Delivery Challan under GST

In the active platform of Goods and Services Tax (GST), understanding the complexities of essential documents like the Delivery Challan is crucial for businesses. A Delivery Challan serves as a vital instrument in the seamless flow of goods, ensuring compliance with GST regulations.

This article delves into the meaning, rules, and format of the Delivery Challan under GST, separating out the essentials for businesses and entrepreneurs.

A Delivery Challan is not only a paperwork formality; it plays a pivotal role in the supply chain. It serves as a comprehensive record of goods being transported from one place to another, acting as evidence of the transaction.

As we navigate through the regulations and nuances surrounding Delivery Challans in the GST framework, we will uncover the significance, guidelines, and the systemized format that businesses must adhere to. Join us on this informative journey as we demystify the complexities of Delivery Challans under GST.

Understanding the Legal Framework

The legal framework of the Goods and Services Tax (GST) becomes crucial for businesses to ensure compliance and smooth operations.

Key Factors and Rules:

- Purpose of Movement: The Delivery Challan is primarily used for the movement of goods and not for the actual sale. It is crucial to understand the purpose behind the movement, such as for job work, exhibition, or supply on approval.

- Details on the Document:

- The document should contain particulars like the name, address, and GSTIN of the consignor and consignee.

- A detailed description of the goods being transported, including their quantity and value.

- Date and place of issue, along with the signature of the person in charge.

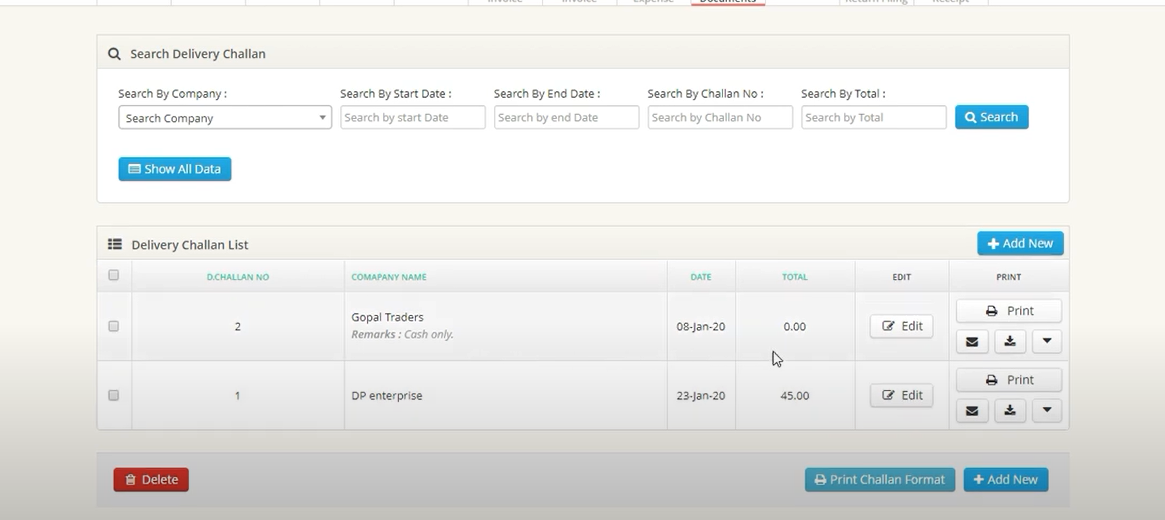

- Unique Serial Number: Every Delivery Challan must have a unique serial number, and it should be issued in consecutive series. This ensures proper documentation and traceability.

- Multiple Copies: The document usually comes in multiple copies – one for the supplier, one for the transporter, and one for the recipient. This helps in maintaining records at various stages of the movement.

- Validity Period: A Delivery Challan is typically valid for a specified period, beyond which it becomes invalid. This ensures that the goods reach the intended destination within a reasonable timeframe.

Challan Components under GST

Let’s break down the essential components that make up a Delivery Challan, shedding light on each element for clarity and compliance:

| Serial Number | Every Delivery Challan must be assigned a unique serial number. This sequential numbering is crucial for systematic record-keeping and ensures that each document can be easily identified and tracked. |

