GST make-in-India, impact on manufacturing sector, its role in economic growth. The Goods and Services Tax (GST) has transformed India’s tax structure and given “Make in India.” fresh life. The eight-month-old GST is a paradigm change to modernize taxation and boost economic growth. It’s becoming clear that the GST helps the “Make in India” effort achieve its goals.

In September 2014, Prime Minister Narendra Modi launched “Make in India” to promote India as a global manufacturing powerhouse, attracting multinational and indigenous companies to design and manufacture things there.

For the most part, the new tax structure is helping already-existing economic programs like “Make in India.” The GST, or Goods and Services Tax, has been in operation in India for over eight months to modernize the tax structure and boost economic growth. The new tax scheme mostly supports “Make in India.”

As we examine GST’s role in economic growth and the impact on “Make in India,” we see how this tax reform has helped India boost economic growth, production capacity, and global competitiveness.

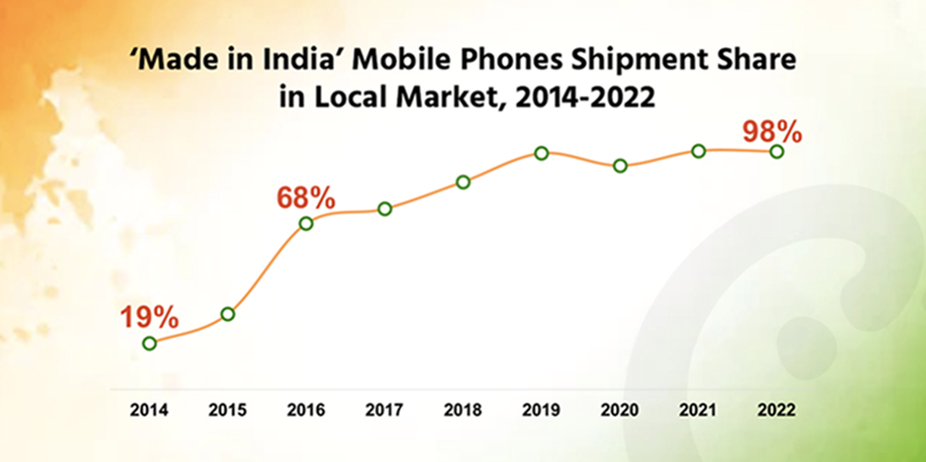

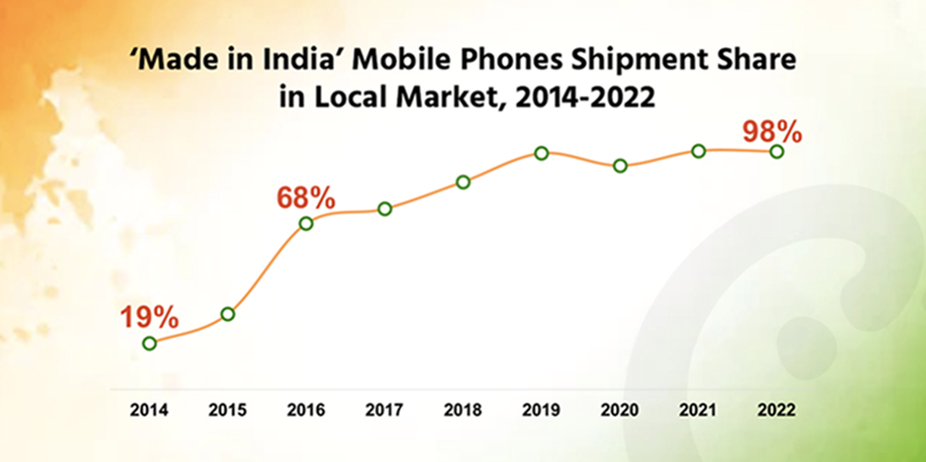

Image Source: Counterpoint Research

Image Source: Counterpoint Research

Table: Bill validity based on kilometers traveled

The GST has increased demand in several areas, including tire production, by moving enterprises from wait-and-watch to execution. In the future years, rising demand will boost production.

The proposed GST impact on the manufacturing sector regime aims to cut manufacturing costs and allow firms to transfer goods across the nation freely. Consequently, it’s feasible that businesses will begin producing in India and exporting their goods worldwide.

What is the “Made in India” Program Exactly?

