On July 1, 2017, India became the first country in the world to implement the Goods and Services Tax, often known as GST. It ended a convoluted system that consisted of several indirect taxes that both the Central and State governments collected.

In order to bring consistency and transparency to the country’s tax system, the Goods and Services Tax (GST) was developed to simplify the structure of the taxing system. Learn more about GST basics, CGST vs SGST vs IGST, how they differ from each other, and how they have changed how they play for companies and consumers with this complete guide.

Also Read: What Is The Difference Between CGST, SGST, And IGST?

Also Read: What Is The Difference Between CGST, SGST, And IGST?

GST Basics: What is GST, and how does it work?

Goods and Services Tax (GST) is a national indirect tax that would convert India into a single market. Every supply chain step, from production to final consumption, is subject to the Goods and Services Tax (GST). Because each level’s input taxes may be used as a credit in the next stage of value addition, GST is effectively a tax on value addition alone. Thus, the end customer will only be responsible for paying the GST that the last dealer in the supply chain charges because of the set-off advantages at every level.Types of GST Tax

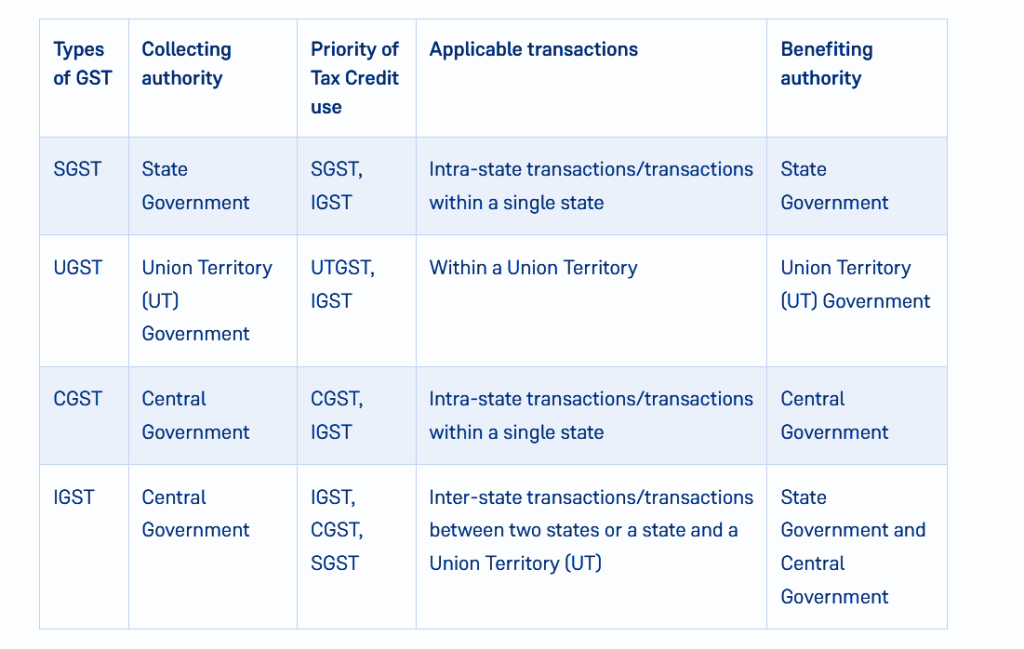

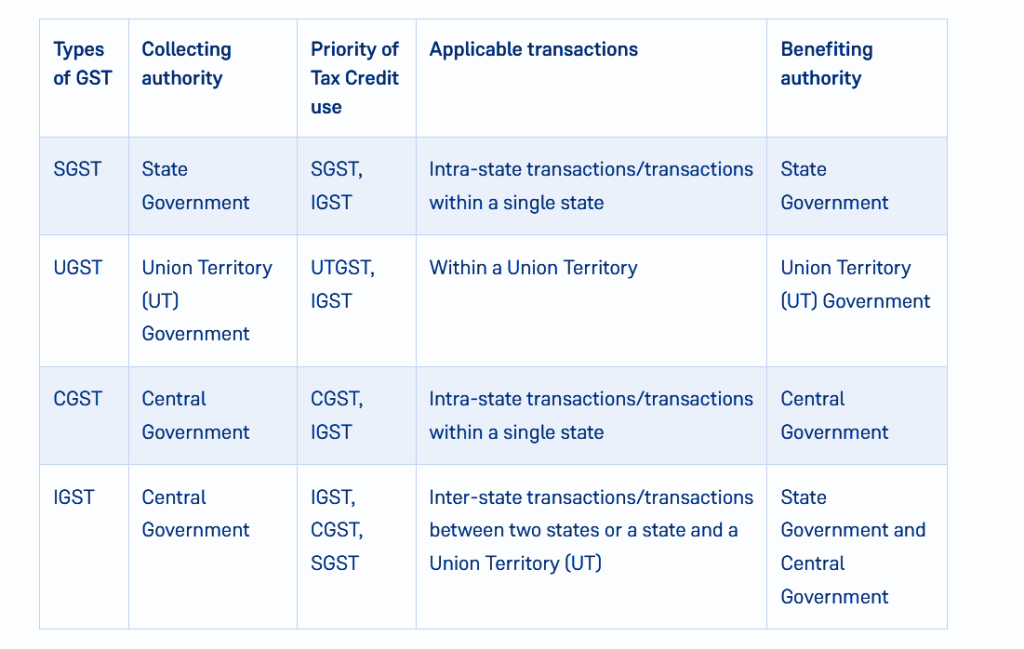

In order to determine the appropriate tax rate, the GST framework considers the nature of the transaction: International financial dealings This is a deal that two states make with each other. Intra-State Deals An intra-state transaction takes place within a single state. The three main forms of GST are based on the following characteristics of transactions:- State Goods and Services Tax or SGST

- Central Goods and Services Tax or CGST

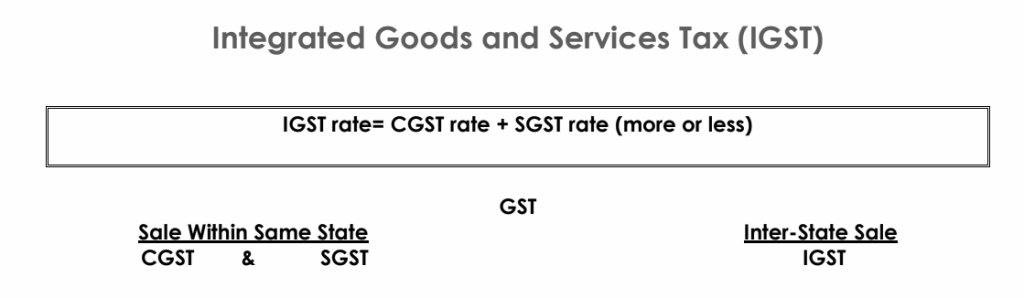

- Integrated Goods and Services Tax or IGST

Components of GST (CGST vs SGST vs IGST)

-

SGST

-

CGST

-

IGST

What are GST benefits?

To conclude, the following are the advantages of GST for business and industry.For business and industry

