1.1 Introduction

GST, or Goods and Service Tax, is a form of indirect tax that has helped the nation’s regulatory bodies replace different forms of unnecessary indirect taxes. It is further divided into indirect and direct taxes for the convenience of the citizens and the multiple functioning businesses.

GST levies the supply of goods and services from one place to another. Tax calculation depends on various factors, depending on the place and form of the transaction. The law with similar rules for all the states of India makes it easy for the governing bodies to regulate the taxation system and decide the rates and policies.

2.1 Introduction to GST Compliance Calendar

The GST compliance calendar in India is a proper calendar indicating the dates and final deadline to file GST returns and make GST payments. The calendar helps businesses check GST filing dates and follow the GST rules and regulations accordingly. The calendar also allows companies to remember the correct date to file GST returns to avoid paying late fees.

The calendar also outlines the mandatory rules to be followed by businesses to remain compliant with the GST laws in India.

2.2 GST Deadlines Covered in the GST Compliance Calendar

Mentioned below are the general GST deadlines covered in a GST compliance calendar. The specific dates may vary as per the registration date and turnover of the business.

- GSTR 3B is a self-declared summary GST return to be filed monthly. All regular taxpayers are expected to point to GSTR 3B. The general monthly due date for filing the GSTR 3B is the 20th day of the following month and the 22nd and 24th days for quarterly tax filers. The government can extend these dates by informing taxpayers through a notification.

- GSTR 9: GSTR 9 is an annual return to be filed by businesses before December 31st of the next financial year. It needs to be filed by every average registered taxpayer. The form involves details about the yearly GST data, sales and purchase register, taxes paid, returns filed, and demands and refunds.

- GSTR 1: It is a monthly or quarterly statement of a taxpayer defining the sales data. A valid GSTIN needs to be filed before entering sales invoice details. It must be filed by every registered taxpayer on the 11th day of the following month.

- GSTR 2: The GST compliance checklist also involves the filing of GSTR 2. The form includes filing monthly purchase details for taxable goods and services. The tax needs to be filed by the 15th of the following month. The five-day gap between paying GSTR 1 and GSTR 2 helps taxpayers rectify any possible errors and discrepancies and follow the GST rules and regulations accordingly. Every registered taxpayer must file the tax on time to avoid late penalties.

- GSTR 3 is a monthly tax that needs to be filed by businesses before the 20th of the following month. The form involves detailed information about sales, purchases, and sales during the month. It is auto-generated with the help of data extracted from GSTR 1 and GSTR 2. It reflects the GST liability of a month and hence is essential to be filed on time.

Also Read: Crack The Code: Your Comprehensive FY 2023-24 Tax Compliance Calendar

3.1 Importance of a December 2023 GST Compliance Calendar

A GST compliance calendar is essential for businesses to stay updated about vital tax filing dates. In the event of missing out on these dates, the companies have to pay a penalty amount, which may differ depending upon the applicable laws of the GST Act.

The December 2023 GST Compliance Calendar throws light on three vital aspects: the issuance of TDS certificates, filing of GST returns, and submission of revised income tax returns for 2023–24. By following the deadlines, businesses can save the excess amount to be paid as penalties in the event of an untimely GST return filing. The calendar is also helpful for companies to start the new year without worrying about remaining or incomplete tax filings by indicating the critical GST filing dates.

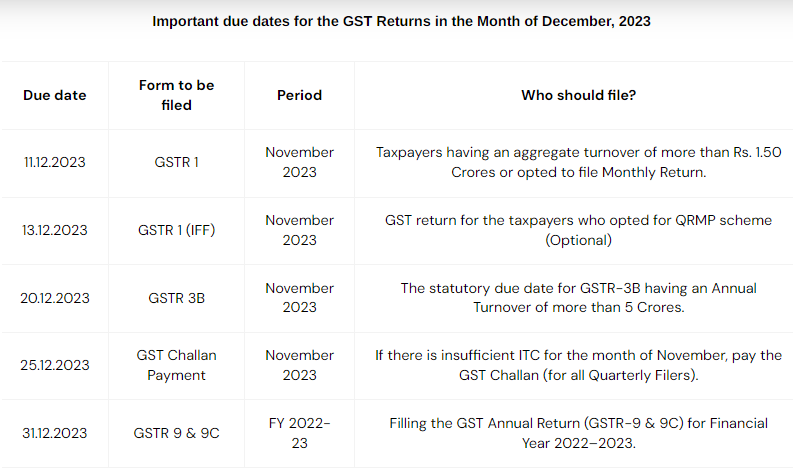

Mentioned below are some of the important due dates for filing GST returns in December 2023

