The Goods and Services Tax (GST) regime in India requires all businesses with multiple places of business in different states to obtain separate GST registration for each such place of business.

If your business has centralized registration and you are looking to start operations in a new state, you need to register your additional place of business with the GST authorities. Proper registration ensures full compliance with GST laws and smooth conduct of business in the new state.

Registering an additional place of business requires submitting certain key documents to the GST portal. Read on to know the complete list of documents required for GST additional place of business registration documents.

Documents Required for GST Additional Place of Business Registration:

Here are the key documents needed for registering a new place of business with GST:

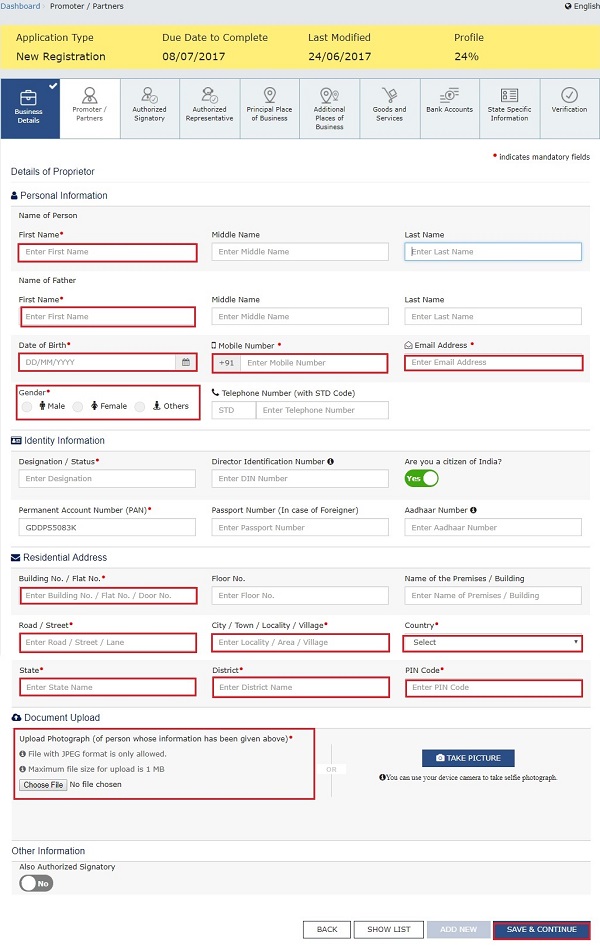

– Application Form GST REG-18: This form contains all the key details like business legal name, jurisdiction, additional place address, nature of possession of premises (owned, leased, rented etc.), date from which the place is used for business etc. It has to be filled online on the GST portal.

– Proof of Principal Place of Business: Any document like rent agreement, electricity bill, Municipal khata certificate etc. that proves your principal place of business is required.

– Proof of Additional Place of Business: Similar documents like rent agreement, electricity bill etc. in the name of the business proving the address of the new additional place of business.

– Authorization Letter : A letter signed by an authorized signatory appointing the person filing the application for new registration as the authorized signatory.

– Identity Proof of Authorized Signatory: PAN Card copy of the authorized signatory who will sign the documents and be responsible for compliance.

– Address Proof of Authorized Signatory: Any officially valid document like Aadhaar, Voter ID, Driving License etc. with the address of the authorized signatory.

– Photographs of Additional Place of Business: Recent photographs of the exterior and interior of the additional place of business showing complete premise details.

– Ownership Proof of Premises: In case the additional place is owned by the business, documents like Sale Deed, Allotment Letter etc. In case of rented/leased property, the rent agreement and NOC from the landlord.

– Business Related Documents: Your business related documents like MOA, AOA, Certificates of Incorporation etc. based on whether you are a company, partnership firm etc.

– Bank Account Related Documents: Certificate from your bank certifying your business account with account number, IFSC code and branch address. Cancelled cheque leaf showing business name.

– NOC from other Tax Authorities: No Objection Certificate from your central excise & service tax authorities transferring control of your business taxes to GST department.

So in summary, the key documents are – application form, address proofs, authorization letter, authorized signatory proofs, photographs, ownership/rent details, business documents and bank account details. Having all documents ready as per requirements will ensure quick and smooth GST additional place registration.

Also Read: GST Registration for Services: Documents Required

Additional Place of Business Registration Process:

Follow these steps to register an additional GST place of business:

Step 1) Access the GST Portal using your login credentials for your current GSTIN.

