Tired of billing issues? Everyone feels the same way! 60 % of small businesses have trouble with billing and collecting payments. Just know that you can count on us to support you.

Introduction

The importance of efficiency and accuracy in financial transactions cannot be overstated in today’s competitive corporate market. Introducing the Bill Book Apps, which are transforming the way businesses conduct invoicing, payment processing, and financial management. We’ll discuss the main features and advantages of these applications in this blog post and provide advice on which one is best for your company.

What is a Bill Book App?

Accounting applications like billing system software help automate and simplify payment services and invoice processing. Businesses can simplify the process of paying customers for the goods and services they’ve received through billing software.

How does billing software work?

- View product details along with prices, deals, and discounts by scanning or searching.

- Use pre-defined tax slabs to compute GST or comparable taxes automatically.

- Get clients’ information and take their money (e-wallets, cash, cards).

- Put your logo and return policy on invoices you create, print, and send to clients.

- Create reports and visual charts using billing data to help with decision-making.

Why do small businesses need GST billing software?

GST billing software is required for small businesses to facilitate invoicing, accurately calculate taxes, and efficiently comply with GST regulations. In addition to automating the tax split-up procedure, online billing software for small enterprises offers excellent data security.

It provides a dependable and comprehensive accounting solution, allowing businesses to experience increased security with no more work.

Latest Update on GST

The Central Board of Indirect Taxes and Customs (CBIC) has launched a special amnesty initiative for taxpayers with GST concerns. Specific GST taxpayers who disagree with a GST tax demand order can file an appeal under this GST Amnesty Scheme until January 31, 2024.

“A Special Amnesty Scheme was announced to excuse late filing of the GST Appeal.” The amnesty program is in effect until January 31, 2024. On December 17,2023, the Ministry of Finance stated on social media, “This is a golden opportunity for those taxpayers who may have missed the appeal deadline.”

Also Read: Latest GST News and Updates

Importance of bill book app

When it comes to financial operations, these apps are a great benefit because of all the ways they improve efficiency, precision, and success. Billing invoice apps are important for the following reasons:

-

Effectiveness and Automation

By automating the invoicing process, bill book apps minimize human mistakes and save time. Automated features, such as regular invoicing and payment reminders, save time and guarantee timely payments.

-

Honesty and Reputation of the Brand

With the help of these applications, companies can make invoices that seem professional by adding their logos and other branding features to pre-made templates.

-

Financial Workflows Made Easier

If a company uses a bill book app, it can create, send, and track invoices more efficiently and with less human intervention. The billing invoice app simplifies accounting procedures by facilitating the systematic generation, transmission, and tracking of invoices.

-

Enhanced Administration of Funds

Apps like this help companies stay afloat financially by easing the burden of accurate and timely invoicing and improving cash flow management.

-

Improved Interactions with Customers

Customers are highly likely to have an excellent one when they receive correct and timely bills, promoting trust and openness.

-

Tax Compliance

Businesses can comply with tax regulations with the help of Bill Book Apps and GST billing software. This eliminates the possibility of mistakes occurring during tax reporting and computations.

-

Efficient Use of Time and Materials

Businesses may free up more time for strategic planning and core operations with automated payment tracking and invoicing procedures.

Benefits of Bill Book for Businesses and Individuals

Not only does a Bill Book provide you peace of mind, but it also provides:

Instant Bills

Bill Book may automatically generate an invoice in seconds once you input your information. Your business’s only responsibility is to submit the invoice and collect payment.

Customer Monitoring

It is now much simpler to follow as a customer. Keeping track of your bills in a bill book makes it easy to find and pay any given invoice.

Data Protection

Businesses should ensure the security of client data since it is important. Bill Book’s top-notch security certifications help safeguard documents and prevent fraudulent transactions.

Personalized Billing Forms

To make your bill stand out from the competition, you may choose from various layouts and add a unique color scheme. Using distinct colors, you may make your company stand out from others on invoices you create.

