Introduction

Goods and Services Tax (GST) is a significant element in Indian business, simplifying taxation by consolidating smaller taxes into a comprehensive system. For businesses, adherence to the GST registration criteria is essential, triggered when income or turnover crosses a defined limit. This ensures businesses contribute to government revenue, streamlining the taxation process. Understanding the diverse types of GST and the applicable GST threshold is crucial for businesses entering the GST framework. Manufacturers, a vital segment, should comprehend the impact of GST on their operations as it influences pricing, supply chains, and compliance. The concept of Place of Supply under GST determines where a transaction is considered to occur for tax purposes, affecting applicable GST rates and revenue distribution between central and state governments. A holistic understanding of these aspects empowers businesses to navigate the GST landscape effectively.GST Registration

-

Who Needs to Register:

- Understanding the Threshold: First, figure out if your business has crossed the turnover threshold that requires GST registration. This threshold varies for different types of businesses.

- Check Eligibility: Check, if your business is eligible for GST registration based on the rules in place.

-

Eligibility Criteria:

- Determine Eligibility: Before registration process, confirm that your business meets the eligibility criteria. This usually revolves around the annual turnover exceeding the prescribed limit.

- Verify Business Type: Different types of businesses may have specific eligibility conditions. Verify that your business type aligns with the criteria outlined for GST registration.

-

Documents Needed:

-

- Proof of Identity: Collect documents that serve as proof of your business’s identity. This might include PAN card, Aadhar card, or registration certificate.

- Address Proof: Gather documents verifying the business address. This could be utility bills, rent agreement, or property documents.

- Details of Authorized Person: Have details of the person authorized to handle GST matters in the business. This includes their identification and address proof.

- Financial Documents: Keep financial documents, such as bank statements and audited accounts, ready for submission.

- Business Entity Proof: Depending on your business structure, provide proof of the entity, like partnership deed or registration certificate.

- Photographs: Keep recent passport-sized photographs of the business owner or authorized signatory.

-

Registration Process:

- Visit the official GST portal.

- Fill out the GST registration form with accurate details about your business, including its name, address, type, and turnover.

-

Submission and Verification:

-

Verification of Documents:

-

Getting a GST Number:

-

Acknowledgment Certificate:

-

Compliance:

-

Ongoing Responsibilities:

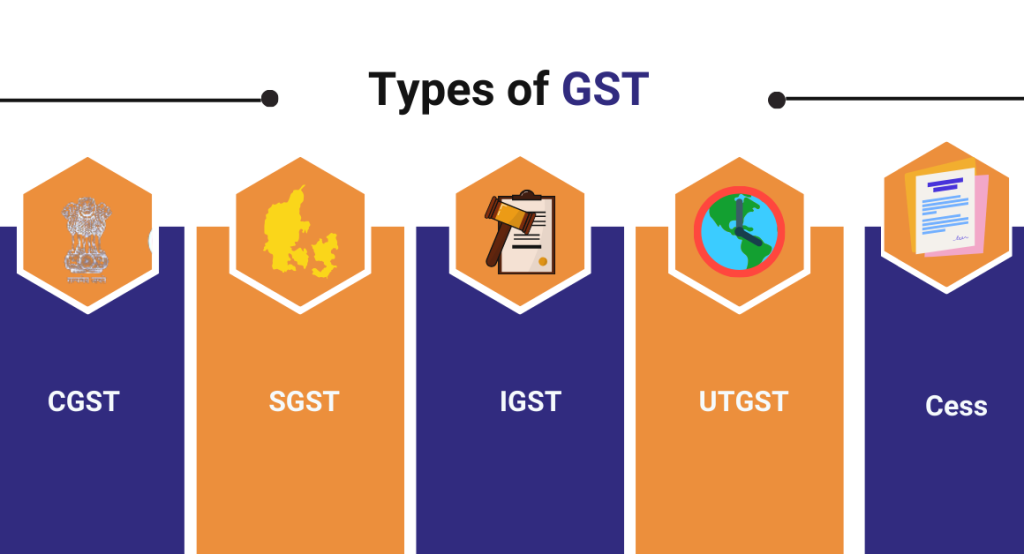

Types of GST

GST is not a single tax but is divided into multiple types. The most common types are Central Goods and Services Tax (CGST), State Goods and Services Tax (SGST), and Integrated Goods and Services Tax (IGST). This section may elaborate on the different types of GST and their respective applications.

