The entire industry is flooded with show cause notices (in form GST DRC-01). However, Apart from notices in Form GST DRC-01 (Show Cause Notice), one of the very common notices issued under GST by GST authorities is GST ASMT-10. Post filing of returns under GST, the first act done by the GST authority is the initial scrutiny of GST returns and identify the gaps in GST return filed by the taxpayer. Any discrepancy noticed is the GST return is provided to taxpayer in Form GST ASMT-10.

Any notice received from the income tax department creates panic among taxpayers even though they are fully compiled. Every notice or communication received from GST authorities is required to be responded properly to avoid any litigations or unnecessary demand against the taxpayer. This article will help you to better understand form GST ASMT-10 and will guide you on how to furnish response to the notice received in form GST ASMT-10.

-

What is GST ASMT-10 ?

- GST officials are required to scrutinize the GST returns post filing of GST returns by the taxpayers.

- As per section 61 of the CGST Act 2017 read with Rule 99 of the CGST rule 2017, The proper officer is required to scrutinize the GST returns on the basis of risk parameters.

- During the process of scrutiny, if any discrepancy or deviation is noticed by the GST authority then the proper officer shall issue the notice mentioning such deviations, inconsistency and errors in Form GST ASMT-10 requiring the assessee to explain such deviations.

- The taxpayer is required to furnish a response against such notice within a period of 30 days from the date of notice of issue. Such time may be extended by a further period of 15 days.

- The notice shall contain the information about deviations or errors and consequential tax payable due to such discrepancy.

- Accordingly, GST ASMT-10 is a first notice issued to the taxpayer identifies the discrepancies or inconsistencies in gst return filed. GST ASMT -10 is issued by a tax authorities to the taxpayer as an opportunity to clarify or rectify such deviation or error.

-

Contents of GST ASMT-10

As per format given under GST rules, GST ASMT-10 shall contain the following information:

-

Basic details :-

- GSTIN of the taxpayer(Goods and service tax identification number)

- Name

- Address

- Tax period

-

Discrepancy observed :-

- Details of discrepancy observed in GST Return;

- Tax payable alongwith interest and penalty, if any.

-

Particulars of the tax officer :-

- DIN (Document identification number).

- Name and Designation of proper officer

- Signature of proper officer

-

Reason for issuing GST ASMT-10

As per Section 61 of CGST Act, 2017 read with Rule 99 of CGST Rules, 2017, the proper officer shall scrutize the GST return as per Information available with him. The GST ASMT-10 is generally issued on following grounds:

- Difference in output tax liability (GSTR-1 and GSTR-3B): If as per GST portal, output tax liability reported in GSTR-1 is higher than output tax liability reported in GSTR-3B then the notice will require the taxpayer to pay the differential tax amount alongwith interest.

- Difference in Input Tax Credit Claimed (GSTR-2A/2B and GSTR-3B): If ITC claimed in GSTR-3B is less than ITC appearing in GSTR-2A or GSTR-2B then the notice will ask the taxpayer to explain the difference for such excess ITC claimed.

- Ineligible ITC claimed: If in GSTR-2A, any of the following Input Tax Credit is appearing then the proper officer may ask the taxpayer to furnish the explanation that whether such ITC is claimed or not:

- ITC is appearing from the supplier whose HSN Code is ineligible under Section 17(5) of CGST Act, e.g., Insurance, motor vehicles, constructions etc,

- ITC Claimed with respect to suppliers whose GST registration is cancelled from date prior to date of issuance of invoice,

- ITC is appearing with respect to such GSTR-1 which are filed after cut off date;

- ITC for suppliers who has filed GSTR-1 but failed to file GSTR-3B and did not pay the tax

In such cases, the taxpayer is required to furnish proper reconciliation of ITC claimed in GSTR-3B and ITC appearing in GSTR-2A.

- Interest for late payment of GST: As per information available on GST portal, if the tax payment is made by the supplier after the due date then the GST ASMT-10 may ask the taxpayer to pay interest on such delayed payment.

- Difference in Invoices as per e-invoice portal and GSTR-1: Specified taxpayers are required to generate e-invoice for evert B2B supplies, credit note and debit Note. As per reports available to the proper officer, if there is any deviation in B2B supplies reported in GSTR-1 and B2B supplies as per e-invoice portal then the taxpayer will be required to furnish an explanation for such deviation.

-

How to check GST ASMT -10 issued to the taxpayer?

