Introduction

The Budget 2023 seems to have caused anxiety among the taxpayers. They are a confused lot between choosing from the old and new tax regimes. The government tweaked some pointers in the 2020 new tax regime to make it more people-friendly.

Though they want to phase out the old tax regime, the new tax regime may need some more time to blend with the people of the country. Before the Budget 2023, an individual could change the tax regime, without much hassle.

However, last year, during the Budget 2023, new income tax regulations were announced for income taxpayers. It states that unless you are a salaried person, you can change your tax regime. If you are running a business, then you have to use the new tax regime.

Can somebody switch from the old regime to the new tax regime every year? What are the eligibility criteria for doing that, and so on? These are some of the questions that we are going to be looking at in this post.

So, if you are worried about the old & new tax regime, then please read the following tax regime comparison post carefully.

Let us read on.

Understanding the Old Tax Regime

The old tax regime existed before the new regime came into effect in 2020, and was changed again, in 2023. In the old tax system, the individual has the claim on different exemptions & deductions on various sections of the Income Tax Act.

Though the old tax regime has a higher tax rate, the individual can claim tax benefits. There are close to more than 65 deductions & exclusions in this tax system. Some of them include LTA, HRA, and so on, which can decrease tax payments and taxable income.

Unveiling the New Tax Regime

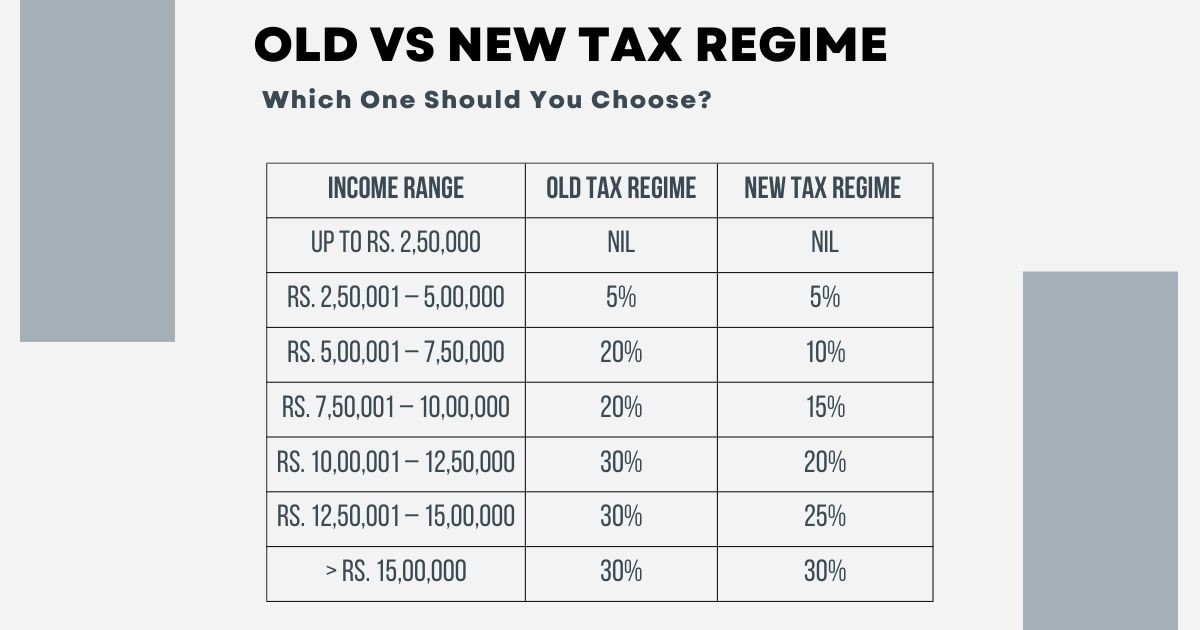

| Income Range | Old Regime | New Regime (2023-24) |

| Up to Rs. 2,50,000 | Nil | Nil |

| Rs. 2,50,001 – 5,00,000 | 5% | 5% |

| Rs. 5,00,001 – 7,50,000 | 20% | 10% |

| Rs. 7,50,001 – 10,00,000 | 20% | 15% |

| Rs. 10,00,001 – 12,50,000 | 30% | 20% |

| Rs. 12,50,001 – 15,00,000 | 30% | 25% |

| Above Rs. 15,00,000 | 30% | 30% |

The new tax regime (optional) was introduced in the 2020-2021 Union Budget. Though it came with higher tax rates, it was not used often then. However, the tax regime was tweaked in 2023, and so changes were announced.

