Introduction

Understanding how the place of supply is determined for export supplies is crucial to navigating international trade. The term “place of supply” refers to the location where goods or services are considered to be provided for taxation purposes. When it comes to exports, pinpointing this place becomes vital for proper taxation and compliance. In simple terms, it involves identifying the geographical location where the recipient of the exported goods or services is situated. This means they need to understand a bunch of things, like different methods, regulatory guidelines, following the right standards, how to document everything properly, what the law says, and ways to get the most advantages out of the whole process. This process ensures that the correct tax regulations and rates are applied, facilitating smooth cross-border transactions. Exploring the intricacies of determining the place of supply in export scenarios helps businesses and individuals engage in international trade with clarity and respect for legal requirements. So, we’ll explore these aspects in detail, offering valuable insights and practical information for businesses as they navigate through the complex landscape of figuring out the materials needed for exporting goods.

Methodologies for Determining the Place of Supply for Export Transactions:

Determining where a product or service is supplied is crucial in international trade, and the process is known as “Place of Supply.” Specifically, when dealing with export transactions, various methodologies are employed to identify the location where the supply is considered to take place. This determination is vital for taxation purposes and ensuring compliance with regulations. Common methodologies involve examining factors such as the location of the supplier, the recipient, and the nature of the goods or services being provided. These methodologies help governments and businesses establish the applicable tax jurisdiction and facilitate smooth cross-border transactions. Understanding the intricacies of these methods is essential for companies engaged in global trade to navigate the complexities of international taxation and ensure legal compliance.

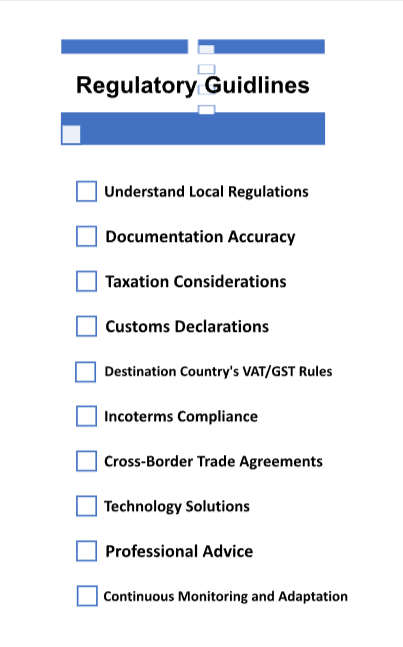

Regulatory Guidelines for Accurate Export Place of Supply Identification:

- Regulatory guidelines for accurate export place of supply identification are rules and instructions set by government authorities to ensure that businesses correctly determine the location from which goods or services are supplied for export. This is crucial for taxation and compliance purposes. The guidelines help businesses identify the right place of supply, which is essential for determining the appropriate tax jurisdiction and rates. Accurate identification ensures that the correct taxes are applied, preventing errors and potential legal issues. These regulations are designed to streamline international trade processes and promote fair taxation practices. Following these guidelines not only helps businesses stay compliant with the law but also facilitates smooth cross-border transactions, benefiting both the companies involved and the regulatory authorities overseeing export activities.

Compliance Standards in Place for Export-Related Supply Determinations:

Understanding compliance standards for export-related supply determinations is crucial to navigating the complexities of international trade. These standards serve as a set of rules and guidelines that businesses must follow when engaging in export activities. Essentially, they ensure that companies follow legal and regulatory requirements, promoting fair and ethical practices in the global marketplace. Compliance standards cover various aspects, including documentation, licensing, and trade restrictions, and play a vital role in safeguarding national security and economic interests. Navigating these standards helps businesses avoid legal pitfalls, fosters transparency, and facilitates smoother cross-border transactions. From this point, we dig into the key components of compliance standards for export-related supply determinations, shedding light on their significance and impact on businesses involved in international trade.

Also Read: Understanding Place of Supply: Import, Export, and Compliance

Strategies for Efficient Documentation of Export-Related Places of Supply:

In the export trade, documenting where goods are supplied is crucial. This is especially important when exporting products to other countries. Efficient documentation of the export-related place of supply involves using smart strategies to clearly record and communicate where the goods originated. This helps businesses, customs authorities, and other stakeholders understand the journey of the products, ensuring smooth transactions and compliance with regulations. In this point, we explore the practical approaches and tips for effective documentation in the context of exporting goods, aiming to simplify the process for businesses engaged in cross-border trade.