- As soon as the GST ASMT-10 is issued to the taxpayer, an auto-generated email and message will be sent to the taxpayer on his registered email Id and phone number. Such email id and phone number shall only specify the a notice has been issued. Copy of notice shall not be available in the email.

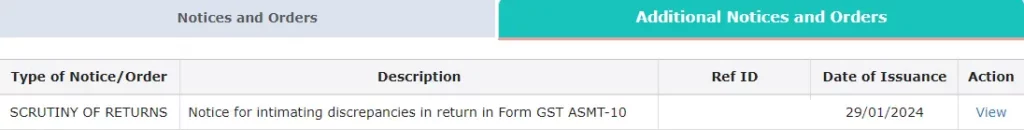

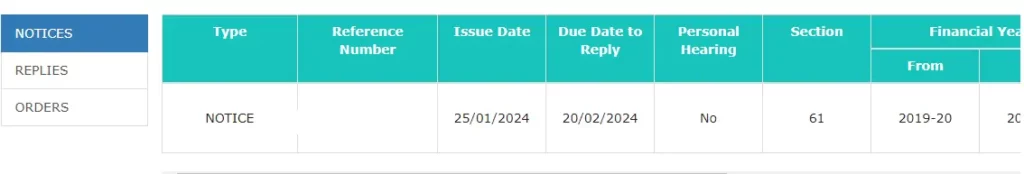

- Copy of order can be accessed at GST portal post login at following path:

Services> User Services > View Additional Notices and orders

- Under View additional notices and orders, taxpayer will be able to view all notices and orders issued against the taxpayer.

- Post clicking on view button, the taxpayer can view the notice issued.

-

Points to be considered while furnishing reply to GST ASMT-10?

The taxpayer is required to keep the following points in mind while furnishing response to GST ASMT-10:

-

- Response should be furnished against the GST ASMT-10 within the time limit specified in the notice itself. Any delay in furnish response may lead to issue further ligitations.

- Taxpayer should address each and every issue mentioned in the notice itself.

- Furnish proper reconciliation of Input Tax Credit, supporting documents (Shipping Bills, Bills of entry, copy of Invoice, certificate from department) and information while submitting response.

- If date of personal hearing is given in the notice, the taxpayer is required to present before the authority on the specified due date.

-

Acceptance of Discrepancies:

-

- If the taxpayer agrees with the information and deviation given in the notice then the taxpayer should pay the applicable amount through GST DRC-03 alongwith interest.

- Copy of DRC-03 is required to be attached with response furnished against GST ASMT-10

-

Disagreement with the Discrepancies:

-

- If the taxpayer disagree with the discrepancies given in the notice then the taxpayer is required to furnish detailed information about:

- Facts of the case

- Legal provisions applicable

- Supporting documents

- Copy of certificate etc.

- If the taxpayer disagree with the discrepancies given in the notice then the taxpayer is required to furnish detailed information about:

-

How to furnish a response against GST ASMT-10?

The taxpayer is required to furnish a response on the GST portal itself post login. Response can be uploaded at following path:

Gst portal>login>user services>view additional notices and order.

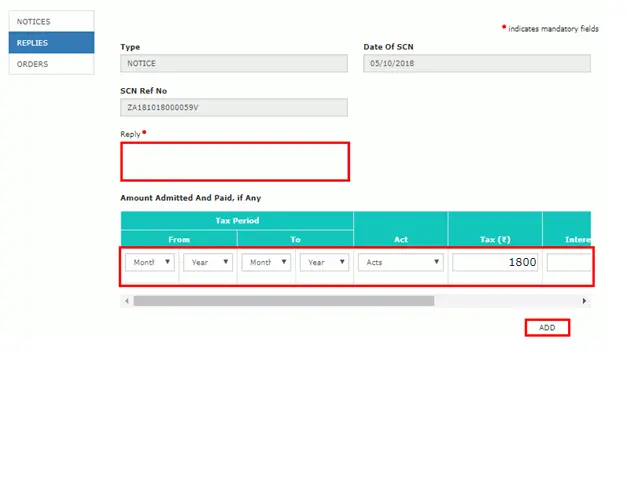

- Reply shall be furnished under Reply tab post clicking on view button.