GST is not a single tax but is divided into multiple types. The most common types are Central Goods and Services Tax (CGST), State Goods and Services Tax (SGST), and Integrated Goods and Services Tax (IGST). This section may elaborate on the different types of GST and their respective applications.

-

Central Goods and Services Tax (CGST):

-

State Goods and Services Tax (SGST):

-

Integrated Goods and Services Tax (IGST):

-

Union Territory Goods and Services Tax (UTGST):

-

Cess:

Threshold for GST Registration

The threshold in GST is like a financial milestone for businesses. It’s a set limit on how much money a business can make before it has to officially register for GST. Different types of businesses have different threshold amounts. Knowing the threshold is crucial because it tells businesses when they’ve reached a point where they must start dealing with GST. It’s a signal that the business has grown to a size where it needs to be part of the tax system. To figure out the threshold for your business, you need to check the rules based on your business type. Different businesses have different thresholds, and these can change. Keep an eye on your business turnover – the total money it makes – and compare it with the specified threshold for your business type. Here’s the details:| Aggregate Turnover | Registration Required | Applicability |

| Earlier Limits – For the sale of Goods/Providing Services | ||

| Exceeds Rs.20 lakh | Yes – For Normal Category States | Up to 31st March 2019 |

| Exceeds Rs.10 lakh | Yes – For Special Category States | Up to 31st March 2019 |

| New Limits – For Sale of Goods | ||

| Exceeds Rs.40 lakh | Yes – For Normal Category States | From 1st April 2019 |

| Exceeds Rs.20 lakh | Yes – For Special Category States | From 1st April 2019 |

| New Limits – For Providing Services | ||

| There has been no change in the threshold limits for service providers. Persons providing services need to register if their aggregate turnover exceeds Rs.20 lakh (for normal category states) and Rs.10 lakh (for special category states). | ||

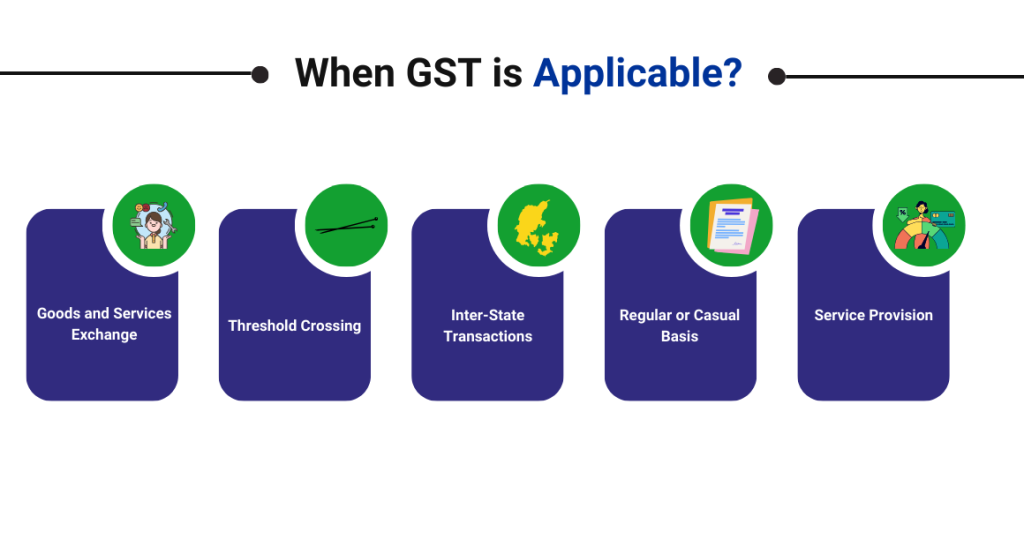

When GST is Applicable

GST is applicable in various ways; however, below are a few key scenarios where businesses need to consider its implications.

