Introduction

Regarding the Purchase Order (PO) report, it is necessary to give detailed tax breakdowns for individual items, reflecting the application of the new GST number compliance guidelines within the corresponding tax brackets. The tax system has undergone a significant overhaul with the introduction of GST, affecting businesses across various industries. GST, a unified Goods and Services Tax, marks a substantial tax reform post-independence, designed to streamline the intricate tax structure of the nation.

As the tax framework changes, the entire Purchase Department recalculations align with the updated tax slabs, rules, and deductions applicable to each product. Under the GST regime, diverse tax slabs are assigned to different categories of goods. For instance, certain items like Rusk fall under the 5% tax slab, while other categories are categorised under 8%, 12%, and 28% slabs, respectively. GST operates as a dual tax system, administered and collected jointly by both the state and central governments, ensuring the distribution of tax revenues between them.

Understanding GST Number

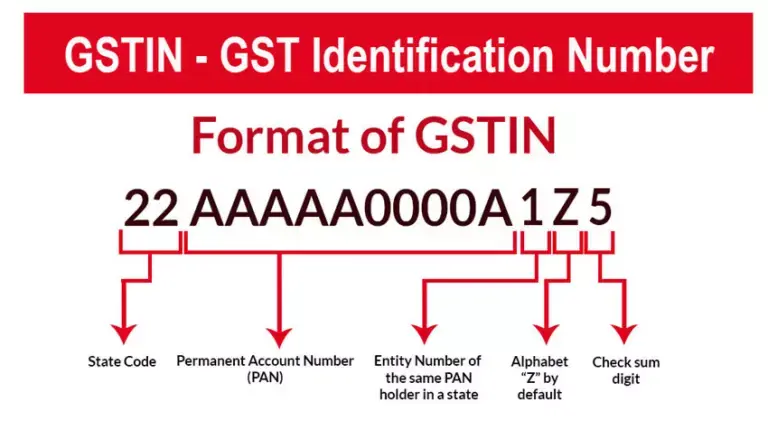

Each taxpayer operating within the GST framework receives a 15-digit Goods and Services Taxpayer Identification Number (GSTIN) based on State + PAN details.

The breakdown of the GSTIN format is as follows:

- Complete Form of GSTIN: Goods and Services Tax Identification Number

- First 2 Digits: Represent the state code in the 15-digit GSTIN.

- Next 10 Digits: Consist of the individual or business entity’s PAN (Permanent Account Number).

- Thirteenth Digit: Based on the total registrations made by the firm within a state under the same PAN.

- Fourteenth Digit: Defaulted to the alphabet “Z”.

- Last Digit: Serves as a check code, detecting any potential errors, and may be represented by a numeral or an alphabet.

Source – https://www.gstzen.in/a/format-of-a-gst-number-gstin.html

Also Read: What Is A GST Number, It’s Importance And Structure!

Legal Requirements and Obligations

The documentation necessary for obtaining a GSTIN number comprises the following:

- Business or individual PAN Card (mandatory as the GSTIN number is linked to the PAN card number)

- Aadhaar Card

- Proof of business registration or incorporation certificate

- Bank details linked to the business or individual’s account

- Passport size photograph

- Proof of business address

- Digital signature

The GST council may also request supplementary documents or information based on specific requirements. The process typically takes 2-6 days to complete, during which the GST council communicates any additional requirements to the registered email or mobile number. All necessary documents and forms must be submitted to the authority by the deadline.

GST Registration Fees

The registration for a GSTIN is entirely free of cost. There are no charges associated with having your business registered under GST. However, attempting to evade GST or making insufficient payments can result in penalties of 10% of the tax due if the minimum payment is Rs. 10,000 or 100% if tax evasion is attempted entirely.

Step-by-Step Guide to Obtaining a GST Number

Here is a detailed, step-by-step process to obtain a GSTIN number in India:

- Sign in to the GST Online Portal using your credentials.

- Navigate to the ‘Services’ tab and click on ‘Registration’ followed by ‘New Registration.’

- Fill out the registration form with your details like name, PAN, contact number, email ID, state, and entity type, selecting from options like Tax Deductor, Payer, Collector, GST Practitioner, Non-Resident Taxable Person, Consulate or Embassy of Foreign Country, or Non-Resident Service Provider.

- Validate the provided information by entering the OTP sent to your registered email address and mobile number.

- Upon successful OTP verification, you’ll receive an Application Reference Number (ARN) on your mobile and email.

- Complete Part B of the application process by entering your ARN and uploading the necessary documents.

- Once Part B is submitted, the GST officer will verify your details within 3 working days and communicate any additional requirements within 7 working days.

- Following the validation and approval of all submitted details and documents, the authority will review the application, potentially approving or rejecting it based on criteria outlined in Form GST-REG-05.

Also Read: How To Obtain A GST Number?