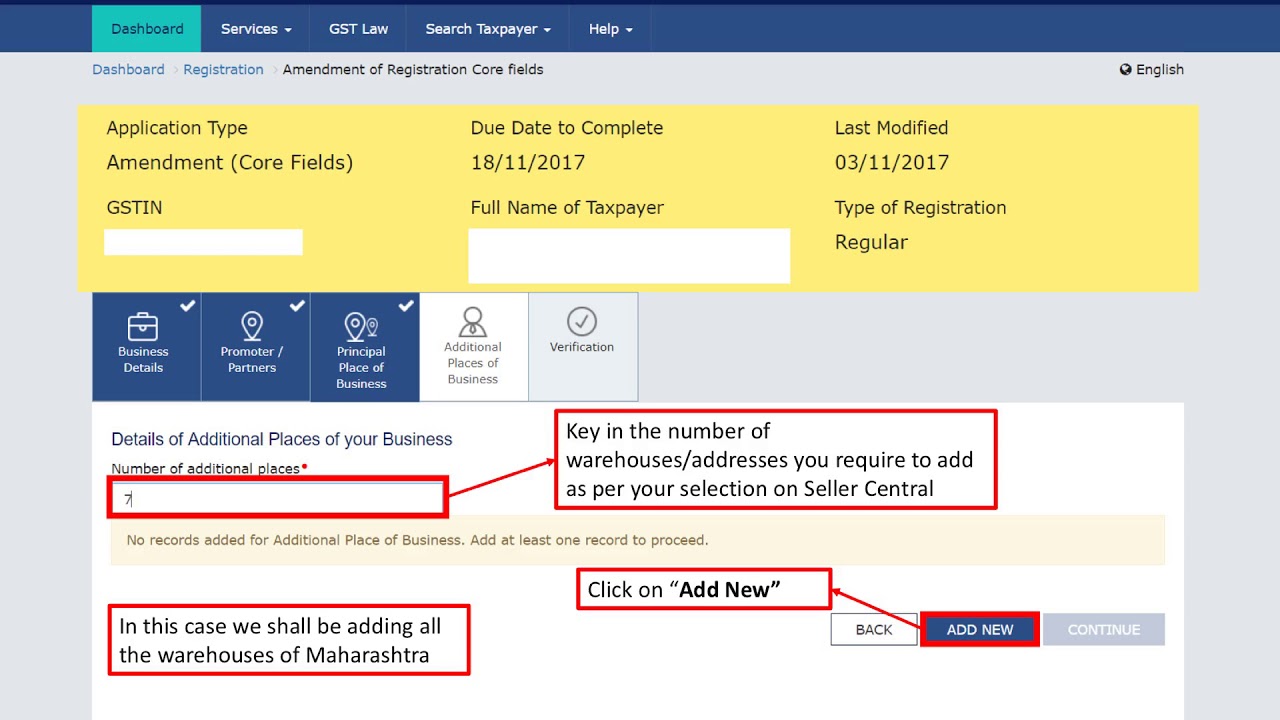

Step 2) Click on ‘Registration’ and then select ‘Application for Registration of Additional Place of Business’.

Step 3) Fill Part-A of FORM GST REG-18 furnishing your principal place of business details.

Step 4) Next, fill Part-B of the form with the additional place of business details like address, jurisdiction, nature of possession, date of use etc.

Step 5) Click on ‘Add’ to add more places of business if applying for more than 1 additional place.

Step 6) Upload scanned copies of all the required documents.

Step 7) E-Sign the application form and submit it on GST portal.

Step 8) Make the application fees payment online through Netbanking, Debit/Credit Card, NEFT/RTGS.

Step 9) Application Reference Number (ARN) will be generated on successful submission.

Step 10) Once the application is processed and approved, new state-wise GSTIN will be issued to you.

Step 11) New registration certificate can be downloaded from the GST portal.

Follow up regularly on the portal for processing status of your application to avoid delays. Once approved, your business can operate from the new place with the separate GSTIN.

Benefits of timely registration:

Registering your additional place of business for GST on time holds significant importance due to several reasons. Firstly, it guarantees that your business fully abides by the Goods and Services Tax (GST) laws, keeping it compliant with legal regulations. This compliance acts as a shield against potential legal issues, hefty penalties, or disruptions in operations resulting from non-compliance.

Timely registration allows your business to expand into new territories seamlessly. It ensures a smooth commencement of operations in the new state, guaranteeing prompt delivery of your services or products to your customers. This effort goes beyond mere compliance with tax regulations in India. It showcases your dedication to following the rules and fosters trust among your clients and partners – an essential factor for the growth and success of your business.

