GST-registered suppliers in India must understand why GST tax invoices are vital. The GST Act mandates issuing a GST tax invoice for the supply of taxable goods and services. The invoice must include your GSTIN number. When you supply taxable goods and services, you must issue a GST tax invoice. If you supply exempted goods, you must generate a bill of supply. Exporters must generate an export tax invoice. It is slightly different from a GST tax invoice.

In this blog, you can learn more about the GST tax invoice and the importance of generating GST-compliant invoices.

Importance of GST Tax Invoice

The GST Act mandates GST-registered businesses to follow the schema for tax invoices. If the annual turnover of your business is more than 5 crore, you must generate an e-invoice based on your tax invoice. The IRP system verifies the invoice details and validates them using a QR code. You must issue only e-invoices for your customers.

When transporting goods to deliver to your customer, you must generate an e-way bill. The road authorities will verify the e-way bill, check the QR code, and allow the goods to be transported.

The e-invoice is not just a soft copy of the invoice. When your business meets the e-invoicing requirement, e-invoice is the only valid tax invoice. If it is not necessary for your business to generate an e-invoice, you can supply a regular tax invoice.

It is possible to generate a tax invoice that doesn’t follow the tax invoice template. While you can supply goods with such invoices, you must always submit GST invoices to the GST portal for filing your returns. So, it is always best to issue GST-compliant invoices. It will also enhance your business reputation, build trust, and improve customer relationships.

Businesses Benefit from the GST Tax Invoice

Adhering to the tax invoice format is a hassle-free way to ensure GST compliance. When there is a template, you need not worry about entering all the mandatory details. The template will automatically include mandatory fields. You must remember to enter the details in the right field.

Maintaining a standardised invoice format will benefit your customers as well. They can import invoices into their accounting software and generate GST reports quickly. It will also establish your brand reputation as a GST-compliant business.

Integrating your invoices with the e-invoicing and GST portals becomes easy when you already have the invoice in the right format. Otherwise, you must spend time and resources on converting your invoice into a compliant invoice.

To ensure you comply with GST regulations, use billing software that generates GST-compliant invoices. You will never miss entering details of mandatory fields when you use an automation tool. Also, it reduces manual labour and prevents human errors.

Tax Invoice Requirements for Small Businesses

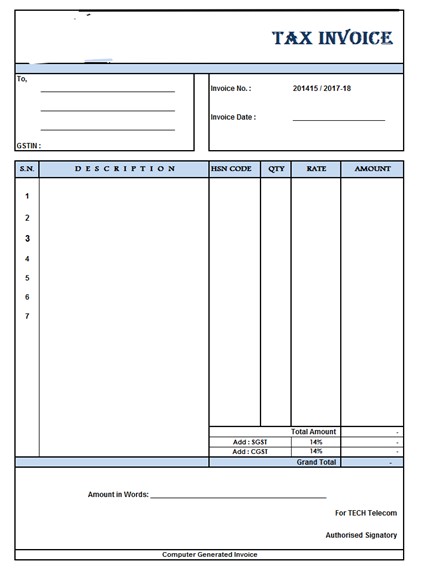

Small businesses that supply taxable goods and services must always issue GST-compliant invoices. These invoices must be digitally uploaded to the GST portal. The authorities will verify the invoices and identify discrepancies. If the uploaded invoices don’t adhere to the prescribed schema, they will be rejected. It can result in complications while filing GST returns. The mandatory fields that must be included in tax invoices for small businesses are:

- Unique invoice number and date

- Customer name and address

- Supplier name and address

- Shipping and billing address

- GSTIN number of supplier and customer

- Place of supply

- HSN code of the goods

- Details and descriptions of goods

- Pricing details

- Total taxable value of goods

- Discounts

- Rate and amount of taxes

- Type of tax

- Reverse charge applicable

- Signature of supplier

If you generate a tax invoice electronically, the supplier’s signature is unnecessary. When the recipient is not registered, and the value of the goods is more than 50,000, the supplier must provide a GST-compliant invoice that must include the following mandatory fields:

- Name and address of customer

- Delivery address

- Name and code of the state

Tax Invoice Requirements for Exporters

Exporters must issue a tax invoice for the export transaction. This invoice contains details about the exports and the amount due that the importer may pay. It is similar to the regular GST invoice. However, there are some key differences.

Exporters can supply goods with or without IGST. Export under Bond/LUT allows exporters to export without paying IGST. You must file a Letter of Undertaking LUT to export without IGST. This must be furnished according to GST RFD 11.

Exporters can also export after paying IGST. This can be claimed for a refund later. The refund can be claimed if the exporter has unutilised ITC. They can also claim a refund when they export to SEZ units. Supplying goods to SEZ is considered a zero-rated supply. This is offered to boost exports.

The mandatory fields that must be included in an export invoice are:

- GSTIN of the exporter

- Invoice number and date

- Name and address of exporter

- Name and address of the recipient

- Shipping and billing address

- Date of issue of invoice

- Due date

- Conversion rate from INR to the correct applicable currency

- Total invoice value

- Shipping bill details

- Type of export

- Authorised person signature

- Notes if any

What is a Tax Invoice Template?

