Input tax about a taxable person means the (IGST and CGST) in respect of the CGST Act and (IGST and SGST) in respect of the SGST Act, charged on any supply of goods and services to him which are used or are intended to be used in the course or furtherance of his business and includes the tax payable under sub-section (3) of section 7.

What is an Input Tax Credit?

Input Tax Credit explained means the Goods and Services Tax (GST) paid by a taxable person on any purchase of goods and services used or used for business.

The ITC value can be deducted from the GST payable on sales by the taxable person only if certain requirements are met. These conditions under the GST law are more or less in line with the pre-GST regime, except for a few additional ones, such as GSTR-2B. These rules are direct and may be stringent.

All dealers are responsible for paying output tax on taxable sales made throughout their commercial operations. With the help of an input tax credit, he can offset the output tax against the input tax already paid. The input tax credit does not apply to all types of inputs. Each state has its norms and conditions in this regard and are applicable accordingly.

Importance of ITC

In the previous indirect tax scheme, the credit for central taxes could not be offset against a state levy, and vice versa. So, we can conclude that ITC was not available for interstate purchases. This resulted in a cascading effect, raising the cost of products and services.

Except for a few exclusions, the GST Regime guarantees seamless credit on goods and services across the supply chain. So, in GST, the ITC Scheme was created to reduce the cascading effect of taxes and make GST a destination-based tax. GST law does not require a ‘one-to-one’ relationship between inward and outward supply, therefore any qualified ITC can now be used to pay tax on any taxable output supply.

Understanding the basics of Input Tax Credit

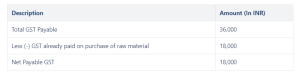

A business owner who deals in electronics purchases raw materials to make tube lights. It costs him INR 1,000,000, plus 18% GST. As a result, he paid a total of INR 1,18,000 to purchase raw ingredients.

Later, the company produced tube lights, which sold for INR 2,00,000 along with 18% GST collected from the consumer. Hence, the company generated a total revenue of INR 2,36,000, including tax collected from GST.

When paying taxes, the taxpayer can deduct the tax amount (INR 18,000) that he already paid to the producer when purchasing raw materials. Hence, instead of paying INR 36,000, the assessee is only obligated to pay INR 18,000.

Key Components Of Input Tax Credit

- Broad Duration: ITC can be claimed on almost all products and services, with the exception of those expressly exempt from GST.

- Capital Goods Benefit: Capital goods, pivotal for many enterprises, also qualify for ITC. For a comprehensive understanding, refer to the ITC 04 filing.

- Flexibility in Supply Types: Both taxable and exempt supplies are eligible to claim ITC. However, proration is applied to those who are exempt.

- Timeliness: GST guidelines prescribe a timeframe for collecting ITC to avoid unnecessary delays.

Essential Conditions for Obtaining Input Tax Credit (ITC) under GST

To claim an input tax credit under GST, a dealer must meet the following requirements:

Valid ITC Documentation and Compliance

The dealer should possess a valid Tax Invoice, Debit or Credit Note, or Supplementary Invoice the supplier provides for the goods or services purchased.

Receipt of Goods/Services

The dealer must have received the items or services for which the input tax credit is sought.

Filed Returns

The vendor should have submitted the relevant returns, particularly GSTR-3, which is a summary return of inward and outgoing shipments.

Tax Payment Confirmation

It is critical to check that the supplier has paid the proper tax amount to the government. The input tax credit can only be claimed if the suppliers’ taxes have been appropriately paid to the authorities.

Invoice Matching

The dealer must have finished the process of matching invoices. This entails validating the data of invoices uploaded by the supplier against the dealer’s records. Any differences should have been handled, and the final input tax credit amount after appropriate recent changes in input tax credit regulations should have been calculated.

Benefits Of Input Tax Credit

Since modern business is intricate and complex, it is essential to utilize business strategies for its success and sustainability. One tool you can use to strategize is the Input Tax Credit on capital goods. Here are some of the advantages that you can get when you claim ITC on Capital Goods.

Tax Savings with ITC on Capital Goods

One of the best ways a business can improve its finances is to claim ITC on capital goods. Understanding that the tax paid to purchase assets is a great way to lower the company’s total tax bill. This leads to a chain reaction that saves businesses a lot of money.

The process of tax planning requires a systematic approach. Businesses must carefully keep track of and collect the credits available for capital goods so that they are only charged for the value of goods and services they purchase. This helps lower the tax load straight away and leads the path to better long-term financial management.

The strategic benefits of tax reduction go beyond producing money and achieving financial rewards. Companies can use the money they save for other essential aspects like R&D, training employees, or bringing changes to the company. In turn, this creates a circle of constant improvement and new ideas, contributing to the business’s long-term growth.

Enhancing Liquidity

Companies can improve their cash flow by applying Input Tax Credits to capital assets. You can use your credit through ITC to meet other financial responsibilities or take advantage of new prospects.

