Calculating Goods and Services Tax (GST) on services is complex and varies according to the kind of service and the applicable GST rate. In contrast to products, where the computation is usually straightforward, services might be categorized into several GST slabs, including 5%, 12%, 18%, or 28%. Accurate GST computation requires understanding these rates’ nuances and their application to the particular service in issue.

Understanding the GST calculation process is essential for consumers and service providers as it guarantees financial transparency and adherence to tax laws. People and enterprises must thoroughly understand how to compute GST on services in this ever-changing tax environment.

Calculating GST on Service Transactions

One of the easiest ways to calculate GST is by using a GST calculator, which is readily available online. Using this calculator, anybody can determine the amount they must pay monthly or quarterly towards GST on service transactions. It is excellent for people who offer different types of services to consumers. These calculators are built to divide the amount within CGST – Central Goods and Services Tax and SGST – States Goods and Service Tax to give the accurate amount.Procedure for GST Computation for Services

Let’s look at how GST is calculated for services step by step:-

Find the SAC Code

-

Check for IGST, CGST, and SGST

-

Check for Reverse Charge Services

-

Determine the Transaction Type

-

Check the GST Composition Scheme

GST Calculation Method for Services

It has become quite simple to calculate because of the simplification of the indirect taxation system. The calculator on services can be done based on the transaction – inter or intra-state. Let’s have a look at both:-

Intra-State GST Calculation

-

Inter-State GST Calculation

Formulas for Determining GST on Services

The formula for GST calculations on services will be as follows: GST amount = GST inclusive price x GST rate/(100 + GST rate percentage) Original cost = GST inclusive price x 100/(100 + GST rate percentage)Service-Specific GST Calculation Guidelines