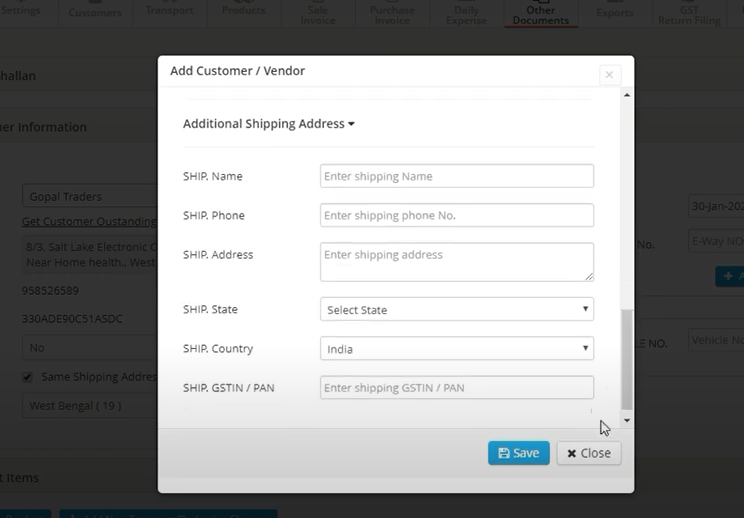

| Details of Consignor and Consignee | The document should contain comprehensive information about both the consignor (sender) and consignee (receiver). This includes their names, addresses, and Goods and Services Tax Identification Numbers (GSTINs). |

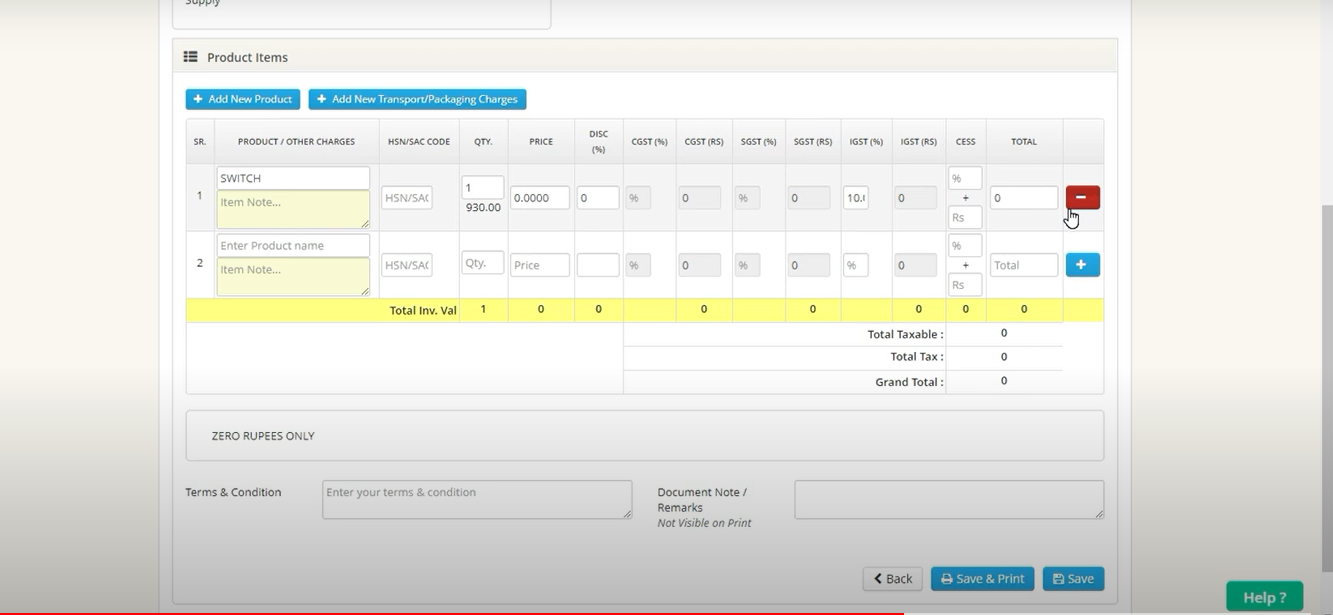

| Description of Goods | A detailed and accurate description of the goods being transported is essential. This includes information such as the quantity, value, and any specific characteristics that help in identifying the goods. |

| Quantity and Value of Goods | The quantity and value of the goods being transported should be specified. This information is vital for both the consignor and consignee to keep accurate records and for taxation purposes. |

| Authorized Signatory | The Delivery Challan must bear the signature of the person in charge. This could be an authorized representative of the consignor or any other responsible individual involved in the transportation process. |

A well-prepared Delivery Challan is not just a formality; it’s a key tool for maintaining transparency and efficiency in the complex world of goods transportation.

Types of Delivery Challan

There are many different types of Delivery Challans under GST, shedding light on their unique purposes and applications.

- Job Work Delivery Challan: Used when goods are sent to a job worker for processing, testing, or any other treatment. The job work Delivery Challan ensures a seamless movement of goods without constituting a supply.