- It was simplified to make it user-friendly.

- The tax was reduced for the middle & lower-income classes.

- It offered flexibility to taxpayers.

Standard Deduction and Family Pension Deduction

- Salary income: The standard deduction of ₹50,000, is under the old regime. This has been provided in the new tax regime too. It gives ₹7.5 lakhs as tax-free income.

- Family pension: When getting a family pension, individuals can claim ₹15,000 or 1/3rd deduction of the pension.

- Reduced surcharge: For high-income individuals, there is a massive reduction in the surcharge rate of 25%. This is for those with income exceeding ₹5 crore and it was brought down from 37%.

- Higher leave encashment exemption: The exemption limit is raised from ₹3 lakhs to ₹25 lakhs.

- Default regime: The new income tax regime is a default option. Those who want to make use of the old regime can do so by submitting the income tax return, with Form 10IEA. However, they can switch between the two regimes annually.

Pros and Cons of the Old Tax Regime

Some of the pros and cons of old vs new tax system have been discussed below:

Pros of the old tax regime

- It offers the taxpayer with extensive deductions and exemptions. There are more than 65 options, including Section 80C.

- This is an established system that has worked flawlessly for so many years.

- There is taxpayer discretion.

- It helps reduce taxes & increases savings.

- It provides enhanced investment opportunities.

- Since it is a very old format, the elderly, seniors, and pensioners will stick with it.

Cons of the old tax regime

- It can be extremely complex for some. Hence, it makes it challenging for the taxpayers to choose the right kind of options, to claim the right deductions.

- There is less flexibility, as taxpayers can’t plan their taxes.

Pros and Cons of the New Tax Regime

Pros of the new tax regime

| Exemptions | Maximum Limit |

| Deduction on Family Pension Income | Rs. 15,000 or 1/3rd of the pension, whichever is lower. |

| Gifts up to Rs. 5,000 | Rs. 5,000 |

| Exemption on voluntary retirement (Section 10(10C)) | Rs. 5 lakh |

| Income tax exemption on gratuity (Section 10(10)) | Rs. 20 lakh |

| Interest on Home Loan on the let-out property (Section 24) | Up to the actual amount paid |

| Deduction for employer’s contribution to NPS account (Section 80CCD(2)) | Up to 10% of the salary |

| Deduction for additional employee cost (Section 80JJAA) | Up to Rs. 3,000 annually |

| Standard Deduction | Rs. 50,000 |

- There are lower tax rates, than the old tax regime. This can immensely benefit the middle & lower-income groups.

- There is enhanced liquidity. It provides taxpayers more flexibility to use money in various schemes.

- The tax format is quite simple & easy to understand, unlike the old tax regime. This helps them to save time to understand how they can file their taxes.

- There is a lower compliance cost.

- It can immensely help in the improvement of the tax administration. Now, government agencies can keep track of the individual’s income & expenses.

Cons of the new tax regime

- It has no deductions or exemptions.

- The flexibility is very low as there are no deductions & exemptions.

- Won’t prove to be beneficial for taxpayers having a high deduction. Those providing high education expenses, high medical expenses, high savings schemes, and so on.

- Sometimes, it may cause tax evasion. It can tempt the taxpayers to not report their income.

Eligibility Criteria for Switching

What are the eligibility criteria for tax regime switch? Now, this is a crucial question, and the answer has to be known to all taxpayers. Not everybody can switch the tax regime every year. The Central Board of Direct Taxes (CBDT) has provided income tax return forms.

Using these forms, individuals can choose their preferred tax regime.

