You may be familiar with the terms invoice, bill, or bill of goods. An invoice is a way to keep track of sales. So, what takes place when the value of those bills changes? Is it possible to change and update the invoices? However, it does not make sense to do so. The invoice has already been created and entered the transactions into the journal. The only way out is to make additional entries indicating an alteration in the initial invoice amount while providing extra proof of the true value of the sale performed. These are referred to as debit and credit notes.

Debit and credit notes are widely recognized as transaction rectification instruments all over the world. Furthermore, these are allowed in tax reporting and are best understood in the wider context of GST (goods and services tax).

The importance of GST debit and credit notes cannot be overlooked, especially for small enterprises and exporters. These financial tools not only assure tax correctness, but they also protect against any conflicts and errors. Retaining accountability and clarity is critical for small firms seeking long-term success, and the prudent use of credit and debit notes may assist in this regard. These companies may correct errors, claim appropriate input tax credits, and reduce their tax bills, retaining their monetary security and credibility.

What is the Time Limit For Issuing a Debit or Credit Note?

Understanding the meaning of debit and credit notes

Debit notes

- Debit notes are also known as debit memos.

- A debit note is a document/voucher issued by one party to another declaring that the other party’s account has been debited in the sender’s books.

- When there is a problem with the debit statements, the client (consumer) issues a debit-note to the seller.

- Such errors are inevitable as a consequence of human error, and these notes aid in the reconciliation.

- Delivery errors are prevalent in any company, and payment modifications are required to correct the problem.

- In the buyer’s books of accounts, a debit note functions as documentation of a purchase return.

- Debit notes are also known as debit memos.

Illustration:

- Company X purchases items from Company Y.

- Company X discovers after getting the supplies that its contents contain certain defective items worth Rs. 10,000.

- Company X must now lower the liability in his accounting records as payment due to creditor Company Y.

- As a result, X sends Y a debit note for Rs. 10,000, highlighting that he has debited his account in his books of accounts.

- The debit note carries information about the original purchase and the value of the defective (damaged) products.

- After Company Y receives the debit note, it carries out the necessary inspection, and issues a relevant credit note to Company X.

Issuance of debit notes

When are debit notes issued?

If the buyer receives a defective item during delivery, a debit note will be sent seeking a refund from the seller of the product.

Common reasons for issuance of debit notes

- Damaged or defective products have been received.

- The buyer has been overcharged in the invoice.

- Wrong entries in the invoice.

- The invoice amount is incorrect.

Advantages of issuing debit notes

- With a debit note, the supplier maintains track of all returned goods.

- The credit note and the duplicated debit note can be matched by the supplier.

- Examining the debit notebook on a regular basis assures that all returned products are properly accounted for.

- The original debit note is kept by the supplier as an evidence for generating a credit note.

- Debit notes facilitate the correction of invoicing or billing errors, guaranteeing accurate accounting records.

- Debit notes make it easier to return products to the supplier and acquire required modifications.

- Debit notes guarantee that liabilities and costs are appropriately documented, preserving the financial statements’ integrity.

- Debit notes can aid in the resolution of complaints about price, quantity, or any other anomalies in the original invoice.

- Debit notes allow for effective contact with suppliers regarding refunds, changes, or other billing concerns.

- Debit notes help to ensure that accounting rules and requirements are met by correctly noting changes.

- Debit notes enhance decision-making by providing insight into the financial impact resulting from returned products or overcharged figures.

- Debit notes create a verification trail by capturing the reasons for and specifics of modifications, increasing transparency.

- Debit notes aid in cost control by assuring proper billing and minimizing overcharging or erroneous billing.

Debit note issuance according to GST Act

According to GST, a seller can only issue a debit note in two circumstances:

- When the taxable amount on the original tax bill is less than the real taxable value.

- When the tax levied on the first tax invoice is less than the tax that needs to be paid.

Credit notes

- Credit notes are given out by sellers when there is a scenario that necessitates payment changes.

- If the invoice has errors, the selling entity can address them on the credit-note.

- It is an official record produced by the seller indicating a whole or partial refund of payments.

- It is often sent in response to a customer’s debit note.

- This document can also be used against a future order by the buyer or purchaser.

- Credit notes are also known as debit memos.

Illustration:

- Company Q executes the order of Company P by sending items valued at Rs.10000 along with its invoice.

- Company Q acknowledges there is an error in the bill of sale value and that the real price is less than the billed amount.

- Company Q issues a credit note to Company P for the difference in amount of the real value of the items vs the amount charged in the invoice.

When are credit notes issued?

A credit note gets issued when a seller discovers an error in a previous invoice, such as billing the wrong price or when a customer returns the products.

Common reasons for issuance of debit notes

- If a seller has supplied the buyer with inferior quality of products that the buyer wishes to return, a credit note can be issued for modifications against the invoice that has already been raised.

- Corrections to previously issued bills.

- Discount rates have been corrected.

- Cancelling any outstanding invoice payments.

Advantages of issuance credit notes

- Credit notes aid in the correction of invoicing or overcharging errors, guaranteeing accurate accounting records.

- Credit notes give a detailed explanation of modifications, which improves openness in billing and financial accounts.

- Credit notes assist the effective implementation of discounts or rebates, increasing customer satisfaction.

- Credit notes simplify the process of amending overcharged amounts, reducing the need for considerable conversation or negotiation.

- Credit notes help suppliers meet with contractual commitments or regulatory requirements for discount or refund provisions.