Goods and Services Tax India system will be based on this scheme. So, taxpayers would be able to access all services, including registration, returns, payments, etc., online, which would facilitate simple and transparent compliance. When implemented, GST would standardize the country’s indirect tax rates and structures, making it easier and more predictable for businesses. In GST basics terms, regardless of the location of a business’s activities, GST would make them tax-neutral inside the nation. A system of smooth tax credits across the value chain and state lines would eliminate or greatly reduce tax cascading. Hidden expenses of conducting business would be reduced as a result of this. Trade and industry would become more competitive if business transaction costs decreased.Advantage for producers and merchants

Lower prices for domestically produced products and services would result from eliminating the Central Sales Tax (CST), the full and thorough set-off of input goods and services, and the consolidation of significant central and state taxes under the Products and Services Tax (GST). This would improve India’s export competitiveness by making its products and services more appealing to buyers abroad. Another major factor in lowering compliance costs is national consistency in tax rates and processes. Also Read: Benefits Of GST RegistrationIntended for Central and State Governments

The Goods and Services Tax India is a straightforward and easy-to-administrate alternative to many indirect federal and state taxes. With a solid end-to-end IT infrastructure, GST would be considerably easier to implement and manage than any of the previous indirect taxes imposed by the federal government or individual states. Higher levels of tax compliance result from GST’s solid IT infrastructure and improved controls against leakage. One built-in mechanism of GST that would encourage merchants to pay their taxes is the smooth transfer of input tax credits from one step to another in the value-addition chain. It is believed that the cost of collecting taxes would drop under GST, leading to higher revenue efficiency. Consequently, government agencies will see improved revenue efficiency.For the buyer

