There are several possibilities when it comes to the best strategies for investing in India. To select the finest investment plans for your portfolio, classify your financial goals into three categories: long-term, medium-term, and short-term.

This will give you an estimate of how much time you have to attain your goal. Then, you can select from the available options based on your risk level and personal goals.

What is an Investment Strategy?

The phrase “investment strategy” refers to ideas enabling individual investors to achieve their financial and investment objectives. This plan guides investors’ decisions based on their goals, risk tolerance, and future capital requirements. Investment strategies can range from modest (a low-risk strategy emphasizing asset protection) to very aggressive (seeking quick growth through capital appreciation).

Investors can use these ideas to build portfolios or work with a financial professional. Strategies are not static; thus, they must be reconsidered when conditions change.

Investment Options in India

Investment alternatives in India are classified as high, low, and medium-risk based on the level of risk and prospective rewards. Let us examine each sort of investment in detail:

Low-risk investments:

Low-risk investments have zero risk or very low risk. They provide consistent returns, which are usually the guaranteed return on investment. These types of investments are ideal for risk-averse individuals seeking assured profits. Fixed deposits, Public Provident Funds, and Sukanya Samridhi Yojana are all examples of low-risk investments.

Medium risk investments:

Medium-risk investments are slightly riskier than low-risk investments. They are excellent for investors who want a portfolio that balances growth and stability. Debt funds, corporate bonds, and government bonds are medium-risk investments.

High-risk investment:

High-risk investments are typically market-linked and involve higher degrees of risk. They aim to provide larger future returns, albeit with severe volatility and unpredictability. They are appropriate for investors who are willing to take on more risk and seek to profit from market swings. Stocks, mutual funds, and Unit-Linked Insurance Plans are all instances of high-risk investments.

Why Should You Begin Investing Early?

Starting to invest at an early age allows you to take advantage of the long-term investment horizon to its maximum potential. With age on your side, you can take a more aggressive approach to your financial strategy. Even if something goes wrong, you will have enough time to recover and make a profit. As a result, getting started early is critical for capitalizing on investment opportunities.

Effective Investment Strategies

Consider several investing options that allow you to pre-define your investment allocation between equities, corporate bonds, government securities, and debt funds.

Mutual Funds

If you have a long-term investment perspective, you may use the power of compounding by investing in mutual funds. Furthermore, you do not require market knowledge.

Fund managers professionally manage mutual funds with a proven track record of overseeing investment portfolios. Since you are a youthful investor, you can invest in equity funds, which are known to provide outstanding long-term returns.

Hybrid and debt funds are also good options, but investing in them will limit your gains. If you want to save taxes, consider investing in an equity-linked savings scheme (ELSS).

These funds are covered by Section 80C of the Income Tax Act of 1961, which permits you to save up to Rs 46,800 in taxes each year. ELSS mutual funds are unique in providing tax benefits and asset building.

Stock Markets: Direct Equity

Investing in stock markets offers any investment strategy’s most significant potential returns. With your age on your side, you can invest for the long term. This will address market volatility and benefit you in the long term.

To invest in stock markets, you must have market knowledge. Investing in stock markets without market expertise is equivalent to gambling. If you had invested Rs 55,000 in Eicher Motors (the manufacturer of Enfield motorcycles) in 2001 (at Rs 17.50 per share), your investment would now be worth Rs 4.75 crore! Such is the power of the stock market.

Equity Mutual Funds

Equity Mutual Funds invest primarily in stocks. These funds let you diversify your assets across several stocks. Most significantly, these funds are managed by competent investment managers. So they only invest your money after conducting thorough investigation. As a result, it improves your chances of making strong long-term profits.

Equity mutual funds are not tax deductible. However, if you have invested in ELSS, you can claim a tax deduction of up to Rs 1.5 lakh every fiscal year. Capital gains from equity funds are taxable.

Short-term capital gains (STCG) will be taxed at 15%, while long-term capital gains (LTCG) will be taxed at 10% if they exceed Rs 1 lakh.

NPS

The National Pension System (NPS) is a long-term retirement-oriented investment vehicle. It combines assets such as shares, government bonds, and corporate bonds.

Depending on your risk tolerance, you can select how much of your money to invest in various asset classes. The benefits are:

- You can deduct up to Rs 1.5 lakh under Section 80CCD(1), plus an extra Rs 50,000 below Section 80CCD(1B).

- If your employer additionally contributes to your NPS, you are eligible for a deduction of up to 10% of your basic salary under Section 80CCD(2).