- Recipient Not Known Delivery Challan: In cases where the consignor is sending goods to a recipient, but the specific recipient details are unknown at the time of dispatch, a Delivery Challan with the label “Recipient Not Known” is used.

- Supply on Approval Basis Delivery Challan: When goods are sent on approval, meaning the recipient has the option to accept or reject the goods after inspection, a Supply on Approval Basis Delivery Challan is issued.

- Sales Return Delivery Challan: If goods are being returned by the buyer to the seller, a Sales Return Delivery Challan is used. This document facilitates the return process without triggering a new supply.

- Recipient’s reject Delivery Challan: In cases where the recipient rejects the goods, a specific type of Delivery Challan is used to document the return of goods due to rejection.

Goods movement under GST involves choosing the right type of Delivery Challan for specific scenarios, remember, we demonstrated only the important Delivery Challan but there might be a few more.

Importance in the Supply Chain Management

Below given are some of the reasons why Delivery Challans are indispensable in ensuring a streamlined and efficient supply chain:

- Proof of Legitimate Movement: A Delivery Challan is concrete evidence of the legitimate movement of goods. This is crucial for regulatory compliance and ensures that goods are not transported illegally.

- Facilitating Job Work and Specialized Processes: In scenarios like job work or specialized processing, the Delivery Challan is a facilitator. It enables the smooth movement of goods for these purposes without triggering a taxable event.

- Efficient Handling of Returns: In cases of sales returns or rejected goods, a properly labeled Delivery Challan streamlines the return process. This ensures that goods move back into the supply chain efficiently without unnecessary complexities.

- Strategic Inventory Management: Delivery Challans contribute to strategic inventory management. By accurately documenting the movement of goods, businesses can make informed decisions about stock levels and distribution.

As businesses navigate the complexities of GST, recognizing the importance of Delivery Challans becomes synonymous with ensuring a robust and agile supply chain.

Also Read: Optimizing Operations And Delivering Excellence: The Importance Of Issuing Delivery Challans

GST Compliance and Regulatory Guidelines

Below given are some of the compliance and regulatory guidelines that should be kept in mind before filling the delivery challan under GST:

- Correct Issuance of Unique Serial Numbers: Ensure that each Delivery Challan is assigned a unique serial number, issued in consecutive order. This not only facilitates easy tracking but is also a regulatory requirement to prevent any duplication or mismanagement of records.

- Mandatory Inclusion of Essential Details: It is imperative to include all essential details in the Delivery Challan, such as the names, addresses, and GSTINs of both the consignor and consignee. Failure to provide comprehensive information may lead to compliance issues.

- Accurate Description of Goods: The description of goods must be accurate and detailed. Any discrepancies between the goods mentioned in the Delivery Challan and the actual goods being transported can lead to compliance challenges and potential legal repercussions.

- Adherence to Validity Period: Delivery Challans have a specified validity period. Businesses must ensure that goods reach their destination within this timeframe. Any deviation may result in non-compliance, requiring additional documentation or explanations.

By conscientiously adhering to these specific guidelines, businesses go beyond mere compliance; they lay the foundation for a resilient and legally secure logistics and basic supply chain management system.

Record-Keeping and Documentation

Our focus centers on the significance of organized storage, leveraging digital solutions, and adopting best practices to build a resilient and legally sound record-keeping system, particularly concerning Delivery Challans under GST.

- Organized Storage of Delivery Challans: Establishing a systematic method for storing Delivery Challans is fundamental. This involves not only sorting and categorizing but also ensuring that retrieval is efficient. Whether opting for physical or digital storage, organization is key to minimizing complexities during audits.

- Digital Record-Keeping Solutions: Embracing digital solutions transforms the record-keeping landscape. Electronic databases or cloud-based systems not only streamline storage but also introduce search functionalities, providing businesses with a powerful tool for managing and accessing records.

- Archiving Old Records: Instituting a regular archiving system for older Delivery Challans ensures that current records remain uncluttered. This practice not only manages the volume of records but also guarantees the availability of historical data when required.

- Cross-Referencing Documents: Enhancing accuracy involves cross-referencing Delivery Challans with associated documents like invoices and purchase orders. This not only aids in comprehensive record-keeping but also offers a holistic view of each transaction.

They form the bedrock of a resilient business model. Focusing on organized storage, digital innovation, and best practices empowers businesses to build a secure and adaptable record-keeping system.