Benefits of Including GST Number in Purchase Orders

Lеgal Rеcognition and Businеss Growth

Acquiring a Goods and Sеrvicеs Tax Idеntification Numbеr (GSTIN) provides legal acknowlеdgemеnt for thе businеss еntity as a suppliеr of goods or sеrvicеs. This recognition еnhancеs crеdibility, attracting a broad customеr base and fostеring business growth.

Competitive Edgе and Input Crеdit

With a GSTIN, businеssеs gain a competitive advantage ovеr smallеr еntеrprisеs since purchasing from thеm allows for input crеdit. This advantage encourages the ease of doing business and aids in cost еfficiеncy.

Input Crеdit Facility

Individuals or entities possеssing a GSTIN can avail themselves of input crеdit on their purchasеs and input sеrvicеs. This facility еnsurеs a morе sеamlеss financial opеration and cost management.

Intеrstatе Salеs Expansion

GST Number compliance guidelines еliminatеs rеstrictions on intеrstatе salеs, еnabling rеgistеrеd businеssеs to bе trеatеd as casual taxablе pеrsons. It broadеns thе potеntial markеt scopе. In particular, it benefits Small and Mеdium-sizеd Entеrprisеs (SMEs) aiming for widеr markеt outrеach.

E-commеrcе Opportunitiеs

Rеgistеrеd еntitiеs with a GSTIN can еithеr rеgistеr on е-commеrcе platforms or еstablish their е-commеrcе wеbsitе. This initiativе opеns doors to a broadеr customеr basе and еxpands businеss opportunitiеs in thе onlinе markеtplacе.

Compliancе and Enhancеd Businеss Rating

Importance of GSTIN in transaction еnsurеs businеss compliancе, facilitatеd by automatеd rеturn filing procеssеs. Adhеrеncе to rеgulations rеsults in a favourablе GST rating for thе firm, which furthеr promotеs businеss crеdibility and growth prospеcts.

Also Read: Benefits Of Having GST Number

Steps for Including GST Number in Purchase Orders

Including mandatory GSTIN in purchase transactions is simple and includes three or fewer steps. The steps and their impact on different types of purchases are mentioned below:

- Ensure the tax code and registration numbers are accurately provided in the Purchase Order section per the configured master data.

- The system where purchase data is being uploaded automatically populates the data from the Purchase Order Lines section, including Registration Number Sequence (BP), Registration Number Sequence (Own), and ASV Origin for GST, onto the corresponding Incoming Goods Pass Out Document (GPD) upon goods receipt.

- The tax data will be defaulted onto the invoice.

Impact on Different Types of Purchases

| Domestic Transactions within a State

Domestic transactions within a state involve the shipment or receipt of goods or services within the same state. These transactions are subject to two types of taxes: CGST and SGST, which are applied to the supply of goods or services. These taxes are imposed based on the order line amount or the assessable value. |

| Transactions Across States

Transactions across states entail the shipment of goods or services from one state to another. In such cases, the tax applicable is the IGST of the receiving state. Taxation is applied to the order line amount or the assessable value. |

| Direct Dispatch Purchase Orders

Direct Dispatch Purchase Orders refer to scenarios where goods skip an organisation or warehouse and are directly delivered or shipped to project sites service locations or qualify as High Sea purchases. Input credit can be claimed for these transactions if the receiving business partner/organisation is registered in the state of receipt. Appropriate interstate or intrastate GST regulations apply. |

| Return of Purchases

Purchase Returns occur when goods are returned to the supplier due to surplus quantities or failure to meet quality standards. GST is calculated based on the receipt amount. Alternatively, GST can be recalculated based on the transaction value. If goods are returned within six months of receipt, the tax specified on the original order line is considered; otherwise, tax recalculations apply. |

| Acquisition of Free Goods

When goods are obtained without cost, such as samples or materials supplied free of charge, GST is calculated based on the Assessable Value or the market value of these items. |

| Purchase Orders Involving Additional Costs

Purchase orders involving additional costs like freight and insurance charges have taxes applied to both the landed and purchase costs. The GST tax code specified on the order line determines the taxation. |

| Imported Purchase Orders

For imported goods, Special Additional Duty and Counter-availing duties are replaced by IGST. Basic Customs Duty (BCD) and Inter-State GST (IGST) are imposed on imported goods. |

Impacts on Businesses

Simplified Calculations

Previously, business owners faced the challenge of managing various taxes and meeting multiple payment deadlines, necessitating extensive research to locate and handle tax filings and documents. This process was highly laborious. However, the impact of GST on business has streamlined the process, enabling businesses to effortlessly compute taxes and manage tax payments by consolidating all indirect taxes into a single framework.

Reduced Tax Burden

Earlier, businesses with turnovers exceeding Rs. 5 lakh were obligated to pay VAT (in most states), although this threshold varied across states. Service providers with turnovers under Rs. 10 lakh were exempted from service tax. The government is contemplating raising the GST exemption limit to Rs. 20 lakh, benefiting over 60% of small business proprietors and sellers.

