Regarding India, the GST was developed to integrate various direct tax systems of central and state authorities. It aimed at promoting compliance in a market platform. As a result, the Indian economy, as well as its business, have been facing difficulties after the economic crisis that was triggered by COVID-19. It is important to examine the effect of GST and how it supports COVID recovery as India progressively recovers from the pandemic and pursues recovery efforts.

GST and the impact of COVID-19 outbreak on sectoral performance and promotion of economic recovery across different industries is the object of this paper. In particular, it scrutinizes the impact that GST has had on manufacturing, services, small businesses, export competitiveness, and general market formalization after initiation. With such integrations of indirect taxes into a single system, GST can enhance labor efficiency, promote the tax obligations observance, and increase the internal as well as external competitiveness of India.

On the other hand, problems related to cumbersome tax regimes, delays with recovering input taxes credits, and compliance obstructions have been emerging, in particular in the case of small organizations. Timeous reforms of the GST and appropriate policies to enhance enterprise performance, which can generate a ripple effect within various industries, will be instrumental as India pursues a robust recovery after the period of pandemic. The paper outlines ways in which India could use GST more efficiently while it goes on with the post-COVID rebuilding exercise.

GST Impact on the Indian Economy

Transparency in taxes has also grown with the adoption of the GST. Because everything is done online, including paying and submitting returns, there is less tax avoidance and corruption. Value addition was the only thing subject to taxation before the GST; however, because GST is applied to all transactions, it is more difficult to conceal transactions. Another benefit is the input tax credit’s smooth passage through the supply chain.

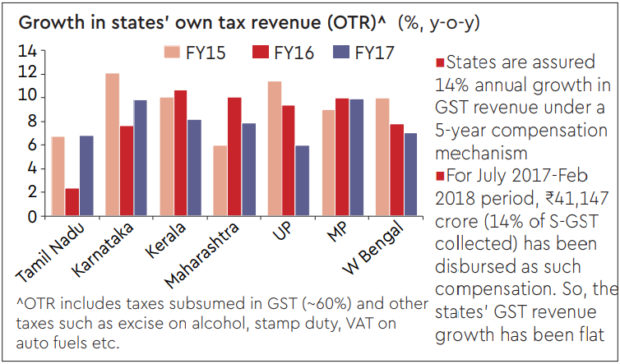

The Centre and States’ pooling of resources and fiscal federalism have benefited from the GST. Service taxes are now shared by all parties, when before the Centre exclusively collected them. States have an equal voice in decisions made by the GST Council.

Positive Effects

- Simplified tax structure: GST integrated multiple taxes, such as excise duty, service tax, VAT, etc., into one tax. This reduced compliance costs and simplified the tax structure.

- Increased tax revenue: GST aims to increase tax compliance and widen the tax base. This has helped improve India’s tax-to-GDP ratio. Total GST collection crossed ₹1 lakh crore mark consistently before the pandemic.

- Reduced tax evasion: Unified taxation under GST makes tax evasion difficult compared to the previous system. Improved compliance has helped increase tax revenues.

- Enhanced competitiveness: GST reduced the cascading of taxes. This has lowered production costs and improved the competitiveness of Indian businesses in domestic and export markets.

- Promoted federalism: The GST Council, consisting of the central and state representatives, jointly administers GST. This has strengthened cooperative federalism.

Negative Effects

- Revenue shortfall: The pandemic severely affected GST collections in 2020. The revenue shortfall was estimated at ₹2.35 lakh crore.

- Compliance issues: Multiple GST filing requirements have increased compliance costs, especially for small businesses. Complex procedures have deterred compliance.

- Technical glitches: Initially, the GSTN registration portal faced technical issues and system failures. This created compliance issues for taxpayers.

- Inflationary impact: GST imposition on previously exempted goods and services led to a slight increase in inflation post-implementation.

- Sectoral imbalances: GST negatively impacted sectors like textiles and handicrafts while benefiting FMCG.

Net Impact

On balance, GST impacted the Indian economy positively. The common national market, reduced tax evasion, and simpler tax structure have yielded productivity gains. However, issues like revenue shortfall, inflationary effect, and glitches during transition have produced some negative outcomes. Appropriate measures to simplify compliance, rationalize rates, and augment revenue collection can help maximize GST’s benefits.

GST Impact on Indian Businesses

For India Inc., GST has significantly altered indirect tax compliance and associated costs. The tax base now includes both goods and services, eliminating the differential treatment earlier. There is also a reduction in the cascading of taxes as taxes paid on inputs are offset from output liability.

Benefits for Businesses

- Lower tax burden: GST reduced the overall tax burden for most goods and services compared to pre-GST taxation.

- Improved cash flows: GST allowed setting off tax paid on inputs against tax payable on outputs. This improved cash flows for businesses.

- Reduced logistics costs: Abolition of check posts post GST reduced transportation time and costs due to faster movement of goods across states.

- Increased market access: A unified market post-GST reduced trade barriers. Businesses gained access to new markets across states.

Challenges for Businesses

- Compliance costs: Multiple returns filing requirements increased compliance costs and working capital requirements, especially for MSMEs.

- Transitional difficulties: Shifting to state-level GST registration from centralized registration took a lot of work for businesses operating across states.

- Input tax credit issues: Businesses faced problems claiming an input tax credit, increasing working capital needs. Procedural difficulties persist.

- Demand shocks: Implementation issues like glitches in the initial months led to demand and supply distortions. This temporarily hurt the revenues of businesses.