Financial liquidity allows businesses to be resilient and flexible. Companies can make use of ITC on fixed assets to deal with problems that were not expected or to take advantage of good market conditions. This is a necessary financial freedom for all business types. It is because it allows businesses to respond quickly to recent changes in input tax credit regulations to grow and adapt.

Businesses with more cash on hand also have an advantage when it comes to negotiating with their vendors. They can also take advantage of early payment discounts and invest in other projects that resonate with their strategy goals. Being able to use money resources properly is a great way to gain short-term security and long-term sustainability.

Also Read: The Benefits Of Claiming ITC On Capital Goods

Effect of claiming ITC in GST on Capital Asset Investments

Several critical business areas benefit from ITC, and it is not only capital things. When it comes to reaping benefits, investment decisions also get the advantage. Enterprises are continuously making decisions about which assets to invest in and how to improve the ones that they already own. Being able to claim ITC gives companies freedom and encouragement to make intelligent financial choices.

- Financial Freedom for Investment Decisions

- Reduced Immediate Financial Impact

- Adaptation to Technological Advancements

When looking at their finances, businesses need to weigh the short-term costs of capital asset purchases against the long-term rewards. When companies claim ITC, it lessens the need for instant financial effect.

This, in turn, makes it possible for businesses to buy or improve essential assets. So, as an effect, companies get to live competitively in the market by making sure their systems and tools are in line with new technologies and industry standards.

Claiming ITC in GST also has a positive impact on investment decisions and helps the organization establish a culture of continuous improvement. Businesses are encouraged by ITC to seek innovation and efficiency in their operations, knowing that the financial effects of capital asset investments are being improved.

Steps to Claim Input Tax Credit

To avail of input tax credit under GST, a dealer needs to meet the following conditions,

- Must have a Tax Invoice, Debit or Credit Note, or Supplementary Invoice issued by the provider.

- Must have received the goods/services

- Must have filed returns (GSTR 3)

- Ensure that the tax collected has been paid to the government by the provider.

- Must have completed invoice matching and arrived at the final ITC after reversals.

Who Can Claim Input Tax Credit Under GST?

Only people or businesses registered for GST in India can enjoy the benefits of input tax credit. Here are the strict conditions under which a registered GST entity can claim ITC:

- They can produce tax documents like tax invoices and debit notes.

- The mentioned goods or services have been delivered.

- They finished filing their income tax returns (ITR) for the financial year.

- The tax amount was paid to the Indian government in accordance with GST legislation.

Registered GST members can obtain ITC by presenting the following ITC documentation and compliance:

- Tax invoice from the registered supplier.

- The registered supplier for an earlier tax invoice issued a debit note.

- An invoice is issued by the good or service recipient who has already paid tax under the reverse charge mechanism.

- Document of Bill of Entry (when it comes to import of goods).

- An invoice or credit note is issued by the input service provider.

Under the GST scheme, eligible members can only claim ITC for tax invoices and debit notes that are less than one year old. Here’s the time restriction for claiming ITC in GST:

- Before filing GST returns for any month following the end of the financial year, for example, if you are filing the GST returns in September 2024, and the tax invoice was issued in June 2024, then you must claim ITC by August 2024.

- Before filing the annual GST return.

Now that we have seen what input tax credit is and who is eligible for ITC let’s discuss who is not. Any person or business organization that is registered under the GST composition scheme is not eligible to receive ITC. Additionally, ITC can be claimed only for business purposes. It is not available for goods or services sold for personal use or selected supplies exempt from ITC.

Are individuals or entities who have applied for GST registration eligible for ITC? Herein, ITC on inputs can be availed on finished goods and semi-finished goods in stock on the day before they are liable to pay tax. This is possible only when the individual has applied for GST registration within 30 days from when they are responsible for registering (or have been registered already).

When may a business dealer voluntarily seek for GST registration? If a business dealer’s total turnover exceeds ₹50 lakhs, they must become a regular dealer under the GST composition scheme. In this situation, they can claim input tax credit for finished and semi-finished goods in stock, as well as capital goods.

Also Read: How to Claim Input Tax Credit for E-invoices

Challenges in Availing Input Tax Credit

Invoice matching to obtain ITC, i.e., ITC, is said to be permitted only when the supplier uploads the invoice with the GSTIN and other recipient details and pays the GST payable to the government. The last four and a half years’ experience has shown the various technical glitches for the government to implement in full force.

The government was very keen on imposing the same, knowing very well that such a requirement would cause undue hardship to the taxpayers. But in the long run, the government does not have any option. The success of GST is solely dependent on the matching.

Also Read: Common ITC Challenges In E-Invoicing: Solutions And Best Practices

Documents Required for Availing Input Tax Credit

Below are some of the critical documents that a GST-registered entity needs to provide in order to avail the benefits of input tax credit:

- Valid invoices issued by suppliers

- Valid ITC entry must be visible in GSTR-2B submitted by the buyer/recipient

- Bill of entry

- Valid bill of supply issued by the supplier in accordance with the applicable GST invoice requirements.

