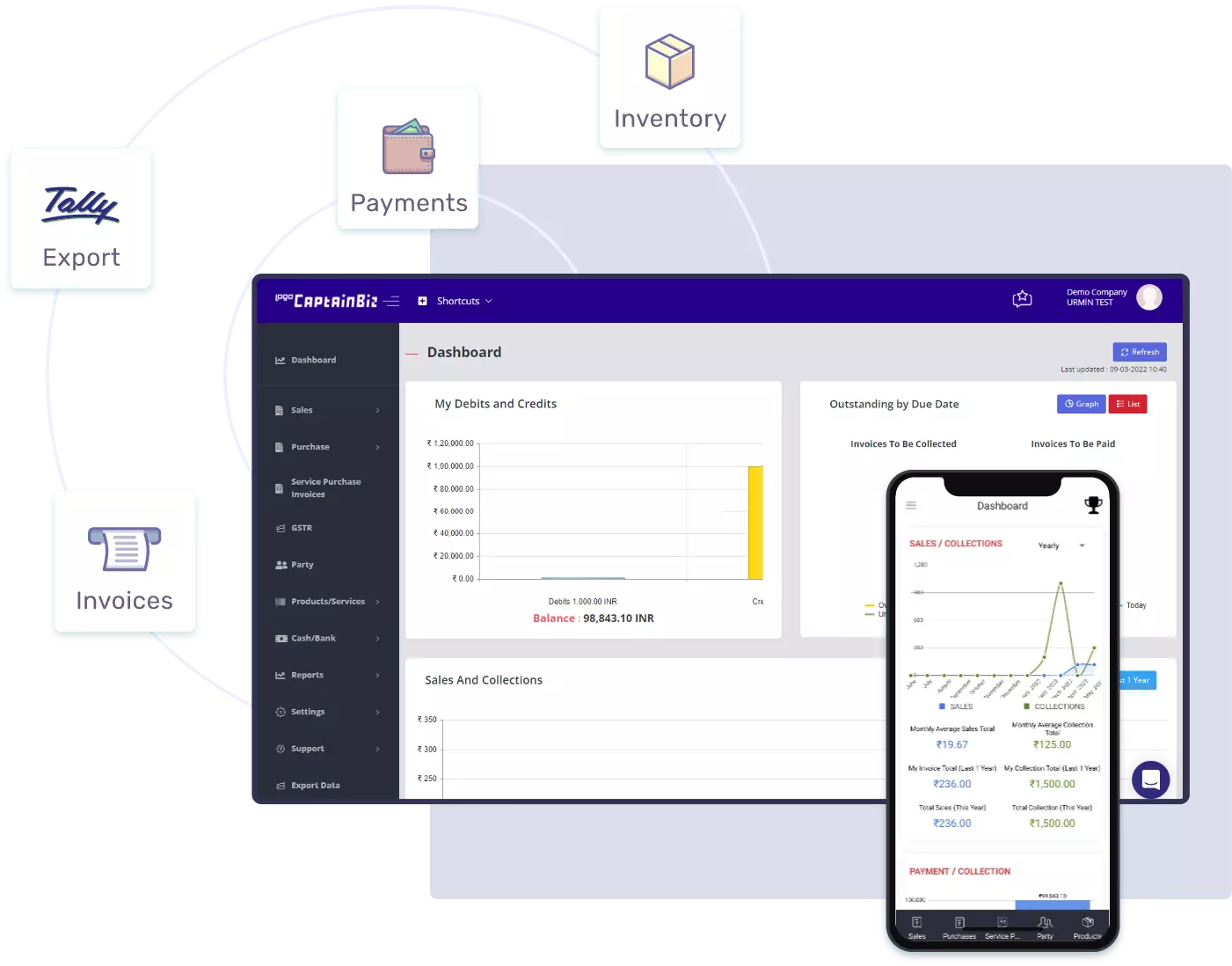

Track payments

Track payments GST approved UOMs supported

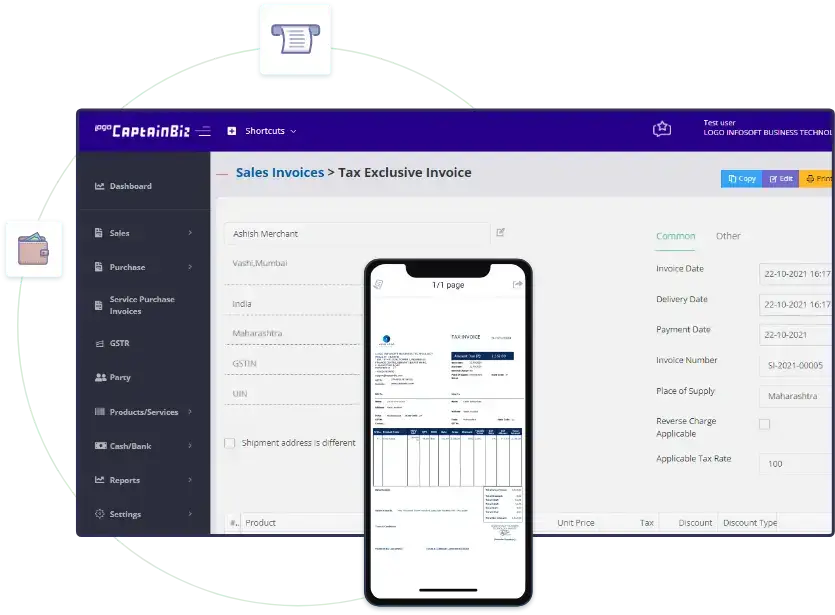

GST approved UOMs supported Industry specific invoice templates for GST and non-GST companies

Industry specific invoice templates for GST and