Every business is concerned with negotiating the maze of taxes and financial compliance in the ever-changing, intricate world of commerce, especially Goods and Services Tax (GST) rules in India. The implementation of GST as a system that absorbed multiple indirect taxes has transformed the way enterprises manage their finances but this move comes with new challenges such as how to handle GST billing and compliance properly.

With various options flooding the market — free solutions being among them which claim convenience and cost-effectiveness — the demand for GST billing software has grown as businesses strive to keep up with shifting regulations. However tempting it may be to go for something that doesn’t charge anything at all, it is essential to look into particulars about functionality, reliability or long-term advantages before settling on one.

This article explains why CaptainBiz was preferred over other free alternatives as a complete GST billing solution. We will do this by looking at what happens when you try complying with GST requirements; examining what CaptainBiz can do considering its features and benefits vis-a-vis other similar tools which are given out without charging any money so that people can make informed decisions when choosing between different types of billing systems or methods.

Understanding The GST Landscape

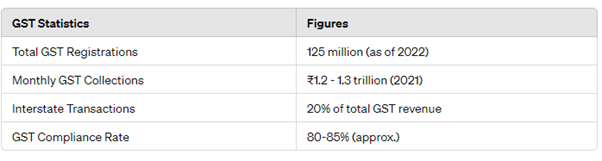

Implemented on July 1, 2017 in India, the Goods and Services Tax (GST) system has been a complete game-changer for the country’s tax structure. It eradicated a multitude of indirect taxes like VAT, service tax and excise duty which were unnecessarily complicated and replaced them with one unified tax structure aimed at streamlining taxation and spurring economic growth.

GST is levied at different stages along the supply chain from manufacturing to consumption with provision for input credits at various stages to prevent cascading of taxes.

-

Unified Taxation System

Another fundamental concept behind GST is that it aims to create a ‘one nation, one market’ idea by doing away with entry barriers between states and bringing uniformity in tax rates across different regions. The simplification of this particular tax has reduced the red-tapism involved in conducting business within the country while also boosting inter-state trade.

-

Compliance Requirements

Among other things, compliance with GST involves activities such as registration under GST, invoicing under GST, filing of returns under GST and reconciliation etc. Businesses are required to maintain accurate transaction records, generate invoices which are compatible with GST system as well as file regular returns so Failure to meet these obligations attracts penalties and legal implications may follow suit.

-

Input Tax Credit (ITC)

One important characteristic of GST is the provision of input tax credit, which allows firms to deduct the tax paid on inputs from the tax owed on outputs. This approach encourages efficiency and prevents tax cascading, resulting in lower consumer prices and better competitiveness for firms.

-

Evolving Regulatory Landscape

GST has undergone several amendments since its establishment to address operational challenges and simplify compliance requirements. Businesses had to keep up with the changes in GST laws, fluctuations in tax rates, and modifications in conformity norms through constant monitoring and adaptation in order to remain updated with the latest rules.

-

Technological Integration

In line with efforts to ensure compliance, digitization of GST activities became paramount after the introduction of Goods and Services Tax Network (GSTN) portal for online registration, return filing, and tax payment. Smooth integration with GSTN portal requires that companies use digital accounting systems as well as billing software that is compatible with GST for accurate reporting and adherence to regulations.

Understanding the GST environment entails dealing with the complexity of a unified tax system, adhering to compliance standards, utilizing input tax credits, responding to regulatory changes, and embracing technology integration. In this context, businesses must prioritize robust GST billing solutions that enable compliance and improve operational efficiency and competitiveness in an ever-changing business environment.

Introducing CaptainBiz

CaptainBiz stands out as a light of innovation and efficiency in the world of GST billing solutions, providing businesses with a comprehensive platform to traverse the difficulties of GST compliance with simplicity and confidence. CaptainBiz, designed with modern businesses in mind, combines cutting-edge technology, a user-friendly interface, and comprehensive functionality to expedite the entire billing and invoicing process.

-

Efficient GST Compliance

CaptainBiz aims at ensuring easy Goods and Services Tax (GST) compliance for businesses in different sizes and industries. The interface of CaptainBiz is simple while its workflows are guided which makes registration for GST, invoicing, tax filing as well as reconciliation to be easier thus enabling organizations stay compliant with the regulations effortlessly.

-

Feature-rich functionality

CaptainBiz comes with a number of features which have been designed keeping in mind various types of enterprises that operate in today’s fast-paced environment. Every aspect of billing can be optimized using different tools provided by CaptainBiz including generating invoices that comply with GST requirements, inventory control, expenditure tracking and financial reporting among others.

-

Customization and Scalability

CaptainBiz understands that not all organizations are the same hence it offers personalized solutions depending on the needs of each company. Small startups, medium-sized enterprises or large multinational corporations; CaptainBiz grows together with you thereby providing flexibility and agility required for adapting to changes in demand patterns or growth trajectories.