- These deductions are exclusively available for Tier 1 accounts; there is no deduction for Tier 2 accounts.

Bank Deposits

Bank deposits are for individuals who are unwilling to take any risks. However, low-risk investments yield modest profits. If you have a lump sum available, you can invest in fixed deposits. Fixed deposit interest rates are quite attractive and can amass a significant sum if invested for an extended period of time.

If you can invest a predetermined amount on a regular basis, such as monthly or quarterly, you can make a recurring deposit. It is essential to realize that bank deposits never match the potential profits of mutual funds and stock markets.

Real estate

It is undoubtedly one of the most popular investment options for Indians. Nonetheless, while property investments have historically produced excellent returns, they are not without risks and restrictions.

One of the primary risks of real estate is that you may be unable to sell it quickly. In addition, if you need to sell the home soon, you may have to offer a steep discount.

Rental income earned from real estate is taxed according to the income bracket. However, it also provides tax advantages such as mortgage loan interest, property taxes, and so on. Long-term capital gains from real estate can also receive favorable tax treatment.

Government schemes

You can invest in a number of government schemes. The Public Provident Fund (PPF) is the most widely used government savings vehicle. It has a 15-year lock-in period and provides annual returns of 7-9%. Aside from that, you can invest in National Savings Certificates (NSCs) and Voluntary Provident Funds.

Unit-Linked Insurance Plans (ULIPs)

These programs provide both insurance coverage and long-term asset creation returns. It is regarded as an excellent choice for those who are willing to take moderate to high risks. The investments made in a ULIP are divided into two parts:

- Premium for life insurance coverage

- Capital investments in debt and equity funds.

The key to being wealthy is to start investing at an early age. This will allow you to save a significant amount of money over time, which you can use to achieve a variety of goals.

Public Provident Fund (PPF)

PPF is a government-sponsored scheme that pays a guaranteed interest rate. It is the most common long-term savings plan for retirement, but it can also be used for other purposes.

The lowest investment amount is Rs 500, with a maximum of Rs 1.5 lakh per fiscal year.

PPF investments are eligible for a Section 80C deduction of up to Rs 1.5 lakh. It falls into the EEE (Exempt-Exempt-Exempt) category, which implies that the investment, interest generated, and maturity funds are tax-free.

Sukanya Samriddhi Account(SSA)

Sukanya Samriddhi Account is a government-backed savings system that guarantees a return on your investment. This project was developed on the premise of the Beti Bachao Beti Padhao Abhiyan to promote girl child welfare and education.

The minimum investment is Rs 250, and the maximum investment amount is Rs 1.5 lakh every fiscal year.

Section 80C allows a deduction of Rs 1.5 lakh. It falls under the EEE category, which implies that the investment, interest earned, and maturity amount are tax-free.

Kisan Vikas Patra(KVP)

Kisan Vikas Patra is another small savings initiative approved by the Indian government that provides a guaranteed return on investment. This initiative intends to encourage long-term investment, particularly in rural areas.

When your investment doubles, you will have reached maturity. The government declares the maturity period based on the current interest rate. Not qualified for a Section 80C tax deduction. Interest paid is taxed based on your income tax status.

Sovereign gold bonds (SGB)

India’s RBI issues sovereign gold bonds on an ongoing basis. It is an alternative to a real gold investment. Although the returns are linked to the price of gold and guaranteed by the Government of India, no physical gold is used as an underlying asset.

The minimal investment is the cost of one gram of gold. However, you can only deposit up to the price of 4kg gold per fiscal year. For trusts, the price is 20kg gold.

The maturity amount received after eight years is entirely tax-free. However, interest earned on SGBs is taxable at the slab rates.

Also Read: Understanding Financial Planning and Tax Saving Investment Plans – Financial Year

The Future of Investment Strategy

The investment landscape is continuously changing, driven by technological breakthroughs and shifting market dynamics. Anticipating future trends and implementing creative techniques is critical to remain ahead.

Predicting Future Trends in the Investment World

As technology continues to disrupt traditional investment strategies, staying ahead of emerging trends is critical. Artificial intelligence, machine learning, and big data analytics are transforming investing decisions. Understanding and adopting developing technology into your investment strategy will improve your capacity to identify hidden opportunities and make sound investment decisions.

The Impact of Technology and Data Analytics on Investment Decisions.