non-GST companies Share invoices over WhatsApp or Email

Share invoices over WhatsApp or Email

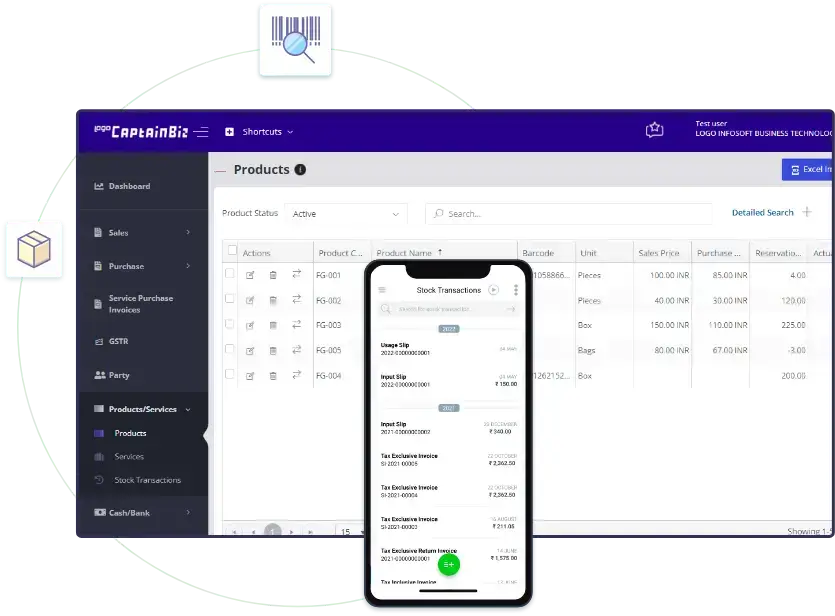

Automatic Sales / Purchase based updates on your account

Automatic Sales / Purchase based updates on your account Real-time check for efficient reorder

