The management of electronic waybills or E-waybills is essential for the movement of goods. Technology has been essential in enhancing and facilitating the validity management of E-waybills in recent years. It helps companies make their transportation operations smoother.

Automation and alerts are key elements that help companies comply with E-waybill regulations and control the validity of these important documents. This article explores the significant role of technology in E-waybill Validity Management, emphasizing how automation and computer-based technologies enable efficient E-waybill validity maintenance and monitoring.

We investigate how technology controls the legitimacy of E-waybills and discover how these advancements are impacting logistics in the future and facilitating more effective trade practices.

Automation in E-waybill Validity Management

Automation in the management of electronic waybills’ validity (E-waybills) includes using technology to monitor and maintain the validity of E-waybills to increase productivity.

It employs computers to carry out repetitive operations, such as delivering notifications and remembering expiry dates, without depending entirely on humans. This increases the effectiveness of handling E-waybills.

With technology, businesses can monitor the expiration dates of their E-waybills and take timely action. And transportation systems can operate more smoothly and efficiently.

Automation in E-waybill management validity lowers the possibility of human error and guarantees appropriate regulatory compliance.

Technological solutions for E-waybill expiry alerts

Technological solutions for E-waybill expiry alerts make use of innovative techniques to improve notification and simplify compliance. These systems usually include the integration of automated tools to monitor and control the validity period of electronic waybills (E-waybills).

The following are important aspects of technological solutions for E-waybill expiry alerts:

- Automated Monitoring: Employing software to automatically monitor E-waybill expiration dates, guaranteeing a proactive approach to compliance.

- Real-time Updates: Businesses may be aware of upcoming expirations by receiving up-to-date information on the status of their E-waybills in real-time.

- Customizable Alerts: They enable customers to customize their experience with notifications by allowing them to establish settings for alert frequency, method (email, SMS), and limits.

- Integration with E-waybill Systems: Allowing for smooth integration with current E-waybill systems to retrieve and update data, guaranteeing precision and reliability in expiry alerts.

- Multi-Channel Communication: Enabling several user preferences by supporting many channels for communication, including SMS, email, and application alerts.

- Predictive Analytics: Utilizing predictive analytics to predict when E-waybills will expire, preventive measures can be set into action before complications emerge.

- Compliance Reporting: Generating compliance status reports and alert responses, assisting with internal evaluation and regulatory reporting requirements.

Legal provisions supporting technology in E-waybill management

Legal regulations that encourage the use of technology in E-waybill management are essential for enabling the smooth adoption of digital solutions in the transportation and logistics sectors. Numerous legal statutes and regulatory guidelines recognize the positive impacts of utilizing technology to improve the effectiveness, precision, and adherence to E-waybill procedures.

The following significant legal provisions encourage the use of technology in E-waybill management:

- Goods and Services Tax (GST) Laws: Numerous nations, including India, have combined their GST regulations with E-waybill systems. These rules frequently place a strong emphasis on the use of technology to create, verify, and maintain E-waybills to maintain accuracy and transparency in tax compliance.

- Electronic Commerce Laws: Electronic papers, such as E-waybills, are recognized as valid by the legal frameworks that regulate e-commerce. These laws provide the norms for the electronic creation, storage, and transfer of E-waybill data.

- Data Protection and Privacy Laws: Legal laws associated with privacy and data protection guarantee that the E-waybill management system follows strict guidelines for handling and protecting sensitive data. Adherence to these legal regulations is essential in safeguarding the privacy of persons and businesses that operate in the transportation industry.

- Transportation Laws and Regulations: Many regions have modified or implemented particular transportation legislation to integrate digital procedures, such as electronic waybill administration. These provisions recognize the use of technology for certain duties, like tracking, validating, and sharing E-waybill data.

- Electronic Signature Laws: The legal recognition of electronic signatures supports the authentication of electronically generated and transmitted E-waybills. Digital signatures on E-waybill documents guarantee their legitimacy and validity.

