The Goods and Services Tax Network (GSTN) is an essential part of India’s taxation framework, operating as a non-profit, non-government company. Its primary role involves offering shared IT infrastructure and services to central and state governments, taxpayers, and various stakeholders. GSTN facilitates essential functions like registration, filing of returns, and processing of payments for taxpayers. Essentially, it serves as a critical link between the government and taxpayers, streamlining the tax administration process through technology.

Evolution and Establishment of GSTN

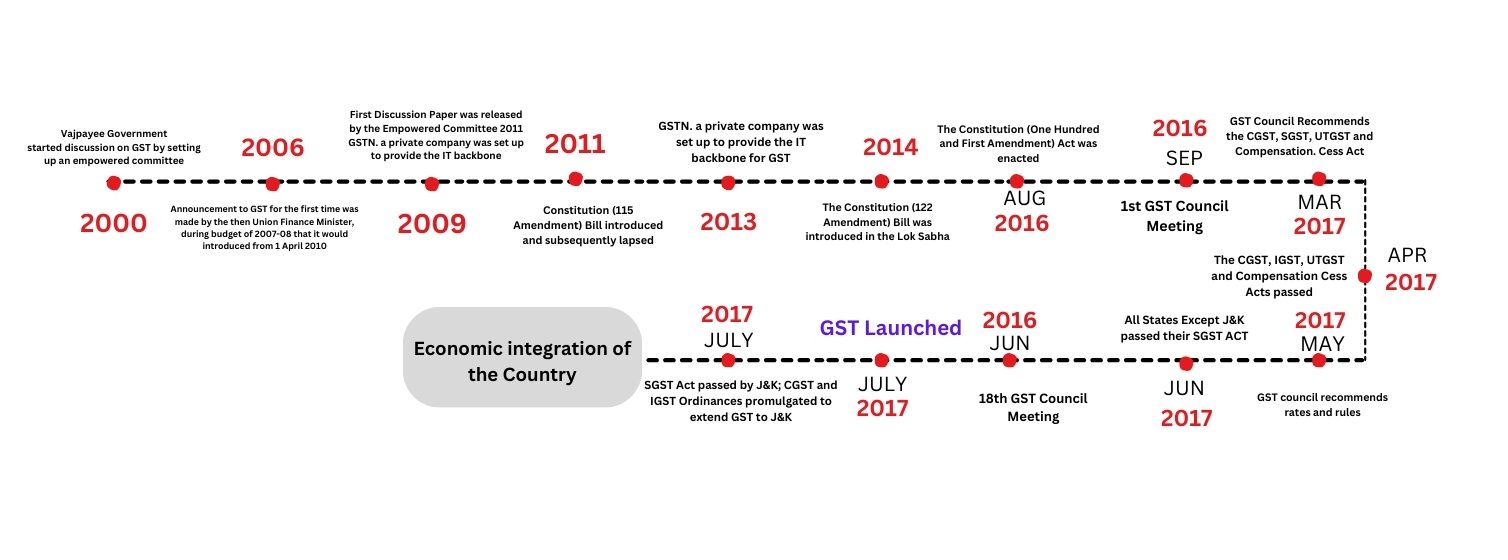

The idea of a nationwide GST in India originated from the Kelkar Task Force on Indirect Taxes in 2000, aiming to replace the fragmented tax system with a unified one. The Empowered Committee of State Finance Ministers laid the groundwork, culminating in the First Discussion Paper in 2009. The Constitution Amendment Bill introduced in 2011, and later the Constitution (122nd Amendment) Bill in 2014, marked key legislative steps. The Bill’s passage through Lok Sabha and Rajya Sabha by 2016, followed by presidential assent, established it as the 101st Constitution Amendment Act, 2016.

Establishment of GST Council and GSTN

The formation of the GST Council and the GST Council Secretariat signified a critical development in the GST framework. The Council, comprising the Union Finance Minister and state representatives, was essential in determining GST’s structure, including tax rates and exemptions. Concurrently, the creation of the GST Network (GSTN) as a not-for-profit company was vital in providing the necessary technological infrastructure for the GST, facilitating taxpayer registration, filing, and payments.

Implementation and Features of GST

GST’s implementation in 2017 marked a significant transformation in the Centre-State financial relationship. The dual structure of GST, encompassing CGST, SGST, and IGST, was a fundamental change. Key features like ‘One Nation, One Tax,’ destination-based taxation, input tax credit, and the Composition Scheme for small taxpayers were introduced. The GST framework also emphasized online compliance, sector-specific exemptions, and anti-profiteering measures, leading to enhanced compliance, transparency, and efficiency in the tax system.

Also Read: The Evolution Of India’s Tax System And GST

Key Entities Involved in Managing GSTN

When it comes to the Goods and Services Tax Network (GSTN), several key entities play crucial roles in its management and operation. Here’s a breakdown of the primary players:

-

Goods and Services Tax Council (GST Council):

- Composition: Union Finance Minister (Chair), Union Minister of State for Finance, State Finance Ministers, and Representatives from Union Territories (without Legislature).

