Introduction

The role of item master is diverse at multiple levels regarding a company’s business strategies and tactics. By providing clean and accurate details of data, it helps manage several business plans. The importance of item master for GST lies in the fact that you don’t have to define a new product number every time there is a variation. It makes day-to-day operational decisions simpler and easier, resulting in efficient workflow. The importance gets multifold when it comes to product lifecycle analysis. Let’s learn more about item masters, their importance in GST, how to make one, and more.

What Is An Item Master?

An item master can be defined as a collection of data and records about a product or its types. It comprises information about the product, including its costs, gross margins, etc. If there is any other info about the product that the company feels is crucial in decision-making and product tracking, that can be included, too. Creating accurate item masters helps establish a go-to source every time someone needs updated information about a product in a company.

The Role Of Item Master Creation In GST

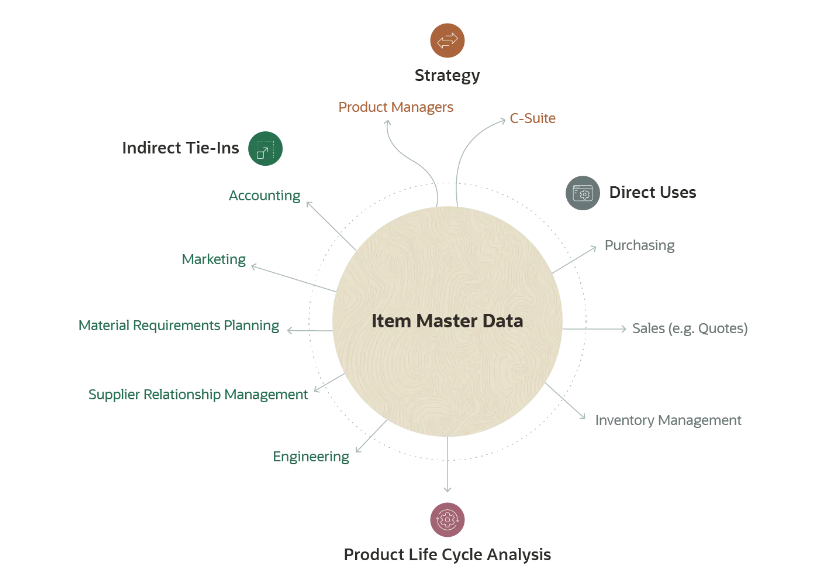

An item master has an integral role in company strategies at more levels than one. It helps create valuable and accurate product data shared with sales, accounting, and engineering departments. Each mentioned department can structure its business plans based on the figure provided in item masters.

The first and foremost benefit of item master creation is helping make day-to-day operational decisions. One can easily decide on reordering supplies and managing stocks as and when required using it. Not only that, but determining staffing decisions and valuing inventory becomes much smoother. They play a critical role in diagnosing unforeseen events in a business while manufacturing or sales. Product tracking and decision-making are the biggest reasons why accurate item masters are crucial for GST reporting. As a result, a business experiences faster and more structured financial analysis.

Another significant role of item masters lies during the product life cycle analysis. Analyzing a product’s lifecycle is key to identifying changes in inventory values, purchase costs, or profit margins of a product. This helps in determining the profitability or health of a product and making informed decisions.

In simple terms, an item master is a multi-source information point crucial in making high-level strategic decisions, whether it is about a product, its category, or the business. Item masters will enable you to know where you stand in your business journey just by taking a glance.

How To Create An Item Master: Step-By-Step Guide

Product creation plays a key role in creating invoices for GST. It includes multiple categories like a product description, its type, price, HSN code, tax type, UOM, quantity, GST rates, etc. This step-by-step guide for creating an item master for GST compliance will help you create and manage products better.

1. Serial Number

A product serial number can be any number used as a code on the barcode. It is usually a 12-digit number that includes numbers and alphanumerics.

2. Description

The next step is entering a description for the product you will sell.

3. Type Of Product

You will mention whether the product is a good or service in this part.

4. HSN Code

Every product has its unique HSN code specified by the recommendation board. SAC is provided for services, while products have an HSN code.

5. Price

Now, mention the price at which one buys goods or services from the supplier.

6. Selling Price

Also, mention the selling price at which the goods or services will be sold to the customers.

7. Measurement Unit

It is the unit quantity code, which can be un numbers, units, centimeters, meters, hours, days, etc.

8. Taxable

Another crucial step is to mention whether the product is taxable or not. Also, mention the tax type depending on the nature of goods and services or transaction type.

9. Tax Rate

You can also set the GST rate for products, depending on whether the CGST, SGST, IGST, or UTGST is applicable.