-

Enhanced User Experience

CaptainBiz focuses user experience, making sure that every interaction with the platform is simple, seamless, and enjoyable. CaptainBiz’s user-friendly layout, straightforward navigation, and contextual assistance resources allow users to confidently and efficiently handle complex invoicing processes.

-

Reliable support and updates

CaptainBiz is not only feature-rich and easy to use, but also offers excellent customer service and regular updates that make sure businesses always have access to the latest functionalities, regulatory changes and technical support as required. CaptainBiz is committed to helping its users all the time whether it means fixing problems, clarifying doubts or giving out information on best practices.

Basically, CaptainBiz can be described as a companion towards the achievement of corporate goals rather than merely being GST billing software. By bringing together technological innovation, user-centered design and an unswerving commitment to customer satisfaction, CaptainBiz allows enterprises to deal with the intricacies of GST compliance with confidence, efficiency and peace. Realize what Captainbiz can do for your business today; let it help you reach your maximum potential not only in terms of GST but also in other areas that require adherence to changing regulations.

CaptainBiz vs Free GST Billing Tools.

GST Billing Software Comparison is critical for businesses that want to optimize their invoicing procedures and comply with regulatory regulations. While free GST billing tools appear to be an appealing option due to their low cost, a deeper look exposes substantial discrepancies between these tools and more complete solutions such as CaptainBiz.

Let’s do a comparison of free and premium GST software, as well as advantages of automated GST invoicing to see why CaptainBiz is the better pick.

Comprehensive Features

-

CaptainBiz:

CaptainBiz offers a variety of capabilities that can be adjusted according to the needs of different businesses. It starts from generating GST-compliant invoices, managing stocks, tracking expenses and reporting finances; CaptainBiz does everything required for billing. They have a wide range of features so that organizations will get all tools necessary for effective money management and compliance with regulatory requirements without any efforts.

-

Free GST Billing Tools:

On the other hand, free GST billing software may only offer limited features; most of them being focused on basic invoicing abilities. Although these solutions might suffice for small companies with simple invoice generation needs but lack extra functionalities or customization options demanded by more giant corporations hence making it necessary for enterprises to find workarounds through manual labour or multiple systems in order to achieve their goals.

Customization and Scalability

-

CaptainBiz:

CaptainBiz recognizes that each business is different and therefore provides customizable packages designed to fit particular specifications. This implies that regardless of whether you are starting up your own venture; running a growing business establishment or operating within an industry giant corporation setting – Captain Biz will grow together with your enterprise giving adaptability and quick response capability towards change management as well as growth directionality flexibilities.

-

Free GST Billing Tools:

The scope for customization in free software for GST billing is limited and they may not be suitable for larger firms. When businesses grow bigger and their needs become more complex, the free options might not be enough to handle them properly leading to inefficiencies and compliance problems. Moreover, lack of scalability often forces a switch over to commercial systems which can be inconvenient as well as costly in the long run.

Dependability and Support

-

CaptainBiz:

CaptainBiz believes in reliability and hence provides dedicated customer service throughout. The support staff at CaptainBiz are always ready to help clients have a seamless experience with their services such as troubleshooting technical glitches, answering queries or giving advice on what is considered best practice. Also, every month there are new releases made by CaptainBiz so that people can get access to latest functionalities, features and security updates required by regulatory bodies.

-

Free GST Billing Tools:

Free GST billing software does not offer this kind of assistance therefore leaving customers alone with technology related difficulties or issues relating to conformity. Additionally, these free tools cannot guarantee dependability since they may lack regular updates or security patches; thus exposing organizations to risks like data breaches while also attracting attention from regulatory authorities which could affect company operations.

Data Security and Compliance.

-

CaptainBiz:

CaptainBiz promotes data security and compliance, employing robust security methods to safeguard sensitive financial information. Businesses using CaptainBiz can rest assured that their data is encrypted, backed up on a regular basis, and maintained securely in accordance with industry standards and regulatory regulations.

-

Free GST Billing Tools:

Free GST billing software may jeopardize data security and compliance, exposing organizations to risks such as data breaches, illegal access, and regulatory fines. Businesses that use accessible technologies may be more vulnerable to financial loss if suitable encryption, backup procedures, and compliance measures are not in place.

Why Should You Choose CaptainBiz?

-

Integration Capabilities

CaptainBiz integrates seamlessly with various corporate systems and applications, ensuring that data flows smoothly between platforms. CaptainBiz can link with a variety of third-party solutions, including accounting software, ERP systems, and e-commerce platforms, to expedite corporate processes and increase productivity.