- Strategies For Efficient Document

- Customs Compliance

- Review By Experts

- Training Staff

- Timely Submission

- Quality Control Checks

- Communication Channels

- Data Security Measures

- Record Retention

Also Read: Documentation And Invoicing Requirements For Exports: Place Of Supply Considerations

Legal Considerations in Determining the Place of Supply for Export Transactions:

It’s really important to understand the rules about where you’re sending stuff. The “place of supply” is where things or services are thought to be given. When you’re sending things out of the country, there are different rules to follow, like international trade laws, taxes, and agreements between countries. These rules decide which country’s laws apply and affect how taxes and rules work for the things you’re sending out. Knowing these rules helps businesses follow the laws and rules when they’re sending things internationally, making sure everything goes smoothly and legally.

Also Read: Understanding the Place of Supply for Export Transactions: Legal and Regulatory Framework

Maximizing Benefits Through Precise Identification of Export-Related Supply Locations:

The topic “Maximizing Benefits Through Precise Identification of Export-Related Supply Locations” focuses on optimizing advantages by accurately pinpointing key locations in the supply chain related to exports. This involves a detailed and careful identification process to determine the most strategic points for exporting goods. By honing in on specific supply locations, businesses can streamline operations, reduce costs, and enhance overall efficiency. This precision allows for better resource allocation, timely deliveries, and improved collaboration with suppliers and partners, ultimately leading to increased benefits and success in the export sector.

Conclusion

In conclusion, determining the place of supply for export transactions involves various methodologies, including adherence to regulatory guidelines and compliance standards. Efficient documentation strategies play a crucial role in accurately identifying export-related place of supply. Legal considerations further contribute to this determination process. Overall, the precision in identifying export-related supply locations is essential not only for regulatory compliance but also for maximizing benefits. A thorough understanding of the methodologies, guidelines, compliance standards, and legal aspects is crucial for businesses engaged in export activities. By embracing these considerations, companies can navigate the complexities of export transactions and optimize their operations for greater success in the global market.

FAQs

-

Why is determining the place of supply crucial for export transactions?

Determining the place of supply is important for export transactions because it helps identify the applicable tax jurisdiction and ensures proper taxation, facilitating smooth and compliant international trade.

-

How has technology influenced methodologies for determining the place of supply?

Technology has made things simpler by using digital tools and automated systems to find where supplies are. This helps us be more precise and efficient in our work. These new methods, like digital platforms, have improved how we figure out where things are located for supplies.

-

What role do compliance standards play in the export supply chain?

Compliance standards ensure legal adherence, facilitate smoother transactions, and contribute to the overall efficiency of the export supply chain. These standards are like guidelines that everyone follows to do things right and make everything work well when sending goods to other places.

-

Can businesses benefit from leveraging preferential trade agreements in supply location determination?

Yes, businesses can gain advantages by using preferential trade agreements to decide where they source their supplies, as these agreements often offer reduced tariffs and trade barriers between participating countries, potentially lowering costs and enhancing competitiveness in the global market.

-

How often do regulatory guidelines for place of supply determination change?

Regulatory guidelines for determining the place of supply can change periodically, and the frequency of these changes depends on the specific regulations and updates implemented by authorities.

-

Are there specific considerations for digital transactions in determining the place of supply?

Yes, when figuring out where a digital transaction occurred, there are specific things to think about, like the location of the customer, the type of service or product, and any applicable rules or agreements between countries or regions. These considerations help determine the proper place of supply for digital transactions.

-

What are the common challenges faced by businesses in documenting export-related place of supply?

Businesses often struggle with documenting the export-related place of supply due to complexities in navigating international regulations, varying tax requirements, difficulties in obtaining accurate and up-to-date information, and the need for accurate and consistent record-keeping to comply with customs and trade standards.

-

How can businesses ensure legal compliance in the determination of the place of supply?

Businesses can ensure legal compliance in determining the place of supply by thoroughly understanding and adhering to the relevant tax regulations and laws governing the location of transactions and seeking professional advice when needed.

-

Are there industry-specific compliance standards for determining the place of supply?

Yes, there are specific rules and guidelines set by industries to decide where a particular service or product is considered supplied. These standards help ensure compliance with regulations and streamline business operations.

-

Can businesses benefit from outsourcing the documentation process for export-related place of supply?

Yes, businesses can be beneficial by outsourcing the documentation process for export-related place of supply. Outsourcing documentation processes can provide efficiency and accuracy, but businesses should carefully choose reliable partners to ensure compliance and security.