Under the Goods and Services Tax (GST) Act of India, the E-Waybill System is a critical component for GST-registered entities and enrolled transporters. This system mandates the electronic creation of E-way bills for the movement of goods exceeding Rs. 50,000 in value.

In this context, one crucial aspect that every business entity must adhere to is the timely generation and verification of invoices. This article explores the strategic aspects of aligning invoice processes with E-waybill compliance, proactive measures, and the far-reaching impacts of a well-executed strategy.

The E-Waybill System, designed to ensure transparency and compliance in the movement of goods, necessitates the electronic generation of E-way bills for transactions exceeding Rs. 50,000. This encompasses various scenarios, including supply, non-supply reasons, or inward supply from an unregistered entity.

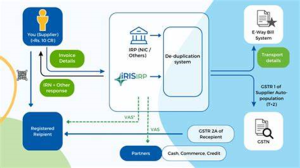

The initiation of this process involves the submission of invoice details to the Invoice Registration Portal (IRP). Upon successful registration, a unique Invoice Reference Number (IRN) is generated and an acknowledgment number for reference. The IRN is valid for 30 days from the upload date, emphasizing the importance of a timely and synchronized approach.

Consequences of Delays in Invoice Processes

Delays in generating and verifying invoices can have a tremendous effect on the supply chain. Beyond the risk of financial penalties, operational inefficiencies, and disruptions may arise. Ensuring a seamless and timely process is not merely a compliance requirement; it is a strategic imperative for businesses operating in the GST ecosystem.

Adhering to these proactive steps not only ensures compliance but also establishes a robust foundation for the successful execution of E-waybill processes. By integrating awareness, technology, training, and regular assessments, businesses can navigate the complexities of invoice generation and verification with confidence.

Also Read: What Are The Consequences Of Issuing A Tax Invoice Late?

Transformative Role of E-Invoicing in Revolutionizing GST Compliance

A report submitted by EY is quite insightful and sheds light on the transformative impact of e-invoicing and technology on GST compliance, making it evident that embracing digital solutions can revolutionize compliance processes.

- Reduction in Manual Data Entry and Reconciliation:

– E-invoicing emerges as a powerful tool in minimizing errors and discrepancies associated with manual data entry and reconciliation processes.

– The automation of these tasks not only improves accuracy but also streamlines the overall compliance workflow.

- Real-time Data Exchange and Validation:

– E-invoicing facilitates real-time data exchange and validation among stakeholders, including taxpayers, GSTN, and Invoice Registration Portals (IRPs).

– This real-time interaction enhances transparency and accountability within the GST ecosystem.

- Seamless Integration of GST Processes:

– One of the remarkable features of e-invoicing is its ability to seamlessly integrate various GST processes such as e-way bills, returns, and refunds.

– This integration streamlines compliance procedures, improving operational efficiency and reducing costs.

Understanding and building on EY’s insights, it is quite evident that the adoption of e-invoicing brings about a paradigm shift in the traditional compliance landscape, introducing efficiency, accuracy, and transparency.

Also Read: How 7-Day E-Invoice Generation Limit Will Impact Your GST Compliance?

Now, let’s explore additional perspectives from diverse sources, emphasizing the significance of timely invoice generation and verification in E-waybill compliance.

Regulatory Awareness Programs:

To proactively ensure compliance, businesses should institute regular regulatory awareness programs. Educating employees on evolving regulations and keeping them updated on changes is essential. This fosters a culture of compliance and empowers staff to navigate complex regulatory landscapes with confidence.

Advanced Software Integration:

Utilizing advanced e-invoicing software is crucial for prompt and accurate invoice generation. The chosen software should not only expedite the invoicing process but also align with the latest regulatory standards. This proactive approach ensures compliance while leveraging technology for operational efficiency. Captainbiz is one e-invoicing software that allows a smooth user interface, seamless integration while providing an analysis of huge chunks of information all in one go.

Continuous Employee Training:

Conducting ongoing training sessions is paramount to ensure that employees understand the importance of timely invoice processes. Continuous education on regulations and standards fosters a workforce that is not only compliant but also proactive in adapting to evolving requirements.

Regular Internal Audits:

Implementing a robust internal audit system is a proactive measure to identify and rectify compliance gaps. Regular internal audits covering aspects such as data accuracy, completeness, and adherence to prescribed formats contribute to a culture of continuous improvement and compliance.

Strategies for Success: Leveraging a Holistic Approach to Timely Invoice Processes:

Cross-functional Collaboration:

Fostering collaboration between finance, IT, and logistics teams is essential for a cohesive approach to timely invoice processes. A cross-functional perspective ensures that all departments work synergistically towards defined compliance objectives, reducing silos and enhancing overall efficiency.

Technology Adoption:

Embracing emerging technologies, such as blockchain, for secure and transparent invoice processes is a strategic move. Technology adoption not only ensures compliance but positions businesses at the forefront of innovation, contributing to operational efficiency and adaptability.

