Introduction

Import and export are the foundation of international trade relations between countries. India is a big exporter in multiple sectors, but its import industry is equally large. Since the passing of the GST Act, all organizations and individual importers of India must follow the e-way bill guidelines of the act.

When goods from other countries are brought to India for domestic use, it is called an import. To transport the imported goods inside the country the importer must generate an e-way bill from the government website. They require the invoice for the goods, the transport vehicle details, and personal documents to generate the e-way bill.

However, people often ask, what happens if they make a mistake while filling out the e-way form? And most importantly, are there consequences of not following e-way bill regulations? Well, there are only a few situations where creating an e-way bill for import is not necessary, and situations where not generating an e-way bill can have severe consequences.

Keep reading to find out the answers to all these questions. We have especially covered the penalties, risks, and impact of non-compliance to give you a detailed idea about the consequences of not generating an e-way bill.

Consequences of Missing E-way Bill in Imports

Since the passing of the GST act, an e-way bill is required for transporting items valued at more than Rs. 50,000. This act is not only applicable to exports but to imports as well.

For every consignment, a distinct e-way bill number (EBN) is produced. At specific checkpoints, authorized officers can stop any vehicle carrying goods to verify the required paperwork, including the e-way bill is in order.

The consequences of not abiding by the CGST law can be severe. There are the punishments for refusing to carry e-way bills:

- You can be fined for not carrying e-way bills.

- The vehicle or the goods can be seized by the enforcers.

- GST authorities can increase their attention on offenders.

Let us explain the consequences of missing e-way bills for import in detail.

-

Fines

- The minimum fine for failing to carry an e-way bill is Rs. 10,000.

- The authorities have the right to impose a fine equal to the tax owed on the specific consignment.

- If the owed tax value is higher than Rs. 10,000, the offender will pay the tax value. Otherwise, they will have to pay the fixed Rs. 10,000.

-

Seizure of Vehicle and Cargo

The seizure of a vehicle or cargo is a possible penalty for breaking the e-way bill requirements.

- Sometimes the seizing of the vehicle and the cargo is ordered, generally in circumstances involving repeat offenders.

- After seizure, the items can only be returned to the owner upon payment of the owed tax within seven days.

-

Increased Interference from the GST Regulators

If the GST authorities are aware of one instance of non-compliance with the e-way bill for import, they will increase their focus on the activities of the violator. If the authorities identify the importer as a repeat offender, there will be severe repercussions.

- An individual or a company might be ordered to submit an accurate list of all the products and commodities they have imported and the related e-way bills to the GST authorities.

- They could also be ordered to hand over the entire tax details of all the goods they have imported and the vehicles they used to transport them.

Also Read: What Are The Consequences Of Not Generating An E-Waybill For Job Work?

Penalties for Not Using E-Way Bills in Imports

We have already mentioned that transporting any taxable goods without an e-way bill is subject to a penalty of Rs. 10,000 or the amount of tax applicable. These fines are charged based on Section 122 of the CGST Act, 2017.

Section 129 of the CGST Act of 2017 clarifies that any goods or vehicles that get confiscated due to noncompliance with e-way bill regulations may only be released upon the payment of applicable taxes.

These are the amount of penalties for not using e-way bills in imports:

- The e-way bill violator must pay 100% of the tax due if the goods were taxable products.

- For exempt products, the penalty amount is 2% of the goods’ worth, or Rs. 25,000, whichever is lower.

- If no payment is made within seven days from the date the notice was sent, Section 130 of the Act can be used to start further proceedings for the seizure of goods, as well as the imposition of more penalties.

Also Read: What Are The Penalties For Not Generating An E-Way Bill?

Import Compliance and E-Way Bill Repercussions

To understand the import compliance process, we need to know how an import process and the tax regulations work.

