures are necessary when handling E-waybills for the temporary import/export of items for international exhibits.

- Exhibitors may experience last-minute modifications to the transportation schedule or specifics, which might make it difficult to comply with regulations and need rapid revisions to the E-waybill data.

Demonstration Goods Exemption in E-waybill

A few examples of demonstration goods exemptions in E-waybills are as follows:

- When traveling by road inside the State or Union Territory for a distance of less than 10 km.

- Listed in the rules’ appendix (e.g. Precious or semi-precious stones, natural or yielded pearls, valuable metals, and metals covered with precious metal Jewellery, goods made by gold and silversmiths, and other items).

- Using a mode of transportation without motorization.

- From the port, airport, air cargo complex, and land customs station to an inland container depot or container goods station for customs clearing

- Inside the boundaries that the relevant State has designated.

E-waybill for Promotional Events

Adhering to transportation laws is necessary while creating E-waybills for promotional events. Here’s a short outline:

- Businesses must create E-waybills that include information on the type of products being transported, how much they are carrying, and the route taken for promotional activities. Planning is essential for timely generation and the avoidance of delays.

- It is imperative to provide certain event details, including the location and date, in the E-waybill.

- Important considerations include coordinating with carriers, following interstate laws, and adhering to customs laws for international events.

- Any last-minute modifications may need quick revisions, highlighting the value of flexibility in E-waybill administration.

Exhibition Goods Audit and Verification in E-waybill

The primary components of exhibition goods auditing and verification, with a focus on E-waybills, are as follows:

- For all intra- and interstate movements of goods, the Proper Officer may intercept any conveyance to confirm the E-Way bill (in physical or electronic form). He is also allowed to inspect the products in person.

- The Commissioner is responsible for installing RFID readers at locations where verification is to take place. With the aid of these consumers, the movement of cars that require the installation of RFID will be verified. This makes it possible to confirm the e-Way Bills that are linked to the RFID on the vehicles.

- The appropriate officer must electronically record a summary report of each inspection of goods in transit in Part A of Form GST EWB-03 within 24 hours of the inspection.

- Within three days following the inspection, the Final Report in Part B of Form GST EWB-03 must be entered.

- If specific evidence about tax evasion becomes available later, this kind of physical verification is going to take place once during the travel.

Conclusion

In Summary, it is important to keep things straightforward when creating E-waybills for goods that are sent for trade fairs, exhibits, or demonstrations. Businesses may handle these situations with ease if they have the required paperwork in place, such as E-waybills.

The E-waybill is a reliable partner that makes it easier to transfer cargo while adhering to rules. Therefore, whether you’re participating in a trade show or exhibiting goods at an event, a well-prepared E-waybill guarantees a hassle-free shipping experience for your cargo. Stay compliant, maintain simplicity, and let your goods take center stage on the exhibition floor!

Frequently Asked Questions

Q1: Can I generate an E-way bill for goods sent for exhibition without an invoice?

No, an E-way bill for goods sent for exhibition typically requires an associated invoice.

Q2: Can I modify the details on an already generated E-way bill for goods sent for exhibition?

No, once an E-way bill is generated, you cannot make modifications. It is advisable to cancel the existing E-way bill and generate a new one with the corrected details.

Q3: Can I use a single E-way bill for multiple consignments of goods sent for the same exhibition?

No, each consignment of goods sent for exhibition requires a separate E-way bill.

Q4: Can I generate an E-way bill for goods sent for an international exhibition?

Yes, E-way bills are applicable for goods sent for international exhibitions as well. However, additional customs documentation may also be required.

Q5: Can I use a single E-way bill for different types of goods sent for the same exhibition?

No, each type of goods requires a separate E-way bill, even if they are intended for the same exhibition.