Data Analytics Utilization:

Utilizing data analytics to derive insights from the entire invoicing and verification cycle enhances optimization. Data-driven decision-making is pivotal for businesses navigating the complexities of E-waybill compliance. It provides actionable insights into improving processes and ensuring compliance.

Also Read: The Importance Of Issuing Tax Invoices In A Timely Manner

Proactive Steps for Businesses Aiming to Enhance Compliance with Timely Invoice Generation and Verification:

Collaboration with Regulatory Bodies:

Fostering collaborations with regulatory bodies provides businesses with insights into upcoming changes. This proactive engagement ensures that businesses can adapt their processes accordingly, staying ahead of regulatory shifts and maintaining compliance.

Automated Verification Systems:

Implementing automated verification systems is a proactive step to enhance accuracy and reduce manual errors. Automation not only speeds up the verification process but also minimizes the risk of human errors, contributing to seamless compliance.

Exploring the Far-reaching Impact and Advantages of a Well-executed Strategy:

Operational Efficiency:

Streamlined processes lead to operational efficiency, reducing the time and resources spent on manual interventions. Operational efficiency is a key advantage that businesses accrue through a well-executed strategy for aligning invoice processes with E-waybill compliance.

Cost Savings:

Minimization of errors and delays results in cost savings associated with penalty avoidance and improved resource allocation. Businesses can redirect saved resources towards strategic initiatives, contributing to long-term sustainability.

Enhanced Reputation:

Timely and accurate invoicing enhances a company’s reputation, fostering trust among stakeholders. A positive reputation not only contributes to customer loyalty but also attracts business partners and investors, creating a favorable business environment.

To summarize the article, the strategic alignment of invoice processes with E-waybill compliance is pivotal for businesses navigating the intricate terrain of GST regulations in India. Timely invoice generation and verification are not just compliance requirements but strategic imperatives for seamless operations.

By incorporating proactive measures, drawing insights from successful businesses, and leveraging technology, businesses can not only meet regulatory standards but also thrive in an increasingly competitive landscape. Embracing a holistic approach ensures that compliance is not a burdensome obligation but a strategic lever for business excellence.

Frequently Asked Questions

1. Why is Timely Invoice Generation Critical for E-waybill Compliance?

Timely invoice generation is critical for E-waybill compliance as it ensures adherence to GST regulations, facilitating the seamless movement of goods. The E-Waybill System mandates the electronic creation of E-way bills for transactions exceeding Rs. 50,000, emphasizing the importance of a synchronized approach in generating invoices.

2. How Does E-invoicing Contribute to Reducing Errors in Manual Data Entry?

E-invoicing significantly reduces errors in manual data entry by automating tasks associated with reconciliation processes. This automation not only enhances accuracy but also streamlines the overall compliance workflow, minimizing the risk of discrepancies.

3. What are the Real-time Benefits of Data Exchange and Validation in E-invoicing?

E-invoicing facilitates real-time data exchange and validation among stakeholders, including taxpayers, GSTN, and Invoice Registration Portals (IRPs). This real-time interaction enhances transparency and accountability within the GST ecosystem, contributing to smoother compliance processes.

4. Why is Cross-functional Collaboration Essential for Timely Invoice Processes?

Cross-functional collaboration is essential for timely invoice processes as it ensures a cohesive approach between finance, IT, and logistics teams. This collaboration reduces silos, enhances overall efficiency, and enables departments to work synergistically towards defined compliance objectives.

5. How Can Businesses Enhance Compliance through Collaboration with Regulatory Bodies?

Collaboration with regulatory bodies allows businesses to gain insights into upcoming changes, fostering a proactive approach to compliance. This engagement ensures that businesses can adapt their processes accordingly, staying ahead of regulatory shifts and maintaining compliance.

6. What Advantages Does Operational Efficiency Offer in E-waybill Compliance?

Operational efficiency in E-waybill compliance results in streamlined processes, reducing the time and resources spent on manual interventions. This efficiency contributes to improved resource allocation, minimizing errors, and ensuring compliance.

7. How Can Automated Verification Systems Contribute to Seamless Compliance?

Automated verification systems enhance compliance by improving accuracy and speeding up the verification process. Automation minimizes the risk of human errors, contributing to seamless compliance and preventing delays.

8. What Insights Can Data Analytics Provide in the E-waybill Compliance Landscape?

Data analytics provides pivotal insights for businesses navigating the complexities of E-waybill compliance. It enables data-driven decision-making, offering actionable insights into improving processes and ensuring compliance.

9. Why is Reputation Enhancement Linked to Timely and Accurate Invoicing?

Timely and accurate invoicing enhances a company’s reputation by fostering trust among stakeholders. A positive reputation not only contributes to customer loyalty but also attracts business partners and investors, creating a favorable business environment.

10. In What Ways Does a Holistic Approach Ensure Compliance as a Strategic Lever?

A holistic approach ensures compliance becomes a strategic lever by incorporating proactive measures, leveraging technology, and fostering a culture of continuous improvement. This approach positions businesses for success in a competitive landscape while meeting regulatory standards.