Introduction

The implementation of GST laws in 2018 ensured that transporters must have an e-way bill with them while moving products from one location to another. However, inter-state transport rules and intra-state transport rules differ in a few areas, and the e-way bill requirements also vary because of that.

Inter-state transport means the goods are transferred from one state to another. The GST Act states that if the seller and the client are located in different states or different union territories, the transport will be considered an inter-state supply. That will also be the case if one lives in a state and the other in union territory and vice versa. Furthermore, the transport of imported products is likewise classified as inter-state supply. On the other hand, the movement of goods inside the same state or Union Territory is regarded as an intra-state transport.

According to CGST rules, if the total value of the product exceeds Rs. 50,000, it falls under GST laws, and an e-way bill will be mandatory. However, this price cap regulation is mostly for inter-state transportation, and for intra-state transport, the state can heavily influence the process. Companies around the country are now prepared to comply with the e-way bill regulations, and they also like to reap the benefits of the inter-state and intra-state transportation exemptions.

Whether you are a seller or a consumer, these inter-state and intra-state tax differences and tax exemptions will affect you financially. In this article, let us discuss the issues related to these tax rules and exemptions. Keep reading to find out all the details of tax exemptions, e-way bill requirements, variations, and more.

Understanding Inter-state E-way Bill Exemptions

Under CGST and SGST Rule 138(14)(d), the State Government may exempt the need for an e-way bill within the State for a designated region. Certain State Governments have issued notices following these state powers. Therefore, a transporter do not need to create an e-way bill, but they still need to ensure that all other documentation, such as the invoice and bill of supply, complies with applicable laws and regulations.

The other most common inter-state e-way bill exemptions are mentioned below.

- Transporting goods valued less than Rs. 50,000 except for certain products such as handcrafted items.

- Items carried with a customs stamp, under customs supervision, or from one customs-regulated port or station to another.

- For customs clearance, the container must go from the port, airport, air cargo complex, and land customs station to an inland container depot (ICD) or container goods station (CFS).

- Goods delivered to or from the Ministry of Defence transported by rail.

Also Read: Threshold Limits for E-waybill Exemptions: State-wise Variations

Navigating Intra-state E-way Bill Regulations and Exemptions

Not all intra-state transports are excluded from the requirement of having an e-way bill. For large transports almost all goods are taxed by the state government, and the transporter must carry a valid e-way bill.

Check out the regulations and the process of acquiring an e-way bill for intra-state transport:

- When goods are given to a transporter for road transport, the transporter is responsible for generating the e-way bill and updating part B, while the registered person is responsible for providing part A information on the e-way bill.

- If the shipment is being sent by rail, air, or in a vehicle, the consignor or consignee must create the e-way bill themselves.

- Transporters may also generate Part-A of the e-way bill upon receiving consent from the consignee or consignor.

- Regardless of the size of the consignment, an e-way bill must be created by either the seller or the transporter if the goods are being moved in one state by a transporter located in another state.

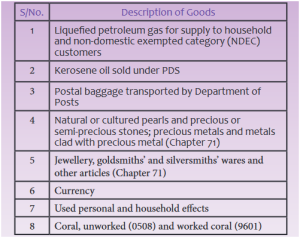

Specific products can be exempted from the GST rules for intra-state transport. The image below specifies the types of goods that can be transported inside a state without an e-way bill.

Implications of Variations in E-way Bill Regulations Between States

Since the adoption of e-way bills in 2018, there has been an increase in e-way bill creation related to inter-state transportation of commodities. All states and union territories now generate e-way bills for the movement of products inside the state/UT, however, as we have mentioned before, the rules slightly vary.

- Some states set their threshold, and instead of Rs. 50,000, some have increased the threshold to Rs. 1,00,000.

- The businesses of those states can profit more because of this rule variation.

- The consumers also benefit since sellers can offer the goods at a lower price because they pay less tax.

- Consumers living in a state that follows the Rs. 50,000 threshold need to pay more for the same product.

Compliance Considerations for Businesses in Inter-state Transactions

A business moving taxable goods for inter-state transactions without an e-way bill or other documents faces harsh penalties from the authorities. Repeated non-compliance only increases the fine the company must pay for the e-way bill regulation violation.

- According to Rule 138 of the CGST Rules, every company that moves consignments valued at Rs. 50,000 or more must follow the e-way bill requirements, and their transporters must fill “part A” and “part B” of the e-way bill.

- Not carrying an e-way bill will result in a Rs. 10,000 penalty for the company.

- Section 122 of the CGST Act states if the tax amount of the goods being carried inter-state without an e-way bill is higher than Rs. 10,000, the business must pay the due tax amount instead of the fixed penalty.

- Section 129 of the CGST Act states that inter-state transport of goods without e-way bills can lead to a complete seizure of the goods and the vehicle used to transport them.