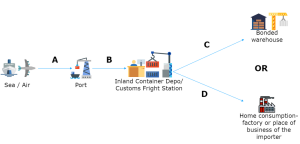

This picture shows how an import procedure works:

When the goods imported from other countries reach India, the below process follows:

- The products are taken into the custody of the customs department upon arrival and sent to either an Inland Container Depot (ICD) or a Container Freight Station (CFS) for final clearance. According to Regulation 138, it is not required to create an e-way bill for this transportation.

- When the goods are in the ICD or CFS, the bill of entry is submitted, and the importer pays the customs duty. If the items are approved for domestic use, generating an e-way bill is necessary.

- Until they get approved for domestic use, the goods may be stored in a warehouse. Generating an e-way bill to transport the goods from the ICD to the bonded warehouse is not necessary. However, an e-way bill must be generated when the products are eventually cleared from the warehouse.

No E-way Bill Required for Exempt Products

Regulation 138(14) of the CGST Regulations, 2017 provides a list of exempt products. This list ensures that individuals/companies don’t have legal obligations to create e-way bills for specific goods or under particular transportation scenarios. This method streamlines the transportation process, and domestic consumption can begin immediately.

Risks of Not Generating E-Way Bill for Imports

To maintain tax transparency and authorize legal transportation of imported goods, all importers and carriers need to generate e-way bills for imported products. If not, they are required to pay the penalty following CGST Act Section 129(1) Clauses (a) and (b).

Consider these risks if you do not generate e-way bills for imports:

Penalties for transporting goods without valid documents

- The importer must pay 50% of the entire value of the products moved if the supplier or transporter paid the tax on the mentioned goods but transported them without proper documentation.

- If the individual/company transported goods exempt from customs duty, they would have to pay a penalty of Rs. 25,000, or five percent of the products’ worth, whichever is less.

Penalties for transporting goods without paying tax and carrying valid documents

- The person in question must pay the necessary tax and penalty equivalent to 100% of the entire tax due on the value of the items transported.

- If the individual transported goods exempt from customs duty, they would have to pay a fine of Rs. 25,000.

Impact of Non-compliance in Import E-way Bill

Importing products for domestic market consumption comes with various regulations, and once the products arrive in India, they must go through customs. After paying the customs taxes, the importer generates e-way bills to deliver the goods to their intended location inside India.

- If the vehicle is caught at a checkpoint carrying goods with no valid e-way bill, the GST authorities can set the penalty amount for the importer or seize the goods.

- When the vehicle or the goods get seized, that affects the supply chain of the importer and causes damage to the business.

- The monetary harm caused by the fine and supply chain damage can be significant.

Legal Consequences of Omitting E-way Bill in Imports

The CGST Act introduced the e-way bill generation process and created guidelines for the importers. Later, in 2022, the Indian government made a few modifications to the bill.

The legal consequences of not maintaining the e-way bill regulations for imports are explained in the tables below:

Existing provision [Before 01.01.2022]

| When the owner comes forward [Sec 129(1)(a)] | When the owner does not come forward [Sec 129(1)(b)] |

| Taxable goods- Tax + penalty equal to 100% of tax payable | Taxable goods – Tax + penalty equal to 50% of the value of goods reduced by tax paid |

| Exempted goods – Lowest of 2% of the value of goods or ₹ 25,000/- | Exempted goods – Lowest of 5% of the value of goods or ₹ 25,000/- |

Notified Amendment [Post 01.01.2022]

| When the owner comes forward [Sec 129(1)(a)] | When the owner does not come forward [Sec 129(1)(b)] |

| Taxable goods – Penalty equal to 200% of tax payable | Taxable goods – Penalty equal to the higher of 50% of value of the goods or 200% of the tax payable on such goods |

| Exempted goods – Lowest of 2% of the value of goods or ₹ 25,000/- | Exempted goods – Lowest of 5% of the value of goods or ₹ 25,000/- |

Also Read: Legal Provisions And Penalties Associated With E-Waybill Non-Compliance

Conclusion

Now that we have discussed everything about an import e-way bill’s significance, we strongly suggest that you never ignore generating one. Since the passing of the CGST Act, the e-way bill has become an integral part of the transportation of goods across the nation, and with valid reasons.