Real-time check for efficient reorder Bulk upload of items

Bulk upload of items

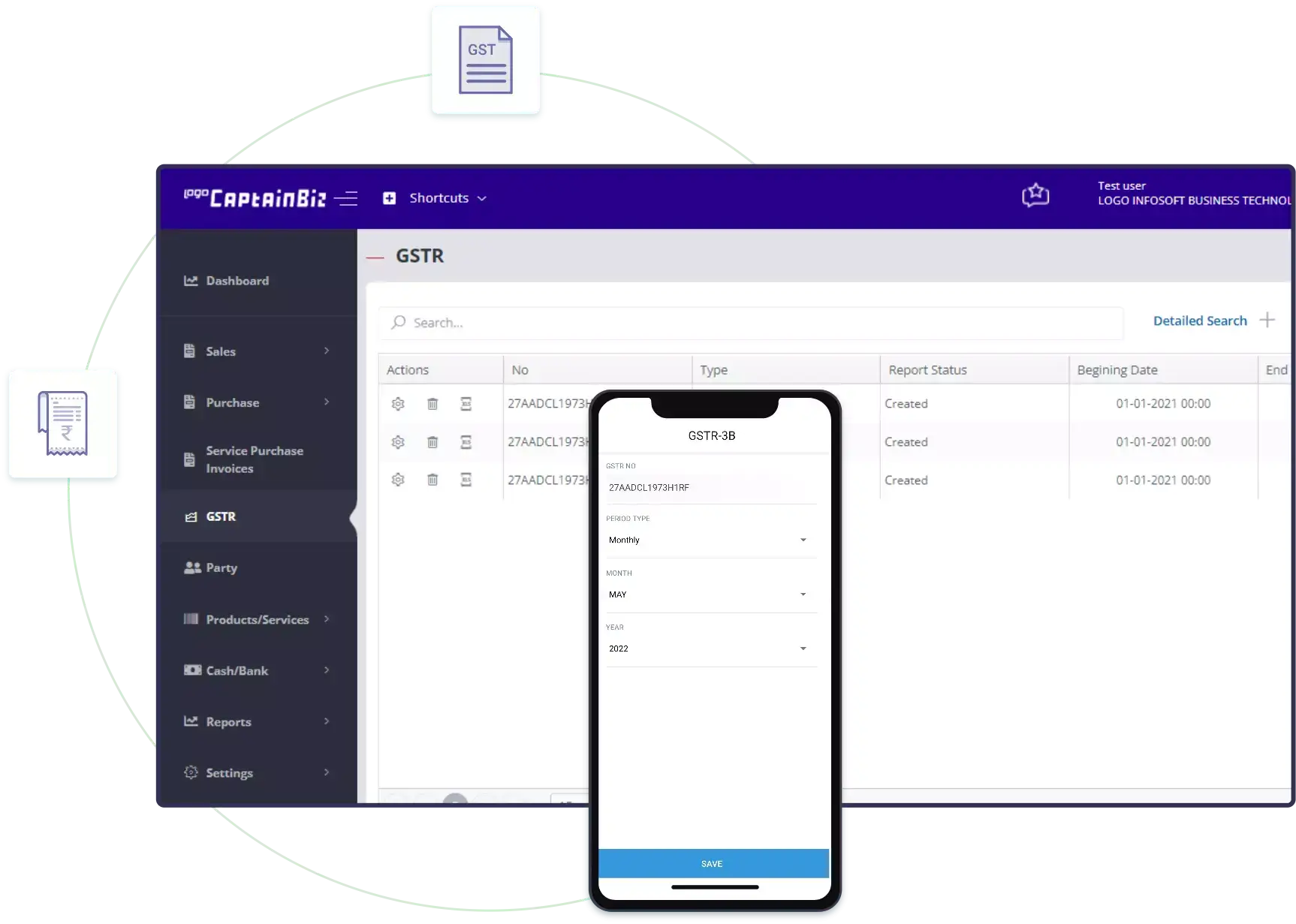

Generate GST-ready reports for filing tax in a click

Generate GST-ready reports for filing tax in a click E-invoice capable

E-invoice capable Empanelled by Goods & Services Tax Network (GSTN) India

Empanelled by Goods & Services Tax Network (GSTN) India

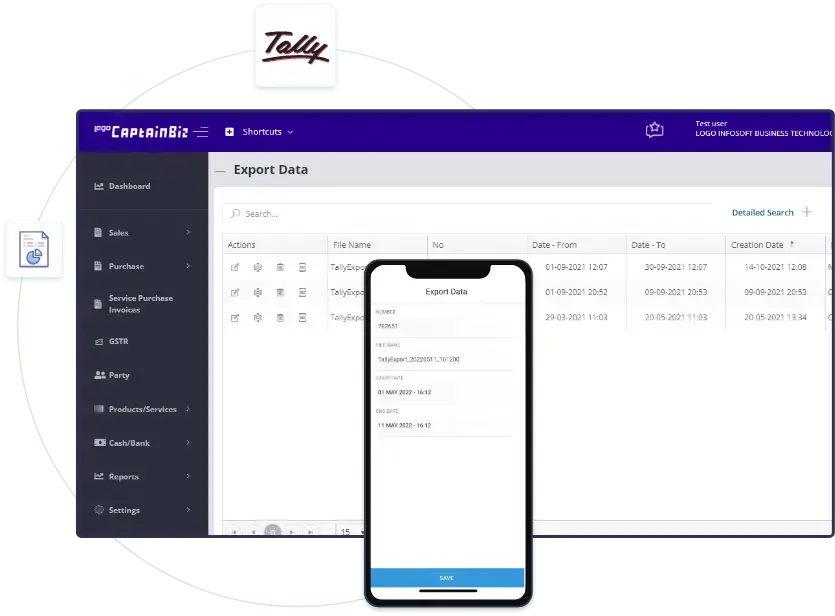

Download financial statements in Excel

Download financial statements in Excel Easily import into Tally

Easily import into Tally

Data hosted in India

Data hosted in India SSL certificate enabled

SSL certificate enabled

Use CaptainBiz on app (Android or iOS) and PC web

Use CaptainBiz on app (Android or iOS) and PC web Set up your company online, in minutes

Set up your company online, in minutes Dedicated Customer Support for immediate assistance on phone

Dedicated Customer Support for immediate assistance on phone