Also Read: Navigating Regulatory Changes: Ensuring Seamless E-Waybill Compliance

Addressing Challenges in Intra-state E-way Bill Exemptions

Rule 138(14) states that no e-way bill needs to be created for exempt goods and services in case of intra-state transport. Rule 138(14)(d) states that exemption is granted even in situations when there is supply but no movement of products. Because of these rules, some exemptions can be useful for a seller.

However, there are three types of exemptions- absolute exemption, conditional exemption, and partial exemption. The absolute exemption is completely tax-free while conditional exemptions come with conditions just like the name suggests. Not all intra-state e-way bill exemptions are absolute exemptions which is a challenge for the transporter.

Also Read: Challenges And Solutions In Import E-Waybill Compliance: Cross-Border Considerations

Legal Nuances in Navigating Inter-state and Intra-state E-way Bill Exemptions

The most troublesome inter-state and intra-state e-way bill exemption issues occur mainly because of different money caps and exemption regulations.

This chart gives you a clear idea of why transporters find it hard to navigate this landscape.

| State | Relaxation from requirement of e-way bill | Notification No. and date |

| Bihar | e-way bill is required only if value exceeds Rs one lakh (earlier it was two lakhs) | Notification No. SO 180 dated 19-4-2018 amended on 19-1-2019 |

| Chhattisgarh | E-way bill not required for 15 specified goods | Notification No. F-10-31/ 2018/CT/V (46) Chhattisgarh dated 19-6-2018 |

| Delhi | e-way bill is required if value exceeds Rs one lakh | Notification No. 3/2018 dated 15-6-2018 |

| Goa | e-way bill is required only for specified 22 articles. For others, tax invoice, DC, Bill of Supply or Bill of Entry is sufficient | Notification No. CCT/26-2/2018-19/36 dated 28-5-2018 |

| Gujarat | e-way bill is not required for intra-city movement of goods, irrespective of value. In case of intra-state movement of goods, e-way bill is required for all goods w.e.f. 19-9-2018 [earlier, it was required on for 19 types of goods]. However, e-way bill is not required for intra-state movement of flank, yarn, fabric and garments for work | Notification dated 19-9- 2018 [Earlier Notification No. GSL/GST/RULE- 138(14)/B.12 dated 11-4- 2018 which has been rescinded on 19-9-2018] |

| Jharkhand | Intra-state movement of goods up to value of Rs 1,00,000 exempted, except in case of 12 specified goods i.e. in case of the 12 specified goods, e-way bill is required for intra-state movement of goods if value exceeds Rs 50,000 | Notification No. 66 dated 26-9-2018 |

| Kerala | Exemptions, irrespective of limit of value – (a) sale of goods using sales van (b) Rubber latex, rubber sheets and rubber scrap, spices (c) Movement of goods to unregistered persons within 25 Km | Notification No. 3/2018- State Tax dated 14-5-2018 |

| Maharashtra | e-way bill for intra-state movement of goods is not required if value is less than Rs one lakh. Further, for movement of Hank, Yarn, Fabric and Garments for job work, e-way bill is not required irrespective of value | Notification No. 15E/2018 – State Tax dated 29-6-2018 |

| Rajasthan | e-way bill is not requirement, but relevant documents like tax invoice, delivery challan, bill of entry etc. should be carried for (1) Movement of goods within State (for job work) (2) Movement of goods within State if value does not exceed Rs. one lakh except tobacco and its products like pan masala, cigarettes, khaini, bidi w.e.f. 1-4-2021 | Notification No. (1) F17(131) ACCT/GST/2017/3743 dated 6-8-2018 (2) F17(131-Pt-II) ACCT/GST/2017/6672 dated 30-3-2021 |

Industry-specific Insights into Variations in E-waybill Regulations

We have already discussed that certain items are free from the e-way Bill regulations, and a few industries benefit more from it than others. These are the three sectors that benefit from these rules.

1. Agriculture Sector

A lot of products from this sector fall under the exemption category because it is necessary to keep the food prices down.

- Fruits and Vegetables

- Butter, curd, lassi, fresh and pasteurized milk

- Unroasted coffee beans and unprocessed tea leaves

- Salt

- Unbranded wheat flour and rice

2. Transportation Sector

Making transportation-related products exempt from e-way bills is important for public transportation services.

- Liquefied petroleum gas

- Kerosene oil

- Transportation of postal luggage

- Department of Posts

- Petroleum crude

- Natural gas

- Petrol

3. Precious Metal and Stones

- Gold and silver jewelry

- Precious and semi-precious stones

- Natural pearls

Strategies for Optimizing Compliance in Inter-state and Intra-state Transactions

CGST Act Section 122 mentions that a transporter carrying any taxable goods without an e-way bill is subject to a penalty of Rs. 10,000 or, if applicable, the amount of due tax on the goods.