Use Cases and Practical Scenarios

Heading up to some of the practical scenarios and Use cases of Delivery Challan under GST:

1. Goods Transportation

- Business to Customer (B2C): When a customer makes an online or in-store purchase, the delivery challan is employed to verify the delivery of the acquired items to the customer’s specified address.

- Business to Business (B2B): Within wholesale or manufacturing sectors, the transfer of goods between businesses employs a delivery challan to document the goods delivered, streamlining the invoicing and payment process.

2. Transfer of Goods

- Inter-Branch Transfer: Within companies with multiple branches, the movement of inventory or materials between these branches necessitates documentation through a delivery challan.

- Warehouse Management: The relocation of goods between a warehouse and a retail store, or vice versa, requires a delivery challan to uphold accurate record-keeping.

3. Return or Replacement of Goods

- Product Returns: In instances where customers return goods due to defects, damages, or other reasons, a delivery challan may be utilized to log the return of these items to the seller or manufacturer.

- Replacement of Goods: When defective goods are exchanged for new ones, a delivery challan aids in monitoring the flow of goods and ensures meticulous documentation.

4. Manufacturing and Production

- Raw Material Supply: The provision of raw materials to manufacturing units is substantiated by a delivery challan, acting as evidence for the quantity and type of materials delivered.

- Finished Goods Distribution: The transportation of finished products from the manufacturing unit to distribution centers or retailers mandates a delivery challan for efficient tracking.

Recent Developments and Updates

In the ever-evolving landscape of Goods and Services Tax (GST), businesses need to remain vigilant and adaptive to recent developments and updates.

| Subscription to Official Updates |

|

| Consultation with Tax Professionals |

|

| Engagement with Professional Networks |

|

Also Read: Latest GST Updates

Challenges and Solutions

While implementing Delivery Challans under GST comes with its share of challenges, businesses can proactively address these issues with strategic solutions:

-

Timely Data Entry and Documentation:

| Issue: Delays in data entry and documentation can impact the accuracy and timeliness of record-keeping. |

| Solution: Implement efficient data entry systems and set clear timelines for documentation. Introduce automated reminders to ensure that stakeholders promptly enter data and generate necessary Delivery Challans. |

-

Handling Multiple Business Locations:

| Issue: Businesses with multiple locations may face challenges in maintaining consistency in documentation across various branches. |

| Solution: Implement an authenticated system that connects all business locations. This ensures uniformity in generating Delivery Challans and facilitates centralized oversight for compliance. |

-

Cross-Border Movements and High Sea Sales:

| Issue: Managing Delivery Challans for cross-border movements and high sea sales involves additional complexities due to international regulations. |

| Solution: Engage with experts knowledgeable in international trade regulations. Implement a robust system that considers the unique requirements of cross-border transactions, ensuring compliance with both domestic and international standards. |

By tackling technology integration, international complexities, training needs, and other relevant issues, businesses can fortify their processes.

Advantages of Using Delivery Challans in GST

Understanding the advantages of utilizing Delivery Challans becomes integral. Beyond being a regulatory requirement, these documents offer substantial benefits to businesses engaged in the movement of goods.

- Swift Settlement of Transactions: Delivery Challans contribute to the swift settlement of transactions. By clearly outlining the details of goods being transported, businesses can expedite the reconciliation process, facilitating faster and more efficient settlement between parties.

- Building Trust in Transactions: The use of Delivery Challans builds trust in transactions. By providing a transparent and documented record of the movement of goods, businesses establish a foundation of trust with their partners, customers, and regulatory authorities.

- Minimizing Discrepancies in Stock Levels: Delivery Challans aid in minimizing discrepancies in stock levels. By accurately documenting the quantity of goods being transported, businesses can maintain precise inventory records, reducing the likelihood of stock-related issues.

- Ensuring Tax Compliance for Job Work: For businesses involved in job work, using Delivery Challans ensures tax compliance. The document helps in distinguishing between goods sent for job work and those intended for regular taxable supplies, contributing to accurate taxation.

Conclusion

In summary, we came to understand a critical intersection where regulatory adherence and meticulous documentation converge for operational excellence. The insights garnered about the purpose, components, and types of Delivery Challans underscore their pivotal role in the GST framework, extending beyond mere paperwork.

The exploration of record-keeping and documentation further reinforces the strategic significance of maintaining organized and accessible records.

Also Read: The Ultimate Guide To Delivery Challan Details: Everything That You Need To Know

FAQs

Q1: What is the purpose of a Delivery Challan under GST?

A Delivery Challan facilitates the movement of goods for various reasons, such as job work, sales on approval, or any non-sale transactions.