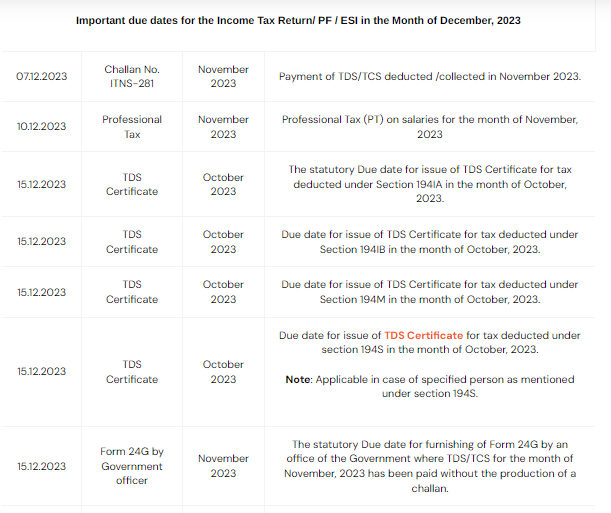

Mentioned below are the important due dates for the Income Tax Return (PF/ESI) for December 2023

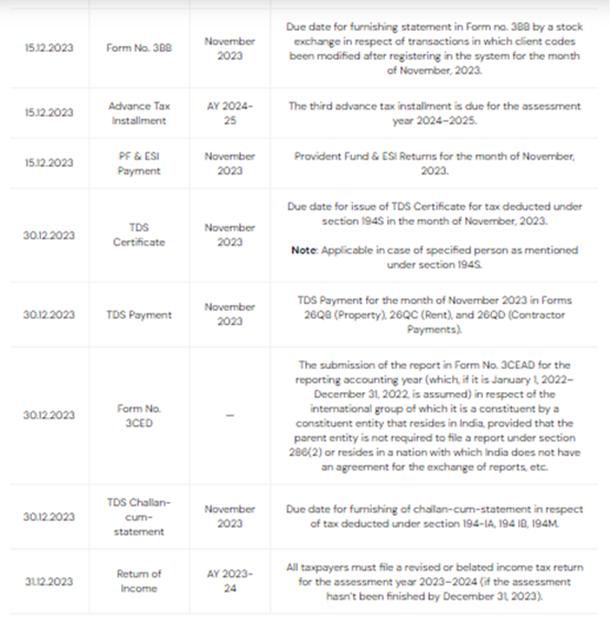

The calendar has specified due dates for different essential forms such as GSTR 1, GSTR 3B, GST Challan Payment, and GSTR 9. The compliance calendar also draws attention to crucial due dates for paying professional tax, Form No. 3BB, advance tax installment, PF and ESI payments, and issuing different forms of TDS certificates.

4.1 Key Dates and Deadlines

Mentioned below are the key dates and deadlines highlighted in the GST Compliance Calendar 2023 that are essential for taxpayers:

| DUE DATE | FORM TO BE FILLED | ELIGIBILITY TO PAY |

| 11/12/2023 | GSTR 1 | Aggregate taxpayers with a turnover of more than Rs. 1.50 crore |

| 20/12/2023 | GSTR 3B | Taxpayers having an aggregate annual turnover of more than Rs. 5 crore |

| 25/12/2023 | GST challan payment | In case of insufficient ITC for November, GST challan is required to be paid. |

| 31/12/2023 | GSTR 9 and 9C | Filing the GST Annual Return for 2022-2023 |

The GST Compliance Calendar for December 2023 also includes important due dates for the Income Tax Return, PF, and ESI. Mentioned below are some of the essential ones:

| DUE DATE | FORM TO BE FILLED | ELIGIBILITY TO PAY |

| 10/12/2023 | Professional Tax | Payment of Professional Tax for the salaries of November 2023 |

| 15/12/2023 | TDS Certificate | It is the statutory due date for issue of TDS certificate deducted in October in 2023 |

| 15/12/2023 | PF and ESI payments | Provident Fund and ESI Returns for November 2023 |

| 31/12/2023 | Return of Income | Taxpayers are required to pay a revised income tax return for the year 2023–24. |

5.1 Essential Components of GST Compliance Calendar for December 2023

Following a GST compliance calendar helps businesses stay updated about the due dates for filing different GST returns. It helps them to avoid late filing and late penalty fees. The calendar also provides various GST compliance tips to help businesses start the next financial year without overdue returns and follow the GST rules and regulations easily.

Mentioned below are some of the highlighted essential dates according to different sectors in the GST Compliance Calendar for December 2023:

- 7/12/2023: Due date for TDS payment for November 2023

- 10/12/2023: Due date for payment of professional salaries for November 2023

- 11/12/2023: Due date for filing GSTR 1 for November 2023

- 15/12/2023: Due date for Advance tax Payment for October to December 2023

- 15/12/2023: Due date for Provident Fund (PF) and ESI Returns and Payments for November 2023

- 20/12/2023: Filing of GSTR 3B for November 2023 (Monthly)

- 25/12/2023: GST Challan Payment if there is no sufficient ITC for November 2023

- 31/12/2023: Due date for Belated and Revised Income Tax Filing for AY 2023-24

- 31/12/2023: GST Annual Return Filing for FY 2022–23 (GSTR-9)

6.1 Strategies for Efficient GST Compliance

Mentioned below are some of the practical GST compliance tips that help to form successful compliance strategies:

-

- Reliable GST Software: A dependable and trusted GST software helps businesses reconcile their purchase data with government records. The software immediately scans the data and points out the errors.

