Introduction

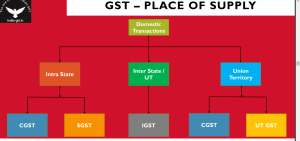

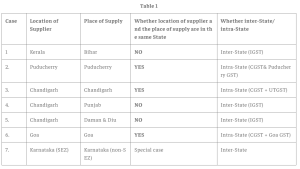

The place of supply is the location of the recipient of goods, and determining it is a crucial aspect of modern commerce. It influences not only taxation but also regulatory compliance and logistical strategies in a business. In India, GST (Goods and Services Tax) is the taxation system that is followed across the nation. According to GST, the place of supply is the location of the recipient of the goods or services. GST is a destination-based tax, which means that the state where the goods and services are consumed will be allowed to levy tax and not the state from which the supply was made. The place of supply determines the type of transaction, i.e., whether it is intra-state, inter-state, or import-export. This helps in determining which tax is to be applied, i.e., a combination of central (CGST) and state (SGST) taxes, or an integrated tax (IGST), with or without additional duties. Thus, in this article, we will simplify how the place of supply is determined for goods, its importance, legal compliance, and much more.

https://icmai.in/upload/Taxation/IDT/PPT/GST-Place-Supply.pdf

Methodologies for determining the place of supply for goods

Determining the place of transaction has a great application in taxation, as we’ve already discussed earlier in the previous account. The methodologies that are involved in determining the place of supply for goods and services depend mainly upon three factors, i.e., the location of the supplier, recipient, and the movement of goods. Here we have a few key methodologies that help in establishing clarity in determining the place of supply for goods under the GST framework in India. This ensures that appropriate taxes are levied based on the nature and circumstances of the transaction.-

Location of the Supplier and Recipient:

-

Location of the Goods at the Time of Delivery:

-

Goods Delivered by the Supplier to a Recipient on the Direction of a Third Person:

-

Import of Goods:

Regulatory guidelines for accurate place-of-supply identification

The regulatory guidelines for accurate place of supply identification are based on the location of the supplier, recipient, and specific transaction scenarios. When it comes to GST, identification plays an important role in the correct application of taxes, as GST is a destination-based tax. The place of supply determines whether a supply is intra-state (within the same state) or inter-state (across different states). This, in turn, determines the applicable tax rate (CGST + SGST/UTGST for intra-state and IGST for inter-state).

https://www.taxmann.com/post/blog/place-of-supply-in-gst-with-examples/

Therefore, here are some guidelines to help you understand all of this in a simple manner:-

Type of supply:

-

Interstate supply:

-

Intrastate supply:

-

Location of supplier and recipient:

-

Invoicing and record-keeping:

-

Compliance and Consequences of Incorrect Place of Supply Identification:

Compliance standards are in place for goods-related supply determinations

Compliance standards for goods-related supply determinations require accurately identifying the place of supply based on established rules. This in turn helps to correctly apply the applicable taxation and ensure adherence to regulatory requirements. Following these standards is crucial for businesses to ensure regulatory compliance, facilitate audits, and avoid penalties associated with non-compliance in the case of goods supply transactions. Here are some of the compliance standards:-

Accuracy in Documentation:

-

Timely Filing of Returns:

-

Correct Application of GST Rates:

-

Verification of GSTIN and cooperation with tax authorities:

Strategies for efficient documentation of goods-related place of supply

Documentation is a pivotal part of taxation. Efficient documentation strategies for goods-related places of supply act as a helping hand for seamless taxation processes. These strategies are important for businesses and reduce the risk of penalties. You can involve Various strategies, like Training the staff, maintaining records, and seeking guidance from GST consultants, to enhance the efficiency of documentation. Some of these strategies are discussed below.-

Clear Invoice Details:

-

Accurate Place of Supply Mention:

-

Comprehensive Record-Keeping:

-

Automated Documentation Systems:

Legal considerations in determining the place of supply for goods

In India, legal considerations involve adherence to provisions outlined in the Integrated Goods and Services Tax (IGST) Act, 2017, as well as relevant rules in the Central Goods and Services Tax (CGST) Act, 2017. In addition, the State Goods and Services Tax (SGST) Acts, must be considered too. The place of supply must be determined with accurate documentation and stay informed about any updates or amendments issued by the GST Council. Here are some key legal aspects,-

Location of Supplier and Recipient:

-

Movement of Goods:

-

Importation Rules:

-

Special cases- high-sea sales, stock transfers, a bill to ship to transactions:

Maximizing benefits through precise identification of goods-related supply locations

Now that we know all about how the place of supply is determined, including the methodologies, benefits, and regulatory and legal compliance, it is time that we get to know how we can maximize this knowledge. This strategy of maximization will provide a seamless taxation process, minimize tax liabilities, etc. Thus, a few strategies for Maximizing benefits through precise identification of goods-related supply locations are as follows,-

Input Tax Credit Optimization:

-

Compliance Efficiency:

-

Enhanced Business Planning:

Conclusion:

Therefore, we can conclude that the determination of the place of supply for goods is a crucial part of the taxation process. It holds a significant role for businesses and tax authorities alike. We can say that determining the correct place of supply is not just a compliance issue but a cornerstone for a business to maximize its efficiency both financially and ethically.Frequently Asked Questions (FAQ)

-

What is a place of supply?

-

Is a place of supply important for business strategies?

-

How is the place of supply related to GST?

-

What are the types of places of supply based on location?

-

What are interstate and intrastate places of supply?

-

In the case of importation, what is the place of supply?

-

Why is record keeping important?

-

Why is invoicing important?

-

What is the role of the correct place of supply in compliance efficiency?

-

What is the role of the correct place of supply in GST law application?

Navigate place of supply regulations in GST efficiently with CaptainBiz support.

Ojashwani Shrivastava

Social Media Manager

I am a passionate finance writer with the ability to simplify complex concepts. Holding a background in writing and extensive research skills, I deliver insightful and engaging content on investment strategies, personal finance, and market trends. By transforming financial terms into accessible insights, I empower readers to make informed decisions for a secure financial future.