Every GST tax invoice generated must adhere to the schema or format prescribed by the GST Act. If your invoices are not generated in the specified format, it will be considered invalid. The GST portal may reject such invoices. If that happens, it can result in non-compliance for both supplier and customer.

The recipient can only claim ITC if they receive a GST invoice. The need for e-invoicing is also expanding, and soon, all businesses will be required to generate e-invoices. The invoice details are auto-populated to the GST forms, so accuracy is vital.

The tax invoice format is:

The export invoice format is:

Use GST Billing Software for GST Compliance

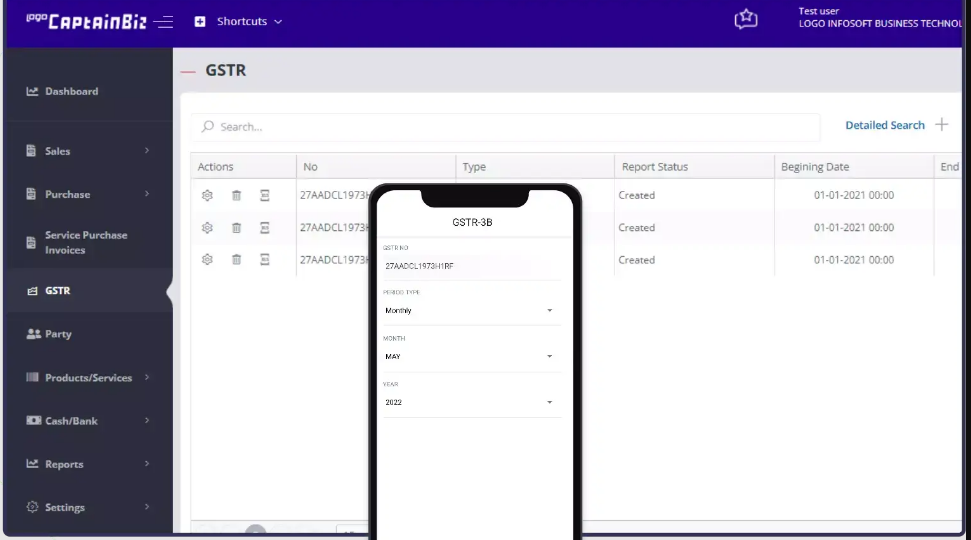

Manually creating GST invoices is not easy for small business owners. The automated GST billing software creates a seamless process for GST bill generation. You can use a tool like CaptainBiz to automate GST invoice generation.

Using CaptainBiz, you can always create GST-compliant invoices and bills. The tool is preloaded with a GST template to include all the mandatory fields in the tax invoice. This template is also customisable to add your business name and logo to generate custom invoices. Once you have updated the masters, the invoice details are also auto-populated in real time. This eliminates the chances of errors during invoice generation.

Integration with the e-invoicing system allows you to generate e-invoices using the CaptainBiz invoices instantly. The GST forms are auto-populated, and they can be readily uploaded to the GST portal. Such an automated tool streamlines GST return filing, maintains an audit trail, and ensures GST compliance throughout.

Conclusion

Generating accurate and compliant GST tax invoices is essential for businesses to stay compliant with GST law. Understanding tax invoice format is crucial to ensure that you generate valid invoices at all times. Before uploading invoices to the GST portal, double-check the invoices and details. Generating invoices with the right details is easier than correcting or cancelling invoices later. Also, accurate invoicing will help you take control of your business transactions and pay GST liabilities without penalties.

CaptainBiz is India’s highly-rated automated GST billing software. Using this cloud-based tool, you can generate GST-compliant invoices and bills. The details are auto-populated from masters to ensure accuracy and compliance. The tool also comes with inventory management and reconciliation modules to enable you to monitor all transactions related to your business effortlessly.

FAQs

-

Is it mandatory to follow the tax invoice template?

Yes, if you are a GST-registered business, you must generate a GST-compliant tax invoice including all the mandatory fields. The invoice must contain all the essential fields. Otherwise, it will be considered invalid.

-

What is the difference between invoice date and due date?

The invoice date is the date on which the invoice is generated. Suppliers must issue a tax invoice at the time of supply or before removing goods from their warehouses for delivery. They can also issue a tax invoice before the supply date. The due date is the date on which payment is due. The recipient is expected to pay the invoice within the due date.

-

What is the time limit for generating tax invoices?

For the supply of goods, a tax invoice must be generated at the time of supply or before removing goods from the warehouse. For the supply of services, a tax invoice must be generated within 30 days of supplying the service. Suppliers can also generate and issue tax invoices in advance. When an invoice is created during the tax period, the GST tax must be paid, regardless of whether the recipient has paid the invoice.

-

What will happen if the GST invoice is issued after the period of 30 days?

If the supplier issues a tax invoice after 30 days of supply, they must pay the GST tax during the time period. However, the recipient cannot claim ITC for invoices that correspond to suppliers older than 30 days. So, it will affect the business relationship between supplier and buyer.

-

What happens if the GST format is not followed?

The GST portal requires businesses to upload invoices as per the schema. If the invoice is not uploaded in the right format, it will be rejected and considered invalid. This means that the supplier has to make amendments or cancel the invoice. They must generate a new invoice as per the format. It will also affect the GST forms of the recipient. Correcting invoices and adjusting GST liabilities is more complicated than creating invoices in the correct format.