- Credit notes help to ensure accurate financial reporting by indicating variations in revenues or accounts receivable.

- Credit notes are essential for adhering to accounting rules and keeping correct financial records.

Credit note issuance according to GST Act

When a tax invoice is produced and it also has to be adjusted to lower the amount of tax due listed on it, the supplier may issue a credit note, according to the GST Act. A note of credit may be issued by the seller for a variety of reasons, including:

- If the buyer returns due to issues with quality of the product or service or receiving damaged products.

- Higher costs were collected from the buyer erroneously or the consumer paid more than the reported amount.

- The buyer got less than the amount specified on the tax invoice.

- If the supplier offers a post-sale discount to the buyer.

- Any overdue invoice payments will be canceled.

- Any other cause that is comparable.

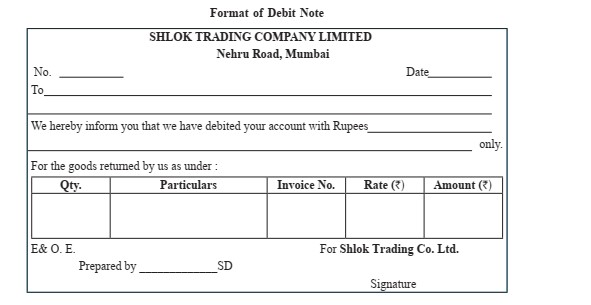

Format of the debit and credit notes

Both debit and credit note formats are comparable to invoices. They are as follows:

- Names, addresses, and contact details for the receiving and issuing companies.

- The date the note was issued.

- A note-specific serial number.

- Details about the note’s related products or services, such as quantity, invoice number, order date, rate, total amount, and more.

Format of debit note

Format of credit note

Debit and credit notes for exporters

- The proper use of credit and debit notes may be an invaluable resource for exporters negotiating the intricacies of foreign trade.

- These permit effective management of returns, adjustments, and refunds in an environment where accuracy and paperwork are critical, lowering the likelihood of financial setbacks and enabling easier transactions between countries.

Things that you need to know – GST debit and credit notes

- Debit and credit notes are standard components of the invoicing process.

- As long as the credit or debit note is issued within the relevant year, there is no time restriction.

- Except in September, the month after the end of the financial year when the supply was made and the month of submitting the yearly return, all debit and credit notes must be stated in GST returns filed the following month.

- Debit notes have no effect on tax collection, however credit notes have a detrimental impact on tax collection.

- According to GST legislation, a debit or credit note provided by a receiver to a supplier is not a valid instrument.

Debit and credit notes – A summary

- Debit notes and credit notes are commercial accounting records.

- A debit note is a notice and request for payment of a financial obligation.

- A credit note is provided for correcting an error or making modifications to a current invoice or purchase.

- The issue of both types of notes aids in the maintenance of accounting records and provides clarification on the amount owing, whether negative or positive.

- They have a few parallels, such as their purpose and grounds for issuance

- They vary significantly in terms of who issues them as well as whether they affect the buyer’s or seller’s accounts payable or receivables accounts.

Nowadays, you may utilize online resources to create debit and credit notes and then issue them. However, in order to have an excellent reputation in the market, you must keep to the government’s constraints when knowing the difference between a debit note and a credit note. The government restricts you from issuing a credit note since it reduces your tax payments.

Debit and credit notes for small businesses are essential financial instruments. It allows small businesses and exporters to survive in a constantly evolving and competing marketplace while remaining compliant with the ever-changing GST laws. Understanding the usage and meaning of debit and credit notes might be the difference between financial prosperity and growth in the GST world.

Frequently Asked Questions (FAQs) about debit and credit notes

-

In terms of GST, what precisely does a debit note represent?

In the world of GST, a credit note is an endorsed piece of paper that corrects blunders in the initial invoice, displaying what the provider owes. Its purpose is to subtract the amount from a later invoice or facilitate a refund directly.

-

In terms of GST, what precisely does a debit note represent?

As per GST rules, a buyer’s communication to the supplier or seller for a refund or adjustment of payments made on account of unsatisfactory goods or services is referred to as a debit note.

-

What are the consequences of failing to maintain records of debit notes and credit notes?

The failure to maintain proper records of debit notes and credit notes can have serious consequences for businesses. It is crucial for business owners to understand the importance of record-keeping in order to avoid any legal issues and maintain a high level of compliance with GST regulations.

-

How are debit and credit notes different from invoices?

Debit notes and credit notes play a different role compared to invoices. While invoices are used primarily for requesting payment, debit notes and credit notes are utilized to correct or adjust the amount owed by the buyer. These documents serve as evidence that changes have been made in terms of payments or refunds.

-

Is it permissible to issue debit notes and credit notes electronically?

When it comes to issuing debit notes and credit notes electronically, businesses need not worry about its permissibility. As long as all necessary information is included in the electronic document and it has been properly authorized by the seller, electronic issuance is perfectly acceptable.

-

What should businesses do to effectively monitor debit notes and credit notes?

To effectively monitor these financial transactions, businesses should implement certain methods within their accounting systems. Integrating management processes related to debit notes and credit notes into their existing system ensures streamlined operations.

-

Who issues a debit note?

A debit note is issued by the buyer of the products or services.

-

Who issues a credit note?

A credit note is issued by the seller of the products or services to the buyer.

-

What is the impact of the debit note in the book of accounts?

The debit note minimizes the account receivables.

-

What is the impact of the credit note in the book of accounts?

The credit note minimizes the account payables.