- E-Invoicing Software Solution: Another helpful strategy for efficient GST compliance is adopting a trusted e-invoicing software solution. It helps to manage the complicated billing procedure without disturbing the current functions of the business.

- Timely Filing of GST Returns: A simple, no-brainer way for a business to get a good GST compliance rating is to file GST returns with the correct information on time. The returns need to be filed monthly, quarterly, or yearly, according to the nature of the business.

7.1 Common GST Compliance Challenges in December 2023

Though the Indian government introduced GST with the motto, ‘ONE TAX, ONE NATION,’ it faced a few difficulties due to its impracticability in certain situations and for various reasons.

Mentioned below are some of the GST compliance challenges observed in December 2023:

- Time pressure: The time pressure created by tax officials was one of the significant challenges faced by a few taxpayers in December 2023. The notice ended with a statement to reply within 7 to 10 days. Many businesses wrote a letter to the officials to request a reasonable amount of time to resolve the issue.

- Providing Detailed Information to Tax Officials: Today, most sectors are tech-savvy, leaving behind a few people who still prefer physical documentation. Hence, providing detailed information asked by tax officials through an electronic medium like mail can be a hassle for officials who try to avoid the medium. Therefore, proper preferences in the cover letter attached to the mail help the tax officials keep a record of the details.

Also Read: Challenges And Considerations For GSTR-7 Compliance

8.1 Tips for Minimizing Errors and Avoiding Penalties

- Maintain Proper Records – Maintaining proper records of sales and purchases by the business helps it file GST timely. It allows companies to avoid skipping GST filing, which causes them to pay heavy penalties. Maintaining records also helps a business manage profit and losses accordingly.

- Filing Timely GST – Filing GST returns on time with the help of a compliance calendar helps businesses stay at bay from paying heavy penalties. These penalties are levied on paying untimely taxes. These penalties can range from paying Rs.200 per day for CGST and SGST to

- Seek Professional Advice – It is advised to seek professional help to understand and study the GST Act rules and regulations. It helps businesses to avoid skipping major points while following the rules.

Conclusion

GST Compliance Calendar helps businesses to complete the GST compliance checklist. The calendar allows companies to remember the essential filing return dates and avoid paying heavy penalties imposed due to untimely filing of returns. The calendar is also vital to follow the crucial PF and ESI filing dates, along with the payment of challan and professional salaries for the following month.

Also Read: Different Types of Documentation Required for GST Compliance

Frequently Asked Questions

-

How is the GST Compliance Calendar defined?

GST Compliance Calendar is a professional calendar maintained by businesses for the timely filing of GST returns and to avoid skipping important GST filing dates.

-

How is a GST compliance calendar helpful for a business?

A GST compliance calendar reminds businesses of vital filing dates and avoids skipping any essential dates.

-

What is a GST penalty defined as?

A GST penalty is the late fee levied by the government for late filing of GST returns. The amount varies depending on the type of offense committed by a taxpayer.

-

What is the general penalty for late GST filing?

The general amount to be paid in the event of an untimely GST filing is 10% of the tax amount, or a minimum of Rs. 10,000.

-

What are some of the general GST deadlines covered in a compliance calendar?

A GST compliance calendar usually covers essential return filing dates for GSTR 1, GSTR 2, GSTR 3, GSTR 3B, and GSTR 9.

-

What are some helpful methods that can help a business avoid paying GST penalties?

A business can follow a compliance calendar and pay attention to paying GST on time, seeking professional advice, and maintaining proper records to avoid paying penalties.

-

What are some of the notable advantages of the online GST filing procedure?

Online GST filing has helped taxpayers eliminate the burden of submitting official documents and paying taxes physically. One can easily attach the required copy in a cover letter in a mail systematically for proper records of the tax officials and correspondence to the required individual or body.

-

Why is it essential to follow a GST compliance calendar closely?

A GST compliance calendar comprises important GST filing dates. The calendar also helps businesses maintain a proper record of sales and purchases that can be used to identify discrepancies and errors while filing GST.

-

Can a GST compliance calendar help a business to plan tax payment?

The GST compliance calendar reminds a business of the critical GST filing dates. Hence, it helps the business to track the finances left at a particular time and manage the payment of different types of taxes accordingly.

-

What are the negative impacts of untimely filing GST returns for a business?

If a business does not file GST returns on time, it may have to go through consequences such as heavy penalties, disturbed business cash flow, and incredibility of business.