The value of products and services should be proportional to a single, clear tax: Most products and services in the nation today are expensive because of all the hidden taxes. This is because the federal government and individual states both charge a few indirect taxes, and there are either partial or no input tax credits available at different levels of value addition. With GST, there would be a clear accounting of all taxes paid by consumers since there would be only one tax from producers to buyers. Reduction of total tax liability: The tax burden on most goods will decrease due to efficiency increases and leakage prevention, which is good news for consumers.Why is SGST, CGST, and IGST separate?

The Constitution of India vests the authority to levy and collect taxes in the federal government and the individual states. The two governments need GST tax money to fund their separate but complementary functions. Taxes are being imposed for GST by the federal government and the individual states. To guarantee “One Nation, One Tax,” the three-tiered tax system allows taxpayers to offset their taxes against one another.Key Differences Between CGST vs SGST vs IGST

Below is a table summarizing the underlying characteristics of each of the types of GST taxes and CGST vs SGST vs IGST: Also Read: What Is The Difference Between CGST, SGST, And IGST?

Also Read: What Is The Difference Between CGST, SGST, And IGST?

Excluded from Goods and Services Tax India

Some items and services are not subject to GST responsibility, as with all taxes. Among the many products that are not included in GST are the following:- Dietary items: Vegetables and fruits, grains, meat, seafood, etc.

- The following are examples of raw materials: khadi yarn (cotton), handloom textiles (wool), raw silk (silk), raw jute (fiber), etc.

- Instruments/Tools: Implements for use by farmers and people with disabilities.

- Vaccines, medical publications, maps, books, non-judicial stamps, pulp pieces, and others are all miscellaneous.