Technology and data analytics have become critical tools for investing professionals. The ability to evaluate massive amounts of data in real-time can yield important insights and improve investment decisions. Using data-driven approaches and technology tools can help you make better investment decisions, boost efficiency, and improve portfolio performance.

What are the criteria for selecting the best investment plan?

Choosing the ideal investment plan in India necessitates careful evaluation of a number of aspects, including your financial objectives, risk tolerance, investment horizon, and present financial position. Here are some of the essential variables to consider:

Financial Goals

One of the most crucial considerations is the financial goals for which you are investing. It could be purchasing a car, educating or marrying one’s children, purchasing a home, or arranging for retirement. Based on your goal, choose the investment option that will help you reach it.

Risk Tolerance

It relates to the level of risk you are willing to accept when investing. Your risk-taking capacity determines which investment option is best for you. If you are eager to take on more risk, you can invest in market-linked assets; if not, you can participate in a government-guaranteed program.

Performance

Before making your investment decision, analyze its past performance and compare it to other investment possibilities. For example, if you wish to invest in mutual funds, you can look at their historical returns and compare them to a benchmark.

Lock-In Period

Many investment choices include a mandated lock-in period. It means you can’t redeem or remove your investment until the stipulated time period expires. For instance, the funds for ELSS have a three-year lock-in duration, indicating that you cannot withdraw the money you invested before then.

You should also analyze the investment’s lock-in duration and choose one that best meets your needs.

Investment-related expenses.

Expense ratio, exit load, brokerage fees, management fees, and other costs associated with the investment may lower your return. As a result, you should additionally consider these costs.

Nonetheless, gold prices typically climb when investors want to invest in safe-haven assets during a crisis. As a result, they serve as an effective hedge against inflation and equities.

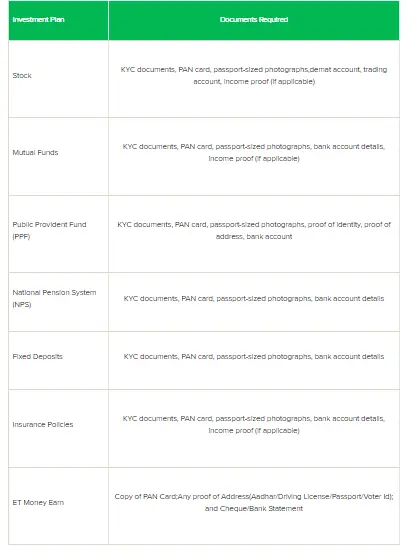

What documents are necessary to purchase an Investment Plan in India?

To participate in any investment avenue in India, you must give certain documents, such as KYC documents, bank data, Form 16, and so on. However, it differs by investment. The following table lists the required documentation for some of the most common investing options:

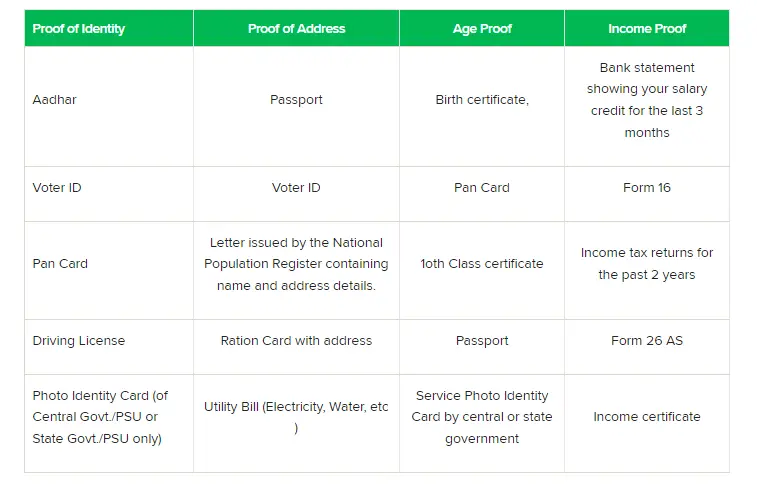

You must have proof of funds, location, age, and identity. The following table displays the eligible documents:

What is the best investment option for you?

We’ve already explored the various investing options available to you, but how can you choose the right one for you?

The answer to this question differs from person to person since everyone has unique goals and risk tolerances. Here are some investment choices based on specific variables.

- You should examine your risk tolerance. If you are a risk-averse investor, you can invest in low-risk assets such as government bonds and fixed deposits. If you are willing to accept more risk, you can consider investing in equities or aggressive mutual funds.