The bill is used to stop illegal imports, end import tax evasion, and make the import process easier for legal businesses. Most states follow the exact regulations, while others, like Maharashtra, have maintained an intrastate movement barrier of Rs. 100,000 rather than Rs. 50,000.

The consequences of not generating a correct e-way bill can be extreme, especially for repeat offenders. However, you don’t need to worry if you have made a simple mistake in the form. All you need to do is to cancel it and re-generate the e-way bill.

Transporting goods with an incorrect e-way bill or not generating it at all will result in steep fines. It is crucial to remember that, in such cases, the transport vehicle and the goods can also be seized if the GST authority decides that way. Thus, by strictly following the e-way bill generation guidelines, situations like those can be avoided.

Frequently Asked Questions

-

Why do I need an e-way bill for import?

The CGST bill made it mandatory for importers to generate an e-way bill for imported goods.

According to Section 68 of the Act, the Government can rightfully demand that the driver of a transporter carrying a consignment of imported goods valued at more than a CGST mentioned sum carry an e-way bill.

-

How do I generate an e-way bill for imports?

The document required to produce an e-way bill from the government website is an invoice for the goods being transported. You need to use the specifics of the invoice to fill the Part A section of the form. Part B contains the specifics of the transportation method for the goods. E-way bills have validity periods based on the transport distance.

-

Can the goods or the vehicle get seized because of the vagueness of the classification rules of Goods and Tax Tariffs?

The simple answer is no. Indeed, the conditions and justifications for a vehicle’s seizure or detention are not specified in the regulations. However, it is generally understood that the vehicle or the goods may be seized only if some specific issues raise the regulation officer’s suspicions regarding potential tax evasion.

-

What is the validity period of an e-way bill for import?

The distance that the goods must get transported determines the validity of the e-way bill. Common transport modes, such as vehicles, have a one-day validity period for every 100 km of the route. Additionally, a one-day validity period is offered for every 20 km of the route for vehicles carrying Over Dimensional Cargo.

-

What is the penalty for minor e-way bill mistakes?

The penalty for not following e-way bill regulations differs. A Rs. 1,000 charge will be imposed on you or the registered firm if the e-way bill contains a minor error. These fines are per the government’s CGST bill, and Section 129 of the CGST Act refers to these fines. Please take note that this amount is applicable only if you have already paid the necessary taxes.

-

Can I edit the e-way bill if I made a mistake?

An e-way bill can be canceled and generated anew if you entered incorrect information in the form. Once created, the entire e-way bill cannot be changed, only Part B can be modified. Remember, the cancellation must be completed within twenty-four hours from the e-way bill generation.

-

What to do if the e-way bill’s validity expires before the goods reach their destination?

When the e-way bill’s validity expires, you should immediately stop transporting the goods. The carrier can extend the validity period if unforeseen situations arise. To extend the validity, you need to revise PART-B of FORM GST EWB-01 with the new information and the cause for the extension.

-

Do I need an e-way bill for high sea sales?

High seas sales are legitimate business transactions in which the initial importer of the goods sells them to a third party before the goods are cleared by customs. There is no need to create an e-way bill for a high sea sale because the sale occurs outside of Indian territory. It is a good practice if an importer wants to lessen the regulatory burden of international commerce.

-

What are the requirements to generate an e-way bill for imports?

To generate an e-way bill, the importer must be registered on the Government GST portal. After that, they need to register on the e-way bill portal – https://ewaybillgst.gov.in. The person creating the e-way bill must have access to the necessary paperwork, such as the tax invoice, bill of sale, delivery challan, transporter’s ID, and the vehicle’s registration number.

-

What documents should the driver carry while transporting imported goods?

A driver transporting imported items must carry a duplicate invoice of the imported goods, and a hard copy or an electronic copy of the e-way bill. An RFID device should be installed on the vehicle if the government sends specific instructions.