Narendra Modi announced “Make in India,” a program to encourage domestic and international enterprises to design and produce items in India, making it a worldwide manufacturing hub, on September 25, 2014. The project seeks FDI, employment creation, and manufacturing capability. The GST raised FDI by almost 40%, notwithstanding the program’s effectiveness in attracting foreign investment to India. The beneficial and bad effects of “Make in India” and GST are now becoming clearer. Image Source: Counterpoint Research

Image Source: Counterpoint Research

Positions for Balanced Payments

The transition to destination-based taxes is one of the most noticeable changes brought forth by the GST make-in-India. The “Make in India” campaign is impacted by this modification in three ways.-

Imports

-

Intrastate transactions

-

Exports

Unrestricted Movement of Goods

GST has successfully reduced economic barriers and paved the way for a nationally integrated economy, giving the logistics industry significant benefits. Previously, officials at border checkpoints frequently delayed vehicles traveling across the country while examining and processing their paperwork. This time, logistics efficiencies have decreased dramatically, which is good for the manufacturing industry and the “Make in India” campaign. Over time, more advantages are anticipated to come from infrastructural improvements.| Distance Range (km) | Validity Period (Days) |

| Less than 100 | 1 |

| 100 – 300 | 3 |

| 300 – 500 | 5 |

Challenges That Remain

- While they wait for their unpaid GST make-in-India returns, many exporters are suffering from cash flow problems. The lack of checklists and issues with necessary documentation have severely impacted these exporters, dealing a major blow to the “Make in India” campaign.

- The country’s leading luxury automobile manufacturer, Mercedes-Benz, even canceled its plan to expand under the “Make in India” campaign after the industry harshly criticized the move.

- In some domains, the combination of GST with “Make in India” and “Skill India” is producing the opposite outcome. Specifically, the country’s startup scene is entering a new era thanks to economic measures and tax reform. India made the biggest rise of any nation last year, rising from position 130 to position 100 to rank among the top 100 nations for ease of doing business.

Effects of GST

The manufacturing industry and the Made in India program will be significantly impacted by GST. A clear, unambiguous tax structure is necessary for a manufacturing sector to thrive, and GST is one of those. The anticipated effects of GST on the Made in India initiative are as follows:-

The Cost of Making

-

Rise in Investments

A lower cost will always draw more investment. Businesses from all over the world select their operating regions based on easy operations and low production costs. This lets them offer high-quality items at low prices and enter worldwide markets.

-

Transformation of Supply Chain Economics

Consequences for the Manufacturing Sector

Here are some of the opposing viewpoints that will harm Made in India in the manufacturing sector:-

Working Capital Requirement

-

Tax on Free Supply

-

Enhanced Adherence

Conclusion

The GST make-in-India campaign has faced both favorable and unfavorable consequences since the Goods and Services Tax (GST) was enacted in India. GST has simplified taxation, decreased manufacturing costs, and promoted an interconnected economy, but it has also come with challenges, including higher working capital needs, taxes on free supplies, and intricate compliance requirements. Destination-based taxes have improved competitiveness in the international market by balancing payment positions. GST impact on the manufacturing sector has ushered in a transformative era by promoting innovation, boosting production capacity, and positioning India favorably for global investments and manufacturing growth—all while enduring teething pains, such as delays in refunding export taxes. Also Listen: Msme of indian economy | MSMEs have a great impact on Indian businessFAQs

-

What Is The Initiative Called “Make In India”?

-

What Beneficial Effects Has GST Had On The “Make In India” Campaign?

-

What Advantages Do Lower Production Costs Under The GST Offer?

-

How Has GST Impacted India’s Free Movement Of Goods And Logistics?

-

What Difficulties Has The “Make In India” Campaign Encountered Since The GST Went Into Effect?

-

How Has The GST Affected Indian Production Costs And Investments?

-

How Does The GST Affect The Economics Of The Supply Chain?

-

What Are The Negative Effects Of GST On The Manufacturing Sector?

-

In What Ways Has GST Facilitated Company Operations In India?

-

Does GST Address All Issues, Or Are There Still Problems?

Make in India gets a GST advantage—Learn how your business benefits.

Aaryan Singh

B.Com degree with finance and accounting Specialisation in Goods and Service Tax (GST) and taxation system Completed certification course on GST from ICAI in 2022 Online GST practitioner course completed in 2023 from Indian Institute of Skill Development and Training.