- Digital Authentication and Security Standards: Legal frameworks frequently include guidelines on digital security and authentication to protect E-waybill data during electronic transmission. Adherence to these guidelines guarantees the authenticity and privacy of E-waybill data.

- Customs and Trade Laws: International trade and customs legislation may include rules that support E-waybill management technology to promote cross-border transactions. This covers the use of electronic records for verification and clearance at customs.

Compliance obligations for utilizing technology in E-waybill validity

Businesses must satisfy compliance requirements to use technology for E-waybill validity management and maintain regulatory conformity. Organizations must adhere to data protection laws when integrating technology into E-waybill procedures to ensure secure storage of sensitive data.

They must also adhere to E-waybill laws, which synchronize automated systems with the designated timeframes for validity and notification obligations.

Managing access and preventing unauthorized use of the technology requires the implementation of user authentication and authorization methods. Moreover, compliance includes maintaining an audit trail, which records automated system usage and results for integrity and accountability.

Businesses can efficiently utilize technology to manage the validity of E-waybills while adhering to legal and regulatory standards by addressing these compliance needs.

| E-Waybill Validity |

| Transport Means | Distance | E-waybill Validity |

| Over Dimensional Cargo | 20 km or less | 1 day |

| Over 20 Km | 1 day extra for every 20 Km | |

| Every Vehicle Except an Over Dimensional Cargo | 200 km or less | 1 day |

| Over 200 Km | 1 day extra for every 200 Km |

Documentation for technology-driven E-waybill expiry management

Technology-driven E-waybill expiration management documentation consists of the following:

- Information on the E-waybill: Details of Part-A and Part-B of the E-waybill, such as the number, expiration date, and necessary consignment details.

- Notification Records: Records of the day, time, and method of communication used to send notifications of an e-waybill’s expiration.

- User Authentication Records: A record of the user authentication procedures that the technology system uses to restrict access to the management of E-waybill expiration.

- Documentation on Communication Channels: Information related to the channels through which notifications are sent, guaranteeing transparency in the notification process.

- Data Privacy Compliance Documents: Documents attest to compliance with data privacy laws, particularly in cases when notifications contain sensitive or identifiable data.

- Regulatory Compliance Documents: Records that demonstrate adherence to applicable regulations controlling electronic notifications, documentation, and the management of E-waybill expiration.

- Documentation of Internal processes: Documentation detailing internal protocols and processes about technology-driven E-waybill expiration management.

- Exception Handling Protocol: A document outlining how to handle extraordinary situations in the technology-driven E-waybill expiration management process, such as trans-shipment events.

- System Integration Documentation: Provides information on how the technology system communicates with E-waybill databases and other relevant platforms to guarantee correct and up-to-date data.

Reporting requirements for technology-enabled E-waybill management

Effective technology-enabled systems require addressing several important issues for e-waybill management. First and foremost, the system needs to be highly effective at handling rules, offering a comprehensive response to all of the legal and non-legal issues that suppliers and carriers encounter.

The increasing complexity is too much for the conventional manual method to handle, which might result in lost revenue and lower production. A strong E-waybill management service should be able to handle complex problems with ease to overcome this.

Transparency is another essential component, as it can lead to inefficiencies in the transportation network. Through the centralization of e-way bill creation and management, the system should improve visibility and optimize the workflow.

Furthermore, an effective E-waybill management tool should be able to combine multi-state E-way bills for different units for organizations that operate in numerous states. By conducting methodical inspections, this capacity guarantees control and improves vehicle performance.

For maximum effectiveness and efficiency, a technology-enabled E-waybill management system has to fulfill legal requirements, handle complexity, improve transparency, and enable multi-state bill consolidation.

Challenges and risks in implementing technology for E-waybill

Technology implementation for E-waybills, which enable electronic recording of the movement of goods, has risks and challenges. Some of them are:

- Broad acceptance and compliance among organizations is a major problem while switching from conventional paper-based methods to digital platforms might encounter challenges.

- Additionally, as electronic systems hold sensitive information regarding shipments, there are privacy and data security issues. Strong data protection policies and cybersecurity safeguards need to exist to mitigate these threats.

