An invoice is generally a commercial instrument a seller issues to the buyer. It contains details about trading parties, goods, items, price, date of shipment, mode of transport, discounts, and other payment and delivery terms. In most cases, the invoice is considered as a demand for payment of supplying goods or services. It becomes a document of title when the payment is made in full.

As per the GST regimen in India, a tax invoice is described in section 31 of the CGST Act, 2017. Sellers registered as GST taxpayers must issue a tax invoice, a bill of supply, or both for selling taxable goods and services. In this blog, you will learn about the correct tax invoice issuance process to ensure GST compliance.

GST Tax Invoice Applicability

Understanding when a GST tax invoice is applicable is essential for business owners. There is a minimum threshold that your business must meet to become a GST-registered taxpayer. If you don’t meet the threshold, there is no need to issue a tax invoice. This means that unregistered suppliers are not allowed to collect GST tax. If you are not registered as a GST taxpayer, you must not issue a tax invoice and collect GST. There is no specific format for unregistered suppliers. You can choose an invoice format as you wish. There is no need to submit GST returns if you are not a registered business.

GST registration is essential for businesses in the manufacturing sector with a turnover of more than Rs. 40 lakh and in the service sector with a turnover of more than Rs. 20 lakh. The GST Act defines different types of invoices and bills. The type of bill to issue depends on the category of the registered person.

When a GST-registered supplier sells taxable goods or services, they must issue a tax invoice. If the taxpayer supplies exempted goods or is registered under the composition scheme, they must issue a bill of supply instead of a tax invoice. The invoice or bill of supply contains details about the products, price, quantity, value, supplier, buyer, etc. There is no need to issue a bill of supply or invoice if the value of the supply is less than Rs. 200.

GST Tax Invoice Issuance Procedure

Commercial businesses must pay the commercial GST tax if they meet the GST taxing requirements. The GST tax invoice issuance procedure is fairly simple:

- Generate tax invoice for all taxable goods and services

- For supplying goods, issue tax invoices at the time of supply or at the time of removal of goods when they must be transported

- For supplying services, issue a tax invoice within 30 days of providing service

- Banks, financial institutions, insurance companies, etc, have a time limit of 45 days

- Create 3 copies of tax invoice for supplying goods – Original for the recipient, duplicate for the transporter, triplicate for the supplier

- Create 2 copies of tax invoice for supplying services – Original for the recipient, duplicate for the supplier

- Issue bill of supply for supplying exempted goods or services or under composition scheme

- Issue receipt voucher for receipt of advance payment

- Issue refund voucher if supply is not made against the advance payment

- If tax charged and taxable value are higher than what is mentioned in the tax invoice, issue a credit note

- Issue credit note for the return of goods by the recipient

- If tax charged and taxable value are lower than what is mentioned in the tax invoice, issue a debit note

- Issue payment voucher if the person must pay tax on a reverse charge basis

- Transporters only transporting goods must issue delivery challan including all details of tax invoice

Your customers also require you to generate a tax invoice because only with a tax invoice can they claim ITC. They can use the ITC to offset their GST liabilities. However, customers cannot claim ITC if the invoices are supplied 30 days after the supply.

How to Issue a Tax Invoice for an Unregistered Customer?

Many times, suppliers supply goods and services to both GST-registered and unregistered customers. Irrespective of the type of your customer, if you are a GST-registered taxpayer, you must issue a tax invoice. For supplying taxable goods, you are eligible to collect GST from the buyer. In that case, you must issue a tax invoice, which serves as proof that you have made the supply and collected the GST. In that case, you must submit the collected GST tax to the government.

The buyer is an unregistered business, so they cannot claim Input Tax Credit (ITC). The invoice will serve as proof of transaction for them, and they must pay for the price of the goods along with the GST. Generally, the B2C invoices are comparable to suppliers supplying goods to unregistered customers.

While issuing tax invoices for unregistered customers, you need not mention the GSTIN of the customer. You only need to mention the name and address of the recipient in your tax invoice. Even if the buyer is an unregistered customer, you must submit your invoices to the GST portal and include invoice details in GSTR 1, as you are liable to pay the collected GST.