Mechanical Estimates

The bill book is a great way to save money and streamline your company’s operations without having to hire new people specifically to handle accounting and financial tasks.

Creating Tax Reports

When you have a bill book, all your tax reports may be in one place, saving you time and effort. Based on the years in operation, you may easily generate correct tax records, detailed reports, and an easy-to-navigate interface.

How the Bill Book and the Traditional Method of Billing Differ

| Bill Book Format | Traditional Billing Method | |

| Professional Look. | Bill Book offers a computer-generated invoice that has a polished appearance suitable for business purposes. | This method necessitates manually generating bills using a pen. This lacks professionalism and undermines the business’s image. |

| Bill records. | Bill Book efficiently manages and organizes all your business records, allowing for effortless access with just one click. | Maintaining physical copies of invoices is a difficult task, and much more challenging is the task of locating a bill from a year ago within a stack of identical ones. |

| Online business | Bill Book enables users to effortlessly send invoices to recipients worldwide. The customer could subsequently verify the invoice and promptly execute the payments. | Dispatching a bill through mail/post/courier necessitates a significant investment of time and effort. Furthermore, payment will be issued to you once the customer has received the bill. |

| Faster Calculations | Disregard the task of determining the tax rate for your products (or services). The Bill Book will efficiently execute all mathematical computations. | This solved the most challenging issue of manually computing pre-tax values and subsequently generating an invoice. |

| Cost savings | The Bill book is offered in both monthly and annual subscription options, which are reasonably priced for new business starting on the process. | To accomplish this, you must reach out to a local printing agency in order to have them produce customized bill templates on your behalf. Subsequently, the owner proceeds to fill it. |

| Taxation updates | The bill book would be promptly updated in response to any changes in taxes for goods or services. Hence, ensuring you remain informed. | Reprinting the bills would be necessary to update them with the new tax slabs if manual copies are used. Consequently, this results in additional costs. |

Step-by-step billing software creation guidelines

Below is a comprehensive, sequential instruction on how to develop billing software.

- Set the objectives and requirements for the project.

- Create the Framework for the Database

- Create Features for the Backend

- Design a user-friendly interface and experience.

- Create an Invoicing and Billing System

- Complete Testing and Deployment

User-Friendly Interface and Accessibility of Bill Book App

Use the capabilities of Bill Book Apps across all platforms, including Android, iPhone, and PC. These applications offer smooth and automated solutions for your organization, helping you remain ahead in today’s fast-paced and constantly evolving marketplace.

Bill book app downloads are easily obtainable on multiple platforms, guaranteeing accessibility for every customer. To start the Bill Book app download, navigate to your chosen app store or the official website of the app provider.

- The Bill Book App for Android offers Android users a convenient method to manage invoices with just a few touches. Check out the Bill Book app for Android with a simple UI, adjustable invoice templates, and seamless integration.

- Bill Book App for iPhone is a reason for happiness among iPhone users. There is a Bill Book App that is specifically built for your iOS experience. Obtain the application from the App Store to experience functionalities such as automatic invoicing, payment monitoring, and customized invoice layouts.

- The Bill Book App for PC is the perfect alternative for individuals who prefer using desktop applications. To access additional functionalities such as integration with accounting software, periodic invoicing, and extensive financial reporting, you download and install these apps on your PC. Effortlessly handle your bills while maintaining full functionality.

Features and Functionalities

In most cases, businesses rely on billing software to keep tabs on employee time and expenses as well as generate invoices for goods and services. Billing software is feature-rich and user-friendly, which helps keep things running smoothly. Features could differ from one provider to the next, but here are a few common ones:

Mastery creation capability

An integral part of any billing system should include a master record of all items and services, as well as the names and addresses of purchasers or clients, GSTINs, purchase orders, etc. It is much easier and faster to generate invoices on a daily basis using a master set of inputs.