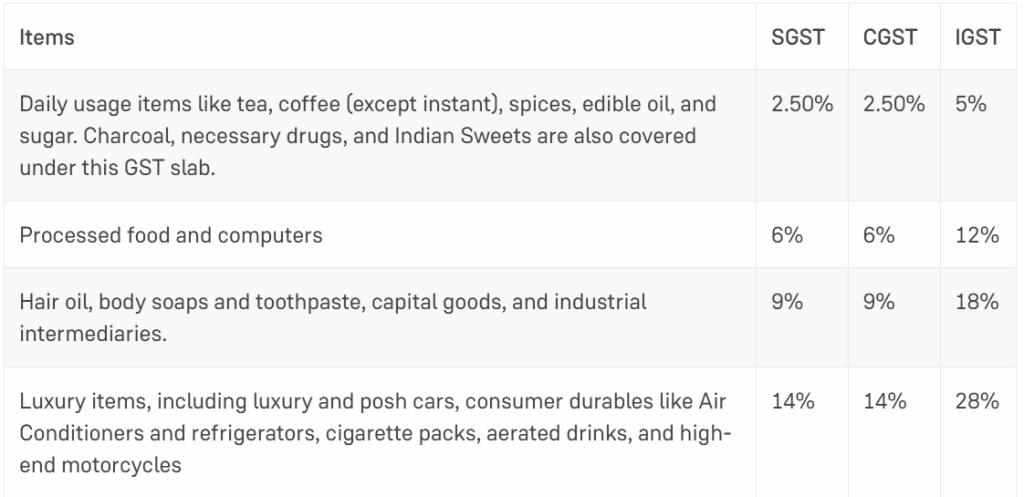

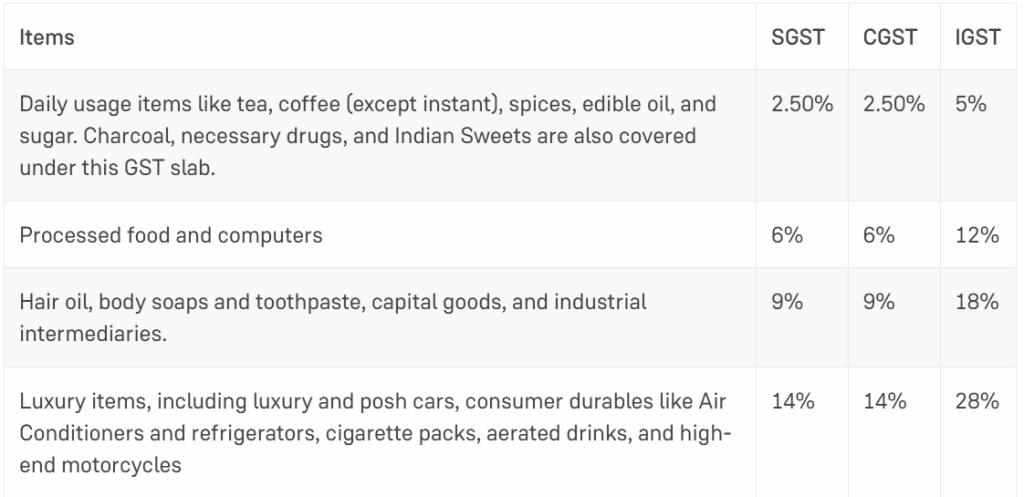

Product-specific SGST, CGST, and IGST rates

What is CGST?

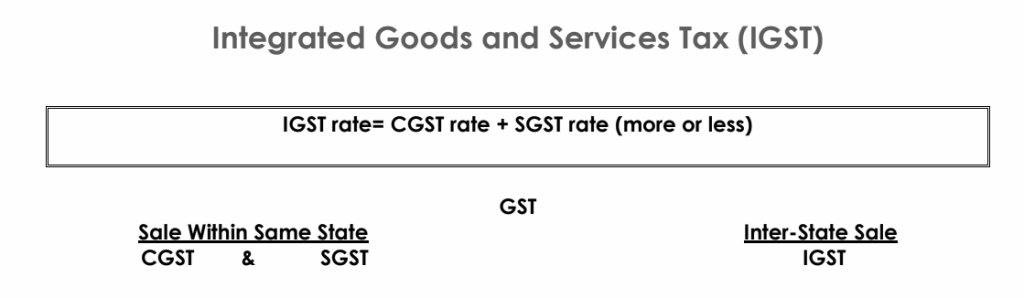

The government of India collects and collects a tax known as the Central Goods and Service Tax (CGST). All products and services provided inside the state are subject to this tax. Any supply that takes place outside of the state’s borders is not considered to be subject to the tax. There are three main parts to GST, as we’ve already learned about GST basics. The following have detailed them. All products and services provided inside the state are subject to the SGST and CGST. Services and products provided outside of the state’s borders are also subject to IGST. The sum of the SGST and CGST rates is the same as the IGST rate. Also Read: Understanding the CGST Act – Central Goods and Service Tax ActA CGST history

The 2017 Central Goods and Services Tax India Act founded CGST. The elimination of several indirect taxes, including service tax, central excise duty, central sales tax, etc., was the primary motivation for its formulation. It is the Central Government of India that receives the CGST funds.Aims of the CGST Act, 2017

The CGST Act’s main aim is to deal with multiple problems related to the taxation system. implemented the legislation to streamline compliance procedures, eliminate tax replication, and lighten the burden on different taxes.Criteria for the CGST Act of 2017

Key characteristics of CGST include-- All products and services supplied inside a state are subject to the Central Goods and Services Tax.

- Taxpayers are permitted to self-assess the taxes that are due to them.

- A number of products and services are able to have their tax loads reduced thanks to CGST.

- Infractions of tax rules may be subject to fines and penalties under the CGST requirements.

- Tax defaulters cannot sell goods and services under the CGST Act’s tax arrears collection processes.

Rules for CGST

- If your registration is subject to the GST composition system, you will need to produce a supply bill.

- If you have previously registered for GST, you are required to provide tax invoices for all taxable products and services.

- Record the invoices in consecutive order and assign each one a unique serial number.

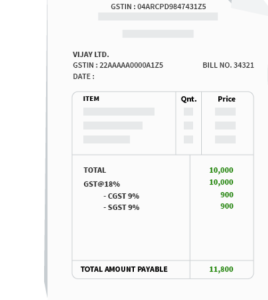

- An equal amount of CGST and SGST is submitted. If the GST rate is 18%, for instance, the CGST and SGST will each amount to 9%.