- GSTN Council Roles: Makes policy decisions regarding GST rates, exemptions, and other related matters.

- Impact: Their decisions directly impact GSTN’s functions and regulations.

Also Read: 52nd GST Council Meeting Update: Key Highlights And Decisions

-

GSTN (The Company):

- Ownership: Non-profit company funded by the Central Government and State Governments.

- Structure:

-

- Board of Directors: Headed by Chairperson appointed by the Central Government, includes representatives from Central and State Governments.

-

- GSTN Management Team: Oversees the day-to-day GSTN operations, managing technology infrastructure, user services, data security, and more.

- Role: Develops and operates the GSTN IT infrastructure, facilitates taxpayer registration, return filing, payment processing, and information dissemination.

-

State Tax Departments:

- Role: Responsible for tax administration within their respective states, including taxpayer registrations, audits, assessments, and dispute resolution.

- Functioning: Integrate with the GSTN infrastructure for data exchange and enforcement activities.

-

Authorized GST Suvidha Providers (GSPs):

- Role: Act as intermediaries between taxpayers and the GSTN system.

- Services: Provide software for preparing and filing GST returns, managing invoices, and interacting with the GSTN portal.

- Regulation: Licensed and monitored by the GSTN.

-

Taxpayers:

- Types: Businesses, individuals, and other entities registered under GST.

- Responsibilities: File GST returns, make tax payments, maintain records, and comply with GST regulations.

-

Additional stakeholders:

- Banks and financial institutions: Facilitate GST payments and provide related services.

- Professional bodies: Chartered Accountants, tax consultants, and other professionals advise taxpayers on GST compliance.

Effective GSTN Management requires close collaboration and coordination between all these entities. Each group plays a vital role in ensuring the smooth functioning of the GST system and facilitating efficient tax administration.

Governance Structure of GSTN

The GSTN Governance structure is meticulously crafted to uphold transparency and accountability in managing India’s vast tax infrastructure. It incorporates a range of entities, each with defined roles and responsibilities, working cohesively to streamline the tax process and facilitate compliance. This structure is pivotal in maintaining the integrity and efficiency of the GST system, ensuring that it functions smoothly for the benefit of all stakeholders involved. Here’s a simplified breakdown of how it operates:

Apex Body – Goods and Services Tax Council

The Goods and Services Tax Council, led by the Union Finance Minister, is the highest authority in the GSTN Governance structure. This council, which includes State Finance Ministers and Representatives from Union Territories without Legislature, plays a pivotal role in setting the strategic direction for GSTN. It is responsible for key decisions like tax rates, exemptions, law amendments, and guidelines for GSTN’s operational and technological aspects.

Operational Oversight – GSTN Board of Directors

The GSTN Board of Directors, comprising 14 members, is responsible for the network’s overall management and performance. This board includes representatives from the Central and State Governments, as well as Independent Directors. Their responsibilities encompass major policy decisions, financial planning, and the appointment of the CEO and other key executives.

Day-to-Day Management – GSTN Executive Team

The executive team, led by the CEO, is responsible for the daily GSTN Operations. This includes managing IT infrastructure, supporting users, ensuring data security, and system upgrades. The team also liaises with various stakeholders, including taxpayers, the GST Council, and State tax departments, to ensure smooth operations and compliance.

Integral Role – State Tax Departments

State Tax Departments are integral to implementing and enforcing GST within their respective states. They are responsible for tasks such as taxpayer registration, audits, and dispute resolution, and work in tandem with the GSTN for data exchange and administrative functions.

Support Entities – Authorized GST Suvidha Providers

Authorized GST Suvidha Providers (GSPs) are private entities licensed by GSTN to assist taxpayers. They provide essential services like software for GST return filing, invoice management, and interaction with the GSTN portal, acting as a crucial link between taxpayers and the GSTN system.

Evolution of Ownership

The ownership of GSTN has evolved over time. Initially, it was a non-profit company with 51% ownership by private financial institutions and 49% by the Central and State Governments. However, in June 2022, the ownership structure was revised, making GSTN a fully government-owned company, with an equal 50% shareholding by the Central Government and the State Governments & UTs.

Governance Principles

GSTN Governance is underpinned by key principles like collaborative governance, transparency and disclosure, professional management, and technological agility. These principles ensure a balanced approach, fostering participation, accountability, and efficiency in the functioning of the GST system.

Functions and Operations Handled by GSTN

GSTN handles a wide range of functions and operations, all aimed at making the tax system more efficient and taxpayer-friendly:

- Registration: GSTN manages the registration process for taxpayers. It ensures that businesses are registered under the appropriate tax categories.

- Return Filing: GSTN facilitates the filing of GST returns, a crucial aspect of tax compliance. It provides an online platform for taxpayers to submit their returns.

- Tax Payment: Taxpayers can make payments through the GSTN portal, making it convenient and hassle-free.

- Invoice Matching: GSTN plays a pivotal role in reconciling invoices between the buyer and seller. This ensures accurate tax calculations.