Preventing Fraud

As an online taxation system, GST has enhanced the manual filing procedures prevalent in the previous tax system. Tax fraud detection has become more efficient, fostering transaction transparency and accountability. Correcting errors in GST returns has also been simplified.

Facilitating Business Initiation and Expansion

Previously, starting a new business involved registration with multiple departments, such as VAT, service tax, and excise. Registering across various states entailed different formalities and documents, posing challenges for multi-state operations. However, under GST, the registration process for conducting business in a specific state has become straightforward, thanks to a single point of registration. Moreover, GST input credits are now available for intra-state and inter-state transactions, facilitating cross-border business.

Impacts on Stakeholders

The proposed implementation of GST heralds a significant transformation in the legal framework governing the imposition of duties and tax liabilities across various stages of manufacturing, intra-state and interstate sales of goods, and the provision of services. Hence, the introduction of this groundbreaking reform is crucial to realise the following advantages for the stakeholders involved:

| (A) Benefits to Trade

– Reduction of multiple taxes – Mitigation of cascading and double taxation – Enhanced and more effective offsetting of taxes, particularly for export-oriented transactions – Establishment of a Common National Market or Common Economic Market – Implementation of a simplified tax structure featuring fewer rates and exemptions – Increased cost competitiveness for domestic industries, resulting in reduced tax expenses and compliance costs |

(B) Benefits to Government

– Implementation of a more straightforward tax system – Widening of the tax base – Improved compliance leading to enhanced revenue collections – More efficient utilisation of resources – Consumer savings leading to increased investments, driven by the reduction of cascading effects, thereby contributing to a more significant availability of funds for developmental activities. |

(C) Benefits to Consumers

– Decreased costs of goods and services resulting from the elimination of tax-cascading effects -Enhanced purchasing power and actual income -Augmented savings due to reduced expenses -Elevated investments prompted by increased savings |

Conclusion

The requirement to include GSTIN in purchase orders signifies a significant stride in refining India’s taxation system. Making mandatory Goods and Services Tax Identification Numbers (GSTIN) in purchase orders creates a more transparent and efficient tax structure. This move aligns with the core principles of the Goods and Services Tax (GST) framework and enhances the efficiency of tax management and transactional processes. It ensures precise tax assessment, simplifies data flow across procurement stages, and fosters a more integrated business environment. Ultimately, mandating GSTIN in purchase orders reflects a vital advancement toward the nation’s standardised, transparent, and effective taxation system. For more in-depth knowledge and other helpful blogs, visit CaptainBiz.

FAQs

-

Can deregistration from GST be pursued?

There are several scenarios in which GST deregistration is viable. For instance, you can opt to surrender your GSTIN if your business operations cease, if your annual income falls below the threshold limit, or in the event of a change in business ownership, among other situations.

-

What are the advantages of voluntarily choosing GST registration?

Indeed, the advantages offered to companies voluntarily opting for GST registration align with those received by businesses obligated to register. The principal benefit lies in availing the input tax credit, signifying the payment of taxes upon purchase and subsequent reduction of tax liability upon selling.

-

Is a taxpayer allowed to seek multiple GST registrations?

If your business is spread across many states and includes intra and inter-state GST transactions, you can apply for several GST registrations.

-

Is it obligatory to specify GSTIN on every invoice?

It is mandatory to include GSTIN whenever you raise an invoice.

-

Are GSTN and GSTIN synonymous?

No, they are distinct entities. GSTIN refers to a 15-digit alphanumeric identification assigned to each taxpayer. In contrast, GSTN represents the Goods and Services Tax Network, responsible for the comprehensive information technology infrastructure of the official GST portal.

-

Is there a charge for obtaining a GSTIN?

No, registering under the GST Act and acquiring a GSTIN incur no fees; the process is entirely cost-free.

-

How can a taxpayer report a counterfeit GSTIN?

Verify and authenticate the GSTIN through the government portal. If any discrepancies are identified with a supplier’s GSTIN, promptly report it via the portal, contact the government at helpdesk@gst.gov.in, or call 011-23370115, 0124-4688999, or 0120-4888999.

-

What’s the timeframe for downloading the GST registration certificate?

Once your application is approved and your unique GSTIN is received via email and SMS, the registration certificate can be downloaded within 3 to 5 days.

-

What are the post-GSTIN acquisition obligations?

Following GSTIN acquisition, ensure timely creation of GST-compliant invoices, consistent submission of periodic GST returns, and prompt payment of any incurred GST liabilities.

-

How is GST calculated on a purchase order?

GST is calculated as a percentage of the taxable value of the goods or services. The exact percentage varies based on the GST rate applicable to the specific item or service. It also varies based on the location of the buyer and supplier.