- If you wish to get a market-linked return, consider investing in stocks, mutual funds, NPS, and so on. If you want to generate regular income, consider investing in bonds, corporate fixed deposits, or dividend-paying equities.

- If you wish to get tax breaks on your investments, you can choose from a variety of choices, including ELSS, NPS, PPF, SSY, and SCSS.

- Consider your financial goals and choose the investment that best meets them. If you want to invest for long-term gain, choose a diverse portfolio of stocks or equity mutual funds.

- SIPs in mutual funds are popular if you want to invest on a regular basis, such as monthly. It allows you to develop a good corpus in the future by investing little amounts on a regular basis. You can choose from a variety of mutual fund categories, including Large Cap, Small Cap, Mid Cap, and Index funds, based on your risk tolerance and investing goals.

Finally, the optimal investment meets your financial needs and risk tolerance.

Wrapping It Up

Investment techniques are the foundation of financial success. Creating a road to your financial goals involves trying out many strategies, adopting vital investment concepts, and integrating your investments with your personal financial plan. By being adaptable and welcoming innovation, you can navigate the ever-changing investing market and ensure a bright future. Begin your investment adventure today to achieve financial prosperity.

Also Read: GST Calculator Online – Simplify Your Daily Finances And Taxes

FAQs

-

What are the safest investment opportunities in India?

There are several safest investing alternatives that provide guaranteed profits. Fixed deposits, PPF (Public Provident Fund), SSY (Sukanya Samriddhi Yozana), NSC (National Savings Certificates), POMIS (Post Office Monthly Income Scheme), SCSS (Senior Citizens Savings Scheme), KVP (Kisan Vikas Patra), PMVVY (Pradhan Mantri Vaya Vandana Yojana), and Mahila Samman Savings Certificate are a few examples.

-

What are the finest investment opportunities for young individuals in India?

As a youthful investor, you can take on more risk than investors up to retirement age. As a result, you should consider investing in market-linked products like mutual funds and national pension systems. These investments will allow you to achieve inflation-beating returns and accumulate a sizable corpus for the future. Otherwise, if you want a guaranteed return, consider investing in government-guaranteed schemes.

-

What are the lowest-risk investment possibilities in India?

Bank FDs, government bonds, PPF, NSC, POMIS, liquid mutual funds, gold, and SCSS are all examples of low-risk investments.

-

What’s the best investment strategy for one and five years?

There is no one-size-fits-all plan because everyone’s risk tolerance and financial goals vary. However, if you want to invest for short-term goals, say 1-3 years, you can consider low-risk solutions such as bank fixed deposits, liquid funds, ET, money earned, and so on.

If you want to invest in the medium term, say 3-5 years, you should consider National Savings Certificates, Debt funds, ELSS, hybrid funds, and so on.

-

Which are India’s top ten investment options?

Stocks, FDs, mutual funds, Senior Citizen Saving Scheme, PPF, NPS, real estate, gold bonds, government bonds, and Sukanya Samriddhi Account are among India’s top ten investing alternatives.

-

What are the best investment opportunities for government employees?

Depending on their risk tolerance and financial objectives, government employees can choose from a variety of investment options. Mutual funds, Public Provident Funds, NPS, and General Provident Funds are among the finest possibilities.

-

Which are the most significant investment options for salaried employees?

Salaried employees have a variety of investing options depending on their risk tolerance and financial objectives. One of the most popular methods is SIP in mutual funds, which allows them to build a substantial corpus by contributing a small sum on a regular basis, usually monthly. However, there are alternative possibilities, such as the Employee Provident Fund, the National Pension System, equity-linked savings schemes, and so on.

-

What is the finest retirement plan in India?

PPF and NPS are the most popular retirement investment alternatives.

PPF provides a guaranteed return on investment, but it may not be enough to outperform inflation significantly. If you wish to earn higher returns than inflation, you can invest in NPS. It offers the potential to earn double-digit returns by investing in a diverse portfolio of market-linked securities.

-

How do savings plans differ from investment plans?

A savings plan is one in which you invest money for short-term or emergency purposes. It provides low-risk and fixed returns. An investing plan, on the other hand, is one in which you invest on a regular basis in order to reach your financial objectives in the future. A savings plan helps you save your money, whereas an investing plan helps you build wealth.

-

Which are India’s top ten investment options?

Stocks, FDs, mutual funds, Senior Citizen Saving Scheme, PPF, NPS, real estate, gold bonds, government bonds, and Sukanya Samriddhi Account are among India’s top ten investing alternatives.