An activity log

The inclusion of an activity log allows for more precise monitoring and validation of the billing software’s activities. With the help of the activity log, the user may keep tabs on everything they did throughout the period.

Security and protection

These days, SSL encryption is standard in most billing applications. Protect yourself from hackers using SSL encryption. Additionally, it guarantees that no other parties will have access to your data. No one outside the server can read the data; therefore, important information is safe.

Essential Features of a Billing Invoice App

Billing software often contains a variety of functionalities intended to help organizations enhance their billing and invoicing procedures. Notable features of billing software include the following:

Factors to Consider When Selecting a Bill Book App

-

Identify the necessary criteria

Determine exactly what is required and what conditions. Identifying the necessary attributes that the organization needs will help in the process of selecting. Considering the company’s business model, it may be smart to consider the user count.

-

Look Into Your Options

Explore other alternatives after the business needs have been determined. Before selecting billing software, it is important to take into account factors such as usability, affordability, support, and scalability.

-

Price Compare

Investigate and contrast the costs of several billing software systems to get the most excellent value. Prior to making a decision, it is important to take into consideration the costs associated with the setup and membership fees. Verify the use charge, as different software options provide varying packages for single-use purposes.

-

Check Before Purchasing

During the shortlisting phase, select the top 5 billing software options and proceed to evaluate each system by utilizing the trial version or demo provided by the companies. It is advisable to thoroughly test each system in real time before making a purchase. Select a GST billing software that is intuitive and efficient without necessitating lengthy training.

-

Find Out What Customers Think

To determine the most suitable product or service from a vendor for specific requirements, it is most convenient to directly obtain feedback from the seller’s current clientele.

-

Standardized Models

The quality of a company may be determined by the structure of its bill. The invoices should be standardized and tailored to meet the specific requirements of each customer. The use of predetermined, personalized forms enhances efficient communication. This boosts productivity and saves time.

-

Flexibility

As a company expands, it needs software tools that can accommodate its growth. Therefore, an ideal billing system should include the ability to develop and operate effectively, irrespective of the volume of daily invoices and receipts produced.

-

Support for Multiple Currencies

This arrangement improves the efficiency of international transactions. It will facilitate businesses in efficiently generating receipts, receiving payments, and promptly fulfilling their tax responsibilities for overseas clientele. It optimizes financial processes, enhancing corporate efficiency.

-

Cloud-based technology

A cloud-based GST billing software enables businesses and workers to create invoices and input expenses from any internet-connected device. This is beneficial if the team often engages in travel or operates remotely.

Choosing reasonable billing software might be a difficult task. Prior to surrendering, check the complimentary billing software. While they may not cover all the required abilities for the organization, they are more valuable than a manual billing procedure. It is advisable for all employees of a business to use cost-free billing software for the purpose of generating invoices and managing billing. The program is user-friendly and accessible online, allowing users to test its features before opting to purchase a more advanced version.