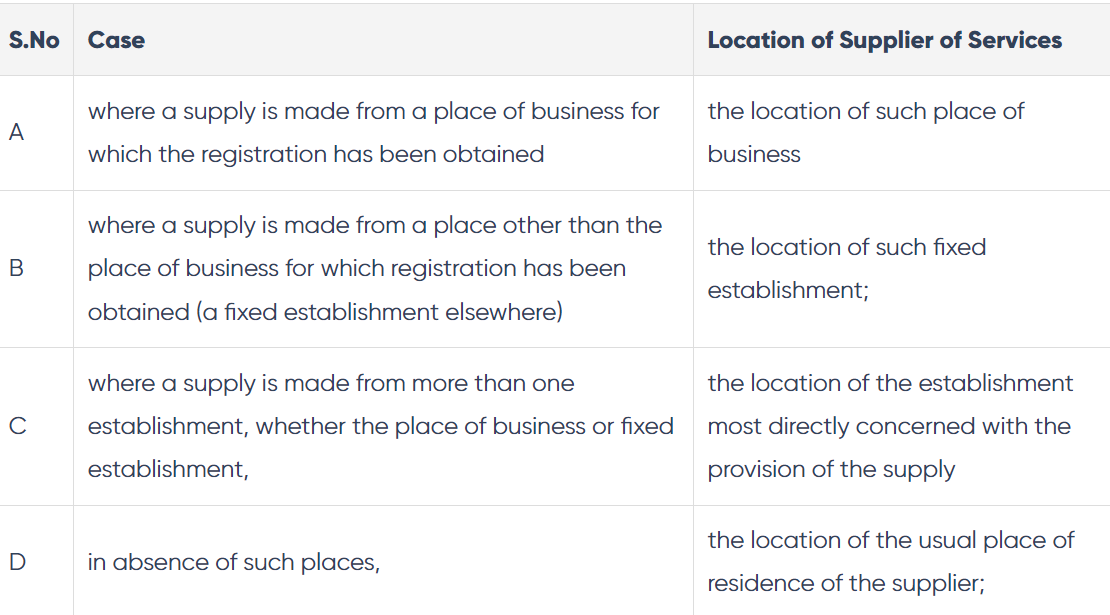

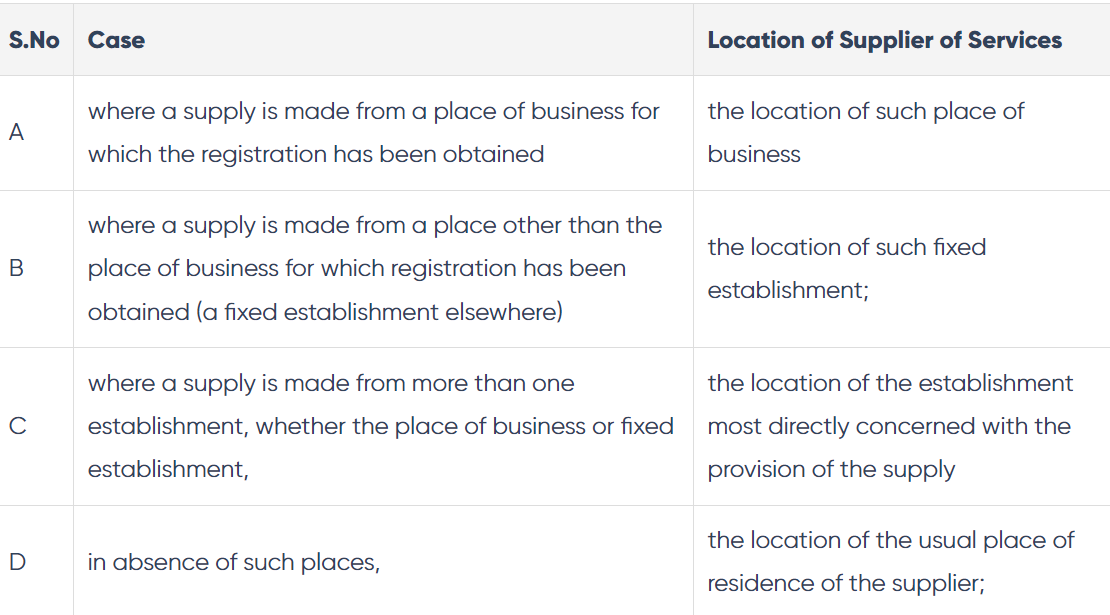

The time and location of the supply—where the services were used—is where the GST statute requires the taxpayer to pay the tax. GST is a destination-based tax applied when services are utilized and paid for in a particular state. It is sometimes referred to as a consumption tax. The three tax levels under GST are IGST, CGST, and SGST. The applicable tax will be assessed based on the supplier’s location and the so-determined place of supply.Location of Supplier of Services

Ensuring Accurate GST Calculations for Services

It is a good idea to use a calculator or consult a tax expert to ensure you are calculating accurately and avoiding errors and mistakes. However, remember the below if you plan to calculate independently.- Use the net price of the services.

- Check for its GST rate, which can be NIL, 5%, 12%, 18%, or 28%.

- Calculate based on the formulas mentioned above or use a calculator.

Conclusion

In conclusion, financial correctness and compliance depend heavily on your ability to calculate GST on services. Due to varying GST rates and the nature of the service, the process necessitates a thorough comprehension of applicable slabs and their ramifications. This information guarantees accurate tax computations and enables you to make well-informed decisions as a consumer or business owner in the constantly changing tax environment. Knowledge of GST computations is essential because, given the continued importance of services to the world economy, it helps create an efficient and transparent financial system that encourages responsible spending and adherence to legal requirements. Also Read: Calculate Your GST within SecondsFAQs

-

How do you calculate 18% GST on services?

-

How to calculate GST?

-

How much is the GST rate for services?

-

Who is liable to pay GST on services?

-

Who all are needed to pay GST on services?

-

Is it mandated to pay GST on services?

-

Are there any services exempt from GST?

-

Is GST applicable on all services?

-

What does the term service mean in GST?

-

How are services taxable under GST?

Learn how to apply GST on service transactions with accuracy using CaptainBiz.

Shradha Kabr

Content Management Specialist

Shradha Kabra is an experienced finance writer based in India with 15 years of experience simplifying complex financial topics for readers. Her articles on taxation, Indian stock markets, and other national finance issues are well-researched and presented in an easy-to-understand style. Shradha holds a Double Master's degree and aims to make financial literacy accessible to all through her writing.