- Reply can be furnished under the reply column and a detailed reply should be attached. Admitted amount paid through DRC-03 should be mentioned in “Amount Admitted and paid” column

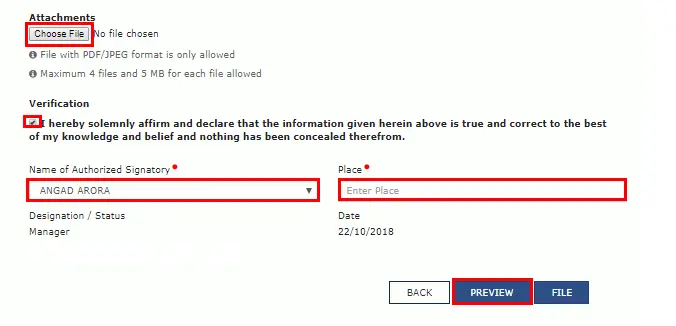

- Detailed reply and other documents should be attached.

- Post entering the entire information and uploading documents, the reply can be submitted through DSC or EVC verification.

-

What are the actions taken post furnishing of response?

Post furnishing of response, the proper officer can take any of the following action.

-

Where Satisfactory Reply is furnished:

- If the Proper Officer is satisfied with the response furnished by the taxpayer then they will issue an order in Form GST ASMT-12 that reply is found satisfactory and corresponding proceedings have been dropped.

- GST ASMT-12 has a predefined format as follows:

“This has reference to your reply dated ——- in response to the notice issued vide reference no. ———- dated — . Your reply has been found to be satisfactory and no further action is required to be taken in the matter. “

-

Where reply is not found satisfactory

- If the reply is unsatisfactory, the Proper Officer may take further action.

- The tax officer can issue Show Cause Notice in Form GST DRC-01 under any of the following sections:

- Section 65 means Audit by tax authorities

- Section 66 means Special Audit

- Section 67 means Survey/inspection

- Section 73 & 74 means Determines tax liabilities due to non-payment, short payment, erroneous refund, or incorrect utilization of input tax credit, without any intention of fraud or willful misstatement or suppression of facts.

Please note that There is no timeline for the issue of GST ASMT-12.

Also Read: GST Calculator Online – Simplify Your Daily Finances And Taxes

Frequently Asked Questions (FAQs)

-

Does issuance of notice in form GST ASMT-10 means confirmation of demand under GST?

Post filing of GST return, first scrutiny of GST returns is made under Section 61 of GST Act. If any discrepancy is noticed during the course of scrutiny then the proper shall intimate the taxpayer about such deviation and possible tax liability due to such deviation.

GST ASMT-10 is an initial communication about deviation in GST returns and it does not confirm the demand under GST law..

-

What are the consequences of not furnishing responses to GST ASMT-10?

Response to GST ASMT-10 is required to be furnished within the time period specified in the notice. If no response is furnished within the time period specified in the notice then the proper officer may issue show cause notice under any of the following sections:

- Section 65 means Audit by tax authorities

- Section 66 means Special Audit

- Section 67 means Survey/inspection

- Section 73 & 74 means Determines tax liabilities due to non-payment, short payment, erroneous refund, or incorrect utilization of input tax credit, without any intention of fraud or willful misstatement or suppression of facts.

-

Whether it is mandatory that a notice will be issued in Form GST ASMT-10?

Notice in GST ASMT-10 shall be issued only if there is any deviation in GST return. Therefore, it is not mandatory to issue form GST ASMT-10.

-

Whether it is mandatory to issue form GST ASMT-10 prior to form GST DRC-01?

Show Cause Notice in Form GST DRC-01 can be issued directly even if no notice is issued in Form GST ASMT-10. Also, there is no mandatory provision that if GST ASMT-12 is not issued then the GST DRC-01 shall be issued.

-

What precautions should be taken by taxpayers while filing GST return to avoid notice in form GST ASMT-10?

While filing GSTR-1 and GSTR-3B, the taxpayer is required to take notes of following points to reduce the possibility of issuance of GST ASMT-10:

- Output tax liability reported in GSTR-1 and tax liability paid through GSTR-3B should be the same.

- Input Tax Credit claimed in GSTR-3B should not exceed the amount of eligible ITC as per GSTR-2B of such period

- Any ITC appearing as ineligible in GSTR-2B, such as insurance, motor vehicle etc, should not be claimed

Conclusion

GST ASMT-10 is issued if any anomalies are found in GST returns and the same is required to be complied with to avoid any further adverse action against the taxpayer. By taking extra care while filing GST returns, possibilities of issuance of GST ASMT-10 can be reduced. If GST ASMT-10 is responded properly with supporting documents and information and GST ASMT-12 is issued by the GST authorities then chances of issuance of GST DRC-01, i.e., show cause notice, also reduces.