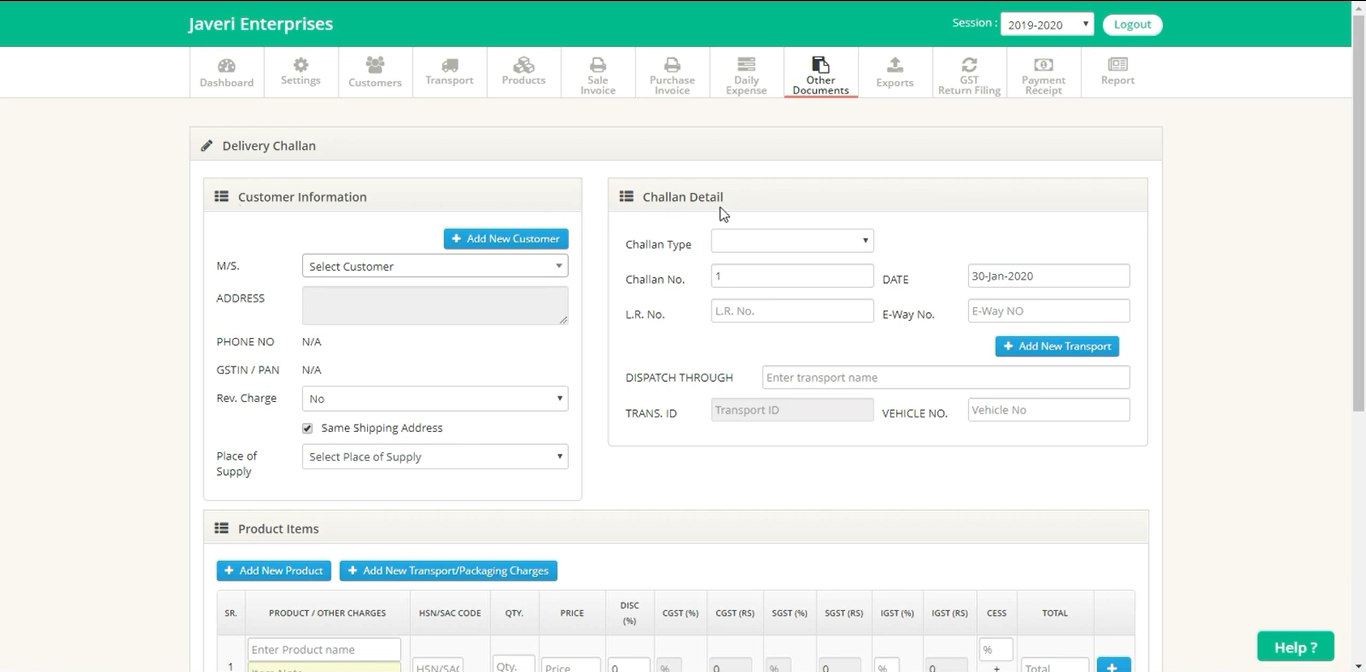

Q2: Is there a specific format for a Delivery Challan under GST?

While there isn’t a prescribed challan format, it must include essential details like unique serial numbers, names, addresses, and GSTINs of the consignor and consignee, description of goods, and the purpose of movement.

Q3: What are the key components of a Delivery Challan?

Key components include a unique serial number, date, and place of issue, details of consignor and consignee, a description of goods, quantity and value of goods, and the signature of the person in charge.

Q4: Are there different types of Delivery Challans for various scenarios?

Yes, there are various types, such as job work Delivery Challan, sales return Delivery Challan, and others, each designed for specific scenarios like job work, sales on approval, or returns.

Q5: How long is a Delivery Challan valid?

A Delivery Challan is typically valid for a specified period, ensuring that goods reach their destination within a reasonable timeframe.

Q6: Can a business design its own format for a Delivery Challan?

Yes, businesses have the flexibility to design their own challan format, ensuring it complies with the necessary rules and includes required information.

Q7: What happens if the recipient rejects the goods mentioned in the Delivery Challan?

In case of rejection, a specific type of Delivery Challan is used to document the return of goods due to rejection.

Q8: How does a Delivery Challan contribute to transparent supply chain management?

The details provided in a Delivery Challan offer transparency at every stage of goods movement, aiding in better tracking and accountability within the supply chain.

Q9: Is it necessary to assign a unique serial number to each Delivery Challan?

Yes, assigning a unique serial number is crucial for systematic record-keeping and to ensure each document can be easily identified and tracked.

Q10: What role does record-keeping play in the context of Delivery Challans under GST?

Meticulous record-keeping is not just a compliance requirement; it serves as the foundation for a resilient and legally sound logistics and supply chain management system.