- Invoice/Credit Note provided by Input Service Distributor under GST invoice rules

The above list of documents is only for illustrative reasons; other documents may be used to obtain input tax credit on an individual basis. To claim ITC under GST, the applicable document(s) must be presented when filing GSTR-2.

Reversal of Input Tax Credit

If a person who is paying tax in the average scheme and wants to shift to the composition scheme or where goods or services supplied by him become wholly exempt, he has to pay credit of input tax in respect of inputs held in stock and inputs contained in semi-finished or finished goods held in stock and on capital goods, reduced by such percentage points as may be prescribed, on the day immediately preceding the date of exercising such option or, as the case may be, the date. After such payment, any remaining input tax credit in his computerized credit ledger will lapse.

If a recipient fails to pay the supplier of goods or services the amount for the value of the supply of goods/services, as well as the tax payable thereon, within 180 days of the supplier issuing the invoice, an amount equal to the recipient’s input tax credit will be added to his output tax liability, along with interest.

This regulation does not apply when the recipient is required to pay tax on a reverse charge basis. Such a person is required to provide such information in Form GSTR-2 for the month in which the 180-day period ends.

ITC for GST paid on reverse charge

GST paid on reverse charge is also authorized as an input tax credit, provided that it is permissible under all other conditions. However, it should be noted that the reversal charge can only be paid in cash.

ITC On Capital Goods And Reversal On Their Sale

The credit for tax paid on capital goods can also be taken in one installment.

Input tax credit for the tax component of capital goods is not permitted if the individual has claimed depreciation for the GST component under the income tax legislation. In other words, a person can either collect GST input tax credit on capital items or claim depreciation on the tax component.

If a taxable person sells capital goods on which ITC has been claimed, he or she is required to pay GST at a higher rate than the following.

ITC taken on such capital goods less five percentage points each quarter of a year or portion thereof from the invoice date.

The GST rate multiplies the sale price of capital goods.

When refractory bricks, molds and fixtures are given as scrap, the taxable person may be required to pay tax on the established transaction value.

ITC On Inputs Sent For Job Work

The principle is permitted to claim ITC on products or capital goods delivered to a job worker for job work. Input is permissible even if it is sent directly to a job worker for job work without first being delivered to his place of business.

If such goods are not returned to the principal or supplied from the job worker’s location within one year of the date of sending goods to the job worker, it will be assumed that the principal supplied such inputs to the job worker on the day they were sent out. The one-year limit is expanded to three years for capital goods.

Where inputs are provided directly to a job worker, the one-year or three-year term begins on the date the job worker receives the inputs.

This presumed supply restriction does not apply to molds and dies, jigs and fixtures, or tools distributed to a job worker for use on the task.

Wrapping It Up

The Input Tax Credit (ITC) is a cornerstone of the GST regime. It provides businesses with an effective way to lower their tax burden. Those in finance or business management must have a thorough understanding of ITC in order to fully profit from GST. Always go to the GST Portal for additional information and official GST-related resources.

FAQs

-

How are input tax credit explained?

You can claim a credit for any GST included in the price of goods and services purchased for your business. This is known as an input tax credit (GST credit). To claim GST credits in your BAS, you must first register for GST.

-

What is meant by the ITC tax?

Input tax credits (ITCs) are the GST/HST rebates paid on a company’s operating expenses. To calculate your overall GST tax payment, subtract the total ITCs paid for running expenditures from the total GST/HST received for the year.

-

Who owns the ITC?

ITC’s full name is an Indian tobacco corporation. Sanjiv Puri is the Chairman and Managing Director of ITC Limited.

-

What’s the distinction between input tax and input tax credit?

When a trader pays GST at the time of purchase, it is referred to as Input Tax, and when he receives GST at the time of selling, it is known as Output Tax.

When paying GST to the government, a trader subtracts the input tax from the output tax and pays the difference. This deduction for input tax is known as the Input Tax Credit.

-

Who can seek a GST refund?

If you paid too much tax, exported products or services, made zero-rated supplies, declared less income than presumptive income, or have an unutilized input tax credit, you may be eligible for a GST refund.

-

What is the time restriction for the GST input tax credit?

Yes, the beneficiary may use ITC. However, he must pay the consideration and tax within 180 days of the invoice’s issuing date.

-

Can the input tax credit be refunded?

A refund of accrued ITC shall be provided under clause (ii) of the first provision of Section 54(3) of the CGST Act, 2017, if the credit accumulation occurred as a result of an inverted duty structure.

-

Can the ITC be claimed after two years?

ITC can only be claimed on tax invoices and debit notes that are less than one year old.

-

Can we withdraw the GST input credit?

However, the GST Law allows for the reimbursement of unutilized ITC in two scenarios: credit accumulation due to zero-rated supply or an inverted duty structure, subject to specific limitations.

-

Is ITC private or public?

ITC is one of India’s leading private sector firms, with operations in fast-moving consumer products, hotels, paperboards and packaging, agribusiness, and information technology.