- ITR-1 (SAHAJ): It is for salaried individuals, with a single house property, interest income of Rs. 2 lakhs, and agricultural income up to Rs. 5,000.

- ITR-4 (SUGAM): It is for business individuals, who can make use of Form ITR-4 to opt for the new tax regime. To opt out, they need to fill up Form 10-IEA.

Financial Planning Strategies

Income Tax Slabs & Rates for AY 2024-25 (FY 2023-24)

| Slabs | Old Tax Regime | New Tax Regime |

| Rs. 0 – 2,50,000 | 0 | 0 |

| Rs. 2,50,001 – 3,00,000 | 5% | 0 |

| Rs. 3,00,001 – 5,00,000 | 5% | 5% |

| Rs. 5,00,001 – 6,00,000 | 20% | 5% |

| Rs. 6,00,001 – 7,50,000 | 20% | 10% |

| Rs. 7,50,001 – 9,00,000 | 20% | 10% |

| Rs. 9,00,001 – 10,00,000 | 20% | 15% |

| Rs. 10,00,001 – 12,00,000 | 30% | 15% |

| Rs. 12,00,001 – 12,50,000 | 30% | 20% |

| Rs. 12,50,001 – 15,00,000 | 30% | 20% |

| >Rs. 15,00,000 | 30% | 30% |

Effective financial planning strategies can help the taxpayer save & invest money as well. This helps protect them from a last-minute hurry in filing the ITR and failing to note the exemptions. That is why, investors may want to plan their taxes, to enhance their overall financial health.

The tax exemptions and deductions have to be taken into account. This can help them find out the net taxable income. Likewise, equity, debt, and fixed deposits have to be taken into consideration too.

This can immensely help in understanding the Public Provident Fund (PPF) so that a balance is created between the ROI. The investor can also make use of the proper asset diversification, using the right kind of account to achieve long-term financial goals.

Legal Implications of Switching

A common question among taxpayers in India is whether switching between old and new tax rules is possible. If by April 1, 2023, when the taxpayer has not decided on the tax regime that they would like to pay, then the employer can deduct tax on the new tax regime.

It is because the new tax regime is the default tax regime. When the individual is salaried, then the following applies to them:

- They can change the tax regime before filing their ITR.

- The preferred regime can be mentioned on the ITR form.

- There is no need to fill out additional forms.

However, then the individual is running a business or has a profession, then the following applies to them:

- There is limited choice to change the tax regime.

- If the individual wants a change in the tax regime, they can change only once in life.

- The Form 10-IE along with the ITR should be filled & submitted.

For a salaried individual, who wants to change the tax regime in the year, this can be done with the help of the following steps.

- Choose the regime that they want.

- Verify so that the individual knows that they meet the eligibility criteria.

- Choose the form accordingly.

- Access the ITR form, and go to the section meant for the tax regime. Now, choose the regime to pay for the year. Fill in the remaining sections of the ITR.

Common Misconceptions

There are common misconceptions about the old & the new tax regimes that we wish to address here. We agree that both the tax regimes can be difficult to understand by the layman. There are several myths about taxes.

Myth 1 – Deduction on home loan repayment is applicable only for one house

As a homeowner, the individual can claim a deduction of Rs. 1.5 lakh, under Section 80C of the Income Tax Act. Besides, they can claim a deduction of up to Rs. 2 lakh on the interest under Section 24 of the Income Tax Act.

It can apply to more than one home loan.

Myth 2 – Not necessary to pay tax on income

The interest income earned through all savings accounts is taxable. That is because all the income has to be filed in forms when declaring the income tax report. But, there are some provisions for tax exemptions of Rs. 10,000/year, on bank savings & post office savings.

Myth 3 – Gifts are tax-exempt

Donations that are received from relatives during marriage & weddings are taxable. The cash gifts that are received above Rs 50,000 are taxable. But cash gifts from non-relatives during the marriage are non-taxable.

When it comes to taxes, it is good to know everything accurately. When the taxpayers know the ins & outs of the tax, then they can enjoy maximum tax benefits. When the individual has a loss due to house, business & profession, these can be considered as well.

Who should move from the old to the new regime?