- The requirement for a dependable and seamless IT infrastructure is also problematic since any glitches in the system might affect businesses and hinder the efficient flow of goods.

Establishing efficient laws, raising awareness, and creating robust technological solutions for E-waybill implementation are all necessary steps towards overcoming these obstacles, which need cooperation between governmental organizations, corporations, and technology providers.

Exemption considerations for specific technological solutions

E-waybill Validity Management has been made easier by introducing several technology solutions, and exemptions are considered for certain situations or sectors. These exclusions are intended to ensure regulatory compliance while addressing specific issues and facilitating a more efficient movement of products.

Industry-Specific Exemptions

- Sensitive goods: Businesses that handle perishable or sensitive items may need extra precautions. Depending on the nature of the products being carried, exemptions may be allowed for shorter validity periods.

Some of them are:

| Valuable metals, genuine or artificial pearls, semi-precious or precious stones, and metals covered with precious metal |

| Goods such as jewelry and products crafted by gold and silversmiths |

| Currency |

| Used personal and household effects |

| Unworked and worked co-rail |

| Curd, lassi, buttermilk |

| Fresh milk and pasteurized milk not containing added sugar or other sweetening matter |

| Vegetables |

| Fruits |

| Unprocessed tea leaves and unroasted coffee beans |

| Live animals, plants, and trees |

| Meat |

| Cereals |

| Unbranded rice and wheat flour |

| Salt |

| Items of educational importance (books, maps, periodicals) |

- Emergency Supplies: Exemptions could be taken into consideration in emergencies to speed up the delivery of necessities like food, medicine, and relief supplies.

Geographical Considerations

- Remote Areas: Goods traveling to or from remote locations where the regular validity period would provide logistical difficulties may be exempt from this rule. A validity extension could be provided to enable more convenient travel.

E-waybill Validity Extension Form1

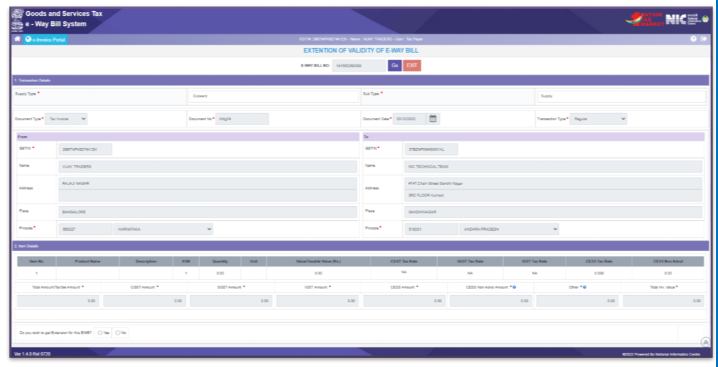

E-waybill Validity Extension Form2

Environmental Considerations

- Green Initiatives: To encourage eco-friendly logistics, companies implementing sustainable transportation strategies, such as using electric cars or other eco-friendly choices, may be eligible for exemptions or longer validity periods.

Best practices for leveraging technology in E-waybill validity management

Organizations may enhance E-waybill validity management, boost productivity, and guarantee regulatory compliance by using these best practices.

Automate the creation of E-waybills:

- Install a system that uses transaction data to generate E-waybills automatically.

- To reduce mistakes in manual data entry, integrate E-waybill creation tools with your accounting or ERP software.

Real-time Data Integration:

- Make sure that pertinent databases and systems are integrated in real time so that transaction data may be quickly collected and updated.

- Make use of APIs (Application Programming Interfaces) to connect your systems with E-waybill platforms seamlessly.

Centralized E-waybill Management System:

- Create a centralized E-waybill management system to prevent inconsistent or redundant data.

- Centralization makes it simpler to monitor and audit E-waybill transactions.

Mobile Accessibility:

- Make the E-waybill administration interface mobile-friendly so that stakeholders may view and update information while on the go.

- To safeguard sensitive data, make sure the mobile application complies with security requirements.

