Understanding taxability means learning whether the item is exempt, not under GST, or excluded from the valuation of goods and services. Since the scope of taxable items has widened under GST, exclusions from the valuations have been clearly defined. The goal is to not simply know the exclusions but also understand the reason behind the implication of each item. Let’s demark different terms like exempt, zero-rated, NIL-rated, non-GSTsupply, etc., and go through the complete list of exclusion items under GST.

Understanding Valuation Of Supply Under GST

GST, or Goods and Services Tax, is considered one comprehensive tax for all taxes. It is usually charged on the transactional value of goods and services. It is the price unrelated parties pay for the supply of goods and services.

- The supplied value under GST includes duties, taxes, fees, cess, and charges implicated under any act apart from GST. If the supplier has charged the GST compensation cess separately, it will be excluded.

- All incidental expenses, like commission, packaging, etc., regarding the sale will be included in the supply value.

- Any amount incurred by the recipient that the supplier is liable to pay and is excluded from the price.

- Late fees/ interest/penalties for delayed payments will be included.

- Supply subsidies, barring Government subsidies, will be included.

What Is Meant By Exclusions?

When the tax is leviable but is exempted from the tax payment, it is called an exemption. Exclusions from GST states that GST will not be applicable either by treating or as supply of goods and services or by excluding it from section 9.

The below three types of supplies are referred to as exclusion:-

- Items taxable at 0% or ‘NIL’ rate

- Items that are wholly or partially exempted from Central Goods and Services or Integrated Goods and Services based on Section 6 of the IGST Act or amending Section 11 of the CGST Act.

- Non-taxable items that are defined under Section 2(78).

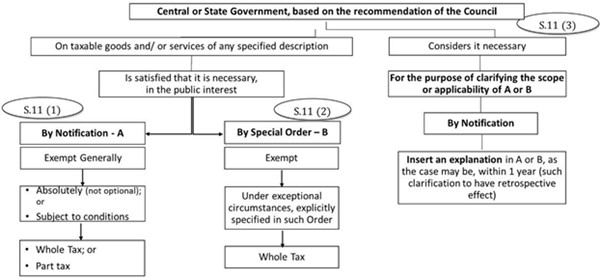

Another point is that state and central governments can grant valuation exclusions. The provisions of the grant are –

- Notification must be issued

- The goods and services exclusions must be in the public interest

- The GST council must recommend the grant

- A special order under extraordinary circumstances can be granted as an exclusion

Conditional or absolute exclusions in valuation can be opted for specifically described goods or services

Different Classifications Of Exclusions/Exemptions

A Supplier Can Be Exempt: A supplier, irrespective of the outward supply’s nature, can be considered as an exclusion. For instance, services offered by Charitable entities.

Few Supplies Can Be Exempt: A few supplies are exempted from the Goods and Services Tax due to their type and nature. For instance, services for the convenience of the public and for sponsoring sports events.

Exclusion Types

- The first one is exclusion without any condition or absolute exclusion Electricity distribution or transmission by a distribution utility or electricity commission.

- Specific exclusions are based on some conditions known as conditional exclusions. For instance, a clinical establishment offering healthcare services in the form of providing rooms may have conditional exclusions where charges for rooms are above Rs. 5000.

What Do You Mean By A Non-Taxable Supply?

A supply of goods or services that is not leviable to tax under the Central Goods and Services Tax or Integrated Goods and Services Tax Act is a non-taxable supply. An example is alcohol for human consumption.

Please understand while these items are not completely out of the scope of GST, a GST rate has not been announced for them. Common exclusions in goods and services valuation under this category are –

- High-speed diesel

- Petroleum crude

- Natural Gas

- Petrol

- Aviation Turbine Fuel

GST Exclusion List

Supplies uncovered under the GST list are included in the negative list. They are also notified under the CGST Act’s Schedule III. The following items are in the negative list and examples of exclusions in GST valuation for services.

- Drugs and pharmaceuticals like contraceptives and human blood

- Fertilizers and organic manure

- Beauty products like bindi, kumkum, kajal, etc.

- Wastes like municipal waste and sewage sludge.

Relief for Small E-Commerce Businesses: GST Registration Exemption

Different GST Terms Related To Supply

| Supply Name | Description |

| NIL-Rated | Supplies with a 0% GST, like grains, jaggery, salt, etc. |

| Zero-Rated | Exports are made to SEZ or their developers. |

| Exempt | Taxable supplies that don’t attract GST and also cannot claim ITC, like fresh fruits, fresh milk, curd, etc. |

| Non-GST | These items are out of the purview of the GST law. Examples include petrol and alcohol. |

Conclusion

The valuation of goods and services consists of a complicated framework considering several factors. Our goods and services valuation exclusions guide helps you better understand the taxation purpose. These exclusions ensure that the tax system remains efficient and equitable. They are significant in avoiding double taxation and also protect several essential industries. However, it is crucial to remember that our country’s taxation system is ever-evolving, and the exclusion list may change over time. Understanding these exclusions is vital for businesses to comply with tax regulations and ensure a smooth economic scenario.

52nd GST Council Meeting Recommendations – Detailed Insight

FAQs

1. What is excluded from the definition of goods and services?

Securities and money are excluded from the definition of goods and services.

2. What are the exclusions in the value of supply?

The supply value includes duties, taxes, cess, charges, and fees levied under any act as per Section 15(2). If the GST compensation cess is separately charged, it will be excluded.

3. Which items are excluded from GST?

The list of items includes fertilizers, drugs, pharmaceuticals, beauty products, etc.

4. What are some goods and services exempted from GST?

Grapes, ginger, melons, garlic, green tea leaves, roasted coffee beans, etc. Foods that do not come in branded containers, like wheat, rice, corn, etc. Others are khadi fiber, raw silk, unspun jute, etc.

5. What is excluded from transactional value in GST?

Discounts like quantity or trade discounts are part of normal trade and commerce. Discounts in the invoice can be excluded while establishing the taxable value.

6. Is rice Nil-rated or exempted?

Branded rice has a 5% GST rate, whereas non-branded ones are exempt under GST.

7. What is an excluded transaction?

An excluded transaction does not appear in any financial reports or account registers. It can sometimes make it challenging to reconcile an account.

8. Is GST calculated on MRP?

A retailer or seller cannot impose any other charges over the MRP of a product as per the Consumer Goods Act, 2006. Therefore, GST is already added to the MRP.

9. Who pays GST in reverse charge?

The recipient pays GST in reverse charge. The supply time under reverse charge is distinct from the supplies under the forward charge.

10. What are exclusions in GST?

Exclusions are specific goods or services that are not covered under the policy.