GST is applicable in various ways; however, below are a few key scenarios where businesses need to consider its implications.

-

Goods and Services Exchange:

-

Threshold Crossing:

-

Inter-State Transactions:

-

Regular or Casual Basis:

-

Service Provision:

Impact of GST on Different Business Types

Different businesses may be affected differently by the implementation of GST. This section might discuss how GST impacts various types of businesses, such as manufacturing, trading, and service-oriented and others.-

Manufacturing Businesses:

-

- GST simplifies tax for manufacturing, reducing taxes on raw materials and making final products more competitively priced.

-

-

Trading Businesses:

-

- Trading businesses enjoy smoother interstate trade as GST integrates taxes, eliminating the complexities of multiple state taxes.

-

-

Service-Oriented Businesses:

-

- GST brings uniformity to service taxation, replacing the earlier service tax and simplifying the taxation of various services.

-

-

Small Businesses:

-

- Small businesses benefit from the composition scheme, simplifying tax payments and reducing compliance burdens, fostering ease of doing business.

-

-

Consumer Impact:

-

- Consumers often see reduced prices due to GST, ensuring transparency and competitiveness in the market by eliminating multiple taxes.

-

-

Digital Businesses:

-

- Digital businesses, especially in e-commerce, benefit from a standardized tax system, ensuring equality with traditional transactions.

-

-

Logistics and Transportation:

-

- The logistics and transportation sector benefits from the removal of state entry taxes, leading to smoother movement of goods across state borders and reducing transit time and costs.

-

Time of Supply under GST

Time of Supply under GST is about pinpointing when a business needs to pay taxes on its transactions. It’s crucial for businesses to understand this as it helps them comply with GST regulations accurately and on time. The time is determined by factors like the date of the invoice, date of payment, and date of receipt, with the earliest triggering the tax liability. This concept acts like a timeline, guiding businesses on when to fulfill their tax responsibilities, making the GST system operate smoothly. Also read: Understanding GST Time Of Supply For Goods And ServicesPlace of Supply under GST

Place of Supply under GST is like figuring out where a sale happened for tax purposes. It’s important because it decides the right tax rates and which government—central or state—gets the tax money. Understanding this helps avoid confusion and ensures fair taxes. Specific rules in GST laws determine the Place of Supply. Knowing this helps apply the correct GST rate—whether CGST and SGST or IGST—based on where the sale took place. This makes sure tax money is shared fairly between central and state governments, making the GST system work better.Conclusion

In conclusion, we talked about how GST affects businesses. We looked at registering, different types, and when it applies. It’s important because it impacts various businesses and makes taxes simpler. Knowing when and where transactions happen for taxes is also crucial. Overall, businesses need to follow GST rules to fit into the tax system smoothly.FAQ’s

-

What is GST?

-

How do I register for GST?

-

What are the different types of GST?

-

When do I need to register for GST?

-

When exactly is GST applicable for my business?

-

How does GST impact different businesses?

-

What is Time of Supply under GST?

-

What is Place of Supply under GST?

-

How does GST affect consumers?

-

Can small businesses benefit from GST?

Understand GST applicability and simplify your compliance with CaptainBiz.

Anjali Panda

Senior Content Writer

Anjali Panda, a skilled wordsmith and literature enthusiast, earned her bachelor's degree in English Language and Literature from KiiT University. Her Highest Qualification Holding an MBA in Finance, she effortlessly blends academic knowledge with practical insights in her finance-centric content. Presently, Anjali is leveraging her financial expertise at BitWale, a startup, where she plays a pivotal role in optimizing the company's overall financial operations