10. Reverse Charges

When the liability is on the recipient of the goods or services, reverse charges are implied. You can also mention the same while creating an item master.

These are some of the most integral parts of creating item masters in GST. They will benefit by easily managing the products you deal with regularly. Maintain the most crucial data about a product with an item master and operate efficiently.

Does Quality Of Data Matter In Item Master Creation?

The data quality of a company’s item master is extremely significant for its operations. It is better to have no data at all than to have poor-quality data. Missing data indeed leads to bad decision-making. Besides, having low-quality data may cost the company in monetary terms. It also gives the people in authority false confidence.

For instance, incorrect inventory figures before a holiday can result in slower delivery and stock shortages. It can simultaneously show late manufacturing, unfulfillment of orders, more cancellations, and not-so-happy customers. The flaws in data quality may harm the brand name and lower customer expectations.

Best Practices For Managing Item Masters

Similar to all other functions in a business, the efficiency of item masters lies in compliance with the best practices of the industry. While it is not recommended to limit to only these, here are best practices for creating and maintaining item masters in GST. It is crucial to follow correct procedures for item masters, as a minor error can result in thousands of issues.

- The first practice to follow is building a process. Know which fields are most important for an item master for your business. Inventory, purchase terms, and analysis must be included in every item master. It will ensure production efficiency and eliminate any guessing.

- The next point is identifying which information is necessary and which is not worthy of collection. Think through the decisions that one may have to make in the future and what data can be crucial. Know that tomorrow’s decisions will depend much on the data collected today.

- Another practice to abide by is the creation of a standard template. To be accurate with an item master, one must not create the item master wheel each time. A standard template can be utilized to create new products for the company efficiently and quickly.

- Having someone to review the item masters occasionally is another great idea. It will ensure data accuracy and prevent inventory errors and costly purchases.

- Data interconnectivity is something one should aim for. While item master data is powerful, it can be more robust when combined with accounting data and sales forecasts. One can plan to combine data from different fronts for making comprehensive business decisions.

- Lastly, remember to train the staff to use the item masters properly. It will automatically prevent errors from happening and lead to efficient workflow. As a result of the training, they will be quickly able to find products in an item master and report the missing items or information.

Conclusion

Creating an accurate item master is paramount for Goods and Services Tax compliance. A well-maintained item master is the foundation for proper tax reporting and inventory management. A correct item master creation will ensure your business complies with the GST regulations. Proper product classification and item codes are crucial in calculating and reporting taxes. This is because incorrect item master information can result in costly penalties and legal issues. The importance of creating and managing accurate item masters for GST compliance cannot be overstated. Companies that invest time developing and maintaining item masters are better positioned in this competitive market.

Also Read: Mastering Business Success: The Complete Guide To Accurate Item Master Management

FAQs

1. What Is An Item Master?

An item master is an amalgamated and stored collection of the most vital information and records of a product or its type. It is significant information about a particular item, like its size, weight, price, etc.

2. What Do You Mean By Master Inventory?

Master inventory means tracking a business’ inventory by the authority. It can be synonymous with a subset or details in an organization’s item master data.

3. What Is Item Master Data In SAP?

An item master data in SAP business manages how the item will act during sales, production, purchase, inventory, MRP, sales, etc.

4. What Is An Example Of An Item Master Data?

An item master data may include materials kept in the inventory like capacitors, resistors, screws, batteries, etc. The non-material items involve shipping charges, NRE fees, labor costs, etc.

5. Why Is Item Master Important In GST?

An accurate item master in GST will ensure workflow and productivity go uninterrupted. Besides, it will eliminate excess work and unnecessary costs. Keeping accurate product records in a central location minimizes errors and reduces misunderstandings.

6. What Are The Different Fields In An Item Master?

The different item master fields are product name, description, price, unit, tax rate, etc. Some products may have seasonal codes, styles, and currency code attributes.

7. What Is Item Data Management?

Storing, maintaining, and manipulating information about items or products can be described as item data management. It includes the name of the item, its description, and more crucial data like production dates, warranty, etc.

8. What Is The Role Of Item Master In GST?

Item master allows you to record detailed information about a product in your inventory. You can create more products, edit existing ones, assign products to new locations, manage vendor details, etc., via item masters for GST.

9. Are There Any Benefits Of Item Masters In GST?

Increased compliance, minimized time spent on invoice discrepancies, improved purchase efficiency, and lesser vendor overpayments are some of the crucial item master benefits of GST.

10. What Are The Three Common Inventory Types?

Manufacturers commonly deal with three inventory types. The first is raw materials that are waiting to be worked upon. Next are the ones that are being worked upon or work-in-progress. The last one is the goods ready for shipping, which are the finished goods.