Section 129 of the CGST Act states that any person who transports or stores goods while they are in transit in violation of the Act’s provisions or its rules, as well as any documents about the goods and conveyance used as a means of transportation, may be subject to detention or seizure.

The CGST Act stipulates in Section 130 that such seized or detained commodities must be confiscated.

This image shows how e-way bill checks get performed and how to carry a valid e-way bill to avoid property seizure.

Adapting to Changes in Regulations Affecting E-way Bill Exemptions

In recent years, the government has made a few changes in the GST bill. These changes, in turn, have affected the e-way bill requirements, regulations, and exemptions. When the GST was first introduced, many lower-income and middle-income people suffered a loss because of tax increases.

In recent amendments to the bill the money ceiling has been raised, and transporters with a high annual income level are charged more taxes through e-way bills. However, companies are adapting and finding new ways to handle the GST regulations.

Proactive Measures for Businesses to Stay Compliant Amid Variations in E-way Bill Regulations

Companies need to actively train their employees and check the legal issues before transporting goods. Not maintaining e-way bill regulations hurts the tax system, and in turn, the complete budget of the nation falters.

Some businesses are taking initiatives and giving their employees access to software that helps e-way bill regulation maintenance easier.

The industry of transport and logistics is crucial to the administration of the e-way bill. The degree to which enterprises comply with and rigorously manage the provisions of the e-way bill will determine the effectiveness of the bill.

Conclusion

Uniform e-way bill regulations applicable across the nation were introduced by the GST Act. The e-way bill was designed to eliminate the shortcomings of the previous transport tax system, which operated under VAT in some states. It was challenging to comply with the various bill regulations that each State had established, and now, under one single bill, the system is more efficient.

However, when it comes to e-way bill exemptions, the situation is not so straightforward. Especially if you consider inter-state and intra-state e-way bills and related exemptions, the procedure is complicated and can confuse transporters.

One thing that has made the process simple to track is its digitization. The digital interface makes it easier for transporters to move goods quickly without violating regulations. The strict penalties that are firmly in place for anyone who violates intra-state or inter-state e-way bill regulation also help to keep the system uncorrupted yet profitable for the state.

FAQs

-

Can authorities stop transport vehicles to check e-way bills?

Any cargo-carrying vehicle can be stopped for e-way bill checking at any checkpoint. Authorities can use RFID readers, and it is also possible that they might verify the goods physically. Keep your e-way bill updated and always provide correct information in the form to avoid trouble.

-

If an e-way bill is not required, should I carry other documents?

An e-way bill is a document for monitoring the flow of commodities and detecting instances of tax evasion. However, the government provides exempt cases where carrying an e-way bill is not necessary for the goods being transported. When generating an e-way bill is not necessary, the transporter must ensure they have a copy of the tax invoice or a bill of supply.

-

How do I generate e-way bills?

To generate an e-way bill, you will need the relevant data such as the kind of products transported, the HSN code, the number of goods and taxable value, receiver and transporter details, vehicle number, etc. An e-way bill must be produced before the goods are in transit, and the transporter must carry it with them.

-

How can a transporter be sure that the e-way bill is assigned to them?

The transporter can access the reports section of the EWB portal, choose the EWB assigned to me for the transport option, and see the list after logging in. The transporter’s dashboard also displays the e-way bill assignments.

-

How does the process of inspection and verification of goods work?

When a vehicle has been stopped and its goods checked, the officer will submit a record of it within 24 hours. Within three days following the inspection, the final report must be filed in Part B of GST EWB-03. A transporter may submit information in Form GST EWB-04 on the common portal if the vehicle is intercepted or held for more than thirty minutes.

-

Is there a rule that needs to be followed when transferring multiple consignments together?

When transporting several consignments in a single vehicle, the driver is required to electronically enter the consignment’s e-way bill serial number on the e-way bill gateway. Before any items are moved, a consolidated e-way bill in type EWB-02 needs to be created.

-

What documents should the person in charge of conveyance carry?

A duplicate of the e-way bill or the e-way bill number, either electronically or physically mapped to an RFID, and the invoice, bill of supply, or delivery challan are required to be carried by the person in charge of a conveyance.

-

Can the transporter change the conveyance mode during transit?

Before making a transfer of goods from one conveyance to another while the products are in transit, a transporter must update the data of the new conveyance in the e-way bill that has already been created.

-

What happens if I generate an e-way bill but fail to transport the goods?

If an e-way bill is created, but the products are not transported, the e-way bill can be canceled within 24 hours. You can generate a new e-way bill for the products after you resolve the issue.

-

Is it possible to cancel an e-way bill?

It is possible to cancel an e-way bill from the portal within 24 hours of the e-way bill’s creation. However, rule 138B of the CGST states once an e-way bill has been used in transit, it cannot be revoked.