Additionally, ensuring timely registration guarantees that one is adequately prepared for upcoming regulatory changes or requirements. Furthermore, it establishes an organized and well-structured tax management system, which can have a substantial impact on the financial health of your business. In essence, prompt GST registration goes beyond fulfilling a legal obligation; it plays a crucial role in establishing a successful, compliant, and trustworthy enterprise.

Challenges in GST Additional Place of Business Registration:

Document Gathering: It also involves organizing and efficiency in obtaining documents. One can simplify this process by creating a checklist containing all the necessary documents.

Complex Application Forms: Applicants should be able to understand complex online application forms. People are advised to seek professional assistance or thoroughly scrutinise given instructions.

Multiple Registrations: Multiple registrations can be simplified by introducing a central registry that will track such registrations as well as their respective statuses. It will reduce the complexities of the registration chores.

Digital Signature and EVC: Sometimes challenges may come up with acquisition and use of digital signatures or EVC. Therefore, there must be an entrance and clarity about their application.

Verification by Authorities: Occasionally, authorities or representatives can show up to verify. Therefore, it would be necessary for compliance and smooth operations of the process.

OVERCOMING CHALLENGES:

Getting help: when it involves difficulties of registered GST, it is strongly recommended to get a consultant in this field. This can help them ensure that the documents are well done and are properly filed up and the forms filed accordingly.

Enhancing literacy: Enhancing literacy will enable members to efficiently move through the Web-based platform, use electronic signatures, and EVC (electronic verification code). Organizations should undertake training sessions for their workers that will educate them on these requirements, and help them enhance their proficiency.

Processes improvement: The system of documents flow and centralized registration will be introduced in order to make our procedures more effective. This strategy is meant to improve productivity and reduce wastage.

Utilizing technolog: Technology is another important area that an organization can use to improve the registration processes. Automation reduces error incurred during tasks like documentation accumulation and monitoring of applications and saves valuable time.

Exercising patience and ensuring compliance:

It is important to show patience during the registration time, since a person must follow every instruction. This may take a while so we should go and verify visits. This will avoid disruption or complication and ensure compliance.

Common mistakes to avoid:

- Proof of identity, address, business documents are needed ahead to register . The lack of proper reporting may trigger incomplete reports, which may ultimately result in unnecessary delays and/or complications.

- Be careful to ascertain the specifics. Ensure that the legal business name, addresses and details of the authorized signatories are okay. It is necessary to double check on these aspects because it promotes high level of accuracy.

- Registration difficulties could result from failure linking the PAN to Aadhaar. It’s important to follow government rules as well as link your PAN to the Aadhar to avert trouble.

- Before commencing operations at a new location, it is crucial to complete the registration process and obtain a new GSTIN. Failing to fulfill this requirement can result in complications arising from starting business activities without proper compliance.

- During the registration process, individuals should be well-prepared for unexpected verification visits from tax authorities. Being vigilant and ready is crucial to handle these visits effectively.

Conclusion:

Expanding your GST operations to new states requires registering in additional places. Before applying online, it is crucial to ensure that you have all the necessary identity, address, ownership, and business proofs in accordance with GST norms.

Proper registration will lead to smooth functioning of your business in the new state. Non-compliance can attract heavy penalties under GST law. Hence, ensure timely registration and full adherence to GST rules for all your places of business.

FAQs

Q1. Can I register my additional place under my current GSTIN?

Ans: No, an additional place of business in a different state requires separate state-wise registration and new GSTIN.

Q2. Is my PAN mandatory for additional place registration?

Ans: Yes, PAN is mandatory for new GST registration and it must be linked to Aadhaar.

Q3. What if I start operating before obtaining a new GSTIN?

Ans: It will lead to non-compliance. You must legally register an additional place and obtain a new GSTIN before starting operations.

Q4. Is there any registration fee for additional GST place registration?

Ans: Yes, you need to pay a basic registration fee of Rs.1000/- on every new additional place registration application.

Q5. Can I apply for additional place GST registration without documents?

Ans: No, all documents like proofs of address, business, bank account etc. are mandatory for GST registration.

Q6. Is physical premises visit required for new GST registration approval?

Ans: In some cases, tax officials may visit your premises physically to verify before approving registration.

Q7. Can I revise registration details after obtaining new state GSTIN?

Ans: Yes, you can file amendments if there are changes in future in registration details like address, partners etc.

Q8. Where do I access application form for additional place registration?

Ans: Form GST REG-18 is available online on the Govt GST portal under Registration section.

Q9. Is rental agreement renewal required for additional place registration?

Ans: If existing rental agreement covers the period of GST registration application, renewal may not be required.

Q10. Can I surrender GST registration later if business plans change?

Ans: Yes, GST registration can be cancelled by filing Form GST REG-16 if the place of business is no longer required.