-

Advanced Reporting and Analytics

A product that makes reports and analytics to show the financials of a business, behavior of clients and operational efficiency is produced by an organization. These reports are flexible and draw on current data to enable firms to make sustainable growth-oriented decisions.

-

Compliance with Regulatory Changes

CaptainBiz stays updated on new regulations or changes in GST law thereby helping businesses conform where necessary. This is achieved by informing users about adjustments made on tax rates; filing dates among other compliance needs which can attract penalties if not met as well as dealing with regulatory issues itself.

-

Cost-effectiveness in the long term

Though there may be initial costs involved in setting up CaptainBiz, its features across different areas together with dependability plus support may lead to significant savings over the long run in terms of finances or assets. The software saves manual hours for more productive work within an organization through automation which ensures timely compliance while at the same time minimizing mistakes that would result in higher return on investment eventually.

-

Industry Recognition and Trust

CaptainBiz is recognized as one of the most reliable GST billing solutions used by different businesses in various sectors. It has achieved this reputation through many years of serving happy customers who always leave good reviews hence creating confidence among other current or potential users so that it becomes firmly established within its industry leadership position.

-

Continuous Innovation and Improvement

At all times, CaptainBiz tries to be different and improve itself; this may include upgrading its systems or adding features based on the current market needs and user CaptainBiz reviews. This ensures that companies are provided with state-of-the-art technologies while giving them the best possible answers.

-

Scalability for Future Growth

As businesses expand or change with time, so does the complexity involved in billing processes. CaptainBiz has the ability to scale up; this can allow a company to have more features integrated into its system, add staff members as well as increase support services depending on how many clients it serves vis-à-vis the size of the operation.

Wrapping It Up

The temptation for organizations to go for free GST billing systems due to low start-up costs should not override long-term implications. Choosing GST Billing Tools might work for basic invoicing, they often lack capability functionality reliability support among others. Insecure data storage environments, lack of scalability and poor compliance measures can cost more than benefits gained leading to future problems and losses.

To recapitulate, putting money into CaptainBiz is a tactical move towards the prosperity and continuity of your company, not merely short-term convenience. Act now proactively and tap into the many abilities of CaptainBiz so that your company does not err in GST compliance paving way for a lucrative future.

FAQs

-

What is CaptainBiz?

CaptainBiz is a complete system for billing under GST which optimizes invoicing processes and ensures regulatory compliance. It can do this by GST-compliant invoicing, inventory management, tracking expenses, and generating financial reports.

-

How does CaptainBiz differ from other free GST billing tools?

The difference between CaptainBiz and other free GST billing tools is that it offers enhanced features, more customization options, reliable support as well as better security measures compared to them which are considered limited in terms of their functionalities. It gives priority to such aspects like data protection, adherence with regulations plus user friendliness hence making it ideal for businesses.

-

What are the critical features of CaptainBiz?

GST compliant invoice creation; inventory management feature; expense tracking option; financial report generation tool; capability to customize various settings according to one’s needs or preferences including scalability where necessary; ability for integration with different systems if required such as CRM software etc.; reliability – always available coupled with dedicated customer care support services.

-

Is CaptainBiz appropriate for enterprises of any size?

Yes, it is designed to be used by enterprises regardless of their sizes whether small or large corporations. The reason behind this is that its solutions can easily be adjusted so that they fit specific requirements of each company at various stages of growth.

-

How does CaptainBiz comply with GST regulations?

CaptainBiz maintains up to current on the newest regulatory changes and upgrades, ensuring that businesses comply with shifting GST requirements. It offers GST-compliant invoicing, tax filing support, and frequent updates to maintain compliance.

-

Can CaptainBiz work with other corporate systems or applications?

Yes, CaptainBiz integrates seamlessly with other corporate systems and applications, ensuring that data flows smoothly between platforms. It is compatible with accounting software, ERP systems, e-commerce platforms, and other applications.

-

How does CaptainBiz prioritize data security?

CaptainBiz promotes data protection by employing strong security measures such as encryption, regular backups, and adherence to industry standards. It protects critical financial information from unlawful access and data breaches.

-

What type of assistance does CaptainBiz provide?

CaptainBiz provides professional customer support to help users with technical questions, explanations, and best practices. Its support team offers prompt assistance and guidance to ensure a smooth user experience.

-

Is CaptainBiz cost-effective in the long term?

While CaptainBiz may need an initial investment, its comprehensive features, dependability, and support can result in significant cost savings and efficiencies in the long term. Businesses may optimize their resources, reduce errors, and maintain compliance, resulting in a higher return on investment.

-

How do I get started with CaptainBiz?

To get started with CaptainBiz, go to their website and join up for a demo or free trial. The team will assist with onboarding, customization, and implementation to guarantee a smooth transition and optimize the platform’s benefits.