Who is Liable to Pay GST?

Introduction Goods and Services Tax (GST) is a behind-the-scenes tax that influences the prices you pay when buying goods or using services. It combines taxes

Introduction Goods and Services Tax (GST) is a behind-the-scenes tax that influences the prices you pay when buying goods or using services. It combines taxes

The reverse charge mechanism in GST is the process where the recipient of the goods and services is required to pay tax despite the suppliers

In today’s Good and Service Tax regime, the reverse charge mechanism has emerged as a much-talked topic. In general, the supplier of the goods and

In the ever-evolving world of taxes and compliance, understanding reverse charge mechanism (RCM) transactions is crucial for businesses. Reverse Charge Outward Supplies can be a

Under normal GST rules, goods and service suppliers must prepare GST invoices. But, in the case of the reverse charge mechanism, it is necessary for

Additionally, adhering to these responsibilities ensures smooth and transparent financial transactions within the framework of the reverse charge mechanism. This online journal is designed to

Introduction The place of supply holds great importance when it comes to exporting or importing goods. The commodities, goods, and services need a proper record

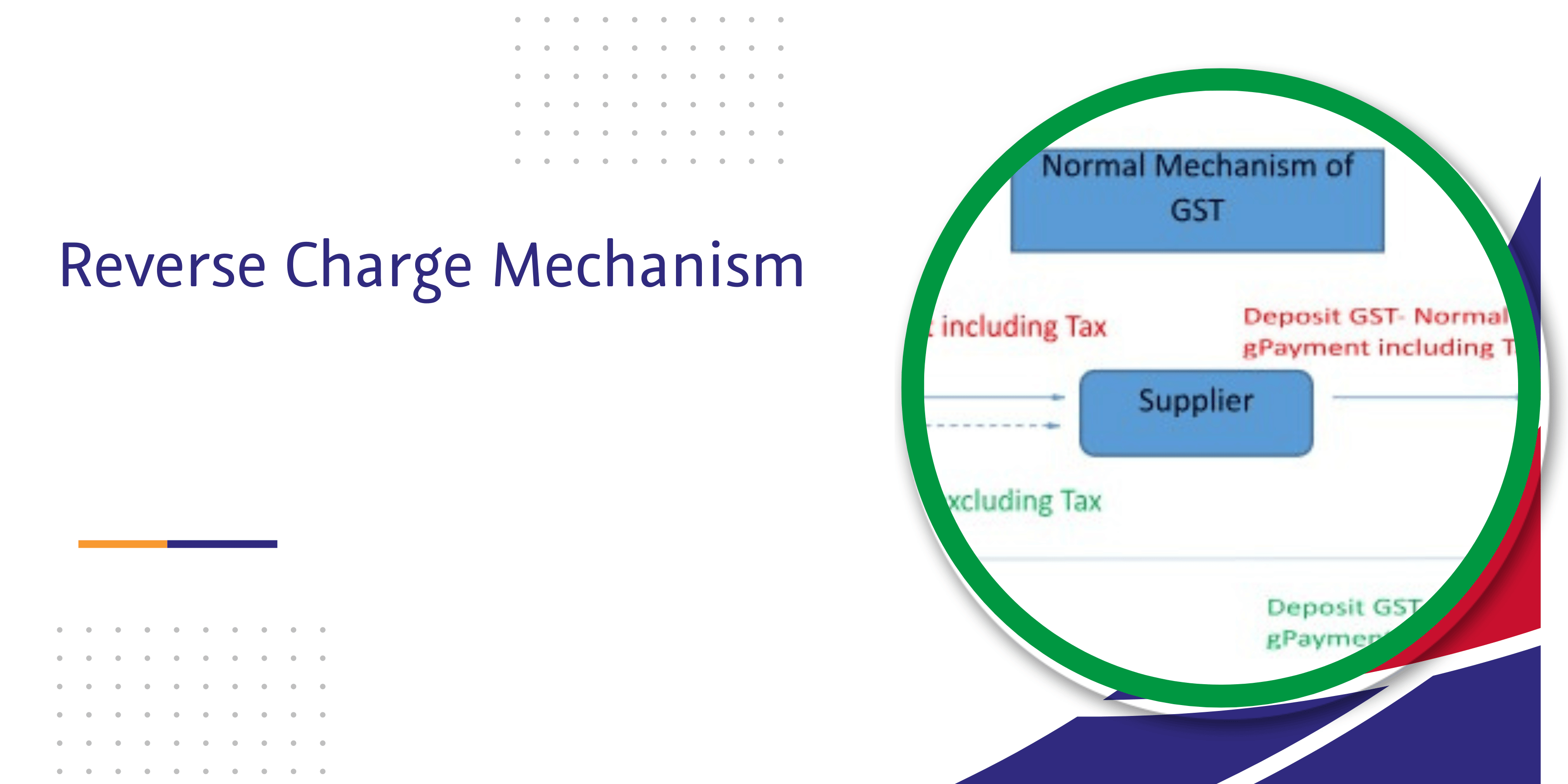

The supplier of goods or services is liable to pay GST. However, in some specified cases like Notified supplies and imports, the liability may be

In the realm of taxation, the Reverse Charge Mechanism (RCM) is a concept that can significantly impact the way goods and services are taxed. This

The idea of reverse charge mechanisms has become apparent in the complicated world of taxes as an essential tool to guarantee tax compliance and prevent

A reverse charge is a system in which the beneficiary of goods or services is liable for paying the Goods and Services Tax (GST) instead

As a general rule, the supplier of goods or services is liable to pay GST. However, in certain cases, GST is payable by the recipient

© Copyright CaptainBiz. All Rights Reserved