What is SGST?

A Goods and Service Tax that falls under the concept of “one tax, one country” is the State Goods and Service Tax (SGST), one of the three primary types of GST (CGST, IGST, and SGST). The 2016 State Goods and Services Tax Act is the legal framework for SGST. Products intended for human consumption do not fall within the remit of SGST. Moreover, the State Goods and Services Tax (SGST) Act 2017 governs and applies to this tax. The value of the products or services delivered is subject to this kind of tax, as stated in section 15 of the SGST Act. The transaction value is the monetary amount exchanged for the mentioned service or commodity. To sum up, the state that receives the tax is not the one that made the products or provided the service; rather, it is the state that receives the tax, as the name suggests.Criteria for the SGST

- All products and services provided for payment are liable for SGST, a tax the states collect.

- Money from each state’s levy is sent to their respective accounts.

- Under the authority of the State Goods and Service Tax Department, every state has its own SGST statute. Although the specifics of each state’s Goods and Services Tax (GST) laws may differ, the fundamentals include but are not limited to charges, valuation, taxable events, measures, classification, etc.

- It would be consistent across all states’ laws. When the total yearly revenue is below the specified threshold, SGST is also not levied.

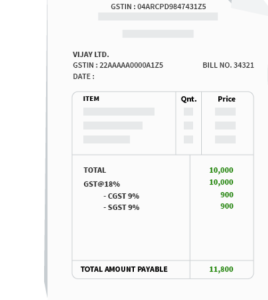

Calculation example for CGST and SGST

Let’s consider M/s Ananya Enterprises, a Maharashtra-based dealer, engaging in a business transaction with Ravi Industries worth Rs. 10,000. Assuming a combined CGST and SGST rate of 9%, the 18% GST rate is formed. In this scenario, if Ananya Enterprises collects Rs. 1800 through the GST system, Rs. 900 will be directed to the Central Government, and the remaining Rs. 900 will be allocated to Maharashtra.

What is IGST

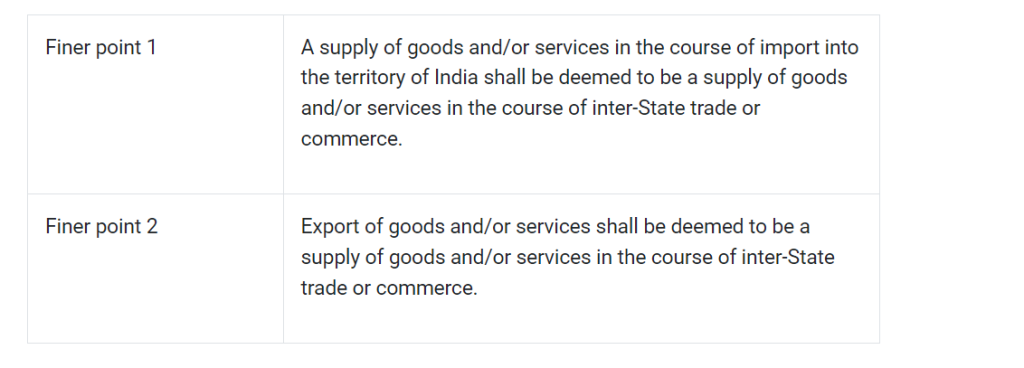

Understanding IGST in Transactions is a more formal way to say it. All taxes on taxable services and items imported into a state and taxes on their sale or supply between states fall under the GST jurisdiction. The Union Government takes in IGST, and each state gets its share. A service or commodity is required to pay IGST whenever it moves from one state to another. Federal and state governments split the tax. The state compromises with the federal government rather than other governments to resolve the amount of interstate taxes.