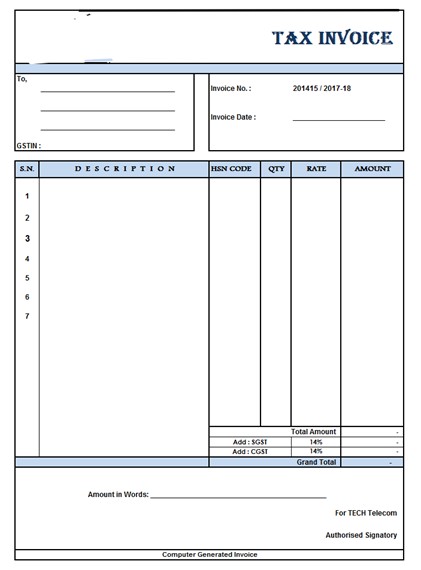

Tax Invoice Issuance Process for Small Businesses

Small businesses that are registered under GST must supply a tax invoice with the following details:

- Name, address, and GSTIN of the supplier

- Consecutive unique serial number of invoice

- Date of invoice issue

- Name, address, and GSTIN or UIN of the recipient (if registered )

- Name and address of recipient and delivery address

- HSN code of goods/accounting code of services

- Description of supplied goods or services

- Quantity

- Total value

- Taxable value

- Rate of tax

- Amount of tax charged

- Place of supply

- Whether tax is payable on a reverse charge basis

- A digital signature or signature of the supplier or his representative

If necessary for your business, you can add other details to the invoice. You can include any delivery or payment terms. For example, you can include a QR code for your business account so that the recipient can scan the code and make the invoice payment. You can personalise the tax invoice, including your business name and logo.

Manually preparing a GST tax invoice is time-consuming, and you may enter the wrong details. Using GST billing software like CaptainBiz will simplify this process for you. The invoice details will be auto-populated from the masters, leaving no room for errors. When you issue a digital invoice to your recipient, there is no need for a supplier’s signature.

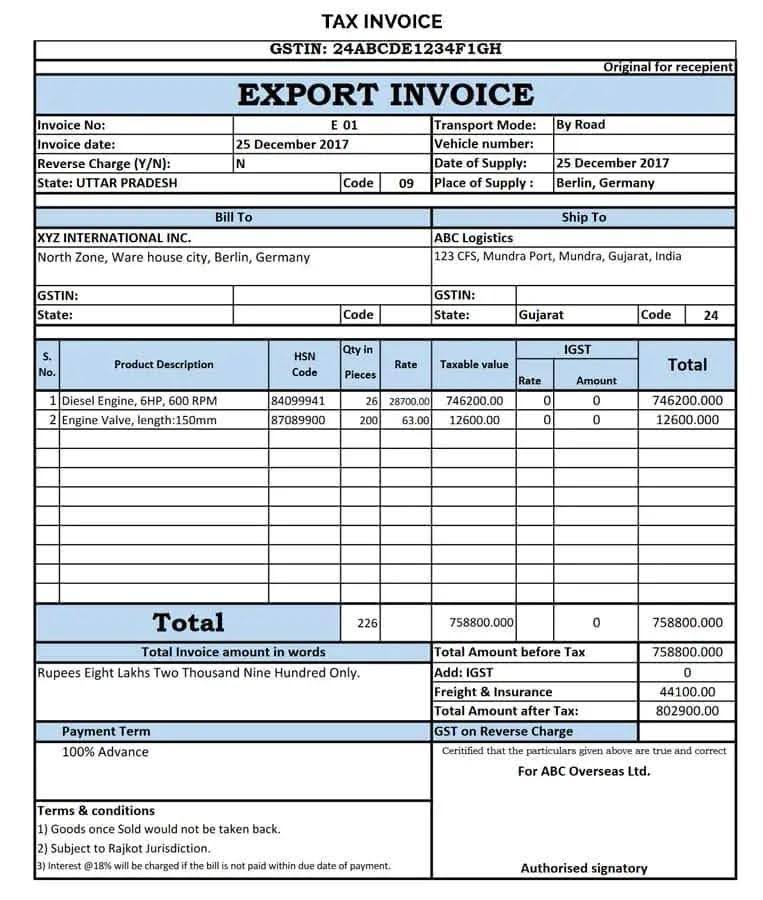

Tax Invoice Issuance Process for Exporters

GST export invoice must be issued when you supply goods for your customers outside of India. It is very similar to the GST tax invoice, but it will include additional details. A GST-registered supplier can supply within and outside of India.