- Data Management: The network stores and manages taxpayer data securely, adhering to strict privacy and security protocols.

Challenges Faced by GSTN Management

While the Goods and Services Tax Network (GSTN) has greatly improved tax administration in India, it still faces a range of challenges. These issues test the system’s resilience and effectiveness, requiring ongoing attention and innovative solutions. Here are some of the challenges faced by the GSTN:

- Technical Glitches: GSTN often encounters technical issues, such as system slowdowns or errors. These glitches disrupt tax filings and payments, causing inconvenience to users. Continuously upgrading and maintaining the system to handle large transaction volumes remains a key challenge.

- Taxpayer Education: Many taxpayers, particularly small businesses, find it challenging to navigate the complexities of GST. GSTN’s ongoing task is to simplify the process and provide clear guidance, helping these businesses to understand and comply with GST regulations effectively.

- Compliance: Ensuring consistent compliance with GST rules is a significant challenge. GSTN must monitor a diverse range of businesses and enforce regulations while balancing fairness and efficiency in its approach.

- Data Security: With vast amounts of sensitive information, data security is crucial for GSTN. Protecting taxpayer data against cyber threats and ensuring confidentiality is an ongoing priority, demanding constant vigilance and updates to security measures.

In Conclusion

The Goods and Services Tax Network (GSTN) stands as a cornerstone in the architecture of India’s taxation framework. Its commitment to streamlining tax administration and bolstering compliance has been instrumental in reshaping the country’s economic narrative. Backed by a robust governance structure and diverse functionalities, GSTN has significantly eased the tax process, benefiting numerous stakeholders in the nation’s financial ecosystem. Despite facing various challenges, GSTN’s continual evolution and adaptive strategies demonstrate its resolve to forge a more efficient, accessible, and user-centric tax environment in India, thereby contributing profoundly to the nation’s economic progress and stability.

Also Read: GSTN Portal Enhancements For GSTR

Frequently Asked Questions (FAQs)

-

What is GSTN Management?

GSTN Management refers to the administrative team responsible for overseeing the day-to-day GSTN Operations. This includes managing IT infrastructure, ensuring smooth taxpayer services, maintaining data security, and implementing system upgrades. They play a crucial role in keeping the GST system functional, secure, and user-friendly for all stakeholders.

-

How does GSTN Governance work?

GSTN Governance involves a structured framework ensuring transparency and efficiency in the GST system. It includes various levels, such as the GST Council, Board of Directors, and Management Team. Each entity has distinct responsibilities, from policy-making to operational management, working collaboratively to maintain and enhance the GSTN’s effectiveness.

-

What are the primary GSTN Operations?

The primary GSTN Operations consist of managing and maintaining the IT backbone for the GST system. This includes handling taxpayer registration, processing returns, ensuring timely tax payments, and providing IT support. These operations are vital for the smooth functioning of India’s taxation system and facilitating taxpayer compliance.

-

Who is in the GSTN Board of Directors?

The GSTN Board of Directors comprises 14 members, including representatives from the Central and State Governments, Independent Directors, and the CEO of GSTN. They oversee major policy decisions, financial management, and appoint executives, ensuring the network operates efficiently and aligns with national tax objectives.

-

What roles does the GSTN Council perform?

The GSTN Council, headed by the Union Finance Minister, includes State Finance Ministers and UT representatives. It acts as the decision-making body for GST-related matters, setting tax rates, exemptions, and policies. Majorly, the GSTN council roles involve guiding the overall strategic direction of GSTN, influencing its operations and governance.

-

How is GSTN Management different from its Board of Directors?

GSTN Management, led by the CEO, focuses on the network’s daily operations, such as IT infrastructure and taxpayer services. In contrast, the GSTN Board of Directors, which includes government and independent members, oversees broader policy decisions, financial planning, and strategic management, providing guidance to the Management team.

-

What challenges does GSTN Management face?

GSTN Management faces challenges like addressing technical glitches, educating taxpayers, ensuring compliance, and maintaining data security. These tasks require constant monitoring, upgrades, and effective communication strategies to keep the GST system running smoothly and securely.

-

How does the GSTN Board of Directors impact operations?

The GSTN Board of Directors significantly impacts operations by making key policy decisions, approving budgets, and overseeing the network’s strategic direction. Their decisions directly influence how GSTN functions and adapts to changing tax environments, ensuring its alignment with national economic goals.

-

How does the governance structure of GSTN work?

GSTN governance is multi-layered, including the GST Council, Board of Directors, and Management Team. This structure ensures balanced decision-making, with the Council setting policies, the Board managing strategic decisions, and the Management Team handling operational tasks, all working in unison for efficient tax administration.

-

What role does GSTN play in India’s taxation system?

GSTN plays a pivotal role in India’s taxation system by providing a technologically advanced platform for seamless tax administration. It facilitates taxpayer registration, return filing, and payment processing, thus ensuring efficient tax collection and compliance. Its efficient operation is crucial for the smooth execution of the GST framework in the country.