A IGST History

Enacted to levy, collect, and manage the Integrated Goods and Services Tax (IGST) in India, this law goes by the acronym IGST. The whole Indian subcontinent, including Jammu and Kashmir, is subject to this law. It will be effective as of the date that the central government announces by notice.The formula for IGST

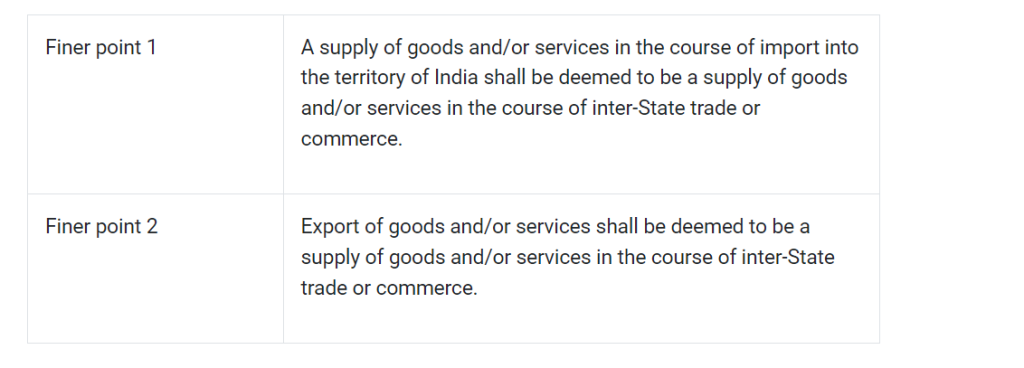

Criteria for the IGST

Revenue taxes are regulated under the Goods and Services Tax Act. In accordance with the Understanding IGST in Transactions Act, the Central Government will impose IGST, which would consist of CGST and SGST, on all taxable supply payments made between states. Parliamentary legislation, based mostly on recommendations from the Goods and Services Tax Council, will determine how the federal government and individual states will each get their share of the tax.- The demand for products and services between states is legitimate.

- That means the SGST portion of the IGST tax goes to the state that does the consumption.

- All interstate supplies remain transparent in the Input Tax Credit chain.

- The Central Sales Tax (CST) Act of 1956 was repealed.

- The term “integrated GST” may also describe goods and services that enter India from outside. An inter-state exchange, also known as an exchange supply, transfers goods or services that occur during importation into the Union of India. Consequently, IGST is liable for such transactions.

The IGST refund

When foreign nationals who are not residents of India visit the nation for six months or less, they are subject to the same integrated tax as exports. For foreign tourists departing India, the Indian government makes it easy to get back the IGST they spent on products exported from the nation. Taxpayers who have sent their money to the SGST or CGST rather than the IGST will get a refund. Such individuals are required to re-deposit funds into the corresponding tax account.Important considerations about IGST

- The seller must include IGST in the invoice when the transaction occurs between states. The purchaser then sends this sum to the seller, who sends it to the federal government.

- A valid Goods and Services Tax Identification Number (GSTIN) is required of both the buyer and the supplier in an interstate transaction to ensure smooth compliance with IGST legislation.

- The federal government has the authority to impose IGST. Taxes on interstate supply may be more easily and uniformly collected.

- Goods and services brought into or sent out of India are also subject to IGST. A transaction’s tax status changes based on whether it’s an import or an export.

Conclusion

A major turning point in India’s tax structure came with introducing the Goods and Services Tax (GST). Changes to the tax system and increased transparency. The Goods and Services Tax (GST) simplified the supply chain and united the country’s markets since it is a value-added tax. Businesses, manufacturers, merchants, and consumers all stand to benefit from GST’s efficiency-boosting, tax-cutting, and growth-boosting advantages. The impact of GST on businesses and consumers is important to consider as a result of the changing tax situation in India as the country adjusts to the current tax revolution.FAQs

-

What are GST types?

-

What is the impact of GST on businesses and consumers?

-

How much of a tax does an intra-state supplier incur?

-

Who Pays GST?

- Those who have registered for GST must use the reverse charge system to pay.

- Taxpayers who are listed under GST have to collect tax at source (TDS).

- Businesses that engage in online trade and are GST-registered.

- Businesses that conduct business online and are GST-registered must implement a tax-at-source (TCS) system.

- People who provide services or items on behalf of manufacturers or suppliers (agents).

-

What is CGST?

-

How high is the CGST rate?

-

What are the advantages of CGST?

-

What is IGST?

-

How often are changes made to SGST rates?

-

Is it Possible to Pay IGST with SGST Credit?

Master the different types of GST in India for smooth tax compliance.

Shraddha Vaviya

Content Writer

With several years of experience, I am deeply passionate about writing and enjoy creating content on topics such as GST, tax and various finance-related subjects. My goal is to make complex financial matters understandable for readers by simplifying them.