Net Impact

GST adoption positively impacted larger firms with the resources to handle the transition-related difficulties. Medium and small enterprises faced greater compliance challenges. Exporters gained from reduced taxes and associated costs. Sectors producing non-essential goods faced dampened demand initially due to rate increases. Overall, GST brought efficiency gains for most businesses through unified taxation. However, issues like complicated procedures, glitches during rollout, and input tax credit restrictions persisted as pain points.

GST Impact on Indian Consumers

GST has influenced prices, inflation, quality, and choices of goods and services for consumers. Prices increased post-GST for certain categories as rates increased from previous taxes. However, the downward adjustment has reduced net costs for many essential items. As per the RBI study, the CPI-based inflation moderated by 20 basis points due to GST.

Advantages of GST for Consumers

- Lower prices: GST reduced the overall tax burden on goods compared to previous indirect tax rates. This helped lower costs.

- Transparency: Consumers gained from transparent taxation. The breakup of tax components in product prices brought clarity.

- Quality improvement: Lower costs due to GST enabled producers to focus more on quality improvement and product innovation. This benefited consumers.

- More choices: A unified market and reduced trade barriers provided consumers access to a wider range of product choices and brands across states.

Disadvantages of GST for Consumers

- Compliance costs: Some compliance rules, including mandatory PAN, made things even more difficult for consumers to purchase goods worth ₹2.5 lakh and above.

- Impact on inflation: Though, as a rule, GST cut costs, specific previously tax-free items became more expensive.

- Limited access: Claiming of input tax credits by consumers without GCS registrations was limited. The restricted GST receivables for certain buyers.

Role in Economic Recovery

As India aims to achieve its $5 trillion economy ambition, GST will have a crucial role in enabling sustainable growth in the post-pandemic period. By increasing the tax-GDP ratio from pre-GST levels of 16-17% to 20%, GST can provide the much-needed revenue impetus. This can propel public spending in infrastructure and social sectors – two growth multipliers.

Also give a leg up to the Make in India initiative. By resolving the inverted duty structure and lowering transaction costs, domestic manufacturing can become more competitive. This will boost export competitiveness and import substitution – twin priorities for India.

Limitations of GST

- Revenue uncertainties: GST collections were severely impacted after COVID-19 due to reduced economic activity. Revenue shortfall persists, limiting fiscal support for recovery.

- Dampened consumer sentiment: Household incomes and consumer confidence took a hit after COVID. Higher taxes on certain items under GST have further dampened consumer sentiment and demand.

- Informal sector impact: GST compliance requirements have hurt micro, small enterprises and the informal sector. Their revival is essential for holistic recovery.

- Uneven recovery: GST-led efficiency gains have favored the formal sector. However, informal sectors employ over 80% of India’s workforce and need focused support.

Conclusion

GST has helped reduce tax complexities, boosted market efficiencies, and led to revenue improvements in the pre-COVID period. However, issues like tax compliance burdens on small firms and technical glitches have impeded its effective implementation.

The COVID-19 economic shock has further complicated GST’s growth impact. Addressing revenue uncertainties, reducing tax burdens on struggling sectors, simplifying compliance for small businesses, and spurring consumer demand is essential for GST to aid the post-pandemic recovery process. A fine balance of growth and equity objectives is needed for GST to realize its full potential as a stimulating force in the revival of the Indian economy.

GST’s role in economic recovery will depend on the statesmanlike decisions taken by the GST Council. If more items are brought into the tax net, and rates rationalized further, GDP growth can get a 2-3 %age points push over the long run, as the RBI estimates. But this requires compromise and consensus between the Centre and States rising above petty politics.

Thus, GST holds promises and challenges as India enters the Amrit Kaal period. Its full gains will only be realized through transparent administration, professional policymaking, pragmatic politics, and robust IT infrastructure. How this complex reform evolves will shape India’s growth trajectory in the post-pandemic landscape.

FAQs

-

What is GST, and when was it implemented in India?

GST, or Goods and Services Tax, is an indirect tax regime introduced in India in 2017. It replaced many escalating levies that the federal and state governments imposed.

-

What impact has GST had on Indian companies since COVID-19?

In India, GST has streamlined company compliance and logistics. But there have also been problems with tax ambiguity, delayed refunds, and compliance challenges, particularly for small businesses after COVID-19.

-

What impact has GST had on startups and MSMEs in India after COVID-19?

For small enterprises, the GST has raised the cost of compliance. They have had to deal with problems including blocked input tax credit, delayed reimbursements, and unclear policies after the epidemic.

-

What are the main obstacles facing India’s GST system at the moment?

The complex tax system, technological issues with the GST interface, barriers to obtaining input tax credit, and expensive compliance expenses, particularly for small businesses, are some of the main concerns.

-

How may GST reform help India recover from the COVID-19 pandemic?

Optimizing the advantages of GST for post-pandemic reconstruction may be achieved by timely changes to tax slabs, dispute resolution, e-invoicing, quarterly reporting, and input tax credit regulations.

-

After COVID-19, have consumer prices increased as a result of GST?

Although the GST has simplified supply chains, the present tax structure’s downward rigidity in pricing has resulted in an inadequate pass-through of GST advantages to consumers.

-

What role does GST play in the post-pandemic formalization of the Indian economy?

Through company registration and transaction tracking, GST includes hitherto unorganized industries in the tax system. Revenues, compliance, and economic transparency all rise as a result.