The export invoice must include the following details:

- Name, address, and GSTIN of supplier

- Unique invoice number

- Date of invoice issue

- The due date for payment

- Name, billing address, and shipping address of the recipient

- The place of supply must be “Outside India”

- Type of export – Export under Bond/LUT, Export with IGST, or SEZ with IGST

- Shipping bill information

- Conversion rate between INR and the selected currency of your customer

- Item details

- Quantity

- Description

- The tax rate for each item

- Signature of supplier or authorised person

- The total value of the bill in both INR and foreign currency

Depending on your export negotiations, you can issue a tax invoice in INR only or in INR and foreign currency. The type of export mentioned above is vital for exporters. Under Bond/ LUT, suppliers supply under bond or letter of undertaking, and they don’t pay IGST. They can claim a refund of unutilised ITC on purchasing inputs for the supply.

Export with IGST allows exporters to collect IGST. They can claim a refund on IGST. SEZ exports are considered as zero-rated supply. In that case, no IGST needs to be paid. These changes are made in the GST rules to allow Indian exporters to conduct export operations seamlessly. The burden of tax is lowered to boost Indian exports.

Conclusion

GST-registered businesses must understand the tax invoice issuance process correctly to ensure they generate the correct type of tax invoice. Based on the type of supply, different types of GST bills can be generated. Knowing the correct GST invoice to generate is crucial to ensure compliance. If your tax invoice doesn’t include mandatory details, it will be rejected and become invalid. An automated GST billing software will auto-populate your GST forms with invoice details for seamless filing of GST returns.

CaptainBiz is a comprehensive automated GST billing software ideal for all GST-registered businesses. Whether you supply goods or services or are an exporter, you can use the platform to generate GST-compliant invoices and bills within a few minutes using the templates. Customise your invoice to include specific business details and seamlessly submit GST returns accurately.

FAQs

-

Is the tax invoice the same as the e-invoice?

If your business meets the requirement for e-invoice generation, you must upload the tax invoice to the IRP portal and generate IRN. The IRP system verifies and validates invoices, generates a QR code, and returns a JSON file. You can upload this JSON file to your billing tool and issue an e-invoice. For mandated businesses, e-invoice is the only valid tax invoice. If an e-invoice is mandated for your business, you cannot issue a tax invoice without IRN.

-

Can I issue a GST tax invoice for service before providing services?

Yes, if you supply services, you can issue a GST tax invoice before providing services. You have 30 days time to submit your invoice to your recipient. Otherwise, your customer cannot claim ITC.

-

What will happen if I don’t issue a tax invoice?

If you are a GST-registered business and supply taxable goods, you must generate a tax invoice. Otherwise, it will be considered as tax evasion or fraud. In that case, you will be penalised. Based on the tax amount and severity of the offence, you must pay the penalty or face prosecution.

-

Can I issue a GST tax invoice for exports?

A GST tax invoice for exports is called an export invoice. It includes additional export details that must be present. Only then the customs authorities will clear your goods for export. You cannot export goods with an exclusive and unique GST export invoice.

-

Is a signature required for the GST tax invoice?

If you print your GST invoice or issue a manual GST tax invoice, you must provide a signature. You can also attach a digital signature to your electronic invoice. However, a signature or digital signature is not mandatory if you issue a GST tax invoice digitally. The GST Act allows you to issue a tax invoice digitally. So, you can use a billing tool like CaptainBiz to email the digital tax invoice to your customer. There is no need to sign it.