Alerts and Notifications:

- To avoid unintentional non-compliance, set up automatic alerts and notifications for E-waybill expiry.

- To guarantee prompt response, notifications can be delivered by email, SMS, or a specific application.

Data Analytics for Compliance Monitoring:

- Use data analytics tools to keep an eye on compliance and spot any unusual or repetitive E-waybill transactions.

- Using the information from analytics, take proactive measures to resolve any problems or inconsistencies in the E-waybill process.

Frequent Software Updates:

- Keep your E-waybill management software up to date with the newest features and security updates.

- Update the system often to make sure it complies with changing rules and to fix any possible weaknesses.

Partnership with Regulatory Organisations:

- Encourage partnerships with regulatory organizations to be up to date on modifications to E-waybill legislation.

- Make sure your IT solutions comply with the most recent legislative mandates.

Audit and verification of E-waybill validity using technology

The use of cutting-edge technology has greatly simplified and improved the audit and verification of the authenticity of E-waybills. The old approaches of monitoring and guaranteeing adherence to E-waybill laws have undergone a radical change with the introduction of digital technology.

Robotic systems use artificial intelligence and data analytics to perform comprehensive audits of E-waybills, instantly cross-referencing data with pertinent databases. These technologies facilitate the quick identification of anomalies, errors, or possible fraudulent activity, allowing authorities to promptly take corrective action.

The verification process has been further reinforced by the application of blockchain technology, which guarantees the transparency and immutability of E-waybill data. Furthermore, machine learning algorithms are always developing to identify trends and abnormalities, which makes the audit framework more resilient and flexible.

Conclusion

In summary, technology plays a critical role in improving logistics and guaranteeing compliance in the management of E-waybill validity, especially through automation and alerts.

Automation makes it easier to process E-waybills quickly and accurately, and real-time notifications provide you with a proactive way to recognize and address errors.

The integration of technology and E-waybill management not only improves operational effectiveness but also cultivates a transportation ecosystem that is more open and accountable.

With the use of these technical developments, we predict further advancements in the accuracy, movement, and general efficacy of E-waybill validity verification procedures.

FAQs

Q1. What is the role of technology in E-waybill validity management?

Technology is essential for effective E-waybill validity management since it automates procedures and offers real-time notifications.

Q2. How does automation benefit E-waybill processing?

Automation expedites the whole validation process, minimizes mistakes, and ensures correctness in the processing of E-waybills.

Q3. What types of alerts are generated in E-waybill management through technology?

Real-time notifications enable stakeholders to take prompt remedial action if they become aware of inconsistencies, possible mistakes, or abnormalities in E-waybill data.

Q4. What is the significance of real-time alerts in E-waybill validity management?

Real-time alerts make it possible to respond to problems quickly, which avoids delays, lowers the chance of non-compliance, and improves the logistics process’s overall effectiveness.

Q5. How does automation improve the overall efficiency of E-waybill management?

Automation eliminates manual errors, reduces processing time, and enhances the overall efficiency of E-waybill management, ensuring a smoother workflow.

Q6. Is technology adaptable to changes in E-waybill regulations?

Yes, technology—especially that which possesses machine learning capabilities can adapt to regulatory changes by constantly changing to meet new norms and criteria.

Q7. Can E-waybill automation systems integrate with other logistics platforms?

Yes, many E-waybill automation systems are designed to seamlessly integrate with other logistics platforms, ensuring a cohesive and interconnected supply chain.

Q8. What happens if an E-waybill expires during transit?

If an E-waybill expires before the completion of the journey, a new E-waybill needs to be generated for the continuation of the transportation of goods to ensure compliance with regulations.

Q9. How long is the validity of an E-waybill?

The validity of an E-waybill depends on the distance the goods are expected to travel. Generally, it ranges from one day for every 100 kilometers to a maximum of 15 days.

Q10. Can an E-waybill be modified once it’s generated?

Yes, certain details in an E-waybill can be modified, such as the vehicle number or transporter details, but this is allowed only before the goods are moved.