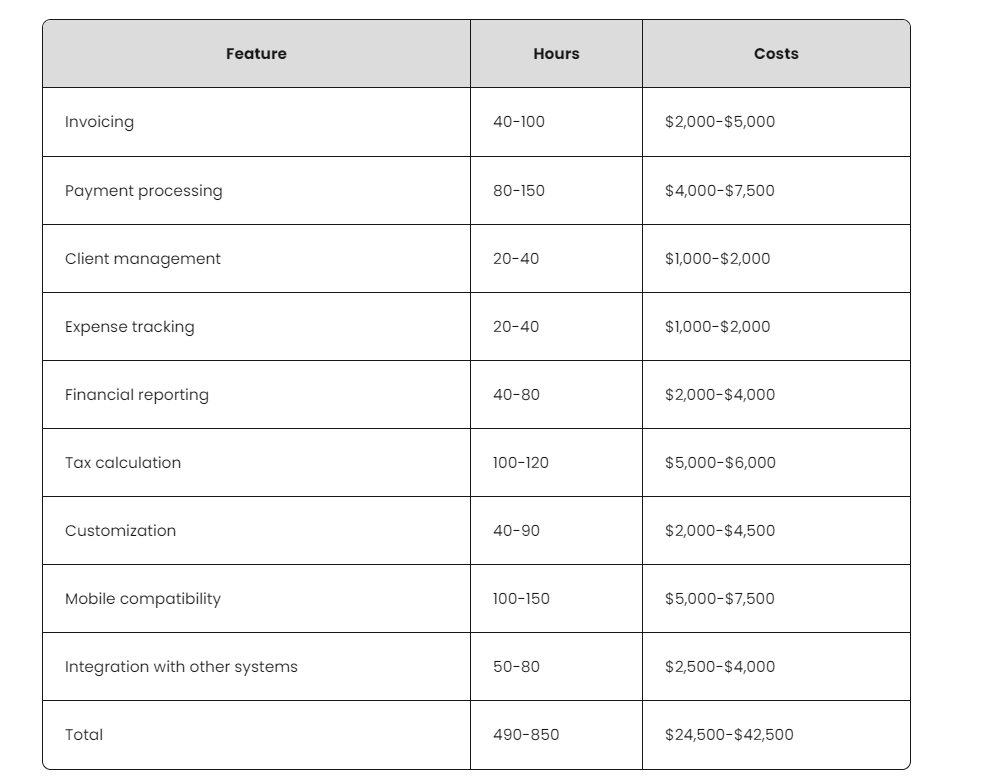

What does customized billing software cost?

There are a lot of variables that can affect how much it will cost to build custom invoicing software, such as:

The creation cost of your solution is directly proportional to its size and complexity.

The development platform can affect the cost of software development. For example, cloud-based solutions tend to be more expensive than local installations.

Software development cost is affected by the selected development team; larger and more experienced teams usually cost more than smaller and less seasoned ones.

There may be an increase in development costs associated with integration with other systems, such as accounting software or payment gateways, into the invoicing software.

Contributions such as correcting bugs, issuing updates, and providing other critical assistance, as well as the costs of invoicing software’s continual maintenance and support, will also affect the total development cost.

Developing some typical features can take around the following amount of time, assuming an hourly price of about $50:

Also Read: Know Everything about GST Billing Software

How to Maximize Efficiency with Bill Book Apps

If you want to streamline your invoicing and financial management processes, you need a bill book app. The ways in which these applications improve the effectiveness of modern business processes are as follows:

- Bill Book Apps streamline the process of generating and delivering bills, minimizing the need for human labor and decreasing the chances of mistakes. Automated invoicing guarantees the on-time creation of invoices, enhancing the overall efficiency of the billing process.

- These applications offer immediate monitoring of financial transactions, enabling enterprises to oversee the progress of invoices and detect outstanding payments. Features for recording payments allow for speedy reconciliation and support the upkeep of an accurate cash flow picture.

- Bill Book Apps frequently feature recurring invoicing, enabling businesses to establish automatic schedules for transactions that occur periodically. This functionality is especially advantageous for services needing regular payments or enterprises with clients making repeated purchases.

- By consolidating financial data within the application, businesses may conveniently retrieve and oversee all their invoicing and payment information from a unified platform. Centralization improves operational efficiency and expedites the process of making decisions.

- Businesses may use customizable templates to personalize invoices according to their branding and special requirements. Customizing invoices improves their professional appearance and saves time by removing the need to prepare invoices from the start for each instance.

- Users may handle invoicing activities while on the go with the help of mobile-friendly bill book apps. Mobile access allows organizations to remain connected with their financial data at all times and from any location, enhancing their ability to respond promptly.

- Automated payment reminders assist businesses in prompting clients to make overdue payments, decreasing the time and effort required for manual follow-ups. This function improves payment cycles, resulting in expedited cash flow.

