e-way bill is a document that needs be generated by the supplier, transporter, or recipient of the goods if the value is more than Rs 50,000. For the generation of the e-waybill, the issuer has to be registered on the e-waybill portal.

If you’re a business owner looking to transport goods, you must issue an e-Way Bill. It’s an electronic document required for the movement of goods, and registering for it is crucial. In this blog, you will learn how to register on e-Way Bill portal in seven simple steps.

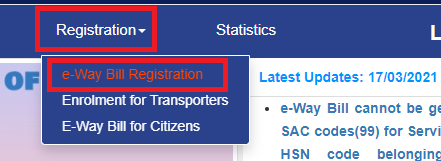

- Step 1: Visit the E-Way Bill Portal – To begin, open your web browser and go to the official E-Way Bill portal – https://ewaybillgst.gov.in/. Once you reach the homepage, look for the “Registration” Menu, and click on it. This will lead you to a new page with different registration options.

- Step 2: Choose E-Way Bill Registration – You’ll find a list of options on the Registration page. Select “E-Way Bill Registration” to proceed with the process.

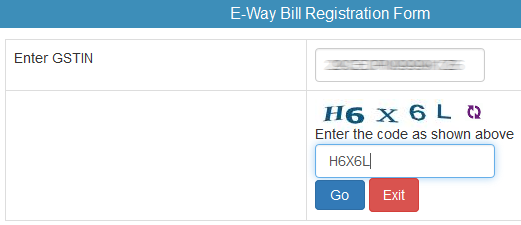

- Step 3: Enter Your GSTIN – Next, on the right-hand side of the screen, you’ll see a section labeled “Enter GSTIN.” Goods and Services Tax Identification Number, 15 digit unique number based on Permanent Account Number (PAN) issued to every registered taxpayer in GST. You must provide your business’s GSTIN in the given space.

Also Read: Eligibility Criteria for e-Way Bill Generation

- Step 4: Complete the Captcha and Go – After entering your GSTIN, you must fill in the Captcha code to verify that you’re not a robot. Carefully type the characters shown in the image. Double-check for accuracy, as this step is crucial to proceed. Once you’ve done that, click on the “GO” button.

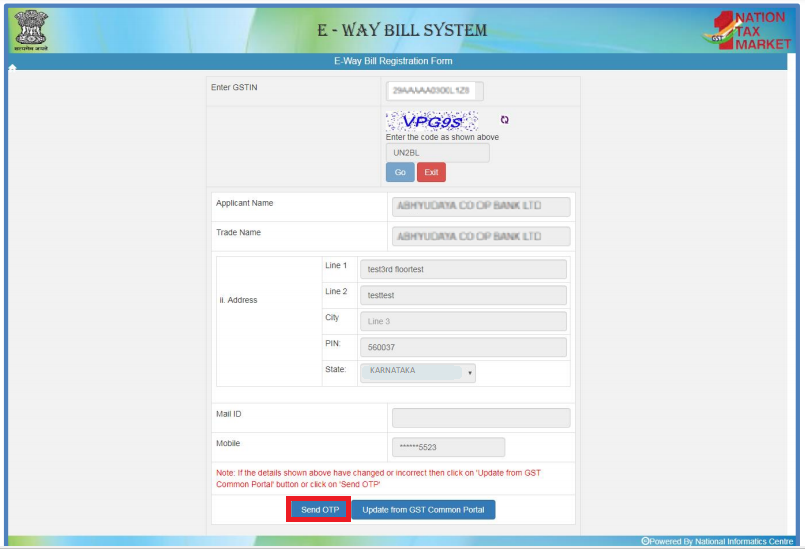

- Step 5: Verify and Generate OTP – After providing your GSTIN, a new screen will appear, displaying your auto-filled details like applicant name, trade name, address, and email ID. It is crucial to review these details for accuracy. If everything looks correct, proceed to generate an OTP (One-Time Password). Click on the “Send OTP” option, and a unique code will be sent to the registered mobile number throgh SMS. Enter the OTP to verify your identity.

- Step 6: Create a New User ID and Password – With the verification process complete. The next step is creation of User ID and password. Choose a User ID of your choice, and the password should be unique and it should contain alphabets, numbers, special characters and one capital letter. Confirm that all the required details are correctly entered before finalizing the creation of your new User ID and password. These credentials will be essential for future logins to the e-Way Bill portal.

- Step 7: Complete the Registration – Review the information entered Once you have created your new User ID and password. If everything is in order, click the “Submit” or “Register” button to complete the E-Way Bill registration process. Congratulations! You are now a registered user on the E-Way Bill portal.

Related Read: How to Register for e-Way Bill

Once you register, the system will take you to this page and from there, you can generate the e-waybill

Following the above steps will complete the e-Way Bill registration process. Now, armed with your User ID and password, you can effortlessly generate E-Way Bills for your business’s goods transportation needs. Memorize the login id and password for accessing the same to generate e-waybill whenever required.