Those who earn more than Rs. 15 lakhs per year. It will decrease their tax burden greatly. Besides, those earning more than Rs. 15 lakhs can benefit from the tax of 25% only.

Who should continue under the old regime?

Those who earn less than Rs. 15 lakhs can claim deductions. They can now maximize their savings under the old system.

Government’s Stance on Frequent Switching

The frequent tax regime changes have been introduced by the government due to some individuals changing their tax regime every year. Probably, they were not able to understand the tax profile and could not file the relevant forms.

This was during the income tax return (ITR) filing process. When the new tax regime was introduced in 2020, the government made it clear that salaried individuals could change their tax regime.

Last year, in 2023, the new tax regime was made the default regime. It means that when the taxpayers haven’t chosen between the old and new tax regimes, the taxes for that year will be calculated using the new tax system.

Conclusion

In conclusion, both the new & old tax regime comes with their own benefits and drawbacks. It is up to the individual to understand and choose the tax regime that will be useful for them. Besides, it is also important that tax is filed before the due date to avoid any late payments.

The new income tax regime is ideal for those who have taken large loans, like home, car, and personal. They can make use of the tax deductions due to ineligibility for section 10 exemptions. In contrast, the old tax system is perfect for pensioners, as they can benefit through Section 80TTB.

The new tax regime is safer, and has a wide range of deductions. But the old tax regime has its own benefits that are hard to ignore. Hence, individuals may want to do a thorough comparison to be able to choose the right fit for them & their family.

FAQs

-

Who cannot switch between the old & new regimes every year?

Those who cannot switch between the old & new regimes every year are those who are self-employed or running a business. But, when they are earning income, apart from their business, then they can switch their regimes annually.

-

How to change the income tax regime?

When the individual is salaried and does not earn income from a business, then they can switch the regime. They can do that by choosing the regime of their choice when they are filing ITR. But, when the individual earns income through a business or is self-employed, then they should file Form 10IE before 31st July, which is the due date for filing ITR.

-

Is it required for an employee to specify the tax regime to his/her employer?

It is required that the employee mention the tax regime to their employer. That is because, when the firm, business or company is filing for their ITR, they will use the regime that the employee has requested them to go with.

-

Can individuals switch regimes while filing a revised ITR?

Yes, individuals can switch their regimes when they are filing a revised ITR. However, that depends on the kind of income of the taxpayer. If the individual is salaried, then they can switch the regime when filing an ITR. But, when the individual gets income from a business, they can switch their regimes once.

-

Can individuals choose a new tax regime after the due date?

Individuals can’t choose a new tax regime, after the due date is gone, and they have already filed for the ITR. That is never possible and that is why, the individual should make sure to choose the tax regime they want to file the ITR, beforehand itself.

-

Is the 80C deduction applicable in the new tax regime?

There are no deductions under Chapter VI-A. This includes the 80C which is mainly used for investment. The 80D also comes under it. This can’t be used under the new tax regime.

-

When is the deadline for filing the form 10IEA?

The form 10IEA needs to be filed before the original return, July 31st. That means the deadline is on the same date of filing for the ITR. So, individuals need to ensure that they file for their ITR before the mentioned date.

-

What are the penalties for not filing taxes under the new tax regime?

The penalty for individuals not filing the taxes are the same as what was present in the old tax system. Some of them include high interest, late filing fees, and other penalties. So, it would be best if the taxpayer pays the taxes on time before the due date.

-

What is the difference between the old and new tax regimes?

There are some notable differences between the old tax & the new tax systems. In the previous slab, the tax was 30% of Rs. 10 lakhs or above. However, in the new tax system, it is only 15%. The amount is between Rs. 9 – 12 lakhs. However, individuals can choose from 20% to be paid for Rs. 12 -15 lakhs, or 30% for Rs. 15 lakhs and above.

-

Which tax regime would be better?

The tax regime to choose would be the best that serves the needs of the individual. When a taxpayer feels that a certain regime can fulfil their financial goals or obligations, then they choose it. The old tax regime provides high deductions, and the new tax regime is helpful when there are no exemptions.