- By implementing faster billing procedures and automated tracking, companies may optimize the use of resources. This efficiency applies to both time and labor, enabling staff to concentrate on strategic duties rather than administrative ones.

Latest billing software trends

Because of these developments, billing software is becoming more user-friendly and cost-effective, which benefits companies of all sizes by streamlining and bettering their financial management.

Here are a few of the most notable developments in billing software:

Automation

Automation

Automation is becoming more significant in billing software development as firms streamline and simplify invoicing. Automatically generate invoices, track payments, and generate reports.

Blockchain

Blockchain is a safe and decentralized platform for recording and validating transactions, making it suitable for billing and invoicing. Billing software may improve financial transaction transparency, immutability, and confidence using blockchain. Blockchain-based billing software tracks bills in real-time, improving dispute settlement and payment.

AI and ML

Companies may improve revenue projections and pricing by using AI-powered algorithms to spot patterns and trends in past billing data. By extracting essential data from bills, ML systems may automate invoice processing and improve efficiency. Billing software is incorporating virtual assistants and AI chatbots to handle customer support inquiries and deliver personalized assistance.

Cloud computing

Billing software is increasingly cloud-based and accessible from anywhere with an internet connection. Since companies can access their software from any device, billing, and invoicing are easier.

Invoicing on mobile

Mobile invoicing

More mobile billing software allows businesses to manage billing and invoicing on smartphones and tablets. Businesses may respond to billing concerns faster and more flexibly.

Wrapping It Up

Personalized billing and invoicing solutions have multiple potential uses beyond resolving monetary concerns. In addition to helping with dependable updates, managing client connections, and tracking team efficiency, among other things, these innovative software programs can do a lot more.

Due to the complex structure of customized billing software, it is easy to overlook important characteristics that are important to your company.

Also Read: Small Business, Big Solutions: How The Right Software Can Transform Your Operations

FAQs

-

What is a Bill Book?

Businesses can generate invoices quickly with Bill Book. It facilitates business automation, leading to cost, manpower, and time reduction while also providing specialized features for business scalability.

-

How should you create a bill on the go?

The Bill Book offers a mobile application that has been designed for use on portable devices, enabling you to ensure accessibility even when you aren’t located at your business location. It is possible to generate your invoices remotely, even if you are located 1000 miles away.

-

Do bills include terms and conditions?

The bill contains all the terms and conditions. Furthermore, it is possible to impose a penalty on individuals who are causing a delay in making payments for the goods or services they have acquired.

-

Is there a detailed breakdown of costs provided on the bills?

Yes, there will be a breakdown of expenses presented on the bill with the GST calculations for reference. The customer has the option to verify the itemized bill in order to verify the prices.

-

Is it possible to generate invoice numbers based on a specific sequence?

Bill Book allows users to generate a numerical sequence based on their selected numbers. However, we would recommend using pre-defined invoice numbers for feasibility.

-

What is the price of a bill book for my business?

The Bill Book app download is available for free. All customers who download and use our services have access to the fundamental features. Exclusive services are exclusively accessible to premium customers.

-

What makes a bill different from an invoice?

Perception is the only distinction between these two terms. The customer receives an invoice, which is essentially a bill.

-

Is it possible to modify my bill’s contact information in the Bill Book?

The Bill book enables you to efficiently modify contact information, if necessary, in a shorter period of time. This feature allows for time and cost savings by reducing the need to reprint traditional bills.

-

What sets Bill Book apart from its competitors?

The Bill book is cost-effective and caters to the requirements of all businesses. Even a 50 years old could learn how to utilize the integration in a day since it is so simple. Bill-tracking is a straightforward process that offers a clear metric for the business.

-

How long is billing the creation of software?

Billing software development timelines rely on factors such as demand complexity, team size, and resource availability. However, roughly six months is the usual period for building billing software.